Mutual of Omaha Life Insurance Review (Companies + Rates)

Mutual of Omaha life insurance rates can be as low as $9 per month for a 10-year, $250,000 term life insurance policy. Mutual of Omaha life insurance reviews find the company with an A+ rating from A.M. Best. The most popular life insurance types from Mutual of Omaha are term life and whole life.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Laura Kuhl

Managing Content Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. In 2018, she started writing for the cannabis industry. She curated news articles and insider interviews with investors and small business ...

Managing Content Editor

UPDATED: Feb 11, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Feb 11, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Mutual of Omaha has a variety of life insurance policies, but the most popular are term and whole life

- Mutual of Omaha life insurance quotes start from $9 per month

- Mutual of Omaha life insurance rating with A.M. Best is A+

| Key Info | Company Specfics |

|---|---|

| Year Founded | 1909 |

| Current Executives | CEO - James T. Blackledge |

| Number of Employees | 6,314 |

| Total Sales | $9,347,200,000 |

| Total Assets | $43,913,400,000 |

| HQ Address | 3300 Mutual of Omaha Plaza Omaha, NE 68175 |

| Phone Number | 1-800-228-7104 |

| Company Website | www.mutualofomaha.com |

| Premiums Written | $3,042,369,348 |

| Financial Standing | $277,300,000 |

| Best For | Final Expense Insurance |

Shopping for life insurance can be confusing and overwhelming. Besides knowing what kind of life insurance you want, you must pick a company to purchase it through. It looks like you are well on your way with that step.

From here on out, I’ll be evaluating Mutual of Omaha (sometimes refered to as simply “Mutual,”) as a life insurer. Let’s take a look at our Mutual of Omaha life insurance review to see what the company has to offer, some sample rates, and a few employee reviews.

Another vital part of buying life insurance is by comparing quotes. It is smart to shop around.

If you’re looking for affordable life insurance premiums, try our comparison tool and find the cheapest coverage that fits your needs.

Mutual of Omaha Ratings

| A.M. Best | A+ (Superior) |

| BBB | A+ |

| Moody's Rating | A1 (Good) |

| S&P Rating | AA- (Very Strong) |

| NAIC Complaint Index-Group Life | 0 |

| NAIC Complaint Index-Individual Life | 0 |

| JD Power | Four power circles (Better than Most) |

| Consumer Affairs | Three out of five stars; 147 ratings |

A.M. Best

A.M. Best’s credit ratings are forward-looking, independent, and objective opinions regarding insurer’s, issuer’s, or financial obligation’s relative creditworthiness. In short, it allows the consumer a professional risk assessment of any rated company.

A.M. Best’s Financial Strength Ratings focus on how well the company can hold up its end of the bargain. Mutual of Omaha received an A+ signifying its superior financial stability.

Better Business Bureau (BBB)

The BBB ratings do not focus on money but on the interactions between businesses and consumers. It is important to note that customer reviews are not used; only public sources and those directly from businesses are taken into consideration.

There are seven rating elements the BBB evaluated before deeming Mutual of Omaha as an A+ company. An A+ company simply means that they have received minimal complaints throughout their long operating history.

Moody’s

Moody’s uses 10 factors to provide the framework for their ratings. They utilize historical and forward-looking data to rate the financial strength of companies by focusing on business, economic, and operating factors.

For Mutual of Omaha, an A1 rating translates to being upper-medium grade and subject to low credit risk.

Standard & Poor (S&P)

At S&P, credit ratings provide forward-looking credit risk, which assists in developing smooth-functioning capital markets by providing information and insight to market participants.

With a AA- rating, S&P considers Mutual of Omaha as having a very strong capacity to meet its financial commitments.

NAIC Complaint Index

The purpose of a National Association of Insurance Commissioners (NAIC) Complaint Index is to compare the performances of different companies. To determine a company’s index, you must divide the number of complaints by the number of premiums written.

Mutual of Omaha had so few complaints last year that its complaint index was zero. For individual life insurance, there were only 10 complaints, and group life insurance only had one complaint, according to NAIC.

J.D. Power

J.D. Power uses a five-point power circle rating system. The four power circles that Mutual of Omaha earned shows that they are rated above average by consumers. They use four factors to average out an overall satisfaction:

- Annual statement and billing

- Price

- Policy offerings

- Interaction

Consumer Affairs

Of all the rating agencies, Consumer Affairs bases its grade strictly on the ratings and opinions of actual consumers. Out of 147 ratings, Mutual of Omaha averages three out of five stars.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Company History

What has become a multi-line organization that provides insurance, banking, and financial services to individuals, groups, and businesses, was established in 1909 as Mutual Benefit Health & Accident Association. Let’s take a look at what it has accomplished in the last hundred years.

One of the first big decisions came in 1917 when Mutual extended coverage to the increasing amount of women who entered the workforce during the First World War. The Second World War brought about a major change, as well.

After Pearl Harbor, the company changed its policy war clause provision to provide full coverage for civilians killed or injured in Hawaii, or within the continental U.S. or Canada by bombing or any other act of war. The government had to start the War Damage Insurance Corporation because of the reluctance of insurers.

Insurance is not an industry that makes money off war, but in the following decade, business starts to pick up, especially for the newly named Mutual of Omaha. By the 1950s, business is being conducted in all 48 states and two territories.

There was also a bold move with the logo, making it a side-profile of a Native American wearing a headdress. In the ’60s, the company started putting its brand out there even more. In 1963, Mutual of Omaha’s “Wild Kingdom” premiered.

“Wild Kingdom” was a wildlife program that aired for over 20 years. Mutual went on to sponsor several other TV programs while diving into the world of sports, as well. In 2001, the USA swim team was sponsored by Mutual of Omaha.

Back to insurance, though. Mutual was one of the first insurance companies to provide supplementary coverage for people enrolled in Medicare as well as disability insurance to non-professional workers. Then, in 1997, its first website was launched.

Once in the new century, it was decided to stop selling variable life insurance. That seems to be the only major life insurance change for decades. They must be doing something right.

Mutual of Omaha is the parent company to five subsidiaries:

- United of Omaha Life Insurance Company

- United World Life Insurance Company

- Mutual of Omaha Investor Services, Inc.

- Omaha Financial Holdings, Inc.

- East Campus Realty, LLC.

Let’s take a look at the finances behind Mutual of Omaha being ranked #336 on the Fortune 500 list.

Mutual of Omaha’s Market Share

Mutual of Omaha had a benchmark year in 2016 when they reached $3 billion in policyholder surplus, and I don’t think they are going to slow down.

Here’s a year-by-year look at the slow, gradual growth of the company’s market share and the number of direct premiums written. For context, the rank based on market share is included.

| Year | Rank | Direct Premiums Written | Market Share |

|---|---|---|---|

| 2009 | 28 | $1,204,565,326 | 0.94% |

| 2010 | 29 | 1,348,371,882 | 1.01 |

| 2011 | 28 | 1,451,889,831 | 1.05 |

| 2012 | 28 | 1,526,779,147 | 1.06 |

| 2013 | 27 | 1,562,775,419 | 1.08 |

| 2014 | 27 | 1,668,354,691 | 1.09 |

| 2015 | 26 | 1,788,840,077 | 1.12 |

| 2016 | 25 | 1,968,030,192 | 1.26 |

| 2017 | 24 | 2,111,825,956 | 1.29 |

| 2018 | 22 | 2,279,872,670 | 1.39 |

There may not be huge leaps from year to year, but steady growth means stable growth. We must remember, though, Mutual isn’t the only insurance company out there. Shall we see how they fare against the industry?

From 2016-2017, the insurance industry increased direct premiums by 2.9 percent. That same year Mutual increased direct premiums by 7.3 percent. The following year, direct premiums increased 6 percent industry-wide.

Again, Mutual of Omaha is above the industry average, with an increase of 8 percent. Overall, for both the industry and Mutual of Omaha, the financial outlook is good and stable.

Mutual of Omaha’s Position for the Future

Now that we have taken a look at Mutual’s current economic status, let’s assess how it stacks up against the top life insurance providers.

| Direct Premiums Written By Company | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|

| Mutual of Omaha | $1,788,840,077 | $1,968,030,192 | $2,111,825,956 | $2,279,872,670 |

| Metropolitan Group | $13,356,782,598 | $11,890,212,278 | $12,069,037,505 | $9,821,445,953 |

| Northwestern Mutual Life Insurance Co. | $10,089,466,811 | $10,067,144,919 | $10,455,506,540 | $10,517,115,452 |

| New York Life Insurance Group | $8,740,203,003 | $8,714,565,090 | $9,335,442,446 | $9,295,848,300 |

| Prudential Financial Inc. | $8,626,713,484 | $8,530,929,470 | $8,977,419,795 | $9,128,805,060 |

| Lincoln National Corp. | $6,731,270,174 | $6,902,867,866 | $7,459,547,086 | $8,769,303,174 |

Most of these companies are growing from year to year — there may be some ups and downs, but that is normal in any business market. Mutual of Omaha may be on a smaller scale than these other companies, but the outlook seems good for the industry as a whole.

Mutual of Omaha’s Online Presence

It would seem Mutual has a good grasp of what it takes to be a company in the age of social media. Not only does the company have a functioning website, but it also has profiles on the five biggest social media platforms.

On Facebook, the company has 145,243 followers and 1,368 on Instagram. (We will pretend that none of those are repeat followers.) Over on Twitter, there are 35,900 followers, while LinkedIn shows 44,331 followers. Now, these may not be huge numbers, but for an insurance company, that’s a pretty decent following.

YouTube is the fifth platform in which Mutual has its own account. This one, in particular, has 829 subscribers and about 100 videos uploaded. Now it’s time to take a look at some of those videos.

Mutual of Omaha’s Commercials

Insurance companies spend a lot of money on commercials for a good reason. Anytime you can associate insurance with pop culture, do it; it’ll boost your sales. Here is a commercial referencing the popular show sponsored by Mutual of Omaha, “Wild Kingdom.”

We can all see that the commercial is a little outdated. This next one is from the past couple years and talks more directly about life insurance rather than disability income protection, which by the way, is probably one of Mutual’s more popular insurances.

From both of these commercials, we can see that cheesiness will never be outdated.

Mutual of Omaha in the Community

With all the cooperate greed in the world today, people are more pleased with a company when it is known to directly or indirectly combat that greed. The Mutual of Omaha Foundation is at the center of the fight in the Omaha area to break the cycle of poverty.

Since 2005, the foundation has been investing in major capital projects that strengthen the community, all while focusing on three areas to help break the cycle: basic needs, at-risk youth, and adult self-sufficiency. The foundation, however, is not the only way Mutual and its employees give back.

Last year, 747 employees contributed more than 6,261 volunteer hours to 129 organizations. There was also over $4.5 billion donated to 80 different organizations.

Mutual of Omaha sponsored the USA swim team for 15 years. The Olympic trials have been in Omaha the past few times, and it is scheduled to be there again this coming year. Not only is the involvement in sports awesome, but the company indirectly helps the local economy of Omaha by hosting such events.

Mutual of Omaha’s Employees

We’ve seen how Mutual of Omaha interacts with the community. Now let’s turn to how they treat their employees and how those employees feel about their employer.

On Glassdoor, Mutual received 3.9 out of five stars overall. That rating stays consistent when we jump over to Payscale. Here are a few statistics and ratings based on employee input from these two sources.

- 77 percent would recommend working at Mutual of Omaha to a friend

- 96 percent approve of the CEO

- 71 percent agree that the business has an overall positive outlook

- 3.5 out of five stars for employee appreciation

- Four out of five stars for manager communication and relationships

- 2.8 out of five stars for fair pay

- 2.9 out of five stars for pay transparency

Let’s talk about the money a little bit more in depth. The average salary at Mutual of Omaha is $66,000/year or $18.89/hour. Salaries range from $41,252-$110,312/year. For bonuses, the average is $5,000.

There are many reviews that suggest a good work-life balance, good pay, and good work environments. At the same time, there are reviews suggesting there is a lack of communication between HQ and individual offices, as well as a lacking sense of unity.

Who is working at Mutual of Omaha? Well, 54 percent of employees are male and 46 percent female. There are employees at every level of experience working at Mutual.

- Early-Career: 34.3 percent

- Mid-Career: 21.3 percent

- Late-Career: 17.8 percent

- Experienced: 17.2 percent

- Entry Level: 9.5 percent

Last year, the company was awarded Best Place to Work in Pennsylvania, the Pro Patria Award, and the Mosaic Diversity Achievement Award.

Shopping for Life Insurance

Anything can be bought online, and most people find it more convenient. Life insurance is no different. About half of adult consumers visited a life insurance company website and/or sought life insurance information online.

Before you start sifting through countless websites and insurance policies, you are going to want to evaluate your life. It will be easier to choose the right policy for yourself when you inventory your needs first.

What do you want your life insurance policy to do? Who do you need to protect? How much are you willing to pay? These are all important questions to ask yourself.

Life insurance policies are about kids, colleges, mortgages, and retirement. It isn’t only about the end of life. Life insurance can help you live a more peaceful and protected life.

The smart approach for shopping for life insurance is acquiring the most information and the most quotes possible. Every estimate is meant only to inform your decision, not make it for you.

Average Mutual of Omaha Male vs. Female Life Insurance Rates

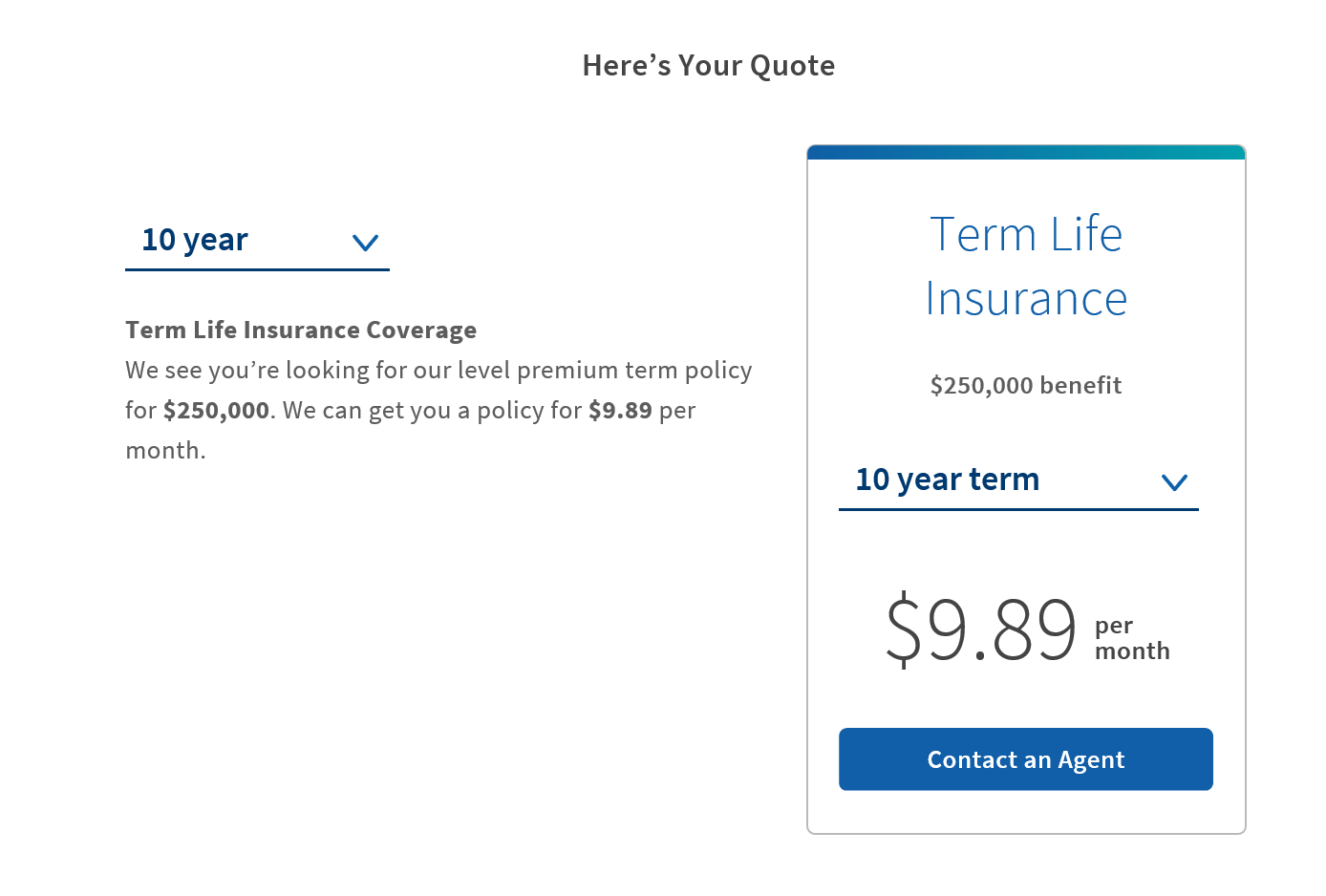

While I have you thinking about what you want from your life insurance, let’s look at some monthly rates for Mutual of Omaha. The rates below are based on term life insurance with $250,000 of coverage. Also, these are only averages; it’s still better to get your own quote.

| Female Non-Smoker | 10 year term | 20 year term | 30 year term |

|---|---|---|---|

| 25 | $9.89 | $12.04 | $16.99 |

| 30 | $10.11 | $12.26 | $17.85 |

| 35 | $11.40 | $13.76 | $20.64 |

| 40 | $13.98 | $17.63 | $27.31 |

| 45 | $15.91 | $25.16 | $39.78 |

| 50 | $21.72 | $35.69 | $61.71 |

| 55 | $31.39 | $54.61 | $108.36 |

| 60 | $46.23 | $101.91 | NA |

| 65 | $84.50 | $172.00 | NA |

First, let’s start with our female non-smokers. A 25-year-old female non-smoker would pay less than $10 a month for a 10-year term policy worth $250,000. We will go over what factors affect rates later on, but right now, you’ll be able to see it.

Logically, the longer the term, the more expensive the policy. The same goes for the age of the policyholder: the older, the more expensive. For a 10-year term, a 60-year-old female non-smoker will spend about $46 a month. That’s nearly five times the amount.

Age isn’t the only demographic that can determine life insurance rates. Another is gender. Here are some sample rates for the male counterpart to the situation outlined above.

| Male Non-Smoker | 10 year term | 20 year term | 30 year term |

|---|---|---|---|

| 25 | $11.18 | $13.33 | $19.57 |

| 30 | $12.04 | $13.55 | $20.86 |

| 35 | $13.12 | $14.84 | $23.65 |

| 40 | $15.05 | $20.64 | $33.11 |

| 45 | $18.06 | $30.75 | $50.96 |

| 50 | $26.02 | $45.80 | $83.42 |

| 55 | $41.50 | $72.24 | $153.73 |

| 60 | $65.15 | $134.59 | NA |

| 65 | $119.33 | $266.60 | NA |

A young man of 25 would pay $11.18 a month for a 10-year term. That’s only $1.29 more than a young woman of 25. The difference between prices for males and females in regard to life insurance increases as they age.

A 60-year-old male would pay almost $20 more than his female counterpart. The real expensive policies come with unhealthy habits.

| Female Smoker | 10 year term | 20 year term | 30 year term |

|---|---|---|---|

| 25 | $32.90 | $43.86 | $53.54 |

| 30 | $34.19 | $47.52 | $55.90 |

| 35 | $36.34 | $51.60 | $65.79 |

| 40 | $41.50 | $60.85 | $94.60 |

| 45 | $61.06 | $91.81 | $141.90 |

| 50 | $90.09 | $132.23 | $248.33 |

| 55 | $123.63 | $197.59 | NA |

| 60 | $179.53 | $311.75 | NA |

| 65 | $269.40 | $588.24 | NA |

If a 25-year-old female smoker is looking for a policy, she can expect to pay more than three times the amount of non-smoking women of the same age. When you add a few more years, the gap gets worse.

At sixty, she would be paying $179.53 compared to non-smokers paying $46.23. Healthy living seems like the way to go. As you can probably guess, male smokers fair no better than women.

| Male Smoker | 10 year term | 20 year term | 30 year term |

|---|---|---|---|

| 25 | $39.78 | $55.47 | $60.42 |

| 30 | $39.78 | $55.47 | $69.02 |

| 35 | $41.50 | $58.48 | $82.78 |

| 40 | $50.74 | $78.69 | $127.93 |

| 45 | $72.46 | $122.34 | $207.48 |

| 50 | $105.35 | $185.33 | $300.79 |

| 55 | $161.04 | $279.93 | NA |

| 60 | $251.55 | $449.78 | NA |

| 65 | $423.12 | $871.40 | NA |

Male smoker

Almost quadruple of what a 25-year-old female non-smoker is what a 25-year-old male smoker pays. At 60, he would pay a whopping $251.55.

Another thing to notice about the rates for smokers is that Mutual of Omaha does not offer a 30-year term to 55-year-old men or women. For non-smokers, the cutoff is 60 years old.

Coverage Offered

This article may focus on the life insurance side of Mutual of Omaha, but the truth is they offer a lot more than that. Here is a list of what you can purchase from Mutual of Omaha.

- Life Insurance

- Long-Term Care Insurance

- Disability Income Insurance

- Critical Illness Insurance

- Cancer, Heart Attack and Stroke Insurance

- Medicare

- Dental

- Financial Services

Let’s dive deeper into what types of life insurance are offered by Mutual of Omaha.

Types of Coverage Offered

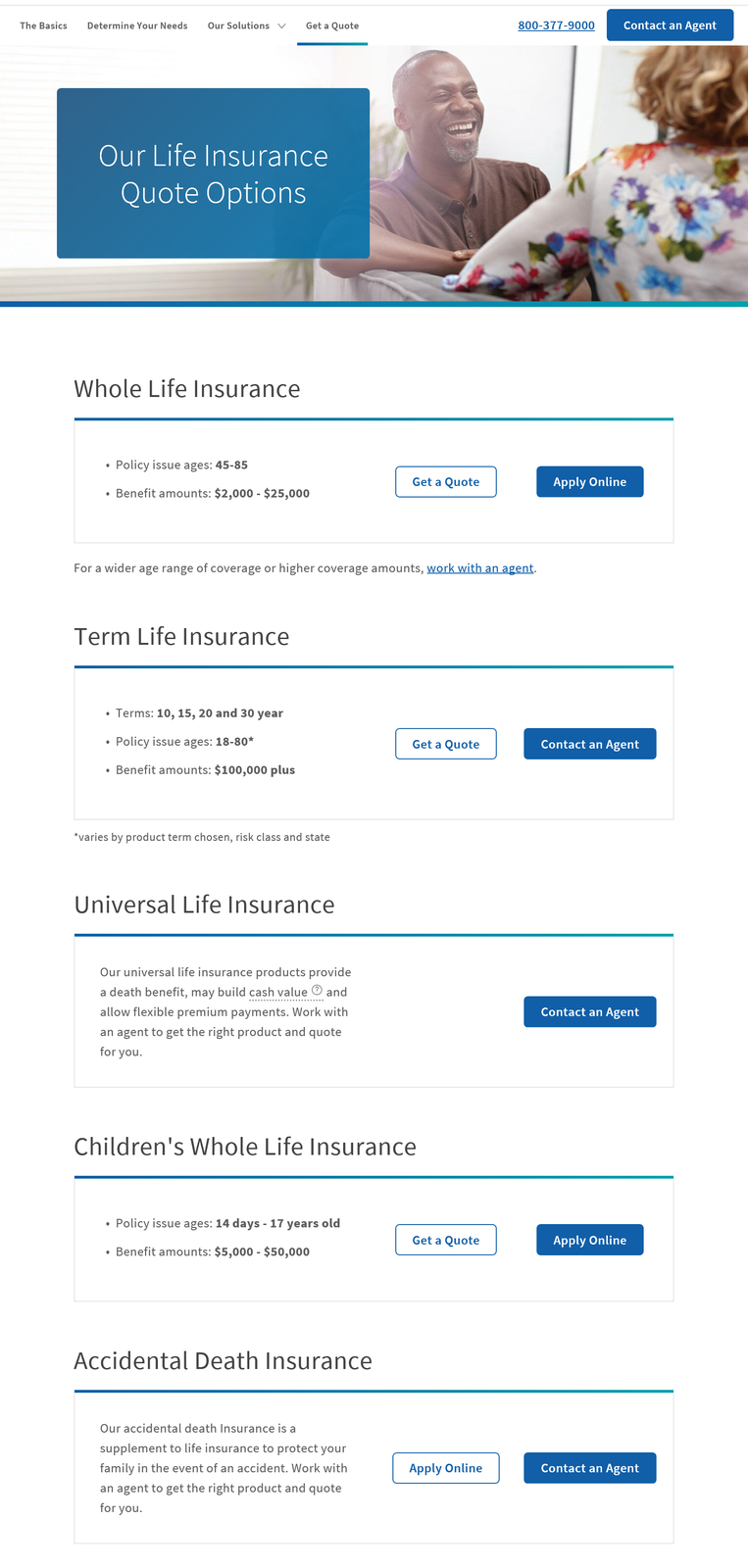

Mutual of Omaha offers a variety of life insurance policies. There are the most popular types like term and whole life, but there are also children’s whole life and accidental death insurance. Also, Mutual has four different universal life policies: Life Protection Advantage, Income Advantage, Guaranteed, and AccumUL.

Group life insurance is available for purchase by employers. A smart addition for certain occupations is the Accidental Death and Dismemberment rider.

Term

Generally speaking, term life insurance is the most affordable of life insurance policies. The coverage is for a specified period of 10, 15, 20, or 30 years. The amount of coverage can vary; coverage will amount to $100,000 or more.

Mutual of Omaha will issue this type of life insurance to those between the ages of 18-80. Along the same line, the term policies at Mutual expire when the policyholder reaches 95.

The best thing about term life is that the payments never change. Also, at Mutual, there is the opportunity to convert term life into a permanent life insurance policy.

Those who benefit the most from this type of coverage are those in temporary need to cover short-term financial responsibilities like a mortgage or during child-raising years.

Whole

Whole life is the policy that focuses on long-term needs; it’s supposed to help with final expenses or leaving behind a legacy. It may seem brilliant to have both a death benefit and a cash value portion, just remember that it can be more expensive than term life.

Mutual will only issue whole life policies to those ages 45-85. In New York, however, it is 50-75. The initial coverage to be purchased ranges from $2,000-$25,000. Learn more about whole life insurance costs.

Besides guaranteeing coverage, whole life has guaranteed premiums that never increase. The most notable aspect of whole life at Mutual of Omaha is that there is no need for a medical exam.

– Children’s Whole Life

Another type of coverage offered by Mutual is children’s whole life, which is for those who are 14 days to 17 years old. Just like the normal whole life, the premiums are guaranteed, and there is a possible cash value.

With simplified underwriting and benefits ranging from $5,000-$50,000, whole life coverage for a child at Mutual of Omaha guarantees the opportunity for them to buy more as an adult.

Universal

Universal life insurance is a permanent type of insurance that is known for its flexibility. With adjustable premiums and benefits as well as a possible cash value portion, universal life seems to have it all.

The life insurance death benefit is tax-free, the potential cash growth is tax-deferred, and policy loans or withdrawals are income-tax-free, as well.

In reality, universal life insurance can be some of the most complicated of life insurances. That is why Mutual of Omaha offers four different types of universal life insurance, to have an option for everyone.

– Life Protection Advantage

This type of coverage is considered an indexed universal life insurance policy. Indexed means cash values are put into a fixed account or an equity index account — exactly why this type has a higher cash value potential.

At Mutual, this policy allows for a death benefit to be guaranteed through the age of 85. There are also accelerated death benefit and guaranteed refund option riders to supplement a policy like this.

– Income Advantage

Again, we see an indexed universal life policy. This one, however, is geared toward building a cash value based on the performance of a market index. The emphasis on potential cash growth is great with this type because it is impossible to lose money when the market does terribly.

– Guaranteed

Guaranteed universal life insurance guarantees a death benefit for a period chosen by the policyholder, which could be for the lifetime.

At Mutual of Omaha, this policy is specifically focused on the death benefit rather than the cash value portion of permanent life insurance. There is flexibility provided via riders.

– AccumUL

I love when insurance companies use ridiculous alterations to the names of the insurance they provide.

This type of policy accumulates cash value using a declared rate, guaranteed to earn more than 2 percent per year. There is way more of an emphasis on the cash value portion with this coverage.

Accidental Death Insurance

The purpose of accidental death insurance is to supplement existing life insurance. This is supposed to provide protection when you are unable to qualify for other forms of insurance. Thus, it is fitting that no medical exam is required.

These policies are issued to those between the ages of 18-70, with guaranteed renewable up to 80 years old. Family coverage is also available.

What this type of insurance would cover is divided into two groups. For accidents where the victim was riding as a fare-paying passenger, there is up to $1,000,000 in possible coverage. Whereas if they were in or struck by a private vehicle, it is up to $300,000.

Group Life

Mutual of Omaha has options for businesses to choose from to have employees protected. Mutual provides step-by-step help with the enrollment process and finding what would suit the business best.

Plans are available with voluntary, non-contributing, and contributing options. There are also annual increase options available for voluntary plans only. A living care benefit and dependent coverage are available, too.

Sometimes it’s all about the little things; employers can combine all group products on one bill.

There are some great employee benefits that come along with group life insurance. Let’s take a look.

- The coverage is fully portable

- Economical and convenient

- The value of the policy is not affected by market conditions

- Premium is waived if one becomes totally disabled and unable to work

A common rider, Accidental Dismemberment & Death (AD&D) can be added, as well.

Factors That Affect Your Rate

With all the different insurance companies and types of policies, it is easy to lose focus on yourself. Several personal characteristics can affect your rates. We must remember that the insurance companies’ goals are to maximize profits and the number of premiums while assessing and minimizing the risks.

Demographics

Age is the number-one factor when it comes to setting a price for life insurance premiums. The younger you are, the lower your rates tend to be. As we age, our odds of dying increase; thus, life insurance rates increase.

Gender is another factor that lies outside our control when it comes to affecting life insurance rates. In general, women live longer than men, and we know that a longer life expectancy is equal to lower rates.

Current Health & Family Medical History

A medical exam — where blood pressure, cholesterol, and the heart are looked at and assessed, as well as overall health evaluation — must be performed before most life insurance companies will agree to insure you. There are always exceptions, though.

Insurers may also request your full health records before insuring you. This is to check for serious conditions such as high cholesterol, diabetes Type 1 or Type 2, or high blood pressure, which would increase your rates.

Some of these medical conditions can be managed or minimized. However, there is a medical history that cannot be overshadowed or diminished. Complicated family medical history (i.e., stroke, cancer) and pre-existing medical conditions of your own often harm life insurance rates.

High-Risk Occupations

What you do for a living may influence how much you are charged for life insurance. Insurance companies won’t pass up the opportunity to charge you more due to you having a high-risk occupation. Even employers of such jobs will be charged more for group life insurance because of the increased risk.

Usually, people think of police officers and firemen first when thinking about dangerous jobs. However, construction and transportation are two industries with extremely high numbers of fatal work injuries. Also, if you dreamed of going out to catch tuna off the coast of Alaska, you might want to think again.

High-Risk Habits

Insurers are fascinated with your everyday life choices. One such choice they are interested in is smoking; smoking causes insurers to increase their rates. If you devalue your life by making unhealthy choices, the insurance companies will charge you more to compensate for the risk.

Smoking is a major behavior evaluated, but it is not the only one. If you are one of the millions of people who have speeding, reckless driving, or DWI/DUI violations on your driving record, an insurance company will see it and charge you accordingly.

To any of my fellow adrenaline junkies, our rates will be higher because of what we like to do for fun. High-risk activities, like skydiving or racing cars, can only increase your rates. However, how much weight each factor holds varies from company to company.

This is why getting the cheapest life insurance quotes is so important when it comes to maximizing your policy and your dollar.

Veteran or Active Military Status

During active military service, there is a low-cost option called the Servicemembers’ Group Life Insurance or SGLI, where you are automatically enrolled under the maximum coverage if you qualify. You may deny or change the coverage, but it is available to all military members.

What happens when you are no longer active duty? Veterans who had an SGLI policy are eligible to switch to Veterans’ Group Life Insurance. A plus side to this that no proof of good health is necessary. There is, however, a maximum of $400,000-worth of coverage. Find affordable life insurance for veterans.

Getting the Best Rate with Mutual of Omaha

Rates not only vary from company to company but also state to state. However, the NAIC puts forth recommendations for states of being somewhat uniform when it comes to laws revolving around insurance.

Now most companies will have its policies set in place, and not much can change that. There is something that affects your rates and can change, though, and that’d be you. Your life expectancy and your lifestyle can either be saving you money or costing you more with regard to life insurance.

So, the most popular and simplistic of tips for getting the best rates are as follows:

- Be Healthy

- Buy Now, Not Later

- Don’t Smoke

- Pay on Time

Mutual of Omaha’s Programs

There are three programs that Mutual of Omaha uses to nurture the employment aspect of the business: a sales trainee program, a mutual actuarial program, and internships.

Resources that are geared toward the consumer are available on Mutual of Omaha’s planning and advice section on its website. There are articles, videos, and calculators used to inform consumers about seven various areas of life and how insurance factors in.

- Be ready for retirement

- Build a stronger business

- Know more about my medicare options

- Live a better, healthier life

- Tackle my finances

- Travel the world

- Understand how life insurance works

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Canceling Your Policy

Life insurance is bought because of the unexpected occurrences in life, but they may also be a reason why one must cancel their life insurance policy. Things change, and there is nothing wrong with that.

How to Cancel (Step-by-Step Guide)

Unfortunately, there have been attempts at the cancellation of a life insurance policy that have failed. So let’s go through how to cancel your policy with Mutual of Omaha properly.

#1 – Get Into Contact with Customer Service or Your Agent

Unfortunately, Mutual of Omaha does not have an easily accessible cancellation form on its website, forcing people to call their agent directly (or at least customer service).

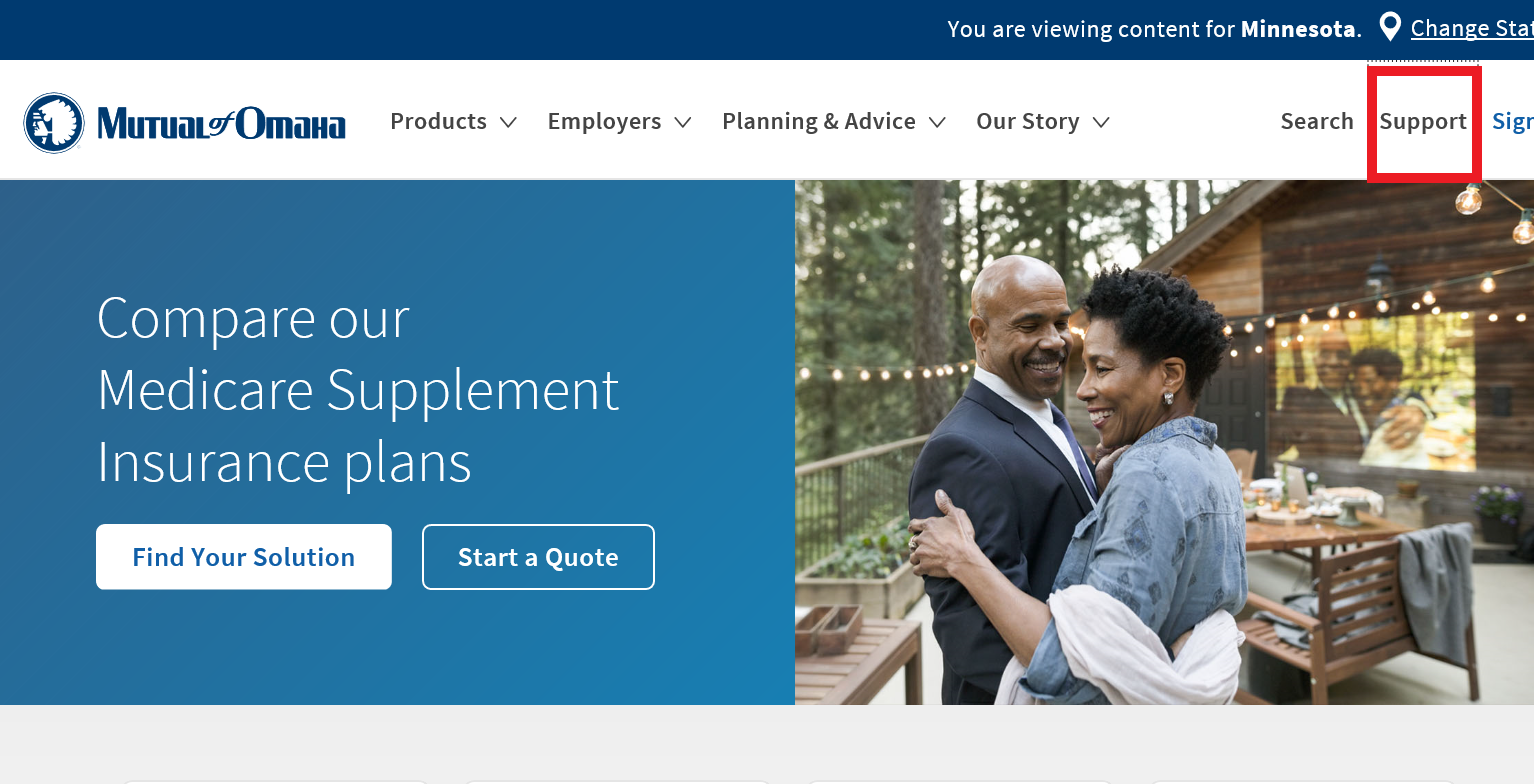

To get the phone numbers for either option, we must click on “Support” in the top right-hand corner of Mutual of Omaha’s homepage.

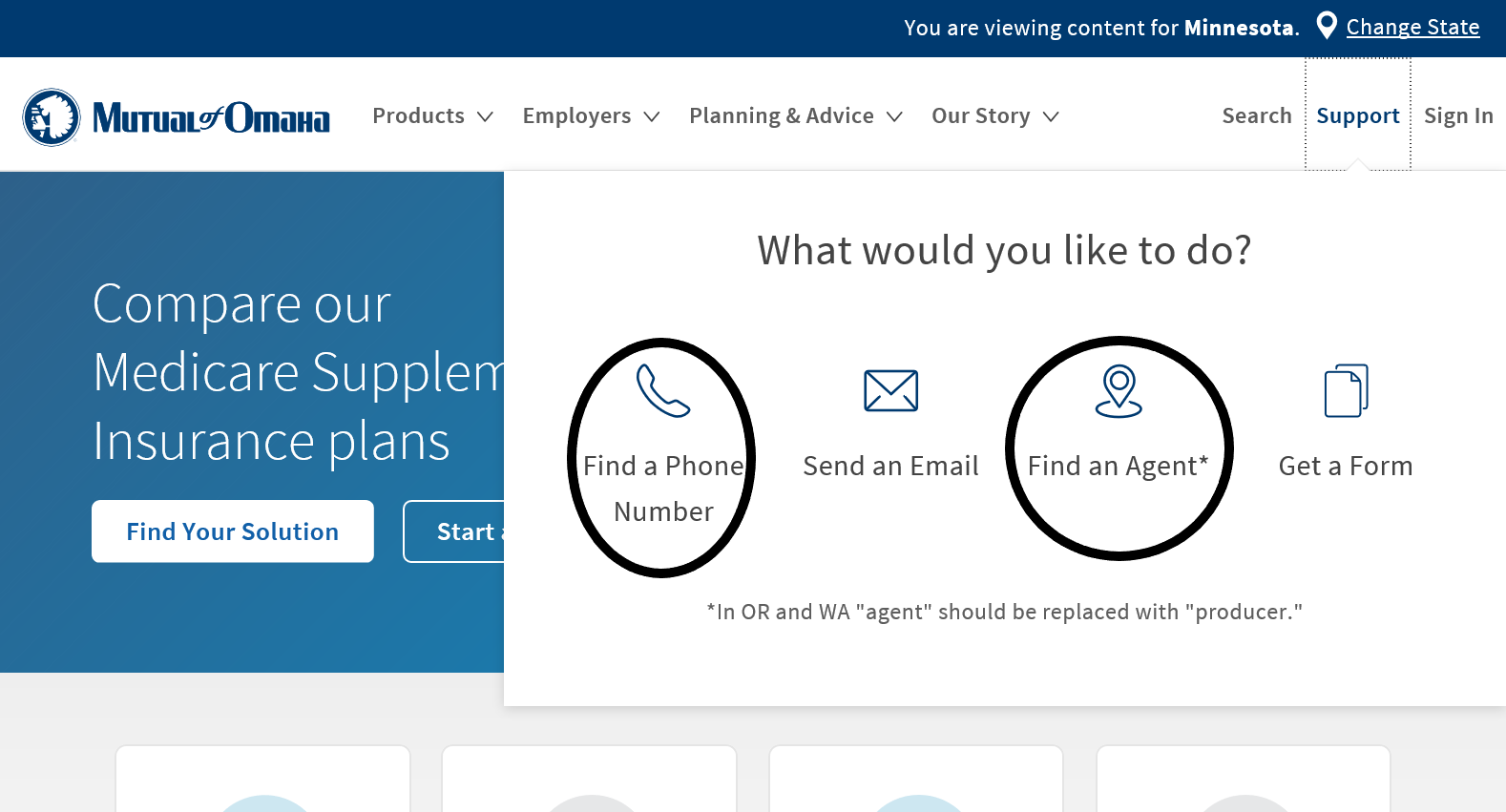

Then a box will pop up with four choices: Find a Phone Number, Send an Email, Find an Agent, and Get a Form. As I mentioned earlier, there is no form online to use to cancel your policy.

Your best bet is going to be finding your agent, where you will enter your zip code to find agents near you. The next best option is to call the customer service number that is given when you go under “Find a Phone Number.” Customer Service: (800)-775-1000.

#2 – Get Everything in Writing

Your agent will be able to tell you specifically what should be sent in to complete the process. Make sure you keep copies for your own records as well. It should be both emailed and mailed to headquarters to ensure that all your bases are covered.

#3 – Stop All Automatic Payments

With today’s technology, auto payments can make life easier, but in this circumstance, it can cause more difficulty. Even though it may seem redundant, not canceling your automatic payments can lead to continued withdraws and delays with refunds.

#4 – Be Aware

Mistakes happen, and there is nothing that can be done about that. However, that is why it is important to stay aware of your bank account and mail to make sure your cancellation stuck.

How to Make a Claim

The days following the death of a loved one are never an easy time. It can be stressful, causing people to be emotional and often forgetful. So here is a video and some tips on how to make a claim and what you will need.

When making a claim, you will need a copy of the policy for the policy number. If you don’t have the policy, you can still get started if you know the deceased’s social security number and other identifying information.

The most important document that must be included when filing a claim is a certified copy of a death certificate. Most companies will also have a specific claim form to be filled out. Mutual of Omaha has one for both medical and life insurance claims.

There is also a number at the top of the form you can call with any questions. If your claim is processed without any issues, you should be mailed your benefit. An agent should contact you if there are missing pieces.

On Mutual’s website, if the policyholder’s account is accessible, you may monitor and make an inquiry about the status of the claim there.

How to Get a Quote Online

Knowing what kind of life insurance best suits you is the hard part. The easy part is getting a quote to see if the pricing with a specific company will suit you, as well. Quotes also come in handy for budgeting out the cost of insurance.

#1 – Visit www.mutualofomaha.com

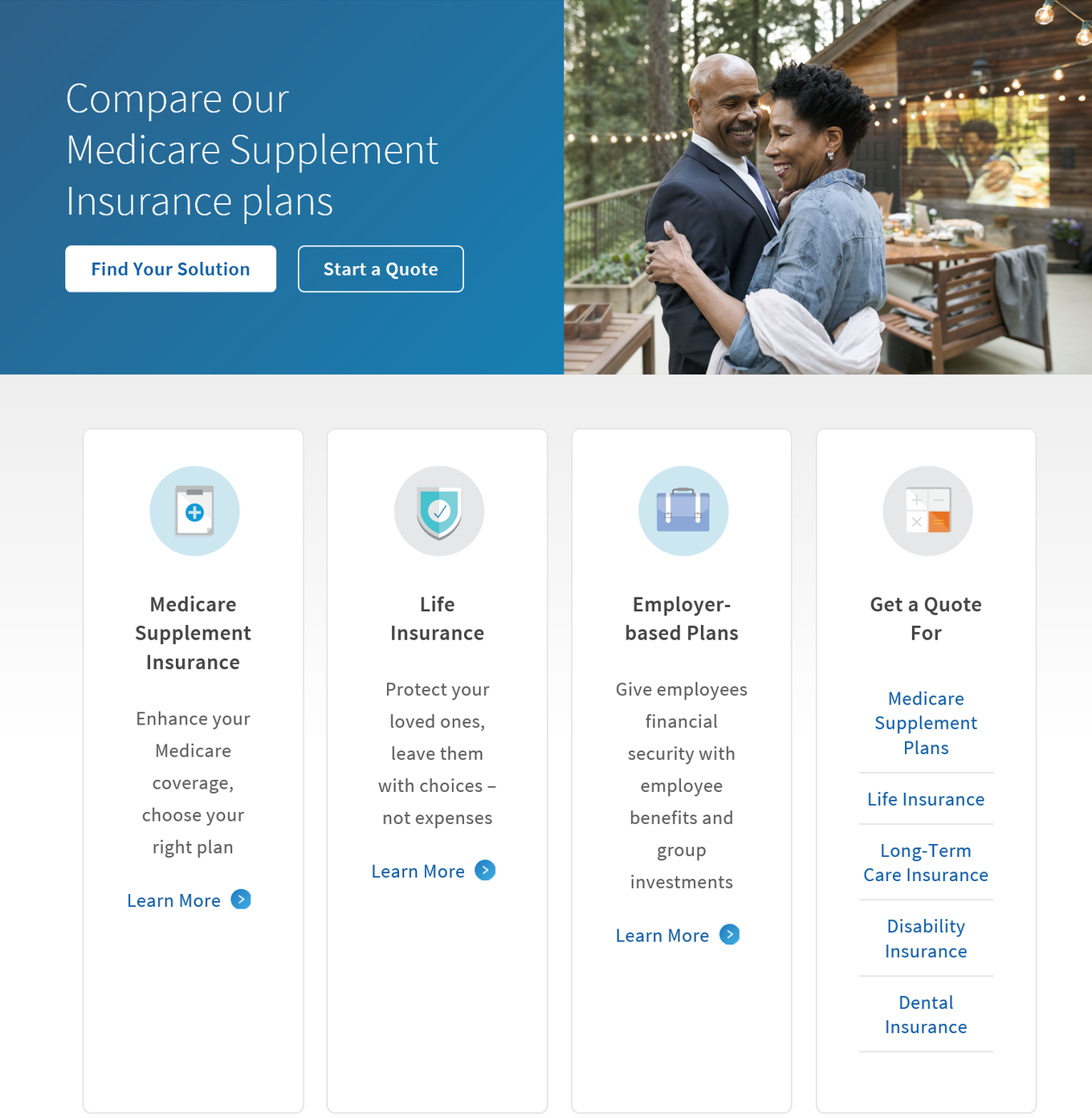

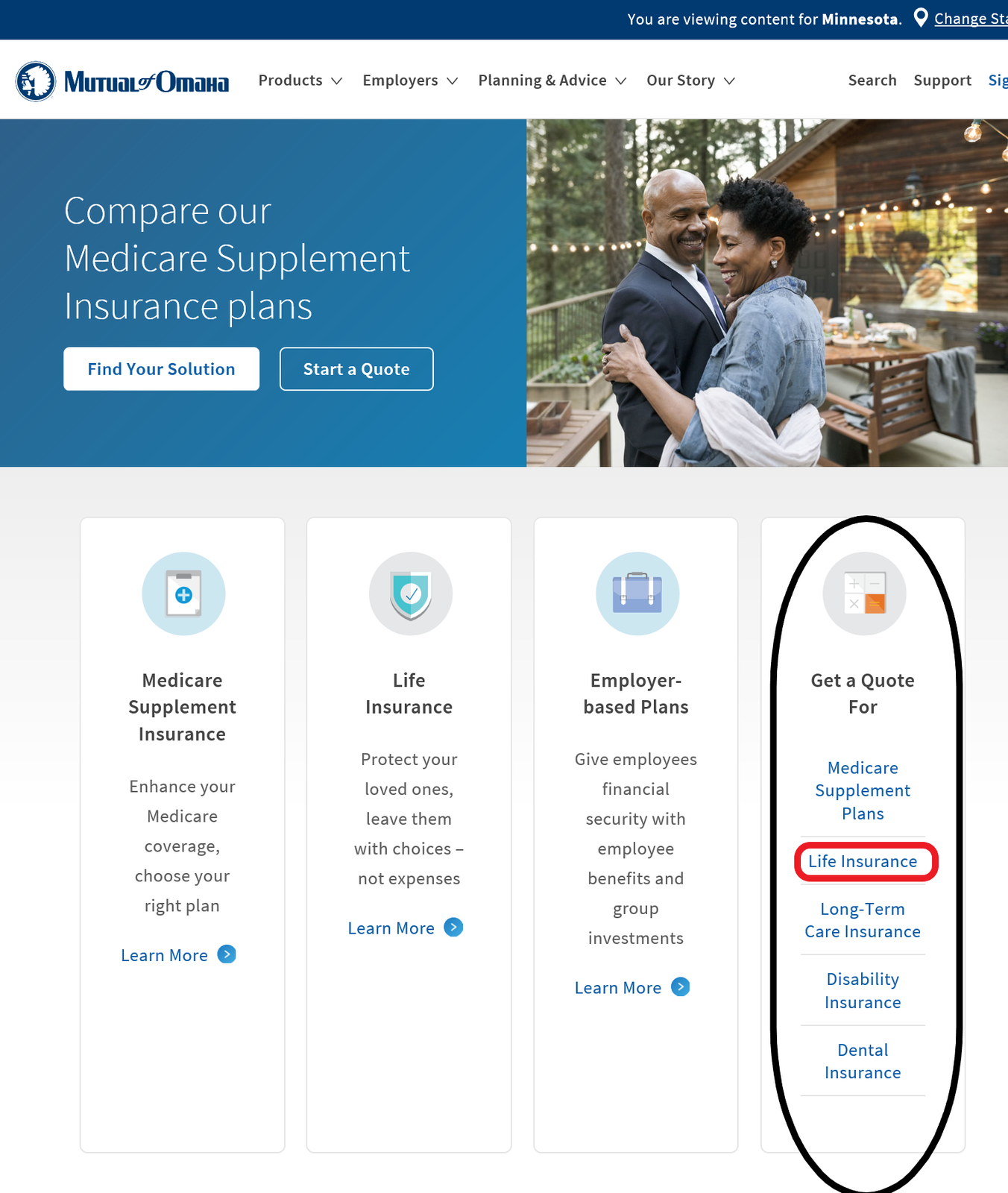

#2 – Click on “Life Insurance” Under the “Get a Quote for” Column

Just scroll down the page slightly, and you will see four columns. The far-right column will say “Get a Quote For.” Underneath that heading, there are five options to choose from. Click on the second option down, “Life Insurance.”

#3 – Choose a Plan

The next page has five boxes, one for each type of plan. The term, whole, and children’s whole life boxes have both a “Get a Quote” button and an “Apply Online” button.

Universal life insurance is not available as an option for getting a quote, but there is a button for contacting an agent. The last box is for accidental death insurance, which has “Apply Online” and “Contact an Agent” buttons.

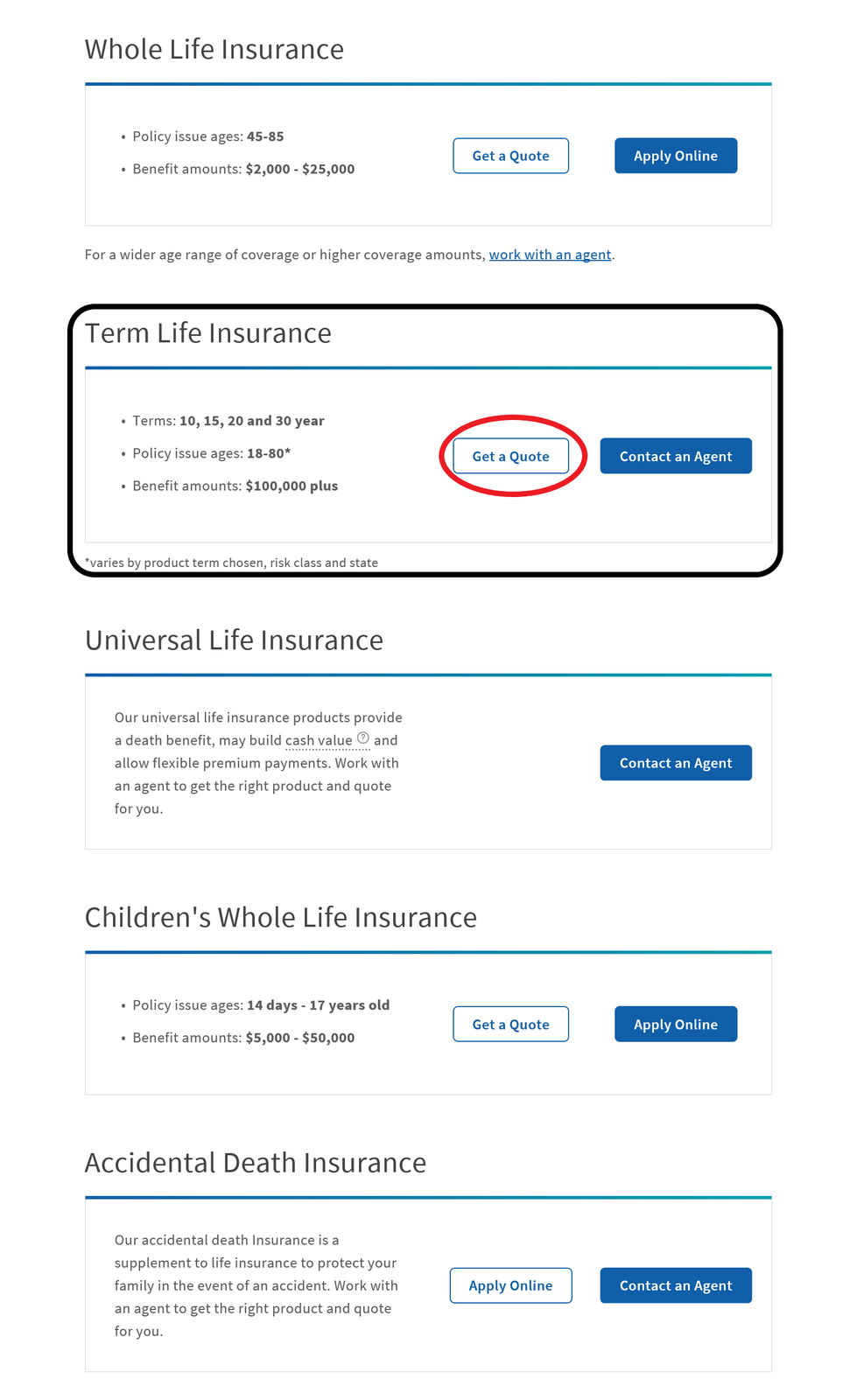

#4 – Click on “Get a Quote”

For this example, on how to get a quote, I choose term life insurance. It is the most common and affordable type. Also, you can always convert to permanent insurance later on.

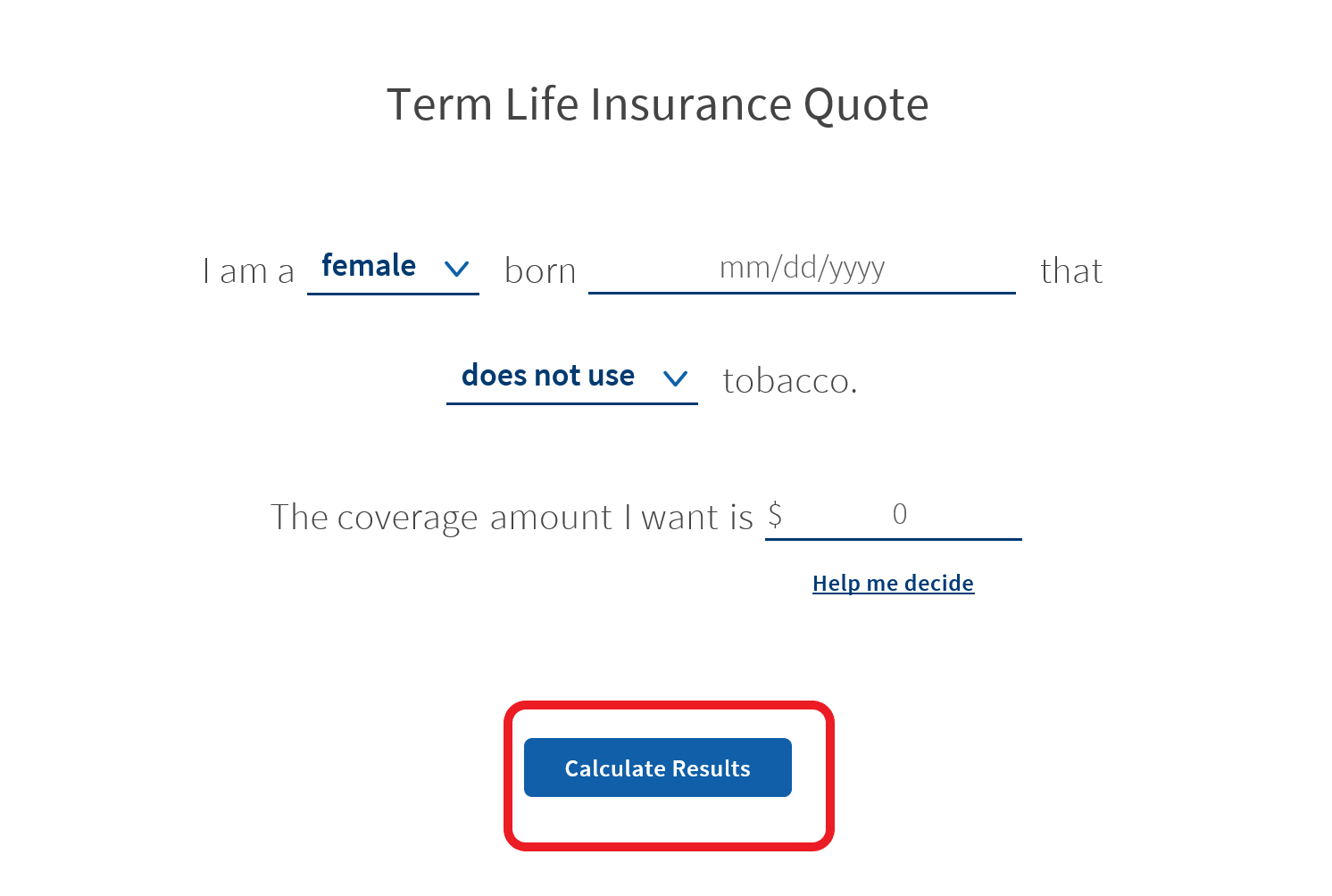

#5 – Fill Out the Form & Click “Calculate Results”

The following page will have a form that asks a few basic questions before your quote can be calculated.

After answering the few short questions, you can calculate how much a month it would cost you to buy a term life insurance policy through Mutual of Omaha.

#6 – Review Your Quote

The information below is based on a 25-year-old female who does not smoke and is seeking $250,000 in coverage.

On the left, you can adjust how long of a term you are looking for. There is also a button to contact an agent right below your quote if you wish to act immediately.

Before jumping at the first quote you get, compare quotes from different companies as well. This will ensure a well-informed decision on your part.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Design of Website/App

Mutual of Omaha does not have an app designed for life insurance policyholders. There are, however, three apps for the company. One is for mortgages, another for banking, and the last one is for insurance agents.

The app for insurance agents is interesting because it is a quote tool app. On Google Play, it has received 4.5 stars.

On Mutual of Omaha’s website, navigation is easy and logical. A policyholder can sign in on the homepage or someone looking for information can easily sift through the broad topics right at the top of the homepage.

There is a lot of information provided via the website, and it is user-friendly, the top two criteria for a good business website.

Pros & Cons

All companies have their strengths and weaknesses. Assessing such pros and cons can help summarize arguments to assist in the decision process. Sometimes it’s difficult for me to make decisions without this strategy.

Pros

- There are four different types of universal life insurance policies

- Term life can be converted into permanent

- The company website is easy to use and informative

Cons

- No cancellation form accessible online

- There is no phone app for life insurance policyholders

- Unfair pay complaints

The Bottom Line

At the end of the day, making a decision on which company to purchase life insurance from can cause some anxiety. Mutual of Omaha provides information and reasonable prices to quiet the anxiety. The company offers many types of life insurance, as well as other types of insurance.

The fact that the company does not have a versatile app for policyholders is a disappointment in this day and age, but the great coverage that is offered makes up for that. Before you push all your chips towards Mutual of Omaha, check out some other companies.

Use our FREE tool below to start comparing quotes today.

Frequently Asked Questions

What are the ratings of Mutual of Omaha?

Mutual of Omaha has received an A+ rating from A.M. Best, an A+ rating from the Better Business Bureau (BBB), an A1 rating from Moody’s, and a AA- rating from Standard & Poor’s (S&P).

How does Mutual of Omaha fare in terms of customer complaints?

Mutual of Omaha had very few complaints last year, with a complaint index of zero. For individual life insurance, there were only 10 complaints, and for group life insurance, there was only one complaint.

How does Mutual of Omaha rank in terms of customer satisfaction?

Mutual of Omaha has earned four out of five power circles, indicating that they are rated above average by consumers in terms of overall satisfaction.

What is the company history of Mutual of Omaha?

Mutual of Omaha was established in 1909 as Mutual Benefit Health & Accident Association. Over the years, it has grown into a multi-line organization that provides insurance, banking, and financial services. The company has a long operating history and has made significant contributions to the insurance industry.

What types of coverage does Mutual of Omaha offer?

Mutual of Omaha offers a variety of coverage options, including life insurance, long-term care insurance, disability income insurance, critical illness insurance, cancer, heart attack, and stroke insurance, Medicare, dental insurance, and financial services. They also offer different types of life insurance policies, such as term life, whole life, children’s whole life, and universal life.

Does Mutual of Omaha require a medical exam?

There are many options offered by Mutual of Omaha that do not require a medical exam. Often when a medical exam is forgone, rates tend to be higher. If your medical exam would have caused even higher rates, it’s not a bad idea.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Laura Kuhl

Managing Content Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. In 2018, she started writing for the cannabis industry. She curated news articles and insider interviews with investors and small business ...

Managing Content Editor

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.