State Farm Life Insurance Review (Updated)

State Farm Life Insurance reviews find the company with an A++ rating from A.M. Best. You can find State Farm life insurance rates for as low as $12 per month for a 10-year, $100,000 term life insurance policy. State Farm offers term life, whole life, and universal life insurance policies.

Read moreFree Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michael Leotta

Insurance Operations Specialist

Michael earned a degree in Business Management with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Automatio...

Insurance Operations Specialist

UPDATED: Feb 23, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Feb 23, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- State Farm offers term life, whole life, and universal life insurance

- State Farm life insurance quotes start from $12 per month

- State Farm life insurance rating with A.M. Best is A++

State Farm Life Insurance Company Overview

| Key Info | Company Specifics |

|---|---|

| Year Founded | 1922 |

| Current Executive | CEO – Michael L. Tipsord |

| Number of Employees | 56,788 |

| Total Sales / Total Assets | $81,732,000 / $272,518,400 |

| HQ Address | One State Farm Plaza Bloomington, IL 61710 |

| Phone Number | 1-800-782-8332 |

| Company Website | http://www.statefarm.com |

| Premiums Written – Individual Life | $4,593,999 |

| Financial Standing | $8,788,000,000 |

| Best For | Strong Financial Ratings |

We hear about State Farm’s auto insurance, but does State Farm have life insurance? They do!

This State Farm life insurance review details a company that is well known and has competitive rates. Its humorous commercials and public outreach make them approachable and alluring. After all, the last thing you want is to take your business to one of the worst life insurance companies.

So, how good are term and whole life insurance through State Farm? How can I get sample life insurance rates? How does State Farm life insurance work? This State Farm life insurance review will tell you everything you need to know about the company.

Before diving into this State Farm life insurance review, enter your ZIP code above to get your FREE online quote for life insurance today.

Shopping for State Farm Life Insurance Quotes

Let’s get right to it: You want to know if State Farm life insurance coverage is right for you. To figure that out, you may want to start by checking out their rates, especially the rates by age, to see if they are a good fit for you. Here are a couple of comparisons for State Farm against their competitors, based on non-smoking men and women.

Average Annual Life Insurance Rates for Non-Smokers

| Non-Smoker Marital Status, Age & Gender | State Farm | New York Life | Aegon/Transamerica | Lincoln National |

|---|---|---|---|---|

| Single 25-Year-old Female | $143.00 | $158.00 | $164.00 | $187.00 |

| Single 25-Year-Old Male | $164.00 | $152.00 | $176.00 | $231.00 |

| Married 35-Year-old Female | $166.00 | $164.00 | $161.00 | $191.00 |

| Married 35-Year-Old Male | $175.00 | $160.00 | $171.00 | $238.00 |

| Married 45-Year-old Female | $238.00 | $262.00 | $229.00 | $239.00 |

| Married 45-Year-Old Male | $239.00 | $245.00 | $255.00 | $283.00 |

| Married 55-Year-old Female | $341.00 | $414.00 | $453.00 | $435.00 |

| Married 55-Year-Old Male | $396.00 | $696.00 | $527.00 | $615.00 |

| Single 65-Year-old Female | $684.00 | $924.00 | $1,139.00 | $903.00 |

| Single 65-Year-Old Male | $955.00 | $1,416.00 | $1,367.00 | $1,577.00 |

Based on these numbers, State Farm arguably has some of the better rates. There are only a few categories in which the company has higher rates, but not by much.

Average State Farm Life Insurance Rates by Age

Something State Farm is good about is appealing to the younger population. Shockingly enough, 44 percent of millennials overestimate the cost of life insurance coverage by five times the actual amount. Also, two in five millennials say they wish their spouse or partner would buy more life insurance coverage.

When looking deeper into the rates, younger females seem to be getting better odds. Since women have a higher life expectancy than men, women get better rates than men. If you don’t smoke and you’re a young female, your rates will be better than a smoker male or female. This table demonstrates the smoker rates for males and females.

State Farm Average Monthly Term Life Rates for Smokers

| Smoker Age & Gender | $100,000/ 10-Year | $100.000/ 20-Year | $100,000/ 30-Year | $250,000/ 10-Year | $250,000/ 20-Year | $250,000/ 30-Year |

|---|---|---|---|---|---|---|

| 25-Year-Old Female | $19.14 | $19.40 | $27.32 | $28.07 | $34.59 | $52.64 |

| 25-Year-Old Male | $22.19 | $22.88 | $32.63 | $35.02 | $45.02 | $63.07 |

| 30-Year-Old Female | $21.05 | $21.66 | $30.71 | $31.54 | $40.24 | $58.72 |

| 30-Year-Old Male | $23.23 | $26.19 | $37.85 | $36.97 | $49.82 | $73.52 |

| 35-Year-Old Female | $23.32 | $24.27 | $34.71 | $35.47 | $46.77 | $68.94 |

| 35-Year-Old Male | $24.36 | $30.10 | $44.02 | $38.94 | $55.04 | $85.92 |

| 40-Year-Old Female | $28.71 | $33.58 | $50.29 | $48.52 | $64.59 | $102.44 |

| 40-Year-Old Male | $31.32 | $41.76 | $65.16 | $53.94 | $79.62 | $138.99 |

| 45-Year-Old Female | $35.76 | $47.59 | $74.21 | $67.42 | $90.04 | $153.77 |

| 45-Year-Old Male | $40.98 | $59.07 | $97.96 | $75.95 | $123.97 | $227.52 |

| 50-Year-Old Female | $48.37 | $67.86 | N/A | $97.02 | $139.19 | N/A |

| 50-Year-Old Male | $56.81 | $88.39 | N/A | $114.42 | $192.49 | N/A |

| 55-Year-Old Female | $66.38 | $97.96 | N/A | $140.94 | $217.07 | N/A |

| 55-Year-Old Male | $79.87 | $133.98 | N/A | $174.44 | $301.02 | N/A |

| 60-Year-Old Female | $106.14 | $158.17 | N/A | $236.22 | $363.89 | N/A |

| 60-Year-Old Male | $124.58 | $207.84 | N/A | $285.37 | $477.64 | N/A |

| 65-Year-Old Female | $172.26 | $257.96 | N/A | $399.12 | $612.92 | N/A |

| 65-Year-Old Male | $196.45 | $324.42 | N/A | $469.37 | $759.94 | N/A |

Typically, women get better rates than men, and married women get even better rates. If you’re married in general, you’ll more than likely get a better rate. Due to men’s average health and mortality rates, they are more of a risk. Sorry, guys.

State Farm’s Life Insurance Policies

Have you ever wondered what type of life insurance coverage would be best for you? Overall, it may depend on what life stage you’re at. However, no matter what state, State Farm offers term, whole, and universal life insurance policies. All policies can be converted into permanent life insurance coverage, regardless of changes to your health.

Term Life Insurance

Term life insurance is a more affordable life insurance coverage option allowing you to choose your life insurance amount in 5, 10, or 20 years. You can also choose to have it until you reach a certain age. State Farm offers some reasonable term life rates for non-smokers.

State Farm Average Monthly Term Life Rates for Non-Smokers

| Non-Smoker Age & Gender | $100,000/10-Year | $100,000/20-Year | $250,000/10-Year | $250,000/20-Year |

|---|---|---|---|---|

| 25-Year-Old Female | $12.44 | $12.70 | $17.62 | $18.72 |

| 25-Year-Old Male | $14.27 | $14.53 | $20.02 | $23.27 |

| 30-Year-Old Female | $13.14 | $13.22 | $18.49 | $20.44 |

| 30-Year-Old Male | $14.70 | $14.96 | $20.67 | $24.59 |

| 35-Year-Old Female | $14.44 | $15.40 | $19.37 | $22.19 |

| 35-Year-Old Male | $15.23 | $17.57 | $21.74 | $26.09 |

| 40-Year-Old Female | $15.49 | $18.62 | $23.49 | $28.49 |

| 40-Year-Old Male | $16.36 | $21.40 | $25.67 | $33.72 |

| 45-Year-Old Female | $20.71 | $22.97 | $28.72 | $37.42 |

| 45-Year-Old Male | $20.79 | $26.54 | $30.44 | $45.47 |

| 50-Year-Old Female | $23.49 | $29.32 | $37.64 | $54.59 |

| 50-Year-Old Male | $26.54 | $36.02 | $44.59 | $69.59 |

| 55-Year-Old Female | $29.67 | $38.11 | $50.02 | $78.97 |

| 55-Year-Old Male | $34.45 | $50.98 | $67.22 | $105.72 |

| 60-Year-Old Female | $40.98 | $60.20 | $78.09 | $131.17 |

| 60-Year-Old Male | $51.50 | $84.91 | $105.27 | $183.79 |

| 65-Year-Old Female | $59.51 | $97.44 | $123.97 | $220.99 |

| 65-Year-Old Male | $83.09 | $144.51 | $167.27 | $323.42 |

Keep in mind that term insurance is temporary. State Farm has some of the best term life insurance, offering a couple of different options for term life including select, return of premium, and instant answer term.

Select Term Life Insurance

This coverage is available for 10, 20, or 30 years and can be renewed even when you’re 95. This payment always stays the same throughout your term and start around $15/month.

State Farm Average Monthly Rates – $250,000 Select Term Life Insurance

| Term | Starting Average Monthly Rates | Average Annual Rates |

|---|---|---|

| 10 Years | $15.02 | $172.50 |

| 20 Years | $15.22 | $175.00 |

| 30 Years | $19.14 | $220.00 |

Feel free to renew this policy if need be but you might get a different premium when you do.

Return of Premium Term

Ever worry about getting term insurance and not being able to take advantage of it? Maybe you feel as if you wasted some of that money, or better yet, are you nervous that you’ll lose money?

This might be the best policy for you. With this coverage, if your money isn’t paid out by the end of the duration of your 20- or 30-year term, then you get your money back. You can also keep this policy and borrow money from the amount since it builds cash value.

Instant Answer Term

This feature provides a base level of coverage for a small cost. it provides $50,000 of a death benefit protection until the age of 50. This can be ideal for people who possibly want to pay off a loan and cover those remaining expenses.

Whole Life Insurance

Whole life insurance policies allow you to have insurance for the duration of your life. Consider State Farm whole life insurance if you’re in a young family. These policies build cash value and continue throughout your lifetime (or if you decide to cancel it, until then).

Whole life is also good for your children. It helps you to invest in their future if something happens or you might need to take out a lump sum.

So, if you’re wondering how much does whole life insurance cost, check out the table below, which demonstrates what a non-smoker’s rates would look like for whole insurance.

State Farm Average Monthly Whole Life Insurance Rates for Non-Smokers

| Non-Smoker Age & Gender | $100,000 | $250,000 | $500,000 |

|---|---|---|---|

| 25-Year-Old Female | $84.91 | $203.14 | $400.19 |

| 25-Year-Old Male | $93.70 | $225.12 | $444.14 |

| 30-Year-Old Female | $97.35 | $234.24 | $462.39 |

| 30-Year-Old Male | $107.71 | $260.14 | $514.19 |

| 35-Year-Old Female | $112.93 | $273.19 | $540.29 |

| 35-Year-Old Male | $128.24 | $311.47 | $616.84 |

| 40-Year-Old Female | $132.15 | $321.24 | $636.39 |

| 40-Year-Old Male | $153.90 | $375.62 | $745.14 |

| 45-Year-Old Female | $156.17 | $381.29 | $756.49 |

| 45-Year-Old Male | $190.79 | $467.84 | $929.59 |

| 50-Year-Old Female | $191.66 | $470.02 | $933.94 |

| 50-Year-Old Male | $234.90 | $578.12 | $1,150.14 |

| 55-Year-Old Female | $243.17 | $598.79 | $1,191.49 |

| 55-Year-Old Male | $294.84 | $727.97 | $1,449.84 |

| 60-Year-Old Female | $311.63 | $769.94 | $1,533.79 |

| 60-Year-Old Male | $399.24 | $988.97 | $1,971.84 |

| 65-Year-Old Female | $421.69 | $1,045.09 | $2,084.09 |

| 65-Year-Old Male | $528.00 | $1,310.87 | $2,615.64 |

State Farm’s rates have proven to be pretty standard. Their premiums are usually paid until age 100, but you can opt to pay in a certain number of years for whole life coverage.

If you’re wondering can I take money out of my State Farm life insurance? Yes, but you can only borrow against a permanent or whole life insurance policy.

Universal Life Insurance

Universal life insurance is very appealing to those who may change their minds in the coming years. Universal is extremely flexible but also allows you to cover your loved ones in the event you pass away.

This can also help your family pay for things such as a mortgage or give you access to your money while you’re still living. State Farm offers two different types of universal life insurance coverage: survivorship and joint.

- Universal Life – Flexibility to change coverage amounts and premiums

- Joint Universal Life – Life Insurance Protection for two lives with a single policy and typically more affordable than two permanent policies. Pays benefits at the death of the first insured to help cover the survivor’s expenses

- Survivorship Universal Life – Pays benefits at the second spouse’s death. Typically used by couples with large estates to pay estate taxes or to leave a large sum

So if you’re still struggling to decide between term and universal since they have similarities, think of it this way: Universal offers flexible payments, lifetime coverage, and cash value, while term coverage offers a specific amount of coverage and a life insurance death benefit. It’s also less expensive and is renewable.

Survivorship Universal Life Insurance

This type of coverage covers two people. The only way to get this payout is for both parties to die. After this happens, the beneficiary can get the benefit. This can be good for getting money for estate instances of funding a trust.

Joint Universal Life Insurance

This coverage also covers two people, but it goes into effect when one of the parties dies. This type of policy can help your loved ones pay bills or help out with a potential college fund.

Life Insurance Riders

State Farm offers some additional add-ons for your policy to make it your own or just better for you in general.

- Flexible Care Benefits – Provides money to your long term care expenses if you incur them

- Disability Waiver of Monthly Deduction – Monthly expense charges, cost of insurance and optional coverages can be waived in times of total disability for up to six months

- Family Coverage – Allows for term life insurance for your spouse and children to be included on your base coverage

- Guaranteed Insurability Option – Guarantees you the right to increase your life insurance coverage on specific dates without evidence of insurability

There aren’t very many, but they are very good riders. These can really help you in a pinch, and it’s probably better that there aren’t numerous choices for you to choose from so you can just keep it simple. Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

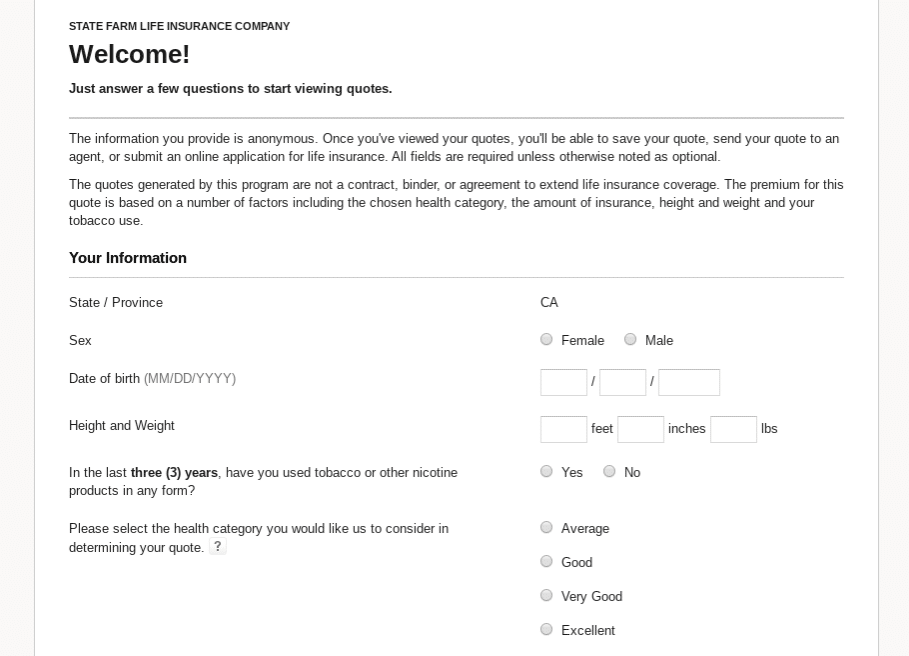

How to Get a Quote Online With State Farm

State Farm makes this extremely easy. First, select the “Get a Quote” tab. Once you select that tab, it will take you to a screen where you’ll select the product type. For this example, we’ll select Life Insurance Products.

Next, enter your birth information. For you to proceed, State Farm needs to make sure you are of age to start the insurance process. After you enter the requested information, click “Continue.”

Then, fill in the requested information. You’ll now be taken to this screen where you’ll enter your personal information.

Make sure to enter this information correctly to get an accurate quote. Scroll to the bottom of the screen and select “Get Quote.” You’ll then be taken to your estimate. State Farm makes getting a quote simple and easy. This process is quick and straightforward and very easy to get to on their website.

Canceling Your Life Insurance Policy

What if you want to cancel your life insurance policy? Maybe a life event comes up and you need to cancel because you cannot afford to pay for your insurance anymore. No problem — life happens. Here’s how to cancel with State Farm.

How to Cancel

Finding the link to cancel is complicated at first. Our best guess is that to cancel, you need an account. If you search “How to cancel,” however, it does take you to a screen that tells you how you can cancel your policy. If you scroll to the middle of the page, you can choose what way you want to cancel your policy. You can also choose to contact your agent for assistance.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Make a Claim With State Farm

Filing a claim with State Farm is pretty straightforward. You can easily see the “File a Claim” tab on the homepage, which points you in the right direction.

From the home page, select the “Claims” tab. After you select the “Claims” tab, click “File a Claim.”

This will take you to the next screen. Click “Start a Claim.“ From this page, you can also scroll down and get additional information about their services. Select the type of insurance you need assistance with. For this example, we’re going to select “Life” for life insurance.

Collect the requested information. After you select life insurance, State Farm tells you what you’ll need to gather for further assistance.

How long does it take to get a life insurance check from State Farm? Around a couple of weeks to 45 days after a decision has been reached.

State Farm’s Customer Experience

As far as customer experience goes, there are many positive reviews. The company prides itself on doing right by their customers. They answer their customers’ concerns quickly and efficiently.

State Farm’s bulk of complaints are mostly about the claims process.

This should come as no surprise since most of all the company’s complaints are about their claims process. The complaints are either about the representative that helped them not being able to approve their claim or about their claim being denied.

However, most people found the employees friendly and helpful. They found everything fair and informational. Customers were pleased with the knowledgeable staff and are happy to be a part of the State Farm family.

State Farm’s Programs

Particularly noteworthy is the State Farm Companies Foundation Scholarship Program, which is exclusively for their associates’ dependents. State Farm holds this special scholarship program through the National Merit Scholarship Corporation (NMSC) in which the children can apply.

This program is awarded to high school students, with at least 100 scholarships awarded each spring to high school seniors. The scholarship awards up to $5,000 per year for the students’ college undergraduate years or until their bachelor’s requirements are met. Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

About State Farm Life Insurance

State Farm was founded in 1922 by a retired farmer and insurance salesman named George Jacob “G.J.” Mecherle. He started the company because he wanted to be able to do the right thing and be fair to all customers.

State Farm started out small as just an auto insurance company but now offers more than 80 products and services. State Farm also tries to continue to do the right thing by always helping out in the community.

The company supports multiple organizations that help prevent losses, injuries, and also to help make the community safer.

State Farm’s Ratings

State Farm has competitive ratings for its overall performance. The company has gotten A ratings across the board.

State Farm Life Insurance Ratings

| Rating Companies | State Farm Life Insurance Ratings |

|---|---|

| A.M. Best | A++ (Superior) |

| Standard & Poor’s | AA (Very Strong) |

| Moody’s | Aa1 (Very High Quality) |

In addition to the company’s great ratings, State Farm won the 2018 Award Recipient (Among the Best) award for their insurance company performance. This adds to their appeal in choosing them for just about any type of insurance. With the AA rating given by Standard and Poor’s, the company’s financial outlook is stable, which is something we want to hear when shopping for insurance.

State Farm’s Market Share

How does the company measure up against its competitors? State Farm ranks in the top 10 for individual life premiums written, which is a good sign. It shows that this is more of where their business is at.

In the table below, we can also see that it’s a bit of a steep jump from the number one company to State Farm’s numbers, but their numbers are consistent with most of the other companies’ premiums written. In 2016, they also placed ninth among the top 10 companies, so they have been pretty consistent over the years.

Top 10 Life Insurance Companies by Market Share (NAIC)

| Rank | Companies | Direct Premiums Written | Market Share |

|---|---|---|---|

| 1 | Metropolitan Group | $12,069,037,505 | 7.37% |

| 2 | Northwestern Mutual | $10,455,506,540 | 6.38% |

| 3 | New York Life | $9,335,442,446 | 5.70% |

| 4 | Prudential of America | $8,977,419,795 | 5.48% |

| 5 | Lincoln National | $7,459,547,086 | 4.55% |

| 6 | Mass Mutual Life Insurance | $7,162,088,704 | 4.37% |

| 7 | Aegon US Holding | $4,738,606,120 | 2.89 |

| 8 | John Hancock | $4,582,866,128 | 2.80 |

| 9 | State Farm | $4,526,855,808 | 2.76 |

| 10 | Minnesota Mutual | $4,136,007,017 | 2.52 |

As far as their market share is concerned, over three years from 2016–2018, the company’s market share has stayed consistent, making them a steady company. In 2016, their market share was 2.82 percent, which is similar to 2018’s 2.8 percent. Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

State Farm’s Commercials

State Farm is well known for their commercials and the jingle “Like a good neighbor, State Farm is there.” Something that really sticks out is that they actually have included the fact that they have life insurance, which isn’t as common as you would think.

Their commercials are humorous, and they make sure you know no matter what, you’re covered. Their commercials promote their agents’ capability to assist you with whatever you may need.

You’ll often see their ads when you’re watching videos on YouTube or when you’re googling about getting life insurance.

State Farm in the Community

State Farm has proven to be extremely involved in the community, offering grants and programs to people of all ages. They believe in building stronger, safer, and better-educated communities. They also offer disaster-ready preparedness programs to help people prepare for the worst.

State Farm’s programs include:

- Good Neighbor Citizenship®

- State Farm Companies Foundation

- Neighborhood of Good®

- State Farm Companies Foundation

- State Farm Arson Dog Program

- Insurance Institute for Highway Safety

State Farm appears to emphasize equality and helps to eliminate discrimination.

“State Farm® strives to be known for our commitment to diversity and inclusion. We are stronger and better together when we seek the broadest perspectives, invite fresh, new ideas and encourage healthy, respectful debate.”

— Michael Tipsord, Chairman, President, and CEO

As you can see, State Farm takes pride in giving back to the communities in which they serve.

State Farm’s Employees

State Farm is extremely involved with its employees. They pride themselves on enforcing diversity and inclusion for their employees.

State Farm has won more than 10 awards just in the past two years, including the National Association of Minority and Women-Owned Law Firms (NAMWOLF) Diversity Initiative Achievement Award. Senior Vice President Annette Martinez was awarded the Women of Excellence Award and named the 2018 Diversity Champion for Women.

The company has also won many awards for its immense employee satisfaction and inclusion.

State Farm was recognized in 2019 for Best Companies for Multicultural Women, 2019 for Best Companies for Diversity, 2020 for Military-Friendly Employer, 2018 for Top 100 Employers, and 2019 LATINA Style’s 50 Best Companies for Latinas to Work. While reviewing the awards on State Farm’s website, you’ll also see multiple quotes from employees of the company.

Based on State Farm reviews, a great deal of the employees appear to be satisfied. Most of the reviews from Glassdoor include happy reviews from the employees. They are pleased with the benefits of the workspace. State Farm also appears to have competitive pay for their staff.

People working there are happy with the opportunities that they are presented with and the multiple opportunities to move up. However, one of the common cons listed was that there wasn’t very much schedule flexibility.

Pros & Cons of State Farm Life Insurance

State Farm’s rates may be a bunch of jargon to you, and you may just want to get the facts or the answer to your question, “Should I consider State Farm for my life insurance provider?”

Consider some of these pros and cons based on our research.

Pros of State Farm Life Insurance

Looking at the pros of a company can make your decision easier. So, let’s take a look:

- You get the coverage of a well-known company who knows insurance and knows it well

- It has great customer service reviews

- It has plenty of riders for you to add and customize your plan

- 24/7 customer service along with plenty of other avenues to contact the company

- Average estimates and rates, meaning you won’t be paying too much for your coverage

- Easy account access using their app, along with an easy-to-use website

Overall, it’s a pretty good outlook, but State Farm may not be for everyone.

Cons of State Farm Life Insurance

With the pros come some negatives:

- It’s a large company, meaning if you’re looking for a very personal experience or the feel of a “mom and pop” company, it may not be for you.

- Higher rates than some other companies.

- Not very many upfront benefits for the military.

Review some of these and make the decision for yourself. You may also come up with more pros and cons of the company on your own.

State Farm Life Insurance: The Bottom Line

The very communicative company tends to be involved in the community and evolves their coverages continually. By heavily involving their employees with their communities and rewarding the employees along with their families, it shows a healthy work environment. State Farm seems like one of the best life insurance companies to work for.

Not only do they make their products affordable for others, but they also give back by getting involved with numerous organizations and provide funding for plenty of great causes. Their online presence seems to grow each day and they get the word out about their company using humorous commercials.

Now that you’ve finished this State Farm life insurance review, don’t wait — get your FREE online quote for term, whole, or no exam life insurance today.

Frequently Asked Questions

How does the life insurance policy work after someone dies with State Farm?

After the passing of the policyholder, the beneficiary will need to file a claim with the policyholder’s life insurance company. They will request documentation, so be prepared. If you’re unsure what the company may need, call ahead and ask what information they may require.

What type of life insurance should I get with State Farm?

That’s completely up to you and your financial situation. If you’re looking for a cheaper option, it would be a good bet to go for term life insurance. If you’re looking for something a little more long-term, opt for whole life insurance.

What types of deaths aren’t covered by life insurance with State Farm?

Some examples of types of deaths that aren’t covered are suicide, accidental death (unless you get a rider that covers that), self-inflicted injuries/hazardous activity, HIV/AIDS, and homicide.

Is life insurance worth all the money through State Farm?

It’s better to have life insurance and not need it than to not have it and have your loved ones not be able to pay for the necessary arrangements. Two in five millennials say they wish their spouse or partner would buy more life insurance, and 61 percent of people don’t buy life insurance or more of it because they say they have other financial priorities. Overall, if it’s within your budget, it would be a good investment for your family.

Did the State Farm rate increase in 2019?

Yes, the rates did increase due to the frequency of claims and the cost to pay them. In a nutshell, if the company incurs a lot of losses, its rates will change (or increase rather).

How does State Farm’s life insurance work?

In short — an individual purchases life insurance. After that person dies, their beneficiary will get their death benefit. The beneficiary will need to file a claim in order to get the funds, however. In order to get specifics on the claims process, it would be best to call a State Farm agent directly.

Is State Farm Life Insurance a reputable choice?

State Farm is a well-established and reputable insurance company with a long history of providing various insurance products, including life insurance. It is important to research and compare different options before making a decision, but State Farm generally has a strong reputation in the insurance industry.

Can I customize my State Farm Life Insurance policy?

Yes, State Farm offers some customization options for their life insurance policies. Depending on the type of policy you choose, you may have flexibility in adjusting your coverage amount, premium payments, and other policy features. Discuss your customization needs with a State Farm agent to explore available options.

How much does State Farm Life Insurance cost?

The cost of State Farm Life Insurance varies depending on various factors, including your age, health condition, desired coverage amount, and the type of policy you choose. It’s best to get a personalized quote from State Farm to determine the exact cost based on your specific circumstances.

How can I apply for State Farm Life Insurance?

To apply for State Farm Life Insurance, you can visit their website, contact a local State Farm agent, or call their customer service. They will guide you through the application process, help you understand the available options, and provide personalized quotes based on your needs.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michael Leotta

Insurance Operations Specialist

Michael earned a degree in Business Management with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Automatio...

Insurance Operations Specialist

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.