Costco Life Insurance Company Review 2025 (Companies + Rates)

Costco has teamed up with Protective Life Insurance Company to offer members discounted term life insurance, Member Advantage Life. Current members can get a term life insurance policy with Costco for as little as $5/mo. This Costco Life Insurance company review will tell you that Costco doesn’t have any insurance ratings, so it's important to look at Protective’s insurance ratings.

Read moreFree Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Life Insurance Agent

Jeffrey Manola is an experienced life insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for life insurance with the most affordable term life insurance, permanent life insurance, no medical exam life insurance, and burial insurance. Not only does he strive to provide consumers with t...

Licensed Life Insurance Agent

UPDATED: Feb 6, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Feb 6, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Costco and Protective Life Insurance Company Overview

| Key Info | Company Specifics |

|---|---|

| Year Founded | Costco – 1976 Protective – 1907 |

| Current Executives | Costco CEO – W. Craig Jelinek Protective CEO – Richard J. Bielen |

| Number of Employees | 245,000 |

| Total Sales / Total Assets | $147,200,000,000 / $42,800,000,000 |

| HQ Address | 999 Lake Dr, Issaquah, WA 98027 |

| Phone Number | 1-800-774-2678 |

| Company Website | www.costco.com |

| Premiums Written – Group Life / Individual Life | $16,134,613 / $2,406,628,653 |

| Financial Standing | +9.7% |

| Best For | 10 to 20-Year Term |

Today’s big-box retailers have become one-stop shops for all of your buying needs. One such retailer, Costco, has taken that everything-under-one-roof philosophy even further by selling life insurance.

In 2014, Costco teamed with Protective Life Insurance Company to sell a member-exclusive life insurance policy, Member Advantage Life. This Costco life insurance company review will tell you everything you need to know when deciding if this insurance is the choice for you.

Before diving into our Costco life insurance company review, you can also use our FREE quote comparison tool to find the best life insurance rates now.

How do you shop for Costco Life Insurance?

Purchasing a life insurance policy is one of the most important decisions you can make for your family. If you pass away unexpectedly, the proceeds from a life insurance policy can provide them with financial security for years to come.

Here are some things to consider while you shop for the cheapest life insurance quotes.

In general, life insurance should cover two types of obligations: Immediate and future.

Immediate obligations are the things that need to be paid soon after your death. These include:

- Funeral costs

- Medical bills

- Mortgage balances

- Personal loans

- Credit card debt

Future obligations are all the expenses that you want to pay for after your death, those you expect and those you might not. They include:

- Income replacement

- Spouse’s retirement

- Emergency savings fund

- Children’s college tuition

A life insurance agent or financial planner can help you determine exactly how much coverage you’ll need, but there are simple formulas you can use to give yourself a general idea.

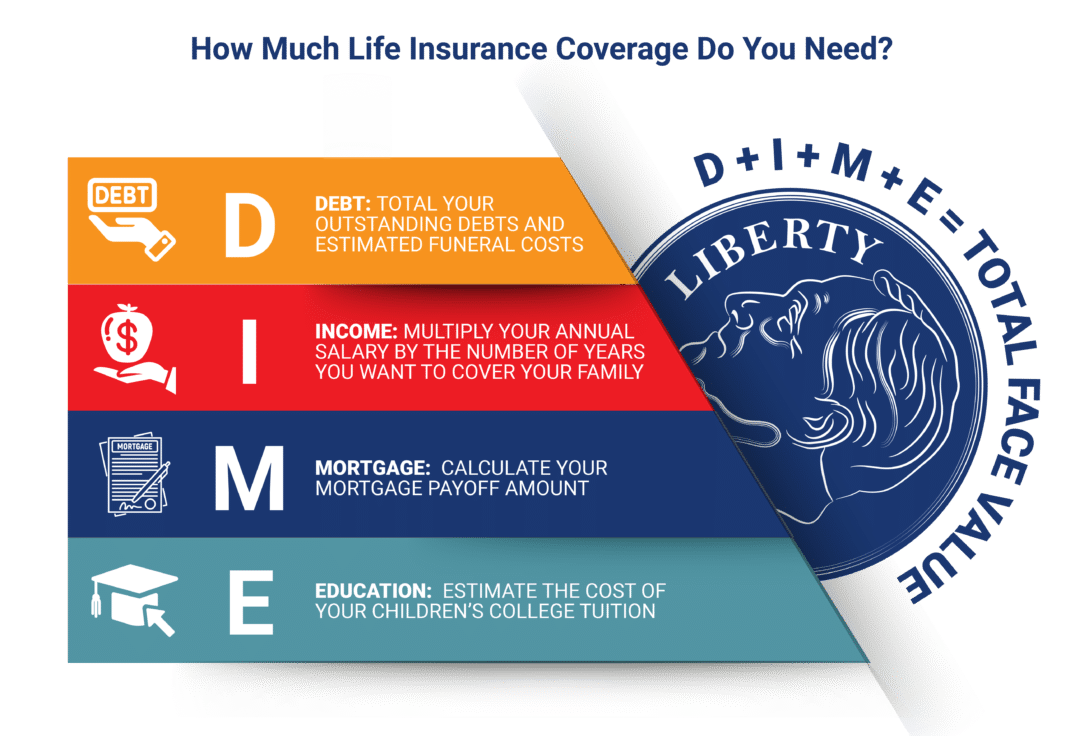

One popular method used by many online insurance calculators is the DIME method. DIME is an acronym that stands for the following:

- D – Debt

- I – Income

- M – Mortgage

- E – Education

Adding up your total obligations in those four categories will give you the minimum face value you need.

Here’s a quick example.

A husband and father of one is shopping for life insurance. He and his wife both work full time. His annual salary is $80,000. The family has a remaining mortgage balance of $150,000, $10,000 left on a car loan, and $5,000 in credit card debt.

He plans to leave his wife five years’ worth of his salary to cover regular expenses and $30,000 for each child to cover the average cost of four years of in-state tuition at a public university.

After factoring in an average funeral cost of around $7,500, the man’s insurance needs are as follows:

- Debt – $10,000 car loan + $5,000 credit card + $7,500 funeral costs = $22,500

- Income – $400,000

- Mortgage – $150,000

- Education – $60,000

- Total need – $632,000

To meet all of those obligations, he should probably buy a life insurance policy with a face value of around $650,000.

To find out how much is Costco insurance for that level of coverage, read on for a look at the average Costco life insurance cost.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What is the average Costco Life Insurance rate by age?

The following table illustrates how the typical Costco life insurance rates by age for a 20-year, $100,000 Costco Member Advantage Life policy compare to the average rates of the top 10 insurers by market share.

Average Annual Costco Life Insurance Rates by Age, Tobacco Use, & Gender

| Policy Holder Age & Tobacco Use | Annual Annual Rates – Male | Versus Average Annual Rates of Top 10 Companies | Annual Annual Rates – Female | Versus Average Annual Rates of Top 10 Companies |

|---|---|---|---|---|

| 25-Year-Old Non-Smoker | $85.34 | -$93.20 | $78.05 | -$82.52 |

| 35-Year-Old Non-Smoker | $89.86 | -$95.18 | $84.10 | -$81.81 |

| 45-Year-Old Non-Smoker | $152.06 | -$115.83 | $126.82 | -$113.43 |

| 55-Year-Old Non-Smoker | $318.62 | -$206.33 | $237.31 | -$169.63 |

| 65-Year-Old Non-Smoker | $933.89 | -$339.23 | $605.76 | -$274.90 |

| Average Non-Smoker | $315.95 | -$169.96 | $226.41 | -$144.46 |

| 25-Year-Old Smoker | $323.14 | +$1.38 | $286.46 | +$37.71 |

| 35-Year-Old Smoker | $388.08 | +$27.85 | $344.65 | +$58.47 |

| 45-Year-Old Smoker | $763.01 | +$125.50 | $584.26 | +$91.06 |

| 55-Year-Old Smoker | $1,618.18 | +$254.09 | $1,407.65 | +$416.02 |

| 65-Year-Old Smoker | N/A | N/A | N/A | N/A |

| Average Smoker | $773.10 | +$102.20 | $655.76 | +$150.82 |

Costco and Protective have premiums that are well below the average for non-smokers, but their policies are significantly above average for tobacco users.

If you smoke, you should probably look for a quote elsewhere. Even with the Costco discount, you’ll pay more than most.

It should also be noted that these heavily discounted rates are only valid for the first five years of the policy (as will be discussed shortly).

What policies can I get with Costco’s Life Insurance?

Life insurance policies fall into one of two general categories: term life insurance or whole life insurance. Term life insurance covers you for a limited period and whole covers you for as long as you live.

What is the best life insurance? That all depends on your personal need. Watch the below video from Protective for a brief overview of the different types of life insurance to help you decide.

Does Costco offer term life insurance? Yes. Does Costco offer whole life insurance? No.

What is Costco’s term life insurance?

Costco and Protective’s Member Advantage Life policy is a term policy with two term options: 10 or 20 years. Coverage amounts range from a minimum of $100,000 to a maximum of $5 million.

The policies are flexible in that you can adjust your coverage amount as your financial needs change. You can request an increase at any time but will have to fill out a new medical questionnaire and will most likely have to take a new medical exam to prove your insurability.

You can request a decrease any time after the third policy year, subject to minimum face amount limits.

The main advantage of buying this policy through Costco and not directly with Protective is that Costco members receive an additional discount on Protective’s rates.

For the first five years of a policy, Costco members receive a 15 to 20 percent discount. In year six, the premiums will increase slightly to be more in line with the average Protective rates.

The policy is sometimes referred to as a term universal life policy as if it’s some hybrid of a term policy and a permanent universal life policy. This is a bit misleading and confusing.

The premiums are level for the initial policy term (either 10 or 20 years). During that time, the face value is also guaranteed. As soon as the initial term period expires, you can continue the policy.

If you do, the face value will decrease every year you continue the policy. The fine print states that your premium could also increase while the benefit decreases, depending on your age and health.

For that reason, it’s best to treat this policy as a traditional term. If you decide that you want to continue coverage, Protective will have options to convert to a traditional whole policy. Doing so would be much more cost-effective.

Also, keep in mind that a Gold membership at Costco starts at $60 per year.

If you’re not already a member but are thinking about signing up so you can get a discount on life insurance, you may want to think again.

The low rates initially make Costco insurance seem like the best term life insurance anywhere. However, depending on your age and health, that annual membership cost could erase any discount you receive.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

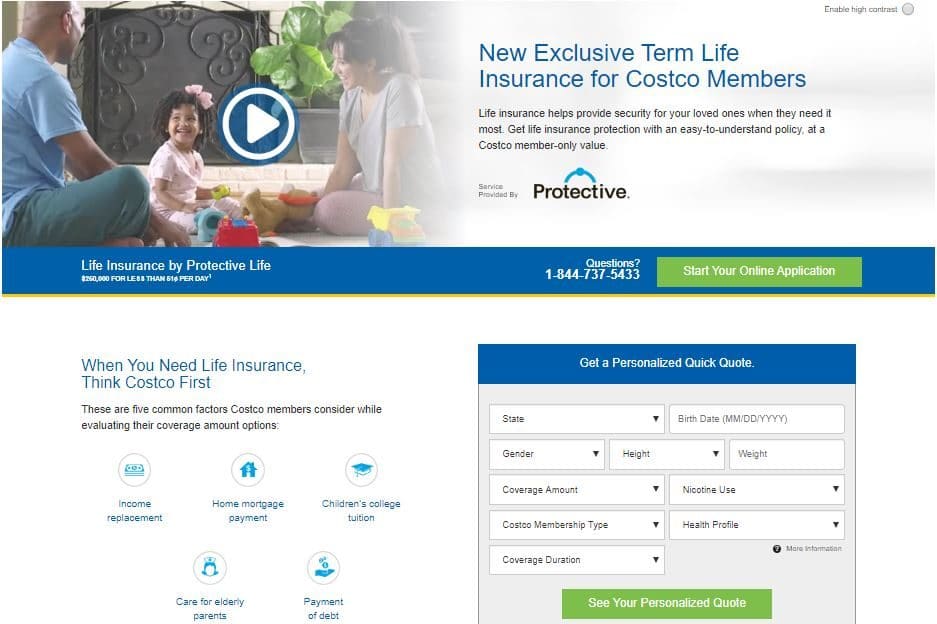

How do you get a quote online with Costco?

Using online tools is the best way to get life insurance quotes. Getting an online quote for the Costco Member Advantage Life policy from Protective is relatively simple.

Go to the Costco Life Insurance Page. There is no easy link to the life insurance information on Costco’s homepage. To get there, you have one of two options.

You can do a quick Google search for “Costco Life Insurance.” The first result will be Costco’s life insurance services page. That page has some basic information on the policy as well as a quote tool.

(Note: A Google search could also return results for the Costco employee life insurance page, which you don’t want.)

You can also go straight to Costco’s website and do a search for “life insurance” at the top of their homepage. If you do that, you’ll automatically be redirected to Protective’s website and their dedicated page for Costco Member Advantage Life.

From that page, click Get a Free Quote.

Enter your information.The quote tool will ask you to fill out your demographic information, coverage amount, term length, nicotine use, and Costco membership level.

Enter your information and click Next. Get your quote.

If you started your quote on the Costco website, you’ll be redirected to the Protective website to get your quote. If you started on the Protective page, it will return your quote instantly.

From there, you can click Apply Now to start an official application.

As you can see, getting a quote for the policy is simple enough, but doing Google searches, homepage searches, and then jumping back and forth between two websites is a lot of trouble for a quote from a single company.

On the other hand, you can use the quote tools on this page to get multiple life insurance quotes from multiple companies at once without having to jump through all those hoops.

How do you cancel your life insurance policy?

If you do need to cancel your Costco and Protective life insurance policy, you can do so at any time.

To cancel your life insurance policy, call Protective customer service at 1-800-866-9933.

How do you file a claim with Costco?

The overall process of filing a death benefit claim with Costco and Protective follows general industry-standard steps:

- Initiate a claim.

- Fill out company-specific paperwork.

- Submit the paperwork along with a death certificate and any other requested documents.

- Choose a disbursement method.

- Receive the benefits.

To initiate a claim on your Costco life insurance policy, you can either call Protective customer service at 1-800-424-1592 or use your Costco and Protective life insurance login on the website to access their convenient online claim center.

When initiating a claim, you’ll need a certified copy of the death certificate and any other requested beneficiary identification documents. Protective will then send you a full claims packet with all the forms you’ll need.

How long does it take to make a life insurance claim? You can initiate the claim in minutes. After that, claims are usually paid within 30 days.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are people saying about Costco’s customer experience?

Price is often the main deciding factor when choosing a life insurance company, but it’s also important to research the average customer experience. You should look for both the best customer experience reviews and the worst customer experience reviews.

To get the information you need on the Costco Member Advantage Life policy, search life insurance reviews for Protective. Once you purchase the policy, all of your interactions will be with Protective, not Costco.

If a company is hard to contact, difficult to work with, and slow to pay benefits, the initial savings from a cheap life insurance policy might not be worth it in the long run. There are some respected sources you can use to get an idea of how well an insurer interacts with their customers.

The National Association of Insurance Commissioners Complaint Index compares the number of complaints registered against an insurer each year with that of other companies.

The NAIC sets the index at an average score of 1.00. Protective has a current score of 0.89, below the industry standard.

Along those same lines, J.D. Power’s annual U.S. Life Insurance Study measures overall customer satisfaction in four areas: annual statement and billing, customer interaction, policy offerings, and price.

The following table shows a breakdown of Protective’s score:

Protective Life Insurance J.D. Power U.S. Study Scores

| J.D. Power Ranking Factors | Protective Life Insurance Score |

|---|---|

| Price | 4/5 |

| Interaction | 4/5 |

| Overall Satisfaction | 3/5 |

| Communication | 3/5 |

| Product Offerings | 2/5 |

| Statements | 2/5 |

| Application and Orientation | N/A |

As you can see, Protective earned its highest scores for price and customer interaction.

What programs does Protective have?

If you’re looking for resources, you’ll need to go to Protective’s site, not Costco’s. Protective’s site includes a learning center with dozens of articles on life insurance and financial planning topics.

What do people have to say about the site and app?

As mentioned, it’s a little difficult to get to Costco’s life insurance page. You either have to find it through a Google search or do a sitewide search from the Costco homepage, which will then bypass Costco’s life insurance page and redirect you to Protective’s site.

On the other hand, the Protective website is well designed and simple to navigate. Your Costco life insurance login is actually on the Protective site, so once you purchase a policy, it’s the website that really matters.

Protective doesn’t have a mobile app for managing life insurance policies. Fortunately, their website is designed for mobile viewing. Everything on the desktop site is accessible on the mobile site.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What more should you know about Costco Life Insurance?

In 2014, Costco began offering a single life insurance policy to its members. The policy is written and backed by Protective, a large life insurer that has been in business since 1907.

Costco isn’t a life insurance company. Because they sell a policy from an outside company, they are more like a life insurance agency. But even then, they are an extremely limited one.

It’s probably more appropriate to think of Protective as a vendor selling their product in another retail store.

Protective is one of the top 20 life insurance companies in the country, currently licensed to sell policies in all 50 states.

What are Protective’s ratings?

Since Costco’s life insurance policy is written, backed, and paid out by Protective, it’s more important to look at the overall company standing of Protective rather than Costco itself. As it stands, Costco doesn’t have any life insurance ratings.

Protective’s life insurance ratings for 2019 give insight into the company’s financial strength, business practices, and quality of customer service.

Protective Life Insurance Ratings

| Ratings Agencies | Protective Life Insurance Ratings |

|---|---|

| A.M. Best | A+ |

| Better Business Bureau (BBB) | A+ |

| Fitch Ratings | A+ |

| Moody’s | A1 |

| Standard & Poor's (S&P) | AA- |

The insurance company ratings from A.M. Best, Moody’s, Standard & Poor’s, and Fitch all measure an insurer’s credit risk, meaning their financial strength as it relates to their ability to pay all of their policy obligations.

Protective’s financial strength ratings show a strong company with low credit risk. Their rating with the Better Business Bureau reflects the same.

The Better Business Bureau assigns one of 13 letter grades based on factors such as time in business, open complaints, resolved complaints, and federal action against a company. Protective has the highest rating.

What is Protective’s market share?

To see how Costco’s life insurance compares to others, you have to look at Protective’s market share. Protective is a top 20 provider of life insurance. They are currently the 18th-largest writer of individual life insurance with a 1.4 percent market share, representing $2.4 billion in direct written premiums.

The following table shows Protective’s market share compared to the competition.

Top 10 Life Insurance Companies and Protective by Market Share

| Rank | Companies | Direct Premiums Written | Market Share |

|---|---|---|---|

| 1 | Northwestern Mutual | $10,547,469,000 | 8.2% |

| 2 | Lincoln National | $7,467,869,000 | 5.8% |

| 3 | New York Life | $7,331,015,000 | 5.7% |

| 4 | Massachusetts Mutual | $6,171,213,000 | 4.8% |

| 5 | Prudential | $5,806,118,000 | 4.5% |

| 6 | John Hancock Life | $4,651,894,000 | 3.6% |

| 7 | State Farm | $4,593,999,000 | 3.6% |

| 8 | Transamerica | $4,567,999,000 | 3.6% |

| 9 | Pacific Life | $3,770,584,000 | 2.9% |

| 10 | MetLife | $3,724,165,000 | 2.9% |

| 18 | Protective | $2,406,628,653 | 1.4% |

The following table compares Protective’s current performance versus previous years.

Protective Life Insurance Market Share Four-Year Trend (NAIC)

| Year | Rank | Direct Premiums Written | Market Share |

|---|---|---|---|

| 2015 | 19 | $2,391,646,752 | 1.50% |

| 2016 | 18 | $2,470,962,105 | 1.54% |

| 2017 | 20 | $2,447,383,271 | 1.45% |

| 2018 | 18 | $2,406,628,653 | 1.44% |

Protective increased in rank from 2017 to 2018, while at the same time experiencing a significant drop in total written premiums and a slight drop in market share.

Normally those decreases would result in a drop in rank, but several of Protective’s closest competitors experienced larger decreases, allowing Protective to slide into a higher spot.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What should you know about Protective’s online presence?

As far as life insurance is concerned, Costco doesn’t have much of an online presence. Their website has a single page devoted to the Member Advantage Life policy that gives a basic overview of the coverage.

That page also includes a quote tool, but it directs you to Protective’s website to get the number, which makes sense. If you purchase a life insurance policy through Costco, you’d ultimately manage it on Protective’s website anyway.

The Protective website offers the ability to get a quote, purchase a term policy, pay your premiums, and file a life insurance claim.

Protective is also one of the many insurance companies using social media. They have an active presence on all major platforms. Both their Facebook and Twitter pages are actively updated with information on the company and its offerings. You can chat directly with a representative on their Facebook page who can answer any questions you have.

Have you seen any of Protective’s commercials?

Protective doesn’t currently have life insurance TV commercials, but they do make videos which they use to advertise across their social media channels.

Their current internet ad campaign features popular vloggers the Holderness Family, who are known for their musical parody videos.

Other videos involve the family discussing the importance of good financial planning and the key role life insurance can play in it.

Is Protective active in the community?

Protective is committed to giving back to the communities in which it operates. It does so through the Protective Life Foundation.

Through financial contributions and volunteer hours, the foundation supports various nonprofit organizations that make a positive impact nationwide.

Last year, the foundation provided over $4.5 million in total gifts and over 1,000 volunteer hours to 238 different organizations. Over the past 24 years, they have given over $68.7 million.

Most recently, Protective pledged $1 million to COVID-19 relief efforts.

Protective has earned its place among other companies that do good for the community.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Who are Protective’s employees?

Protective currently employs about 3,000 people in the United States. Glassdoor employee reviews for Protective averaged 3.4 out of 5 stars based on 227 reviews. A majority, 63 percent, of current employees say they would recommend the job to a friend.

https://youtu.be/Oefs24n0VPI

Protective does not currently rank on any notable lists of best places to work.

What are the pros & cons of Costco Life Insurance?

Here are some of the biggest pros and cons of term life insurance from Costco.

Pros of Costco Life Insurance

- Costco member discount

- Flexible face values

- Online quote

Cons of Costco Life Insurance

- Only one policy option

- Only two term options

- Above-average rates for smokers

You should weigh all of these factors carefully before making any purchase decision.

What is the bottom line?

Buying your life insurance policy from the same retail store as your year’s supply of bath tissue is certainly a novel idea, especially when you get the same wholesale discount that brought you to that store in the first place.

Unfortunately, the lack of policy types and term lengths offered severely limits the number of people who would benefit from a life insurance policy from Costco. The discount is nice but not necessarily enough to offset the price of membership necessary to get it (especially after the discount ends).

Is Costco life insurance a good deal? If you’re already a Costco member and you have simple life insurance needs, it might be worth checking out.

Most others are sure to find more choices at comparable prices elsewhere. Smokers especially could probably find a comparable policy at a price lower than the Costco discount here.

Did we leave any of your questions unanswered? If so, make sure to read the following FAQs where you might find the information you need.

Now that you’ve finished this Costco life insurance company review, you can use the free quote comparison tool at the bottom of this page to compare quotes instantly from multiple insurers to see how they compare to Costco and Protective’s rates.

Frequently Asked Questions

What is the bottom line with Costco Life Insurance?

Costco Life Insurance offers discounted term policies for members. Consider coverage needs, compare quotes, and evaluate customer experience.

What are the cons of Costco Life Insurance?

Limited term options, potential premium increases, and the need for a Costco membership for discounted rates.

What are the pros of Costco Life Insurance?

Discounted rates for Costco members, flexible coverage adjustments, and the ability to convert to whole life.

How do I make a payment on my Costco life insurance policy?

Contact Protective customer service at 1-800-866-9933 for payment options and instructions.

Can I change my term length with Costco Life Insurance?

No, Costco and Protective’s policy offers fixed term lengths of 10 or 20 years.

Can I change my face value with Costco Life Insurance?

Yes, you can request an increase or decrease in coverage, but an increase may require a new medical exam.

Do Costco & Protective offer a no-exam life insurance policy?

Depending on your age, medical history, and the coverage amount, you could be approved for a Member Advantage Life policy without taking a medical exam.

How do I make a payment on my Costco life insurance policy?

You can have your payments automatically debited from your checking account every month by filling out an authorization form or by making electronic payments from a savings or checking account online on Protective’s website.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Life Insurance Agent

Jeffrey Manola is an experienced life insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for life insurance with the most affordable term life insurance, permanent life insurance, no medical exam life insurance, and burial insurance. Not only does he strive to provide consumers with t...

Licensed Life Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.