Foresters Life Insurance Company Review

Headquartered in Canada, Foresters life insurance rates start as low as $16 per month. Foresters life insurance reviews are usually positive, with customers focusing on how many policy choices the company offers. However, Forester reviews also say that the company receives more complaints than similar companies.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Aaron Englard

Insurance Premium Auditor

With over a decade of experience in insurance premium auditing, audit department management, and business audit representation, Aaron has developed a deep understanding of audit regulations, compliance requirements, and industry best practices. As the Founder & CEO of AdvoQates, he specializes in representing businesses during their audits to ensure accurate, transparent, and fair assessments ...

Insurance Premium Auditor

UPDATED: Jun 9, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Jun 9, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Foresters is a popular option for life insurance in the U.S., Canada, and the U.K., primarily because it offers a wide variety of life insurance policies and customization options. Quotes tend to be affordable, though you’ll often find lower prices at other companies.

However, there are a few drawbacks to shopping at Foresters. For example, Foresters financial reviews have a higher number of complaints than similarly-sized companies receive. You also can’t get an online quote from Foresters — you’ll need to speak with a representative.

When you shop at Foresters, you’ll have access to a variety of types of life insurance to help you find the right policy for your needs.

- Foresters offers several life insurance policies in the U.S., Canada, and the U.K.

- Foresters life insurance quotes are usually affordable, though not the cheapest

- The company receives more complaints than average

Explore what Foresters life insurance has to offer you, then compare rates and policy options with other companies to find the best coverage possible.

Foresters Life Insurance Company Ratings

According to A.M. Best, an industry leader that measures insurance company ratings, Foresters Life Insurance Company has an A (excellent) rating, as of August 19, 2016. This A.M. Best rating of Foresters Life Insurance means that you won’t have to worry about your death benefit being paid.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Foresters Life Insurance Options

Foresters Life offers Term, Accident, Whole, and Universal life policies. We will go over each type to find out a little more.

LifeFirst Term Insurance

This Foresters term life insurance plan provides level benefits and premiums, which means that the premiums and death benefits never change after you buy the policy. They have 10-, 20-, 25- and 30-year term life coverages. The policies are renewable and convertible.

LifeFirst Highlights

- Issue ages 18–55 years. For a non-medical policy, the range is $50,000–$250,000. For medical: $250,000 and up.

- Issue ages 56+. For a non-medical policy, the ranges are $50,000–$150,000. For medical: $150,000 and up.

- Renewable. After the term is over, you can keep the policy at annual renewable rates (which is not recommended, because rates usually are crazy high) up to age 100, without providing evidence of insurability, and regardless of your current health.

- Convertible. This means that the term policy you bought can be converted to a whole life policy 5 years before the end of the term, or when the insured is age 65. No health questions or underwriting questions. You are guaranteed approval.

- It comes with an accelerated death benefit rider at no additional cost. It allows the policy owner to withdraw a portion of the policy if he/she is diagnosed with a terminal illness. Learn how a death benefit works here.

Prepared Accidental Death Term Insurance

This is a policy that pays benefits only if you die as a result of an accident. The max death benefit is $300,000. This isn’t considered life insurance in my book since you’re only covered if you die from an accident. The individuals who buy this policy are typically not qualified for a traditional policy. They may be under probation or have major health issues that prevent them from qualifying for a regular life insurance policy.

Whole Life Insurance

As the name suggests, whole life provides a lifetime of protection as long as premiums are paid. Foresters offers a few types of whole life policies: PlanRight, Advantage Plus, Interest Sensitive, and Legacy Single Premium.

PlanRight Highlights

- A lifetime coverage up to age 121.

- Guaranteed level premiums (the premium stay the same for life).

- There is no income tax on the death benefit.

- Common Carrier Accidental Death Rider – This rider is included automatically and provides an extra death benefit if you die as a result of an accident, for example while riding as a passenger on a bus, train, or plane.

Advantage Plus Highlights

- Guaranteed level premiums payable in 20 years or to age 100.

- Allows the policyholder to borrow against the cash value in the policy.

- Since this is a participating whole life, you are entitled to dividends and can use it to pay premiums, let it accumulate in the account, or use it as cash.

- Accelerated death benefit is included with no extra cost.

- Common Carrier Accidental Death Rider is included with no extra cost.

- Family health benefit rider is included with no extra cost. This can help you pay some family-related expenses if there are natural disasters, such as tornados, earthquakes, and hurricanes.

Interest Sensitive Highlights

This is a whole life policy that also provides an income tax-deferred accumulation benefit.

- Coverage lasts until age 121.

- Fixed premiums that stop at age 100.

- The accumulation benefit grows at a guaranteed minimum interest rate, plus a potential to earn more if there is growth.

- Income tax-deferred growth. This allows the policyholder to accumulate wealth more quickly.

- You have the option to suspend premiums. If there is enough cash value in your policy, you may elect to suspend payment. Keep in mind this slows the growth value of your policy.

Legacy Single Premium Highlights

A single premium life (SPL) is a type of life insurance policy that is practically paid in full with one payment. This could be ideal for estate planning.

- The cash benefit grows a lot faster because the policy is fully paid.

- Permanent coverage for life up to age 121.

- Can be purchased on children from birth to 15 years.

- Guaranteed one-time payment.

- Allows you to borrow against it if you choose in the future (however this will reduce the death benefits).

- Guaranteed accumulated cash benefit.

- You may also earn dividends (not guaranteed) which can help you to buy extra coverage, or get paid in cash.

- Three extra riders are included at no additional cost: family health benefit, common carrier, and accelerated death benefit.

Universal Life Insurance

Universal life policy is a whole life policy that allows you the flexibility to make changes to the premiums, let you skip premiums, or change the death benefit amount.

Foresters Smart Universal Highlights

- Lifetime coverage.

- The cash value grows on a tax-deferred basis until withdrawn.

- Can borrow against the funds in the account.

- Smart universal guarantees a minimum interest rate of 3% per year.

- Three extra riders are included at no additional cost: family health benefit, common carrier, and accelerated death benefit.

Foresters Final Expense Policies

Final expense or “burial policies” are policies that provide a low death amount of $2,000 to $35,000. It’s worth mentioning that Foresters burial insurance policies are simplified issue, which means there is no exam to take, and there are only a few health questions to answer on the application.

This type of insurance is used to cover the expenses associated with death or burial. There are a few types of policies Foresters offers through its PlanRight whole life:

PlanRight with a Level Death Benefit

Once this policy is issued, 100% of the benefits will be paid when you die. There is no waiting period, and the maximum death benefits are up to $35,000, depending on your age at the time of application. The premiums will stay the same. Keep in mind, this type of policy is geared towards the healthier kind of individuals.

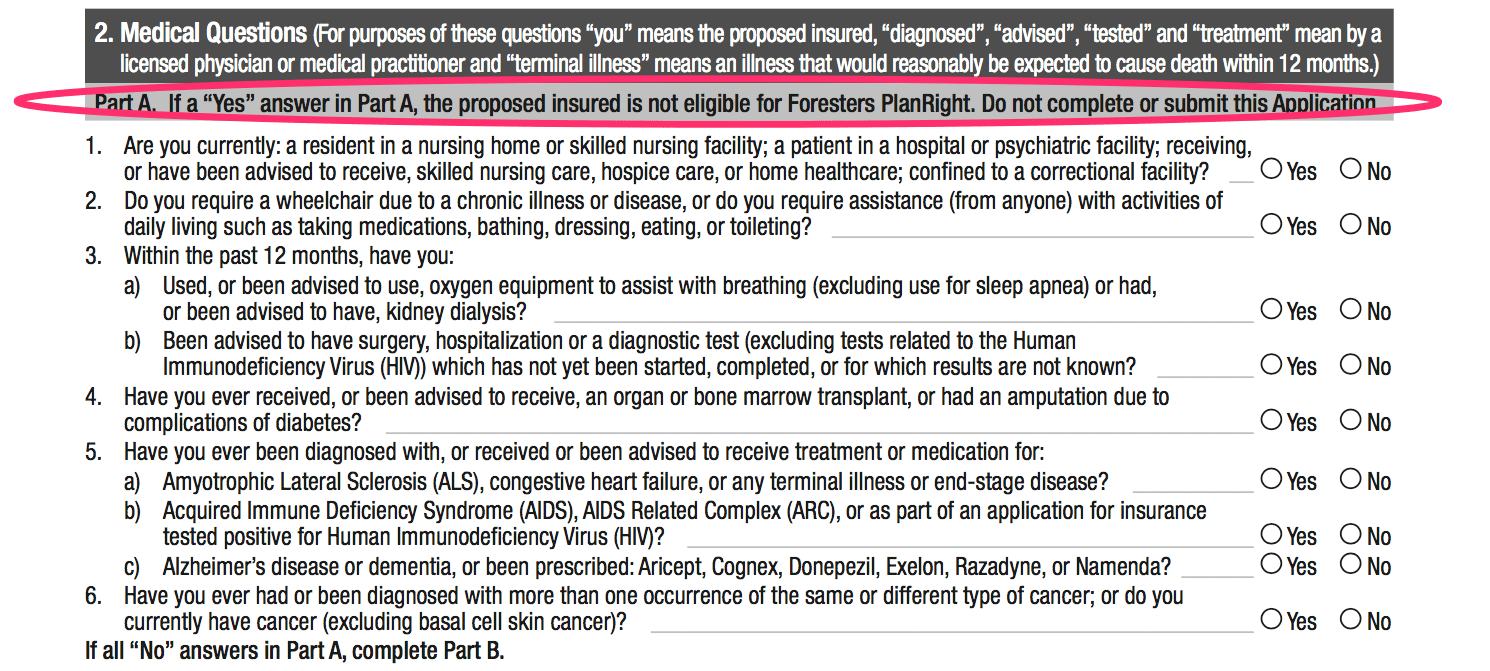

Level Death Benefit Health Questions

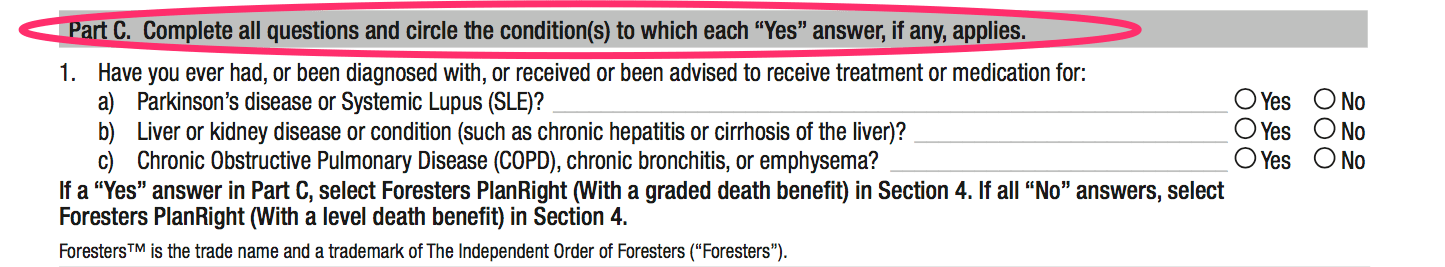

PlanRight with a Graded Death Benefit

Graded benefit is geared toward individuals with less than perfect health. This limits the death benefits for the first or second year, depending on the purchased policy. The insurance company is hedging their bets by paying less benefits if you die in the first few years, and you also are taking a chance by buying a policy for which you otherwise couldn’t qualify.

The maximum death amount with Foresters is $20,000, and the death benefit is limited to 30% of the death amount for the first year, 70% for the second year, and 100% at the beginning of the third year.

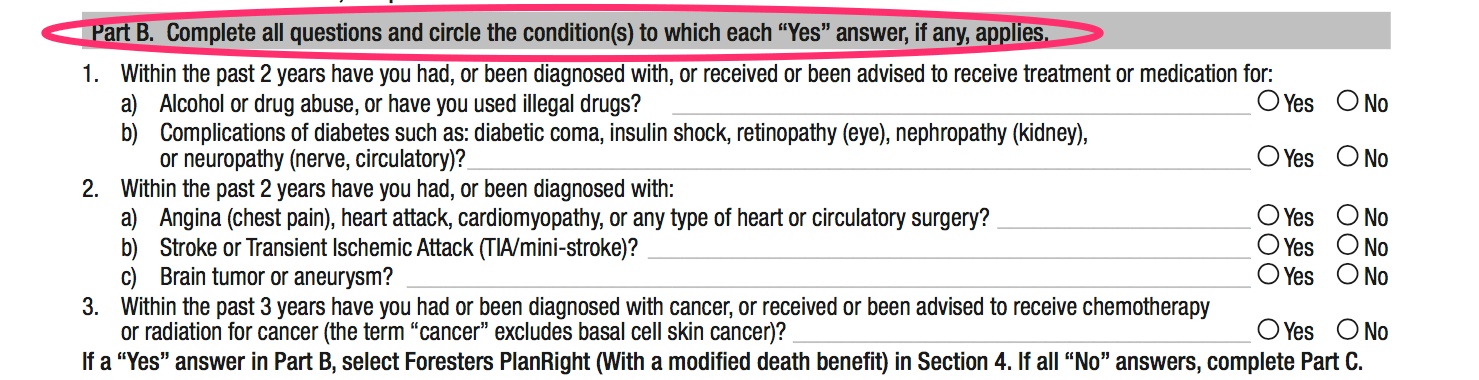

Graded Death Benefit Health Questions

PlanRight with a Modified Death Benefit

Modified death benefit is for even less healthy individuals. The death benefit is limited for the first two years to a return of premium plus 10% interest. The maximum death amount is $15,000, and you still need to answer health questions. At this point, Gerber Life would be a much better choice. They still only pay the 10% in interest if you die within two years, but at least Gerber is a guaranteed issue policy with no health questions asked.

Modified Death Benefit Health Questions

Foresters Optional Riders

- Waiver of Premium Rider: Your premium will be waived if you are disabled and can’t work.

- Critical Illness Rider: You can withdraw a portion of the death benefit if you are diagnosed with a critical illness (as defined by the policy).

- Disability Income Protection: Provides you an income for up to two years. Comes in two forms: accidents and illness.

- Accidental Death Coverage: Provides an extra death benefit to your beneficiaries if you die from an accident.

- Children’s Term Rider: You can buy coverage for your kids, which later could be converted to a whole life policy, regardless of their health.

Related: Life insurance riders explained.

Foresters vs. Other Carriers’ Sample Monthly Rates

*All rates quoted on this page are for a super-preferred healthy individual who does not use tobacco. Monthly rates are updated as of March 2017 and are subject to underwriting approval.*

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Do You Choose the Right Policy?

You can do a lot of reading on your own, or you can work with an experienced insurance broker that will provide all the information for you to make the right decision for yourself. The good news is that working with a broker costs you nothing and you get other options than just Foresters. Foresters is a great company with a strong financial background, however, they are not competitive in premiums for all ages and all face value amounts.

Here at Effortless Insurance, we represent more than 50 insurance companies and believe that there is no one insurer who fits all individuals, but the individual can fit at least one carrier we represent. You can use the life insurance instant quotes on this page.

Frequently Asked Questions

What is Foresters Life Insurance Company?

Foresters Life Insurance Company is a financial services organization that offers life insurance and investment products. They have been serving individuals and families for over 140 years, providing financial security and support.

What types of life insurance policies does Foresters Life Insurance Company offer?

Foresters Life Insurance Company offers various life insurance policies, including:

- Term Life Insurance: Provides coverage for a specific period, such as 10, 20, or 30 years.

- Whole Life Insurance: Offers lifelong coverage with a cash value component and potential for dividends.

- Universal Life Insurance: Provides flexibility in premium payments and death benefit coverage.

What are the benefits of choosing Foresters Life Insurance Company?

Some benefits of choosing Foresters Life Insurance Company include:

- Financial strength and stability: Foresters is a financially stable organization with a long history of serving policyholders.

- Competitive coverage options: They offer a range of life insurance policies to meet different needs and budgets.

- Member benefits: As a policyholder, you may be eligible for additional benefits, such as scholarships and grants.

- Community focus: Foresters actively supports various community initiatives and offers member events.

How can I apply for Foresters Life Insurance Company policies?

To apply for life insurance policies from Foresters Life Insurance Company, you can contact a licensed insurance agent or visit their website. The application process typically involves providing personal information, medical history, and selecting the desired coverage amount and policy type.

How can I get a quote for Foresters Life Insurance?

To obtain a quote for Foresters Life Insurance, you can visit their official website and use their online quoting tool. Alternatively, you can contact their customer service or work with an independent insurance agent who can provide quotes from multiple insurance companies, including Foresters Life Insurance.

Can I customize my Foresters Life Insurance policy?

Yes, Foresters Life Insurance policies typically offer customization options. You can often choose the coverage amount, policy duration (for term policies), premium payment frequency, and add optional riders to enhance your coverage. These options allow you to tailor the policy to your specific needs and preferences.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Aaron Englard

Insurance Premium Auditor

With over a decade of experience in insurance premium auditing, audit department management, and business audit representation, Aaron has developed a deep understanding of audit regulations, compliance requirements, and industry best practices. As the Founder & CEO of AdvoQates, he specializes in representing businesses during their audits to ensure accurate, transparent, and fair assessments ...

Insurance Premium Auditor

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.