Liberty Mutual Life Insurance Review 2024 (Companies + Rates)

Our Liberty Mutual life insurance review reveals that Liberty Mutual is an A-rated life insurance provider from the BBB and S&P. You can find Liberty Mutual life insurance for as low as $16 per month. Liberty Mutual offers a wide range of life insurance options, including term life, whole life, and fixed income insurance.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Zach Fagiano

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Licensed Insurance Broker

UPDATED: Jan 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Jan 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Liberty Mutual Life Insurance Company sells term life, whole life, and fixed income insurance

- Liberty Mutual life insurance quotes start from $16 per month

- Liberty Mutual insurance rating from A.M. Best is A

| Key Info | Company Specifics |

|---|---|

| Year Founded | 1912 |

| Current Executive | Chairman, President & CEO – David H. Long |

| Number of Employees | 50,000 |

| Total Sales / Total Assets | $2,160,000 / $125,989,000 |

| HQ Address | 175 Berkeley Street Boston, MA 02116 |

| Phone Number | 1-617-357-9500 |

| Company Website | www.libertymutualgroup.com |

| Premiums Written – Individual Life | $55,255,022 |

| Financial Standing | $17,000,000 |

| Best for | Term & Whole Life Insurance |

Having life insurance has become more common throughout the years to help our families take care of whatever expenses may occur after we pass. We’ve all heard of Liberty Mutual investments or seen those Liberty Mutual commercials, but is Liberty Mutual a good life insurance company? Our Liberty Mutual life insurance review will answer all your questions.

Liberty Mutual is a well-known name in the world of insurance. Since 1912, Liberty Mutual has been helping people find their perfect premium match. Each year, the company continues to improve its customer service and employee satisfaction.

What are some of the types of life insurance? Should you buy term life or permanent life insurance coverage…which one is best for you? This Liberty Mutual life insurance review will help examine the options presented by this well-known insurance company.

Ready to see if Liberty Mutual life insurance is right for you? Get a life insurance quote with our FREE quote tool above.

Shopping for Liberty Mutual Life Insurance Quotes

Known for commercials about auto and home insurance, you may be wondering: Does Liberty Mutual have life insurance? Yes, they do. In fact, as a mutual life insurance company owned entirely by its policyholders, Liberty Mutual offers some of the best coverage around.

So what are some factors to consider when shopping for life insurance? How does Liberty Mutual compare to other companies, and what can alter the rate?

Average Liberty Mutual Life Insurance Rates by Age

An average monthly payment for a healthy male in his 30s who is a non-smoker is $33.75. Other companies such as Mutual of Omaha and Transamerica have similar rates of $35.96 and $46.28.

| Marital Status, Age & Gender | New York Life | Prudential | Lincoln National | Massachusetts Mutual | Aegon/ Transamerica | John Hancock | State Farm | Average |

|---|---|---|---|---|---|---|---|---|

| Single 25-Year-Old Female | $158.00 | $195.00 | $187.00 | $132.00 | $164.00 | $172.50 | $143.00 | $164.50 |

| Single 25-Year-Old Male | $152.00 | $237.00 | $231.00 | $147.00 | $176.00 | $178.30 | $164.00 | $183.61 |

| Married 35-Year-Old Female | $164.00 | $196.00 | $191.00 | $137.00 | $161.00 | $178.30 | $166.00 | $170.47 |

| Married 35-Year-Old Male | $160.00 | $248.00 | $238.00 | $151.00 | $171.00 | $189.80 | $175.00 | $190.40 |

| Married 45-Year-Old Female | $262.00 | $314.00 | $239.00 | $209.00 | $229.00 | $241.50 | $238.00 | $247.50 |

| Married 45-Year-Old Male | $245.00 | $378.00 | $283.00 | $230.00 | $255.00 | $292.10 | $239.00 | $274.59 |

| Married 55-Year-Old Female | $414.00 | $496.00 | $435.00 | $373.00 | $453.00 | $407.10 | $341.00 | $417.01 |

| Married 55-Year-Old Male | $696.00 | $584.00 | $615.00 | $451.00 | $527.00 | $533.60 | $396.00 | $543.23 |

| Single 65-Year-Old Female | $924.00 | $941.00 | $903.00 | $763.00 | $1,139.00 | $937.30 | $684.00 | $898.76 |

| Single 65-Year-Old Male | $1,416.00 | $1,412.00 | $1,577.00 | $1,049.00 | $1,367.00 | $1,380.00 | $955.00 | $1,308.00 |

Liberty Mutual has a significantly lower monthly payment for a healthy non-smoker female in their 40s at $42.53 in contrast to its competitors, which average $62.35.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Liberty Mutual’s Life Insurance Policies

Liberty Mutual offers its customers a wide range of life insurance policy options. They offer term life, whole life, and fixed income insurance.

Term Life Insurance

Term insurance provides you with coverage to meet your temporary needs. You would be covered if a death occurred within a certain time. This option does not include the lengthy application process.

There are 10-, 15-, 20-, and 30-year terms that you can choose from which allows you to get a large amount of coverage for a not-so-large price tag. This type of coverage is mainly for someone who is 18–65 and looking for affordable coverage. A sample of term life insurance rates shows that they tend to vary by your age and can be more appealing when you are younger.

| Age | Male $100,000/ 10-Year | Female $100,000/ 10-Year | Male $100.000/ 20-Year | Female $100.000/ 20-Year | Male $250,000/ 10-Year | Female $250,000/ 10-Year | Male $250,000/ 20-Year | Female $250,000/ 20-Year | Male $500,000/ 10-Year | Female $500,000/ 10-Year | Male $500,000/ 20-Year | Female $500,000/ 20-Year |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 20 | $20.79 | $16.83 | $22.14 | $17.73 | $31.28 | $20.70 | $33.30 | $23.40 | $42.75 | $27.00 | $45.45 | $35.55 |

| 30 | $21.89 | $17.10 | $23.27 | $18.09 | $32.07 | $21.16 | $36.68 | $27.68 | $43.65 | $29.03 | $54.68 | $40.95 |

| 40 | $23.76 | $19.58 | $34.38 | $28.26 | $39.94 | $29.37 | $66.83 | $52.43 | $56.93 | $45.90 | $103.95 | $79.65 |

| 50 | $47.84 | $36.05 | $80.28 | $58.77 | $100.47 | $71.89 | $182.82 | $128.82 | $151.20 | $209.70 | $313.20 | $210.15 |

| 60 | $118.76 | $70.52 | $166.86 | $107.01 | $279.12 | $158.07 | $399.83 | $250.65 | $373.95 | $214.43 | $648.90 | $390.60 |

See how this compares to the rates for smokers.

| Age | Male $100,000/ 10-Year | Female $100,000/ 10-Year | Male $100.000/ 20-Year | Female $100.000/ 20-Year | Male $250,000/ 10-Year | Female $250,000/ 10-Year | Male $250,000/ 20-Year | Female $250,000/ 20-Year | Male $500,000/ 10-Year | Female $500,000/ 10-Year | Male $500,000/ 20-Year | Female $500,000/ 20-Year |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 20 | $27.90 | $20.61 | $33.84 | $24.93 | $56.25 | $36.23 | $70.43 | $44.10 | $80.10 | $61.20 | $104.40 | $76.05 |

| 30 | $28.85 | $22.01 | $36.54 | $29.39 | $61.21 | $40.84 | $77.07 | $58.28 | $90.45 | $69.98 | $128.70 | $98.10 |

| 40 | $48.33 | $38.57 | $72.36 | $55.94 | $109.80 | $85.51 | $158.97 | $122.18 | $170.76 | $127.58 | $267.30 | $202.95 |

| 50 | $128.52 | $96.39 | $174.69 | $121.77 | $308.14 | $228.16 | $420.87 | $281.71 | $393.08 | $287.10 | $622.35 | $439.88 |

| 60 | $338.76 | $226.26 | $334.53 | $228.06 | $828.45 | $537.08 | $818.10 | $551.48 | $905.10 | $572.63 | $1,099.35 | $776.70 |

So overall, non-smoking younger females appear to be getting the best deal.

Whole Life Insurance

Whole life insurance is kept through the person’s life and would pay a benefit upon death. This option does have the opportunity to build cash value with the company, which you can access through loans. You would also get a return of premium guarantee, which is a good bonus.

This premium price never changes, and you have a solidified death benefit that has a very wide range if you’re over 66.

This is ideal for anyone, ranging from babies to those 90 years of age and in need of permanent life insurance to ensure security.

This plan is ideal if you’re getting a new home, or need an income replacement. It allows you to leave money to your family if you were to pass on. If you are adding a new member to your family, this plan is also ideal for you but keep in mind that there are some key things you need to know as a parent purchasing life insurance. Find out how much whole life insurance costs.

Liberty Series Whole Life Insurance

This includes uniform payments that are made during the whole life of the insured (covered until the person’s 100th birthday).

Liberty Series Life Insurance

These payments are made until the person’s 65th birthday.

Liberty Series 20-Year Payment Life Insurance

These consist of payments made for 20 years.

Liberty Series Extra Value Life Insurance

This combines permanent and temporary life insurance.

| Key Info | Whole Life Insurance | Term Life Insurance |

|---|---|---|

| Length of Coverage | Life Long | 10, 15, 20, 30 years |

| Cash Value | Yes! Easily accessible through withdrawals and loans | No |

| Premium | Higher payments that do not increase | Lower payments that do not increase for the policy term length |

Whole life insurance gives you a lot of freedom and coverage to support just about all of your needs. By adding a couple of riders to your coverage, this could be the total package.

Life Insurance Riders

If you need some add-ons for your coverage, Liberty Mutual offers appealing riders for your insurance at an additional cost:

- Children’s protection

- Accidental death and dismemberment

- Liberty’s living benefit

- Disability waiver of premium

- Payor death and disability

- Waiver of withdrawal charge for qualifying medical stay

Adding a couple of these makes your plan customized to your specific needs. Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Get a Quote Online With Liberty Mutual

Getting a life insurance quote with Liberty Mutual seems easy enough. They also offer you a lot of answers to common questions and a contact phone number if you need help.

Select “Life” in the “Shop Insurance” Dropdown

This will take you to the portion of the site specifically for life insurance information.

Click “ Get a Quote”

Keep in mind that getting a quote just shows you what it would look like if you chose them for your life insurance provider.

Enter Requested Information

You’ll then be taken to this screen, which will ask you to fill in the requested information.

Need help? Select “Contact an Agent.” This screen will populate in which you’ll be asked multiple questions and prompted to enter your concerns.

Want to calculate your coverage or see which one you should choose? Select “Calculate Your Needs” for information.

You can also call the company by phone, send an email or even mail them to get your quote.

Using our quote tool to see who has the best life insurance allows you to get multiple online quotes at a time. Getting multiple quotes at once is efficient because it allows you to compare the price range that’s right for you without having to search so many sites.

Canceling Your Life Insurance Policy

If you want to cancel your life insurance policy with Liberty Mutual, you’ll need to call the Liberty Mutual life insurance phone number at 1-800-290-7933 to reach the customer service, who will go through the process with you.

It’s hard to determine exactly what type of process you’ll go through since the terms will depend on what state you’re located in and what type of policy you have. For example, if you are a business customer, you can learn more about canceling your policy at mybusinessonline.libertymutual.com.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Liberty Mutual Life Insurance Claims

Making a claim with the company seems fairly simple and easy to do. You can either call the company or file a claim online. When filing online, you can file a claim right from their home page.

After You Select “File a claim,” You’ll need access to your Liberty Mutual life insurance login in with your username and password.

Although finding out where to start your claim can be simple enough, actually filing it can be challenging if you’re not prepared. It can take on average 30 to 60 days for a company to file a claim, but they need a lot of information from you first.

The items they will request are a death certificate, policy document, and a claim form to begin the claims process. Once you have all of those, you can file your claim online or call into the company to get it started.

Some good news: If your payout amount is less than $15,000, it can be expedited.

Liberty Mutual’s Customer Experience

The best Liberty Mutual’s customer service reviews involve their great rates and how well everything is explained. Other reviews explain how an employee went above and beyond for the customer situation.

There are also some common negative reviews. Most of the Liberty Mutual complaints come from the customer’s experience with the claims department process or the service they received with an employee directly.

No matter the comments, Liberty Mutual appears to answer each complaint in an attempt to resolve the issue.

Based on research provided by the National Association of Insurance Commissioners (NAIC), the company’s complaints appear to be on a slow decline for the past three years with a 52 percent average decrease.

Liberty Mutual’s Programs

For life insurance, the company does not offer any programs for their customers. Liberty Mutual does, however, offer programs for their home and auto insurance.

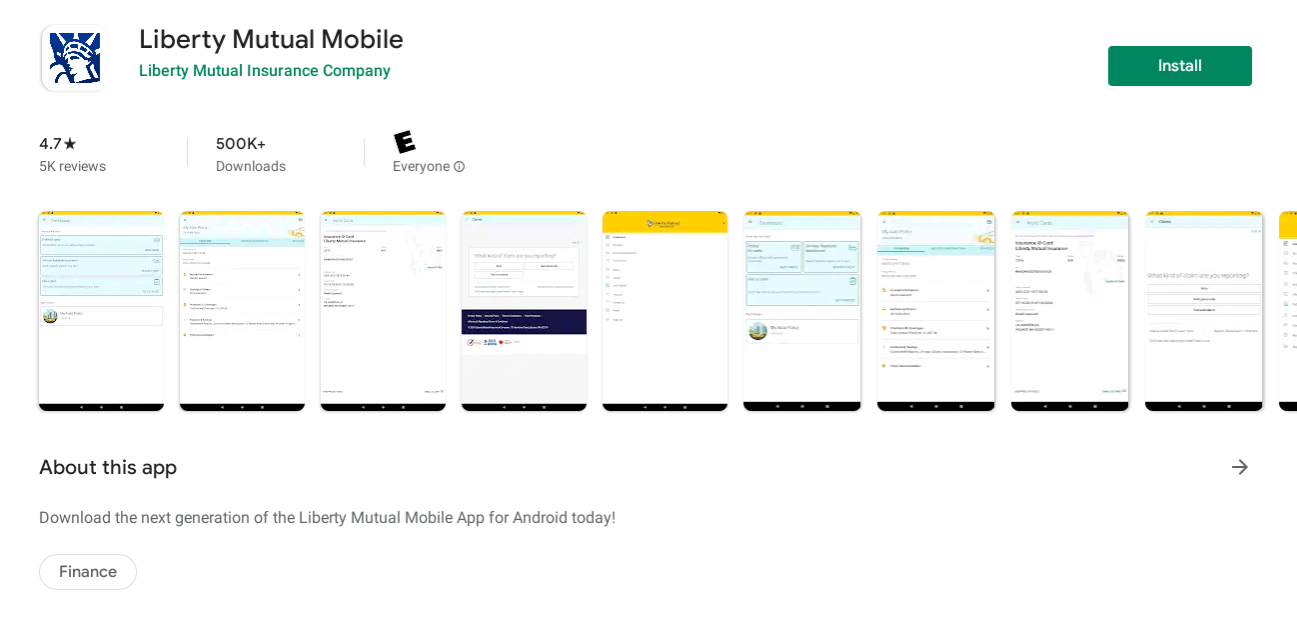

Design of the Website/App

The website is user friendly and clearly shows its many options available on the home page. Liberty Mutual even has contact options easily accessible if extra help is needed.

As expected, you’ll get the most out of the website if you’re one of their customers. There are some aspects of the site that require a username and password.

Liberty Mutual also offers the option for customers to tweet them on Twitter if they prefer to speak to them through social media.

So, how do you get to their contact information? First, select “Contact Us” in the “Overview” tab.

Under the General Information and feedback section, there are dropdowns that have the phone numbers, hours of operation, social media information, and mailing address so that you can get your issue resolved.

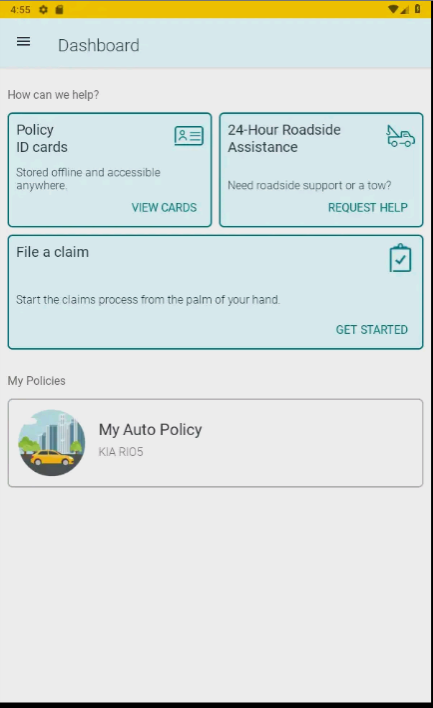

The company does have a mobile app that seems to be very user friendly as well.

Navigating the application is simple, with all your policies and claims on your dashboard. It even allows you to file a claim right from the dashboard.

The ratings for the mobile app is 4.7out of 5. Most people find it easy to use and a great way to easily see all of your documents.

About Liberty Mutual Life Insurance

What happens to your loved ones after you pass? Have you thought about the expenses of your funeral?

Many people don’t consider getting life insurance. Liberty Mutual appears to make that process simpler.

To make an educated choice, you should review the company’s term and whole life insurance along with the average burial and final expenses.

What do you want out of your insurance, and what do you want to be done in remembrance of you after you pass?

Liberty Mutual’s Ratings

The Better Business Bureau (BBB) gives Liberty Mutual an A rating, which is the second-highest rating on their scale. There are 997 documented complaints to the BBB. Even with complaints documented to the BBB, Liberty Mutual seems to be a very responsive company, which helps explain the high BBB rating.

The average customer review is a one and a half stars, but there is a response for almost every comment, compliment, and complaint. The responses are always very descriptive and give the customer steps to resolve the issue with the company.

Liberty Mutual has been recognized for its impeccable customer service under the J.D. Power and Associates Call Center Certification Program.

S&P Global Ratings provided Liberty Mutual with an A rating for issuer credit and financial strength with a strong performance outlook rating. Additional researchers have come to the same conclusion.

Liberty Mutual Life Insurance Ratings

| Ratings Agencies | Ratings |

|---|---|

| A.M. Best | A (Excellent) |

| Better Business Bureau | A |

| J.D. Power | 4 (Better than most) |

| Moody’s Rating | A (Upper medium grade subject to low credit risk) |

| S&P Rating | A (Strong) |

Liberty Mutual was viewed to have been able to resolve the customer’s inquiries quickly and efficiently, which boosts customer satisfaction.

| Year | Total Complaints | Percent Change |

|---|---|---|

| 2020 | 12 | -93% |

| 2019 | 167 | -29% |

| 2018 | 236 | -35% |

| 2017 | 361 | N/A |

So what do Liberty Mutual’s premiums look like?

Liberty Mutual’s Market Share

The company’s market share has steadily improved through the years and has written over $55 million in insurance premiums.

The Boston-grown company has locations nationwide and was named the fifth-largest global property and casualty insurer.

The parent organization of Liberty Mutual is LMHC Massachusetts Holdings, Inc. with Liberty Mutual and Liberty Mutual Finance Europe Designated Activity Company as its subsidiaries.

From 2016–2018, their ranking has slowly dropped along with their direct written premium amounts. Even though the cumulative market share continues to increase from 2016–2018, the market share has been declining, with a large drop in 2018. The company’s net income continues to have a steady increase over the past three years with an unusual spike in 2017.

| Year | Rank | Direct Premiums Written | Cumulative Market Share | Net Income |

|---|---|---|---|---|

| 2018 | 125 | $55,255,022 | 98.63% | $2,160,000 |

| 2017 | 35 | $1,079,731,188 | 78.37% | $17,000,000 |

| 2016 | 34 | $1,092,333,298 | 77.14% | $1,069,000 |

For 2018, Liberty Mutual was ranked 125th in 2018 for direct premiums written for life insurance.

| Rank | Companies | Direct Premiums Written | Market Share |

|---|---|---|---|

| 1 | Northwestern Mutual Life Insurance Co. | $10,517,115,452 | 6.42 |

| 2 | Metropolitan Group | $9,821,445,953 | 6.00 |

| 3 | New York Life | $9,295,848,300 | 5.68 |

| 4 | Prudential | $9,128,805,060 | 5.57 |

| 5 | Lincoln National | $8,769,303,174 | 5.36 |

| 6 | MassMutual | $6,854,713,057 | 4.19 |

| 7 | Aegon | $4,809,856,650 | 2.94 |

| 8 | John Hancock | $4,640,905,017 | 2.83 |

| 9 | State Farm | $4,633,004,963 | 2.83 |

| 10 | Minnesota Mutual Group | $4,422,100,028 | 2.70 |

| 125 | Liberty Mutual | $55,255,022 | .03 |

These direct premiums were written of group life insurance for the company’s competitors in 2018.

The company is projected to continue to grow financially and have a stable financial outlook. Their recent dip in premium amount appears to differ from their average annual premiums written. A.M. Best gave Liberty Mutual an A rating, listing them as number three out of 16 companies. This means that they have a great ability to meet their customer’s ongoing obligations.

Liberty Mutual’s Online Presence

Liberty Mutual appears all over the internet. Along with the easily accessible company information located both on and outside of their website, they have very catchy commercials. The commercials are what appeal to the young population more so than those who don’t watch TV or even YouTube.

Liberty Mutual spreads the word of their great coverage and customer service, displaying ads on the internet or streaming services such as Hulu. This can help to get millennials to consider life insurance or insurance in general through their company.

Liberty Mutual’s Commercials

One could say that Liberty Mutual’s commercials stick with you and make you laugh.

By incorporating humor into their commercials, Liberty Mutual helps to appeal to the general public and allows the company to connect with potential customers. They even have a comical twist on a TV series with a catchy intro song.

With their humorous commercials, catchy song, and relatable situations, Liberty Mutual is more likely to appeal to the younger generation.

By making their commercials so versatile and funny, the company approaches things with a sense of humor but also realizes that everyone has differences, and well…life happens. Even though the commercials only advertise Libert Mutual auto insurance and home insurance, it puts your attention to the company for insurance. Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Liberty Mutual in the Community

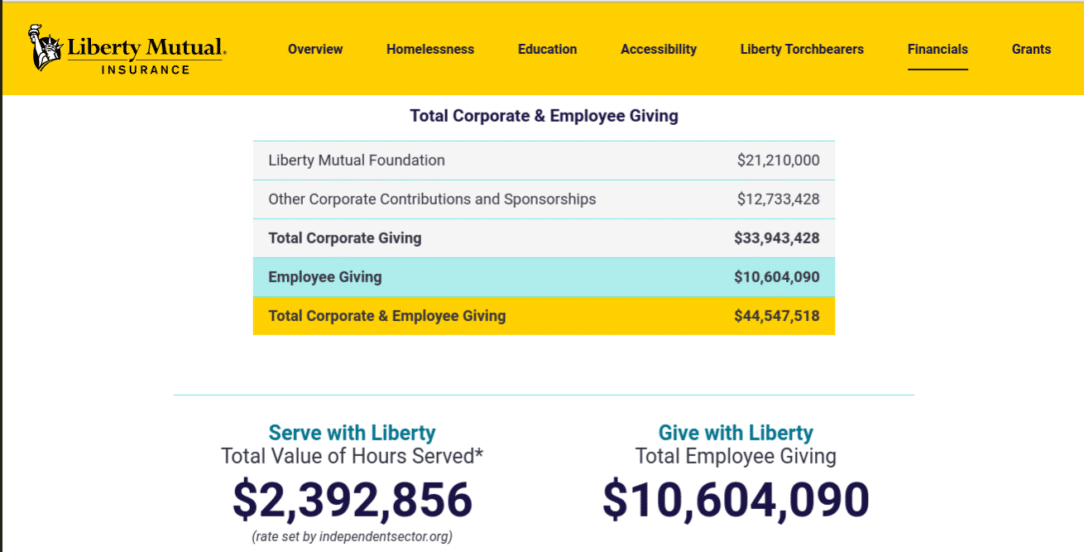

Liberty Mutual offers multiple ways to give back to the community. They look to be involved and want to get others involved as well.

The company has developed programs to help the homeless and mentally disabled as well as increase educational opportunities.

The company has a program called the Liberty Torchbearers for the employees who want to help with the causes they care about through Serve with Liberty, Give with Liberty, and Volunteer with Liberty.

The company has completed 2,759 projects worldwide with 55 percent employee participation to serve the community in 2018. Liberty Mutual has supported 7,808 charities and raised $18 million from both the employees and the corporate organization.

They have also given 1,398 total grants to nonprofit organizations totaling $598,000.

As far as being involved and serving the community goes, this company has that covered and appears to care.

Liberty Mutual’s Employees

Liberty Mutual employs people from all over the world, with millennials making up 45 percent of the employee population. Liberty Mutual has 27 percent of its employees who have been with the company for two to five years, and 14 percent have been there for over 20 years.

The company was certified by “Great Place to Work” with 83 percent of its employees reporting that they were satisfied with their employer and that they felt welcomed when they joined the company.

With the unbeatable management and great benefits, the employees appear to be happy and feel as though they are trusted to complete the tasks they are given and be trusted with new responsibilities. Reviewing employees’ positive comments about Liberty Mutual is a reassuring quality to have.

Liberty Mutual was ranked Number 73 in “Best Workplaces for Diversity” and Number 27 in People magazine for “Companies that Care.”

One of the pros listed for the company was that it provides a great work-life balance.

According to the research completed, the average pay is slightly above average, ranging from $44,197 to $121,476.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Pros & Cons of Liberty Mutual Life Insurance

When looking into life insurance you want to consider some positives and negatives to getting your coverage through them. So what are some pros and cons for Liberty Mutual?

Pros of Liberty Mutual Life Insurance

- You get great coverage from a well-known company

- 24/7 customer and claims service

- Easy-to-use website and app

- Multiple coverage options and insurance products to support your needs

- Multiple discounts are available

- Additional features are available for your children, accidental death, etc.

- Affordable life insurance death benefits and policies

- Great customer service ratings

Cons of Liberty Mutual Life Insurance

- With a big company comes a slightly bigger price tag

- There isn’t as much “flash” with life insurance, which means that it appears that it’s not their specialty. You might be better off with a company who focuses mainly on life insurance.

- The death benefit in the whole life insurance plan does not increase over time

- A lot of complaints

- Appear to have a strenuous underwriting process (but some might also see that as a good thing)

The pros may outweigh the cons for Liberty Mutual if you don’t mind spending the extra cash.

Liberty Mutual Life Insurance: The Bottom Line

Overall, Liberty Mutual provides its customers with multiple options to choose from. Even though they have a lot of complaints from customers, the company also has been rated as one of the highest performing companies for customer service. It’s a well-known, trustworthy company so you know that they have a long history of handling insurance.

Even with all the positive (and negative) human interactions, the company may be susceptible to some form of crash. With that being said, their financial standing is pretty strong.

Don’t wait! Get a life insurance quote with our FREE quote tool below.

Frequently Asked Questions

Is Liberty Mutual a good life insurance company?

Liberty Mutual is a well-known and trusted insurance provider with a long history in the industry. They have consistently improved their customer service and employee satisfaction over the years. However, it’s important to compare quotes and consider your specific needs before choosing a life insurance company.

What types of life insurance does Liberty Mutual offer?

Liberty Mutual offers a range of life insurance policy options, including term life insurance, whole life insurance, and fixed income insurance. Term life insurance provides coverage for a specific period of time, while whole life insurance offers coverage for the entire lifetime of the insured.

How can I get a life insurance quote from Liberty Mutual?

To get a life insurance quote from Liberty Mutual, you can visit their website and select “Life” in the “Shop Insurance” dropdown menu. From there, you can click on “Get a Quote” and enter the requested information. Alternatively, you can use a free online quote tool to compare quotes from multiple companies, including Liberty Mutual.

How do I cancel my life insurance policy with Liberty Mutual?

To cancel your life insurance policy with Liberty Mutual, you will need to call their customer service at 1-800-290-7933. The specific cancellation process may vary depending on your policy type and the state you are located in.

How do I file a life insurance claim with Liberty Mutual?

Filing a life insurance claim with Liberty Mutual can be done either by calling the company or filing a claim online. If you choose to file online, you will need to log in to your Liberty Mutual life insurance account and provide the required information, such as the death certificate, policy document, and claim form. The claims process typically takes 30 to 60 days, and it’s important to have all the necessary documents ready before filing.

Do I need to have a health exam for life insurance with Liberty Mutual?

In short, no. However, if you don’t, you may be limited in your options. Most of the time, term life insurance does not require a health exam but you should ask the insurance company you’re interested in which of their plans you don’t need an exam for. Not having a health exam may also cost you more money for your policy.

Do I need to lose weight before I purchase life insurance from Liberty Mutual?

You can but it will more than likely not help. You’ll be asked about your BMI, but they’ll also look at whether your weight has changed throughout the year. So you may not get that lower rate you’re hoping for.

Can I purchase term and whole life insurance from Liberty Mutual at the same time?

If you’re considering purchasing both whole and term life insurance, you could be in a couple of different stages in your life.

You could just want to have money by adding some additional coverage on your policy or you originally purchased term life insurance but now, you want permanent coverage in addition to the coverage you already have.

Another option would be adding term insurance to your whole insurance policy. If you have children or buy a house, this could be a good investment because it allows you to add additional coverage for a low price tag.

Who took over Liberty Mutual life insurance?

Lincoln Financial has agreed to acquire Liberty Life Assurance Insurance Company from Liberty Mutual, while Protective Life Corp will acquire Liberty Mutual’s individual life and annuity business.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Zach Fagiano

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Licensed Insurance Broker

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.