Nassau Re Life Insurance Review 2025 (Companies + Rates)

Our Nassau Re life insurance review of the formerly Phoenix Life reveals that life insurance policies start at $16 per month. Nassau Re Life offers three main life insurance products, including term life (Safe Harbor Term Life Express & Non-Express plan), whole life (Remembrance Life plan) and universal life (Nassau Re Simplicity Index Life).

Read moreFree Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Laura Kuhl

Managing Content Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. In 2018, she started writing for the cannabis industry. She curated news articles and insider interviews with investors and small business ...

Managing Content Editor

UPDATED: Feb 7, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Feb 7, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Nassau Re Life was frmerly known as Phoenix Life (PHL Variable Insurance Company)

- Nassau Re Life offers term life, whole life, and universal life insurance

- Nassau Re life insurance quotes start from $16 per month

Nassau Re Life Insurance Company Overview

| Key Info | Company Specifics |

|---|---|

| Year Founded | 2016 |

| Current Executives | CEO – Phil Gass COO – Kostas Cheliotis |

| Number of Employees | 600 |

| Total Sales / Total Assets | $475,430,000 / $22,000,000,000 |

| HQ Address | 1 American Row Hartford, CT 06103-2801 |

| Phone Number | 1-860-403-5000 |

| Company Website | www.nsre.com |

| Premiums Written – Group Life | $1,558,520 |

| Financial Standing | $94,233,376 |

| Best For | No-Exam Term Life Insurance |

What is Nassau Re? Formerly known as Phoenix Life (or PHL Variable Insurance Company), Nassau Re (we’ll refer to it as Nassau Re Life) was purchased and reinvented in 2015.

As Phoenix Life, it had several years of life insurance strength, which continues today under its new name. Even though they are now Nassau Re Life, their policies have a strong resemblance to the old Phoenix Life insurance policy.

This Nassau Life insurance review is designed so that you can look at this recently rebranded company juFst like an insurance broker would before they recommend or advise against its service. We will even examine sample life insurance rates for term life and whole life insurance.

Ready to compare rates for the best company now? Enter your ZIP code above.

Shopping for Nassau Re Life Insurance Quotes

When looking into purchasing life insurance, one should review the life insurance basics such as what are some of the final, expenses, who your beneficiary should be, and the 17 life insurance mistakes to avoid. Be sure to look at what makes the insurance company of your choosing right for you when you are reviewing what policies are right for you.

Nassau Re Life has two basic life insurance products:

- Nassau Re Safe Harbor Term Life

- Nassau Re Remembrance Life (Burial and Final Expense insurance)

We’ll cover the details of both of these options later in the article, but let’s get right into some rate comparisons.

Average Nassau Re Life’s Insurance Rates by Age

To give you an idea of how they compare to major life insurance providers, we display Nassau Re Life’s No-Exam term life insurance rates by gender and age.

Nassau Re Life’s No-Exam Term Life vs Competitors’ Term Life Monthly Rates

Women in their 30s appear to be getting the best rates when compared to Nassau Re Life’s competitors. A 20-year term might be considered an option for a man who wants to cover the potential for lost income for the family if he were to pass on. Obviously, the younger you are when you purchase the policy, the better your rate is.

Nassau Re Life is a little pricier than other major brands, but once you get to know the company’s particular riders and selling points, you’ll see why.

Women need to be insured, perhaps as much as or more than men. Women are increasingly becoming the primary breadwinners, and they are also at the same time the primary caregivers, which means they need to compare rates for life insurance as meticulously as men. Here’s an example of what women can expect to pay for protection.

Based on the comparisons, Nassau Re Life is more expensive than other top life insurance names, but what is hidden in these quotes is its ability to provide other built-in riders that you would pay more for with another company. You’ll see from this rate chart that men pay significantly more than women in this category, but Nassau Re’s rates become increasingly higher as one ages.

20-Year Term, $100,000 Average Monthly Life Insurance Rates by Age and Gender

| Age & Gender | Nassau Re Life Safe Harbor | Nassau Re Life Safe Harbor Express | American National | SBLI | Sagicor |

|---|---|---|---|---|---|

| 30-Year-Old Female | $16.14 | $22.27 | $12.96 | $9.14 | $10.05 |

| 30-Year-Old Male | $17.43 | $24.08 | $14.69 | $9.92 | $11.41 |

| 40-Year-Old Female | $22.52 | $32.36 | $17.37 | $12.12 | $12.18 |

| 40-Year-Old Male | $26.15 | $36.85 | $19.35 | $12.67 | $14.26 |

| 50-Year-Old Female | $42.11 | $61.36 | $29.89 | $20.16 | $23.52 |

| 50-Year-Old Male | $51.69 | $79.31 | $38.62 | $24.63 | $32.03 |

| 60-Year-Old Female | $89.06 | $154.22 | $66.53 | $42.26 | $60.09 |

| 60-Year-Old Male | $119.78 | $189.43 | $95.39 | $64.34 | $90.03 |

The same pertains to women: The earlier you apply for and buy life insurance, the more you’ll save. As you can see by these comparison rates, women pay significantly more for Nassau Re Life’s coverage than with other companies, but as we’ll explain, it also has riders that other insurers don’t offer, even at the short-term purchase.

20-Year Term, $250,000 Average Monthly Life Insurance Rates by Age and Gender

| Age & Gender | Nassau Re Life Safe Harbor | Nassau Re Life Safe Harbor Express | American National | SBLI | Sagicor |

|---|---|---|---|---|---|

| 30-Year-Old Female | $31.02 | $46.34 | $24.62 | $13.31 | $15.34 |

| 30-Year-Old Male | $34.26 | $50.87 | $28.94 | $14.79 | $18.12 |

| 40-Year-Old Female | $46.99 | $71.59 | $35.64 | $18.99 | $20.88 |

| 40-Year-Old Male | $56.05 | $82.80 | $40.61 | $21.67 | $25.80 |

| 50-Year-Old Female | $95.97 | $144.08 | $66.96 | $36.46 | $48.73 |

| 50-Year-Old Male | $119.91 | $188.95 | $88.78 | $51.68 | $57.18 |

| 60-Year-Old Female | $213.33 | $376.22 | $158.54 | $90.37 | $138.24 |

| 60-Year-Old Male | $290.14 | $464.25 | $230.69 | $147.70 | $198.51 |

Compared to the lowest quote here, women with Nassau Re Safe Harbor or Safe Harbor Express will pay significantly more than they would with other companies.

The fine print is in the policy: Nassau Re Life sells its insurance with the additional, no-cost riders contained within.

20-Year Term, $400,000 Average Monthly Life Insurance Rates by Age and Gender

| Age & Gender | Nassau Re Life Safe Harbor | Nassau Re Life Safe Harbor Express | SBLI | Sagicor |

|---|---|---|---|---|

| 30-Year-Old Female | $45.91 | $70.42 | $17.54 | $20.76 |

| 30-Year-Old Male | $51.09 | $77.67 | $21.32 | $29.94 |

| 40-Year-Old Female | $71.46 | $110.81 | $26.62 | $29.63 |

| 40-Year-Old Male | $85.95 | $128.76 | $30.91 | $37.49 |

| 50-Year-Old Female | $149.82 | $226.80 | $54.58 | $74.19 |

| 50-Year-Old Male | $188.13 | $298.60 | $78.93 | $87.71 |

| 60-Year-Old Female | $337.61 | N/A | $140.84 | $217.40 |

| 60-Year-Old Male | $460.50 | N/A | $232.57 | $313.84 |

As the above chart demonstrates, getting life insurance at a higher level isn’t always an option. This means that the more you want to be insured for comes at a cost that’s significantly higher. By age 60, you can no longer be insured at the $400,000 level by Nassau Re Life. Females looking for new life insurance will have a better chance of being insured by Nassau Re Life later in life than other insurers but you’ll also see that women will pay significantly more to be insured by Nassau Re Life.

All rates quoted on this page are for a super-preferred healthy person who does not use tobacco. Monthly rates are updated as of Feb 2018 and are subject to life insurance underwriting approval.

Nassau Re Life’s Final Expense vs Other Carriers’ Sample Monthly Rates

Nassau Re Life calls its final expense insurance Remembrance Life, and it’s a type of whole life policy that’s usually purchased to cover the expenses of a funeral or critical care. At the $10,000 whole life coverage, Nassau Re Life’s rates are in line with other insurers. It’s pretty straightforward — its whole life rates are at a glance competitive with other insurers’ rates.

The average cost of a funeral in the United States ranges from $7,000 to $15,000, and according to the Federal Trade Commission, it can be even higher, since people often overlook the fact that there are other expenses, such as estate taxes.

The $200,000 whole life comparisons demonstrate the fact that purchasing final expense insurance (whole life insurance) earlier in life is less expensive and can save the survivors significant money when the plan is put in place earlier in life. Nassau Re Life is in the middle of the $200,000 whole life coverage rates. It’s not the most affordable, but as you’ll learn later in this article, it receives high ratings from its customers for its service.

To purchase $200,000 coverage, people can not only look to cover funeral expenses, but they can probably expect to cover other unexpected costs associated with the death of a family member. Nassau Re Life is once again in about the middle of the pack in terms of cost.

$10,000 Whole Life Average Monthly Life Insurance Rates by Age and Gender

| Companies | 50-Year-Old Female | 50-Year-Old Male | 60-Year-Old Female | 60-Year-Old Male | 70-Year-Old Female | 70-Year-Old Male | 80-Year-Old Female | 80-Year-Old Male |

|---|---|---|---|---|---|---|---|---|

| Americo | $24.56 | $32.06 | $33.93 | $43.68 | $53.43 | $72.93 | $112.77 | $145.65 |

| Mutual of Omaha | $24.67 | $29.16 | $32.87 | $42.76 | $53.24 | $73.70 | $98.43 | $132.65 |

| Transamerica | $25.32 | $30.73 | $33.72 | $43.85 | $71.59 | $74.66 | $104.11 | $140.22 |

| Assurity | $25.48 | $28.82 | $34.74 | $41.65 | $56.41 | $73.05 | $113.89 | $155.57 |

| Liberty Bankers Life | $25.57 | $30.51 | $34.67 | $45.80 | $54.79 | $73.31 | $109.16 | $146.80 |

| American-Amicable | $25.96 | $30.80 | $37.22 | $45.76 | $58.70 | $76.57 | $110.44 | $151.36 |

| Settlers | $26.01 | $31.45 | $36.38 | $45.31 | $55.76 | $72.85 | $113.48 | $153.80 |

| Foresters | $26.05 | $32.00 | $35.41 | $45.19 | $83.41 | $72.91 | $111.08 | $216.09 |

| United Home Life | $26.06 | $31.02 | $35.42 | $44.69 | $73.28 | $74.63 | $141.58 | $138.60 |

| Nassau Re Life | $26.63 | $30.15 | $36.46 | $43.27 | $55.26 | $72.74 | $110.24 | $146.92 |

These charts also illustrate the mathematics of aging: The longer you live, the higher your life insurance rate will be, regardless of the company. These tables also demonstrate the fact that the earlier you buy whole life, the lower your rate will be because of the statistical chance of your age at death.

$20,000 Whole Life Average Monthly Life Insurance Rates by Age and Gender

| Companies | 50-Year-Old Female | 50-Year-Old Male | 60-Year-Old Female | 60-Year-Old Male | 70-Year-Old Female | 70-Year-Old Male | 80-Year-Old Female | 80-Year-Old Male |

|---|---|---|---|---|---|---|---|---|

| Americo | $45.32 | $60.33 | $64.07 | $83.56 | $103.06 | $142.06 | $221.75 | $287.51 |

| Mutual of Omaha | $46.14 | $55.11 | $62.53 | $82.31 | $103.28 | $144.20 | $193.66 | $262.11 |

| Liberty Bankers Life | $46.51 | $56.39 | $64.71 | $86.97 | $104.95 | $141.99 | $213.69 | $288.97 |

| Transamerica | $47.07 | $57.89 | $63.87 | $84.05 | $104.41 | $145.74 | $204.65 | $276.88 |

| United Home Life | $47.76 | $57.68 | $66.49 | $85.03 | $100.59 | $144.91 | $204.87 | $272.05 |

| Assurity | $48.77 | $55.44 | $67.28 | $81.10 | $110.62 | $143.90 | $225.58 | $308.93 |

| Foresters | $48.95 | $60.85 | $67.67 | $87.22 | $103.69 | $142.66 | $219.01 | $290.33 |

| Nassau Re Life | $49.12 | $56.16 | $68.78 | $82.40 | $106.37 | $141.34 | $216.34 | $289.69 |

| American-Amicable | $49.28 | $58.96 | $71.81 | $88.88 | $114.75 | $150.50 | $218.24 | $300.08 |

| Settlers | $52.02 | $62.90 | $72.76 | $90.61 | $111.52 | $145.69 | $226.95 | $291.13 |

For the $300,000 whole life coverage level, many of a person’s final expenses can be covered, including burial and other medical expenses that were previously unforeseen. The incremental cost for insurance is illustrated above.

$30,000 Whole Life Average Monthly Life Insurance Rates by Age and Gender

| Companies | 50-Year-Old Female | 50-Year-Old Male | 60-Year-Old Female | 60-Year-Old Male | 70-Year-Old Female | 70-Year-Old Male | 80-Year-Old Female | 80-Year-Old Male |

|---|---|---|---|---|---|---|---|---|

| Americo | $66.07 | $88.59 | $94.20 | $123.44 | $152.68 | $211.19 | $330.72 | $429.36 |

| Liberty Bankers Life | $67.45 | $82.27 | $94.76 | $128.14 | $155.11 | $210.67 | $318.23 | $431.14 |

| Mutual of Omaha | $67.60 | $81.06 | $92.20 | $121.86 | $153.31 | $214.69 | $288.89 | $391.56 |

| Transamerica | $68.82 | $85.04 | $94.02 | $124.29 | $154.84 | $216.83 | NA | NA |

| United Home Life | $69.47 | $84.35 | $97.55 | $125.38 | $148.71 | $215.19 | $305.13 | $407.10 |

| Nassau Re Life | $71.61 | $82.17 | $101.10 | $121.53 | $157.49 | $209.94 | $322.43 | $432.47 |

| Foresters | $71.85 | $89.70 | $99.93 | $129.26 | $153.96 | $212.42 | $326.94 | $433.91 |

| Assurity | $72.05 | $82.06 | $99.83 | $120.55 | $164.82 | $214.75 | $337.27 | $462.30 |

| American-Amicable | $72.60 | $87.12 | $106.39 | $132.00 | $170.81 | $224.43 | $326.04 | $448.80 |

| Settlers | $78.03 | $94.35 | $109.14 | $135.92 | $167.28 | $218.54 | $340.43 | $461.81 |

Nassau Re Life is fairly competitive with other insurance companies compared to its competitors, seeing as it still offers insurance to people who are well into their 80s — a good option for seniors in good health.

For females at the $300,000 level, the rates are significantly higher, but for families that would like that extra coverage for unexpected costs, such as medical or long-term care costs, this level can help families prepare for end-of-life expenses.

Nassau Re Life is in the middle of the pack with its rates in this scenario.

You should compare and speak with an insurance specialist before deciding which insurance company is best for your particular circumstances.

About Nassau Re Life Insurance

In 1851, a group of religious and business leaders in Hartford, Connecticut established the American Temperance Life Insurance Company, a company that only insured those who abstained from drinking alcohol.

In 1860, American Temperance decided to insure everyone else, and so changed its name to Phoenix Mutual Life Insurance Company. To answer the question who bought Phoenix Life insurance, in 2016, Nassau Re did, and the company serves as their U.S. life insurance and annuity platform. Thus, the Phoenix Companies became the Nassau Re Companies of New York.

So we know who owns Nassau Re, the parent company of Nassau Re Life. It contributed greatly to increasing the financial strength and liquidity of the company. Nassau Re Financial Group also bought other life insurance companies, a process known as reinsurance, which protects insurers and their clients through combining assets.

Nassau Re Life Ratings

According to A.M. Best, a leader in ratings in the insurance industry, Nassau Re Life has a B (fair) rating, with a negative outlook. Fitch gave the company a little better of a rating scoring a BB+ (speculative) with a stable outlook. Since Nassau Re Life is still a fairly new company, it’s no surprise that they have B ratings that give them a chance to improve and show everyone what they’re made of.

Nassau Re Life’s Market Share

The newly partnered company has been improving its numbers over the years. The company advertises its 473,000 policies written and $18.4 billion in statutory assets. However, compared to the top 10 companies for life insurance, they have the least amount of direct premiums written for 2018 along with market share percentage.

Top 10 Individual Life Insurance Companies and Nassau Re Life by Direct Premiums

| Rank | Companies | Direct Written Premium | Market Share |

|---|---|---|---|

| 1 | Northwestern Mutual Life | $10,517,115,452 | 6.42 |

| 2 | Metropolitan Group | $9,821,445,953 | 6.00 |

| 3 | New York Life | $9,295,848,300 | 5.68 |

| 4 | Prudential | $9,128,805,060 | 5.57 |

| 5 | Lincoln National | $8,769,303,174 | 5.36 |

| 6 | MassMutual | $6,854,713,057 | 4.19 |

| 7 | Aegon | $4,809,856,650 | 2.94 |

| 8 | John Hancock | $4,640,905,017 | 2.83 |

| 9 | State Farm | $4,633,004,963 | 2.83 |

| 10 | Minnesota Mutual Group | $4,422,100,028 | 2.70 |

| N/A | Nassau Re Life | $11,074,742 | .275 |

For group life insurance, Nassau Re Life appears to be keeping up with the top 10 crowd, with $1.7 million in 2017 and $1.56 million in 2018.

Top 10 Group Life Insurance Companies and Nassau Re Life by Direct Premiums

| Rank | Companies | Direct Premiums Written |

|---|---|---|

| 1 | MetLife Inc. | $7,133,718 |

| 2 | Prudential Financial Inc. | $3,364,765 |

| 3 | Securian Financial Group | $2,510,157 |

| 4 | New York Life Insurance Group | $2,054,828 |

| 5 | Cigna Corp. | $1,703,227 |

| 6 | Unum Group | $1,617,900 |

| 7 | Lincoln National Corp. | $1,357,411 |

| 8 | Hartford Life & Accident Insurance Co. | $1,334,463 |

| 9 | Nationwide Mutual Group | $1,315,267 |

| 10 | CVS Health Corp. (2) | $946,226 |

| N/A | Nassau Re Life | $1,558,520 |

Because it’s a fairly new company since the merge, the numbers seem to show some growth, a positive outlook and represent Nassau Re’s wealth management. The increasing numbers could have a lot to do with people getting to know the company and the new things it has to offer.

Based on the National Association of Insurance Commissioners (NAIC), their financial standing improved from 2017 to 2018, but in 2019, Nassau Re revenue declined by almost $15 million.

Nassau Re Life Insurance Net Income/Loss

| Year | Nassau Re Life Insurance Income |

|---|---|

| 2019 | -$14,651,171 |

| 2018 | $94,233,376 |

| 2017 | $68,386,022 |

It’s no wonder Fitch gave them a speculative rating.

Nassau Re Life’s Online Presence

Other than their website, they aren’t really present online. It’s hard to find ads, informational videos, or commercials for the company. The only videos for the company are located on their site and YouTube and are about the two main life insurance policies they offer and why you need them. Something they really go into depth for is their final expense insurance.

Nassau Re Life’s Commercials

As far as commercials go, Nassau Re Life doesn’t have any. This says to consumers that they are hoping their quality of service speaks for them. With that being said, to grow effectively and reach more people, a couple of commercials wouldn’t hurt. By adding commercials (or even ads) it allows the public to see they are a company to be talked about.

Nassau Re Life in the Community

Nassau Re Life enjoys being involved with the local community. They have provided grants, scholarships and volunteer work for their local community by providing things such as basic housing or food to those in need.

The company has donated 800 pints of blood and spent 22,100 hours mentoring. Nassau Re Life encourages its employees to get involved with any non-profit of their choice. The employees are given 40 paid hours to do volunteer work each year.

The below video explains more about Nassau Re Life’s work to help communities

Many employees help the Hartford community by participating in food share. This cause is one the company is a big supporter of. The company also partners with organizations such as the Red Cross, Unity House, and the YMCA.

Nassau Re Life’s Employees

Nassau Re Life’s employees have given positive reviews about working with the company. They report the staff to be friendly, and that the company has a great work culture and gives great benefits.

Some of the common complaints were that there weren’t many chances to move up, and a lot of people were nervous about getting laid off. Some of the reviews are from people who were still with the company when it was Phoenix, so they were nervous about their job.

Compare Quotes From Top Companies and Save Secured with SHA-256 Encryption

Nassau Re Life’s Insurance Policies

On average, each insurance will have the two principal types of life insurance, whole and term life. Nassau Re Life offers two main life insurance coverages: Safe Harbor Term Life and Remembrance Life. They approach life insurance a little less traditional than the companies that offer just whole or term life insurance.

Term Life Insurance

As you’re aware by now, term life insurance is the most economical protection you can have and is also the simplest to understand. The word “term” refers to the length of time that you buy a policy for, such as 10, 20, or 30 years. During that time, your premium and death benefits stay the same.

If you die during that time, your beneficiaries will receive the death benefit. If not, when the term is up, you can consider an annual renewable term renew it annually until a certain age (most commonly 95), or drop the policy altogether. Learn more about term life insurance rates.

Safe Harbor Term Life Express & Non-Express

Nassau Re has a unique term life insurance product. Their term product is simplified-issue life insurance packed with four riders at no additional cost. Simplified-issue means that there is no invasive paramedical exam, and an attending physician statement isn’t needed in some cases. Safe Harbor Life is split into two products: express and non-express.

They both offer a no-exam life insurance policy. However, the non-express death amounts are higher and the underwriting process will be longer. They will order medical records in certain cases, which tends to take longer to issue your policy. The good news is that the non-express costs less than the express. The faster you want it, the more you’ll pay for it. Nassau Re Life’s advantage over other term products out there is with the riders included in the policy.

These riders allow the policyholder to tap into the death benefit without dying.

For instance, if you were diagnosed with a terminal illness and were given 12 months or less to live, you could accelerate 95 percent of the policy value and use the money as you wish while you’re still alive. This means you could take your family on a dream vacation, supplement your partner’s income while they care for you, or even pay your mortgage — the choice is yours.

Contrary to the belief that money from a life insurance policy is something that the policy owner will never see in their lifetime, it isn’t true in this case. With this added rider, you can get life insurance with living benefits.

Safe Harbor Term Life Highlights

This unique term life contains some familiar highlights.

- Ages – 18–80

- Terms offered – 10, 15, 20, and 30 years, depending on age

- Death benefit – $25,000–$400,000 (express)

- $50,000–$500,000 (non-express)

- No-exam life insurance

- Option to continue the policy until age 100

- Chronic illness rider included

- Critical illness rider included

- Terminal illness rider included

- Unemployment rider included

- Optional accidental death benefit rider

This plan is mainly for families looking for that just-in-case coverage. It’s great to make sure that your children and spouse are taken care of if something were to happen to one of you. It also helps cover short- or long-term debts that you may encounter. That includes college tuition and potential medical bills.

Whole Life Insurance

Whole life insurance is good if you’re looking for something to last your lifetime and not just a set amount of time. Find out how much whole life insurance costs.

Nassau Re Remembrance Life

Remembrance life is a final expense insurance, which is a whole life policy that has a cash value component that accumulates during the policy’s life. There is no expiration date, and as long as premiums are paid, the policy can’t be canceled. Final expense policies also have a smaller death benefit when compared to term life.

There are a few companies that will cover you up to $100,000, but most stop at $50,000. The policies are a simplified issue without the need for an exam or blood work.

This plan helps with some of the things you may have forgotten about, such as organizing property titles or your death wishes.

This plan also pays right to the beneficiary so hopefully, this allows them to cover some of the necessary costs.

Just like the term product, Nassau Re Life’s final expense excels over the others by providing extra riders within the policy without an additional cost. While we usually think most riders aren’t necessary, we do think that terminal and critical illness are definitely imperative to have.

Nassau Re Life allows the policy owner to use the death benefit while still alive, instead of watching loved ones crumbling financially due to their condition. Death can be a slow process and having this rider can be a great benefit.

They also include an accidental death benefit rider that will pay an additional lump-sum amount equal to 100 percent of the purchased death benefit.

In other words, if you bought a $50,000 policy and died as a result of an accident, the policy will pay $100,000 in benefits.

Remembrance Life Highlights

These highlights will point out the way the company helps to provide assistance for any of their customers.

- Ages 30–59 can get $10,000–$100,000 in coverage

- Ages 60–69 can get $10,000–$75,000 in coverage

- Ages 70–80 can get $10,000–$50,000 in coverage

- Simplified issue

- Whole life

- Critical illness rider included

- Terminal illness rider included

- Accidental death rider included insured must be under 65 and terminate at 75

Overall, this coverage would be good for anyone at almost any age looking to have coverage for surprises that may happen.

Universal Life Insurance

Indexed universal life is another form of permanent life insurance coverage with greater flexibility than a traditional whole life policy. You can adjust the payments, death benefit, and even skip payments (as long as the policy has the value).

There is also a tax-deferred growth potential because this is tied to a stock market index. Most indexed universal life insurance policies allow the policyholder to choose a bucket or account option to park the money, so the account can be more or less risky based on their needs and comfort level.

Nassau Re Simplicity Index Life

Just like the other products, Nassau Re Simplicity Index Life requires no exam or lab tests. It provides the three accelerated benefit riders at no extra cost. This policy also provides three accounts you can choose from based on your risk level: two indexed accounts tied to the S&P 500, and one fixed account that earns a 1 percent guaranteed minimum rate.

Nassau Re Simplicity Index Life Highlights

Below are the perks of this coverage.

- Ages 18–50 can get $50,000–$400,000 in coverage

- Ages 51–60 can get $50,000–$300,000 in coverage

- Ages 61–70 can get $50,000–$200,000 in coverage

- Living benefits included

Nassau Re Life provides plenty of options and personalization for people of all ages. Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Canceling Your Life Insurance Policy

Canceling your life insurance policy can be a fairly easy process.

How to Cancel

As far as canceling with Nassau Re Life, they don’t give you the option to do so directly on their site. By calling their customer service phone number at 1-800-541-0171, you can ask about canceling your service with them, and they’ll help you with your cancellation.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

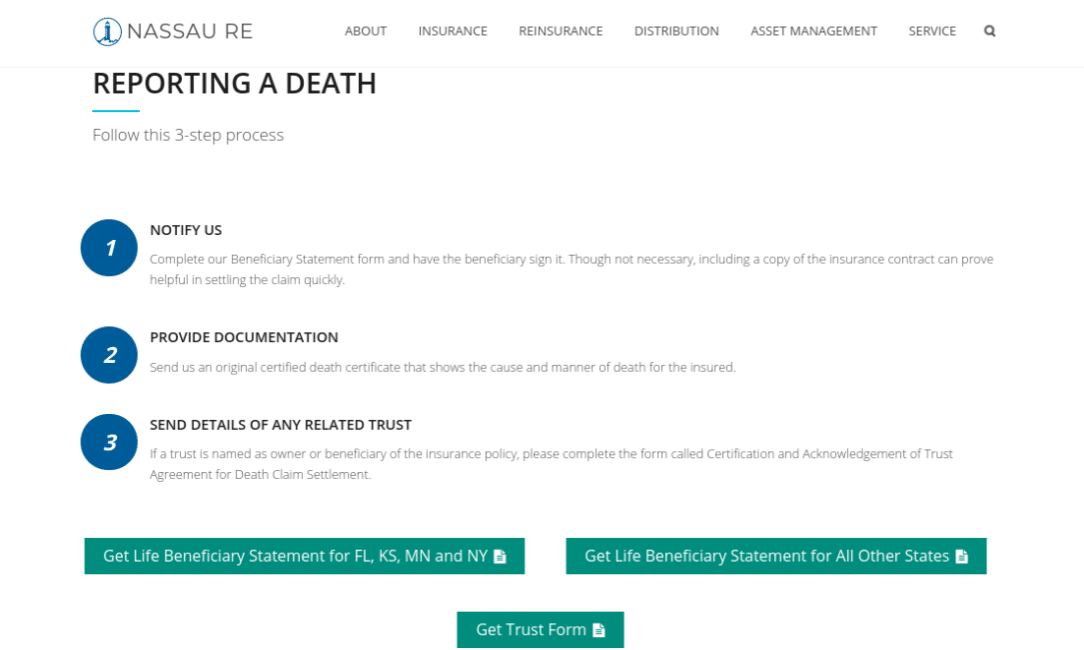

How to Make a Claim with Nassau Re Life

Making a claim with Nassau Re Life is easy and simple. No need to for a Nassau Re agent. Login to your account and follow these steps. First, hover over the service tab and select “File a Claim.” Then, read the instructions provided and select the form for your state.

After you’ve selected the appropriate form, you’ll fill it out and send it to the company for review. Nassau Re Life also provides their phone number along with the answers to some frequently asked questions at the bottom of this page.

As far as getting your money is concerned, it’s a process and may take a while, but they do give the beneficiary the option to deposit the benefits into a concierge account if the amount is under $5,000. Money is issued out based on the probability of the claim being approved.

Nassau Re Life’s Customer Experience

The average customer was extremely pleased with the service they received. In the positive reviews given, customers even mentioned the specialists’ names to make sure they got the proper recognition.

Although Nassau Re Life has not had many complaints over the past years, the number of complaints rose slightly from 2017 to 2018.

Nassau Re Life Insurance Complaint Index (2017–2019)

| Year | Nassau Re Life Insurance Total Complaints | Nassau Re Life Insurance Complaint Index |

|---|---|---|

| 2019 | 4 | .52 |

| 2018 | 6 | .64 |

| 2017 | 4 | .39 |

This more than likely has something to do with them becoming better known. The number of complaints decreased from 2018 to 2019.

Pros & Cons of Nassau Re Life Insurance

Every company has its good and bad aspects. Below are the pros and cons of Nassau Re Life.

Pros of Nassau Re Life Insurance

- It’s ideal for those who want to skip a medical exam and get a no-exam life insurance policy.

- Nassau Re Life offers living benefit riders included in the purchased plan whether you buy final expense or term life.

- Their final expense policies are more in line with the market price-wise, and also offer death benefits up to $100,000 (depending on age), while most other carriers stop at $50,000.

Cons of Nassau Re Life Insurance

- Let’s talk about the elephant in the room. Their A.M. Best rating is B. For most people, this isn’t a reason to be concerned, but it’s something to pay attention to.

- At the time of this post, Nassau Re Life no-exam term policies aren’t competitive price-wise. Other companies that offer no-exam policies, such as SBLI or Sagicor, are priced much lower than Nassau Re Life. Check out our SBLI life insurance company review or our Sagicor life insurance company review to learn more.

- When it comes to their convertibility option, we don’t like the fact that they only allow you to convert the policy based on the duration of your policy, instead of when the term expires. Let us explain: If you bought a 30-year policy, you can only convert it to whole life during the first 10 policy years. This is unlike other companies such as Banner Life, which lets you convert it at the end of the term and not just 10 years into it. If you choose not to convert it and decide to keep it after 30 years, your policy will cost an exuberant amount of money and it will be renewed on an annual basis.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Nassau Re Life Insurance Review: The Bottom Line

So here you go, our review of Nassau Re Life. Just like any other insurance company out there, they are one of many. The fact that conversion isn’t available at the end of the term, combined with their higher pricing compared to similar plans from other companies, is a turn-off.

Even though the plans include a lot of riders, remember that at the end of the day, these are calculated into the premium price. You just don’t have the option to decline them. Most people may not need all these bells and whistles and would be better served with simple protection at a better price.

In addition to their life insurance policies, Nassau Re annuity has many options that will help you with your retirement plans. If you are looking to have some cash when you retire to help with your every day and potential health care costs, make sure you check them out.

Now that you’ve read this Nassau Re Life insurance review, you can use our FREE quote tool to can compare rates from top insurance companies nationwide.

Frequently Asked Questions

What is the claims process?

Contact the claims department promptly, follow their guidance, and submit required documents.

How can I reach customer service?

Call, email, or use the website’s contact form for inquiries.

How do I update personal information?

Contact customer service with updated details for guidance.

How do I cancel my policy?

Submit a written request to customer service for cancellation instructions and any applicable fees.

Can I convert my term policy to permanent?

Yes, contact customer service to discuss conversion options.

What happens if I miss a premium payment?

There is typically a grace period to make payment without coverage lapse. Contact customer service for specifics.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Laura Kuhl

Managing Content Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. In 2018, she started writing for the cannabis industry. She curated news articles and insider interviews with investors and small business ...

Managing Content Editor

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.