Best Life Insurance After Prostate Cancer in 2025 (Review the Top 10 Companies Here)

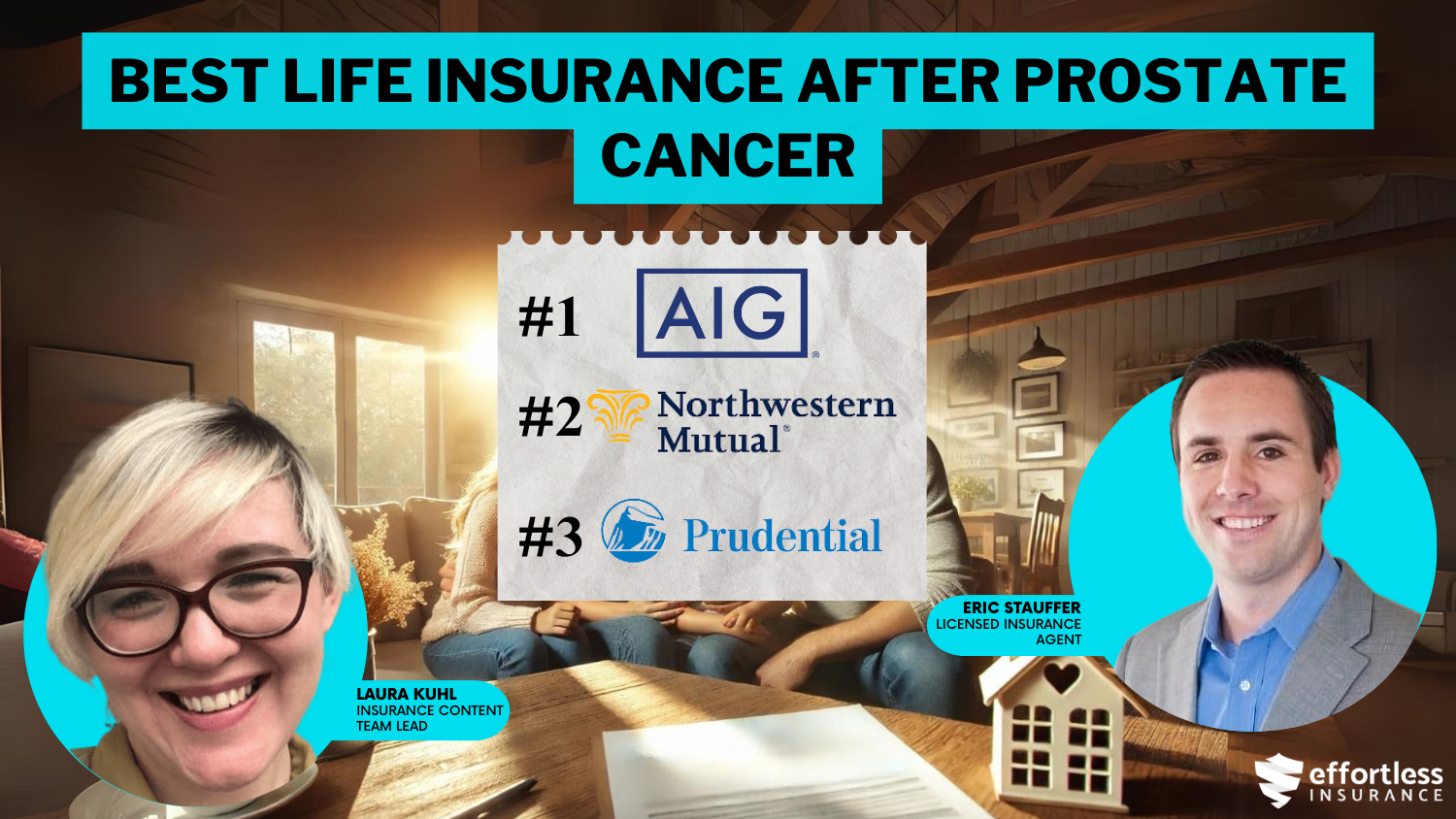

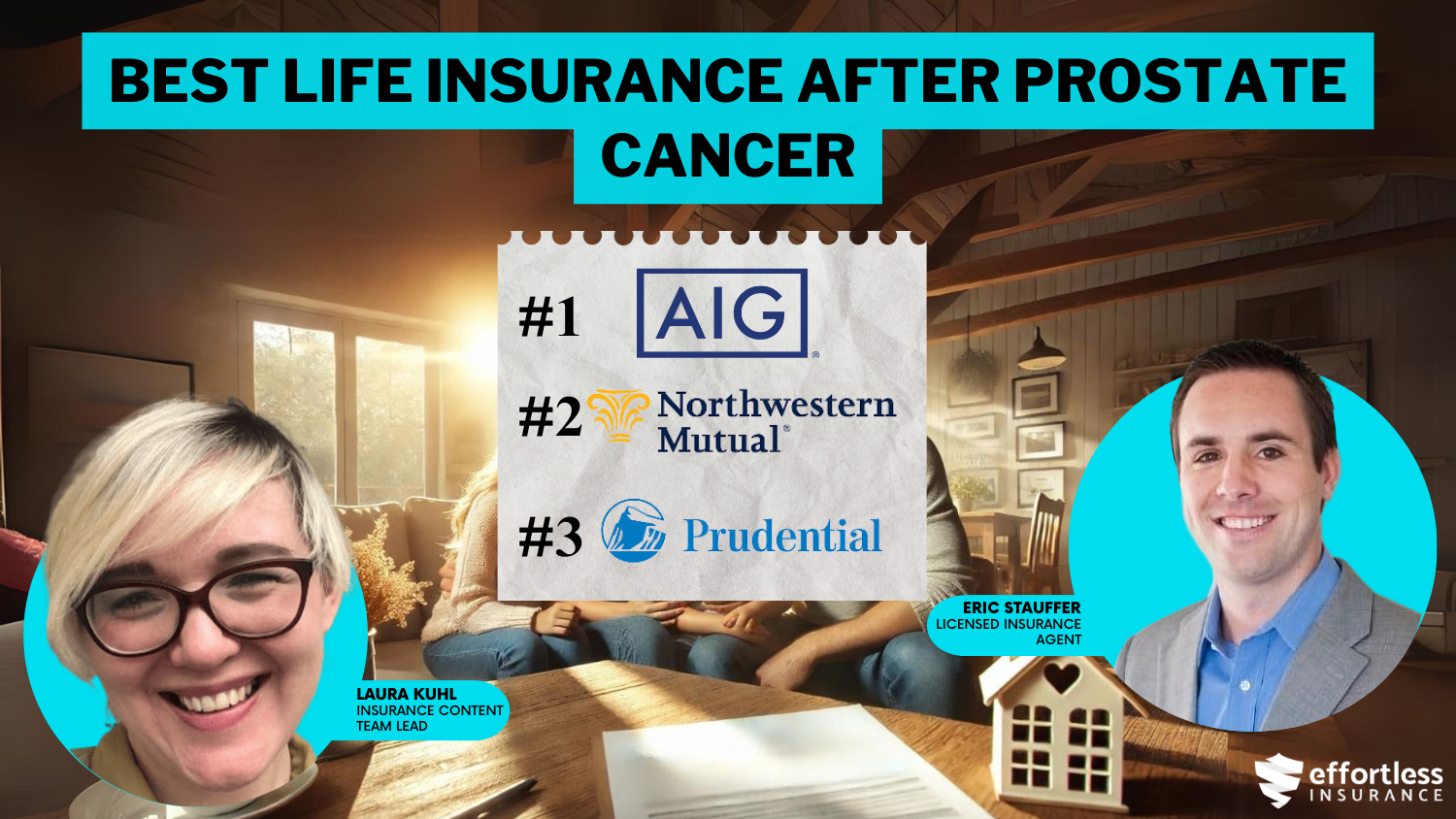

The best life insurance after prostate cancer comes from AIG, Northwestern Mutual, and Prudential, with rates starting at $37 per month. These companies stand out for their affordable prices, flexible plans, and favorable underwriting for those seeking insurance after prostate cancer.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Dec 23, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Dec 23, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

0 reviews

0 reviewsCompany Facts

Whole Policy for People After Prostate Cancer

A.M. Best Rating

Complaint Level

0 reviews

0 reviews 0 reviews

0 reviewsCompany Facts

Whole Policy for People After Prostate Cancer

A.M. Best Rating

Complaint Level

0 reviews

0 reviewsFind the best life insurance after prostate cancer from AIG, Northwestern Mutual, and Prudential, with rates starting at only $37 per month.

AIG is known for its affordable prices and flexible coverage options, making it a great choice for people who have recovered from prostate cancer. For more information, view this “Types of Life Insurance: Find the Right Policy for Your Needs” guide.

Our Top 10 Company Picks: Best Life Insurance After Prostate Cancer

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 15% | A+ | Coverage Flexibility | AIG |

| #2 | 25% | A++ | Financial Security | Northwestern Mutual | |

| #3 | 10% | A+ | Policy Options | Prudential | |

| #4 | 20% | A+ | Affordable Options | Transamerica | |

| #5 | 17% | B | Customer Service | State Farm | |

| #6 | 10% | A+ | Health Coverage | Mutual of Omaha | |

| #7 | 10% | A++ | Senior Policies | AARP | |

| #8 | 10% | A+ | Affordable Rates | Banner Life |

| #9 | 15% | A+ | Competitive Premiums | Lincoln Financial | |

| #10 | 10% | A+ | Wellness Programs | John Hancock |

They offer strong protection with good terms, ensuring reliable and budget-friendly life insurance. These providers provide tailored policies to meet the specific needs of individuals seeking coverage after prostate cancer.

Getting affordable life insurance with a medical issue can be a challenge, but it’s not impossible. Use our free quote comparison tool to find the lowest rates.

- The best life insurance after prostate cancer starts at $37 per month

- AIG offers tailored coverage for individuals with prostate cancer

- Northwestern Mutual and Prudential provide reliable options

#1 – AIG: Top Overall Pick

Pros

- Coverage Flexibility: AIG provides life insurance options that adjust easily to suit the different needs of people who have recovered from prostate cancer.

- Affordable Rates: At $58/month coverage, AIG gives affordable life insurance plans for people who have had prostate cancer. Visit this “AIG Life Insurance Review” guide.

- A+ Rating: AIG has a strong A+ rating from A.M. Best, showing they are a financially solid and dependable option after prostate cancer.

Cons

- Limited Policy Options: AIG offers fewer specialized life insurance options than other insurers, especially for those with a history of prostate cancer.

- Limited Wellness Programs: There are fewer wellness programs for prostate cancer than other insurers, which may be less appealing to those focused on health and wellness.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Northwestern Mutual: Best for Financial Security

Pros

- Financial Strength: Top-tier A++ rating for peace of mind, especially for prostate cancer survivors.

Tailored Policies: This plan is ideal for building long-term financial security after prostate cancer. Look for more details in this “Northwestern Mutual Life Insurance Review” guide.

Big Discounts: A 25% bundling discount is the best on this list for prostate cancer coverage.

Cons

- Higher Rates: Term policy starts at $81/month, which might be steep for prostate cancer patients.

- Less Flexible Plans: Policies may feel rigid for prostate cancer-specific needs.

#3 – Prudential: Best for Policy Variety

Pros

- Wide Choices: Offers many policy types to fit unique needs after prostate cancer. Read this “Prudential Life Insurance Review” guide to learn more.

- Affordable Rates: Term coverage costs $61/month, suitable for prostate cancer survivors.

- Strong Reputation: Backed by an A+ rating, Prudential is a reliable choice for prostate cancer coverage.

Cons

- Smaller Bundling Discount: The bundling discount is smaller, offering only a 10% savings, even for prostate cancer coverage.

- Costly Whole Coverage: Starts at $190/month, impacting prostate cancer patients.

#4 – Transamerica: Best for Affordable Options

Pros

- Affordable Coverage: Transamerica provides competitive, affordable options for life insurance after prostate cancer.

- Good Data Rates: Starting at $56/month for whole coverage, it is a great option for individuals looking for insurance after prostate cancer.

- Policy Customization: Offers options for individuals after prostate cancer tailored to their policy needs. See this “Transamerica Life Insurance Company Review” guide for more info.

Cons

- Customer Service: Some reports indicate slower response times for prostate cancer patients from customer service.

- Limited Benefits: Transamerica provides fewer additional perks for prostate cancer patients compared to higher-rated competitors.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – State Farm: Best for Customer Service

Pros

- Helpful Customer Support: State Farm is great at helping people with prostate cancer. They make everything easier.

- Bundling Discounts: State Farm offers discounts when you bundle insurance, making it more affordable, especially after prostate cancer treatment.

- Affordable Rates: Starting at just $67/month for whole coverage, State Farm is a dependable option for life insurance after prostate cancer.

Cons

- Higher Premiums: Premium costs may be higher than some competitors for prostate cancer patients.

- Limited Policy Variety: Fewer policy options are available for individuals with prostate cancer. Learn more from this “State Farm Life Insurance Review” guide.

#6 – Mutual of Omaha: Best for Health Coverage

Pros

- Focused on Health: Great for covering health needs after prostate cancer. Find more details in this “Mutual of Omaha Life Insurance Review” guide.

- Affordable Rates: A term policy costs $49/month. It is an excellent choice for prostate cancer coverage.

- Trusted Reputation: An A+ rating adds confidence to prostate cancer patients.

Cons

- Smaller Discount: Only a 10% bundling offer for prostate cancer policies.

- Higher Whole Coverage: Prostate cancer-related plans cost $155 per month, which might be higher for some individuals after prostate cancer.

#7 – AARP: Best for Senior Policies

Pros

- Senior-Focused: Tailored policies for older adults with prostate cancer. Check this “AARP Life Insurance Company Review” guide for more info.

- Low Cost: Term coverage costs $47/month for prostate cancer survivors.

- Top Rating: A++ for stability and trust, especially for prostate cancer patients.

Cons

- Limited Discounts: They only offer a 10% discount for bundling prostate cancer policies.

- Higher Whole Coverage: Prostate cancer-related coverage starts at $135/month.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Banner Life: Best for Affordable Rates

Pros

- Affordable Rates: Banner Life offers some of the lowest data rates for prostate cancer at $37/month for whole coverage.

- Strong A+ Rating: They are known for financial reliability and are a great option after having prostate cancer.

- Quick Application Process: Simple, efficient process for obtaining coverage for prostate cancer.

Cons

- Limited Benefits: Fewer add-ons and perks are available for prostate cancer patients. Find more details in this “Banner Life Insurance Company Review” guide.

- Limited Policy Types: There is less variety in policy structures for prostate cancer survivors.

#9 – Lincoln Financial: Best for Competitive Premiums

Pros

- Competitive Premiums: Lincoln offers affordable coverage options after prostate cancer, with premiums starting at $62/month for whole coverage.

- Good Financial Stability: State Farm is rated A+ for financial strength, making it a great option after having prostate cancer.

- Policy Flexibility: Offers more policy customization options for prostate cancer survivors. View this “Protective Life Insurance Review” guide for additional information.

Cons

- Moderate Customer Service: Some prostate cancer customers report slower response times from customer support.

- Fewer Discounts: After having prostate cancer, there are limited opportunities for additional savings.

#10 – John Hancock: Best for Wellness Programs

Pros

- Wellness Programs: John Hancock provides wellness initiatives and support for prostate cancer patients.

- Data Rates: Competitive monthly rates starting at $53 for whole coverage, a quality rate for individuals after having prostate cancer.

- Good Policy Options: Offers flexible life insurance solutions for prostate cancer. Review this “John Hancock Life Insurance Review” guide for more details.

Cons

- Higher Initial Costs: Sometimes, the cost of insurance premiums can be a bit higher for people who’ve had prostate cancer compared to what other providers might offer.

- Limited Policy Simplicity: Policies can be complex to navigate for some individuals with prostate cancer.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Life Insurance for Prostate Cancer Survivors and How to Secure Coverage

While searching for life insurance with a pre-existing condition can be tiring, it is entirely achievable. View this “How a Pre-Existing Conditions Affects Life Insurance” guide for more details. Don’t be discouraged just because you had or have a serious illness.

Prostate Cancer Life Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Term Policy | Whole Policy |

|---|---|---|

| $47 | $135 | |

| $58 | $180 |

| $37 | $130 |

| $53 | $175 | |

| $62 | $210 | |

| $49 | $155 | |

| $81 | $230 | |

| $61 | $190 | |

| $67 | $190 | |

| $56 | $185 |

Even though there isn’t prostate cancer insurance, you should still consider life insurance. Getting life insurance after prostate cancer is possible, provided that you can meet certain requirements. It’s important to keep in mind that you can expect to pay more than you would without that diagnosis, but we’ll help you sort through the process.

Navigating life insurance after a prostate cancer diagnosis requires understanding your stage and working with a professional to find the best coverage for your situation.Michelle Robbins Licensed Insurance Agent

We understand that getting any cancer diagnosis can be scary, and the first thing you may think of is, “Can I treat it?” It is essential to know the facts about prostate cancer and the ways of treatment. This guide will walk you through everything you need to know, from buying term life to how to improve your life insurance profile.

Prostate Cancer Survivors Life Insurance Rates

Prostate cancer survivors have slightly different rates than those without. Regardless, when you’re younger, your rates are going to be better.

strong>Life Insurance Discounts From the Top Providers After Prostate Cancer

| Insurance Company | Available Discounts |

|---|---|

| Multi-policy, Healthy lifestyle, Automatic payment, Long-term member | |

| Multi-policy, Non-smoker, Healthy living, Policy bundling |

| Multi-policy, Non-smoker, Automated payments |

| Multi-policy, Non-smoker, Wellness program, Healthy living, Family plan | |

| Multi-policy, Non-smoker, Healthy living, Annual payment | |

| Multi-policy, Non-smoker, Bundling, Auto-pay, Healthy lifestyle | |

| Multi-policy, Non-smoker, Preferred health, Auto-pay | |

| Multi-policy, Non-smoker, Health program, Family plan | |

| Multi-policy, Non-smoker, Bundling, Safe driving, Auto-pay | |

| Multi-policy, Non-smoker, Bundling, Healthy lifestyle, Annual payment |

Smoking males with prostate cancer can have higher rates due to their risky health habits. The rates can increase moderately or greatly depending upon the company. Overall, it might just be a good idea to get life insurance sooner rather than later for a good rate.

Underwriting Factors Considered by Companies for Prostate Cancer Survivors

As mentioned in previous articles, each and every insurer on the market has different rules and regulations when it comes to underwriting an individual applying for life insurance. They all have different risks they are willing to take during the life insurance underwriting of a potential client.

Can you get life insurance if you have prostate cancer? The process of life insurance underwriting for prostate cancer involves evaluating various factors, such as the stage and treatment history of the condition.

When applying for life insurance with a history of prostate cancer, there are five key things insurers look at. They consider your age when you were diagnosed and the type of prostate cancer you had, including how severe it was.

Your PSA levels before and after treatment and your Gleason Score, which shows how aggressive the cancer might be, are also important. Lastly, they’ll check the kind of treatment you had and whether there’s proof that the cancer is no longer active.

Cancer Stage

Insurers will be looking through your application for evidence of your diagnosis, including the stage and your Gleason Score, to determine the severity of tumors. They will also want to know what your most recent PSA screening results were. If you’ve received treatment and are in remission, that will help improve your chances of getting insurance.

Whether you have early-stage prostate cancer or have been managing the disease for some time, understanding your options for life insurance and prostate cancer is essential to securing the right policy for your needs.

Each Stage Affects Your Ability to Qualify for Life Insurance

Deciding when to get life insurance after a prostate cancer diagnosis can be tricky. Your stage at diagnosis affects your rates. If you’re in stage 1 or 2 and in good overall health, you may qualify for lower rates.

Mind the Gap! We believe everyone deserves access to life insurance that meets them where they are. Financial protection can look different in many situations. Calculate what could be right for your now: https://t.co/TRqu7LbqOl pic.twitter.com/TGS5p6qXLg

— Transamerica (@Transamerica) April 29, 2024

For stage 3, life insurance is still possible but may involve longer waiting periods. Stage 4 can make it harder to get traditional life insurance, so you might need a guaranteed issue policy. Getting advice from a professional can help make the right choice.

Your Treatment

The treatment that was recommended to you will give the underwriter a glimpse of the severity of your prostate cancer. There are many treatments out there, such as hormone therapy, radiation, radical prostatectomy, and observation only, to name a few.

For those who have had prostate cancer surgery, such as a prostatectomy, life insurance after prostate cancer surgery is still an option, although it may require more detailed underwriting. From the insurance company’s viewpoint, any time a prostatectomy was successfully performed and the cancer did not spread outside the prostate, it’s good news.

You can apply for life insurance after your prostatectomy and traditional life insurance would be your best bet. Looking at sample life insurance rates can help be prepared.

Other Questions the Underwriter Will Ask

Keep in mind that the type of policy you purchase will determine the type of questions you’ll be asked to answer. For instance, a simplified issue policy that doesn’t require an exam will have a few health questions. On the contrary, a term policy that requires an exam will have certain questions so make sure you review what a term life insurance policy offers and its details.

They will ask your age, gender, state of residence, height and weight. They will also ask you about your occupation, hobbies, health history, smoking habits, and criminal history. There will be some additional questions, but those may depend on your own personal situation.

For individuals who have undergone a prostatectomy or other related procedures, life insurance after prostate cancer may still be attainable, though it may require more thorough evaluation.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Get a Better Life Insurance Rate After Prostate Cancer

Prostate cancer life insurance provides essential coverage for individuals managing the condition. Getting a better rate can completely depend on how you approach your treatment, how you live your life and how you continue to live your life after treatment. Even if your cancer is aggressive, your rate can still vary.

Overall, insurance companies appear to give better rates to men over 60 who have had successful treatment. Check this “Term Life Insurance Rates by Age” guide for more information.

You may ask, Can I get life insurance if I have prostate cancer? While it may be possible, rates and coverage options will depend on the specifics of your diagnosis and treatment.

How to Improve Your Life Insurance Profile After Prostate Cancer

If you’re in remission, showing that your cancer treatment has helped you, you have a better chance of being insured. Documenting all of your treatment and positive results can help you find a better rate, although it may be sub-standard. If you’ve survived prostate cancer beyond five years, your life insurance profile is improved.

Having the right life insurance after prostate cancer treatment involves considering your stage and finding the best policy for your needs.Chris Abrams Licensed Insurance Agent

With modern treatment, the typical survival rate is much higher than in previous generations and will be taken into consideration. This is something high-risk insurers are familiar with and will take into consideration.

Case Studies: Life Insurance Options After Prostate Cancer Recovery

When recovering from prostate cancer, figuring out life insurance can seem really tough. These stories show how people explored their choices and got coverage that worked for them. Visit this “10 Best Life Insurance Companies” guide for additional details.

- Case Study #1 – John, Stage 1 Prostate Cancer: John, 55 years old, was diagnosed with stage 1 prostate cancer and was able to get a term life insurance policy with preferred rates. Thanks to his good health, John worked with an insurance professional to find a policy with affordable premiums and strong coverage for his family.

- Case Study #2 – Luke, Stage 3 Prostate Cancer: Luke, 60 years old, had been in remission from stage 3 prostate cancer for three years. He was still able to get life insurance but had to wait a little longer after treatment. With her advisor’s guidance, Luke chose a policy with a longer term for full coverage.

- Case Study #3 – Mark, Stage 4 Prostate Cancer: Mark, 65 years old, struggled to get traditional life insurance due to stage 4 prostate cancer. He explored guaranteed issue policies, which provided limited coverage but ensured his family would be financially protected.

These case studies show how people recovering from prostate cancer found life insurance that works for them. Consulting with a professional can help guide you through the best options for your situation. If you want to explore your life insurance options, enter your ZIP code in our free tool to get started.

Frequently Asked Questions

How does the stage of prostate cancer affect life insurance rates?

Your cancer stage impacts risk assessment. Early stages (1 or 2) may qualify for better rates, while advanced stages (3 or 4) may lead to higher rates or limited options. Additionally, does life insurance cover prostate cancer? Yes, it can, but premiums and eligibility may vary based on individual circumstances.

Can I get life insurance with stage 1 or 2 prostate cancer?

Yes, with good overall health, you may qualify for preferred rates. Each case is evaluated based on your health and cancer stage. If you need life insurance coverage, enter your ZIP code into our free tool to save time and money.

Is life insurance available with stage 4 prostate cancer?

Stage 4 prostate cancer can make traditional life insurance difficult to obtain. Guaranteed issue policies offer coverage regardless of health conditions. Review this “10 Best Life Insurance Companies for High-Risk Individuals” guide for more information.

What happens if I’m in stage 3 prostate cancer?

For stage 3, life insurance is possible, but it may involve longer waiting periods post-treatment. Your individual recovery plays a role in eligibility. A life insurance policy for someone with prostate cancer will be tailored to reflect the level of risk associated with the condition, ensuring that applicants receive appropriate coverage.

How does treatment affect life insurance?

Getting life insurance with prostate cancer can be possible, but it often depends on factors such as the stage of the disease, treatment history, and overall health. Treatment history impacts your coverage. Ongoing treatment may limit options, but policies are still available based on health recovery.

What is guaranteed issue life insurance?

Guaranteed issue life insurance doesn’t require a medical exam or health questions. These policies are available for individuals with advanced health conditions like stage 4 cancer. For more details, view this “Best Guaranteed Issue Life Insurance Companies” guide.

When should I apply for life insurance after cancer treatment?

The timing depends on recovery. Earlier stages may allow for quicker applications, while advanced stages may require more time for health stability. Many people wonder if they can get life insurance for someone with prostate cancer or if travel insurance prostate cancer is available for those who have been diagnosed.

Can a family history of prostate cancer affect life insurance?

A family history can influence the underwriting process, but it doesn’t automatically disqualify you. Your current health and cancer stage are the primary factors. Additionally, individuals need to understand how prostate cancer affects life insurance policies and how it influences their coverage to ensure they have the proper protection in place.

How does age impact life insurance rates post-cancer?

Younger individuals may receive more affordable coverage compared to older individuals due to lower health risks. View this “Life Insurance Cost by Age: How Your Age Impacts Life Insurance Premiums” guide for more info.

Should I consult a professional for life insurance after cancer?

Yes, a professional can help guide you through policy options, ensuring the best coverage based on your health history and cancer stage. When you’re ready to look at life insurance quotes, enter your ZIP code into our free comparison tool.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.