Globe Life Insurance Company Review 2025 (Companies + Rates)

Globe Life provides term and permanent life insurance policies. Customers can find cheap Globe Life life insurance rates with no exam. The company has been rated an A by A.M. Best and an A+ by the Better Business Bureau but has more complaints than most competitors. Learning more about Globe Life life insurance will help you determine if the company is right for you.

Read moreFree Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michael Leotta

Insurance Operations Specialist

Michael earned a degree in Business Management with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Automatio...

Insurance Operations Specialist

UPDATED: Mar 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Mar 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Globe Life Insurance Company Overview

| Key Info | Company Specifics |

|---|---|

| Year Founded | 1951 |

| Current Executives | Gary L.Coleman – Co-Chairman Larry M. Hutchinson – Co-CEO |

| Number of Employees | 3,102 |

| Total Sales / Total Assets | $4,303,800,000 / $23,095,700,000 |

| HQ Address | 3700 South Stonebridge Drive McKinney, TX 75070 |

| Phone Number | 1-972-569-4000 |

| Company Website | www.globelifeinsurance.com/globelifedirect |

| Premiums Written - Individual Life | $2,581,628 |

| Financial Standing | $701,500,000 |

| Best For | Cheap Individual Life Insurance for Families With Children |

Globe Life insurance offers cheap term life insurance, with the company promising $50,000 worth of coverage for only a few dollars a month. This Globe Life insurance company review will look at Globe Life insurance rates, the company’s reputation, and more.

Read more of our Globe Life insurance review to get the details. If you’re ready to compare life insurance company rates, you can use our tool now.

How do you shop for Globe Life Insurance quotes?

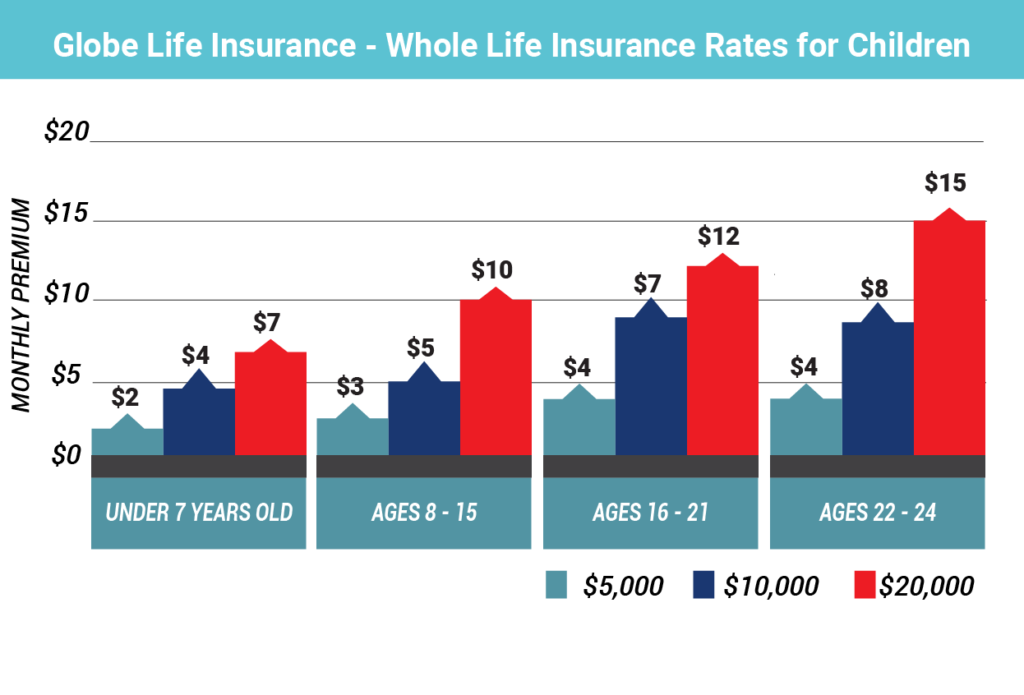

If you’re wondering whether you really need life insurance, the answer is yes. Otherwise, you risk struggling with finances after the death of a spouse, parent, or other loved one, so shopping for life insurance is necessary. Globe Life insurance even offers cheap life insurance for children. Take a look at the Globe life insurance rate chart below.

It’s important to begin to shop for Globe life insurance quotes as soon as possible to lock in the best rates. And since it’s simple to get a quick life insurance quote online, there is no excuse for not starting your search right away.

Globe Life Average Monthly Term Life Insurance Rates by Policy Amount and Gender – Non-Smokers

| Age | $5,000/Male | $5,000/Female | $10,000/Male | $10,000/Female | $20,000/Male | $20,000/Female | $30,000/Male | $30,000/Female | $50,000/Male | $50,000/Female |

|---|---|---|---|---|---|---|---|---|---|---|

| 18–20 | $1.99 | $1.69 | $3.49 | $2.99 | $6.49 | $5.59 | $9.49 | $8.19 | $15.49 | $13.39 |

| 21–25 | $2.49 | $1.99 | $4.49 | $3.99 | $8.49 | $6.49 | $12.49 | $9.49 | $20.49 | $15.99 |

| 26–30 | $2.99 | $2.49 | $5.49 | $4.49 | $10.49 | $8.49 | $15.49 | $12.49 | $25.49 | $20.49 |

| 31–35 | $3.49 | $2.99 | $6.99 | $5.49 | $12.49 | $10.49 | $18.49 | $15.49 | $30.49 | $25.49 |

| 36–40 | $4.49 | $3.49 | $7.99 | $6.49 | $14.99 | $12.49 | $21.99 | $18.49 | $35.99 | $30.49 |

| 41–45 | $5.49 | $4.49 | $9.99 | $7.99 | $18.99 | $14.99 | $27.99 | $21.99 | $45.99 | $35.99 |

| 46–50 | $6.99 | $5.49 | $12.49 | $9.99 | $23.49 | $18.99 | $34.99 | $27.49 | $56.49 | $45.99 |

| 51–55 | $8.99 | $6.99 | $16.49 | $12.49 | $31.49 | $23.49 | $46.49 | $34.49 | $76.49 | $54.49 |

| 56–60 | $11.99 | $8.49 | $21.49 | $15.49 | $40.49 | $29.49 | $59.49 | $43.49 | $97.49 | $71.49 |

| 61–65 | $15.99 | $11.49 | $29.49 | $20.49 | $56.49 | $38.49 | $83.49 | $56.49 | $137.49 | $92.49 |

| 66–70 | $21.99 | $14.49 | $39.99 | $26.99 | $75.99 | $51.99 | $111.99 | $76.99 | $183.99 | $126.99 |

| 71–75 | $29.99 | $19.99 | $55.49 | $36.99 | $106.49 | $70.99 | $157.49 | $104.99 | $259.49 | $172.99 |

| 76–80 | $41.99 | $27.99 | $79.49 | $52.99 | $154.49 | $102.99 | $229.49 | $152.99 | $379.49 | $252.99 |

As you can see, Globe Life insurance offers annual renewable term life insurance. Your rates usually go up when you renew.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are average Globe Life Insurance rates by age?

Typical Globe Life insurance rates by age range from less than $2 a month to almost $400 per month.

Globe Life Insurance Monthly Rates for a $30,000 Policy by Age and Gender

| Age | Male | Female |

|---|---|---|

| 18–20 | $9 | $8 |

| 21–25 | $12 | $9 |

| 26–30 | $15 | $12 |

| 31–35 | $18 | $15 |

| 36–40 | $22 | $18 |

| 41–45 | $28 | $22 |

| 46–50 | $35 | $27 |

| 51–55 | $46 | $34 |

| 56–60 | $59 | $43 |

| 61–65 | $83 | $56 |

| 66–70 | $112 | $77 |

| 71–75 | $157 | $105 |

| 76–80 | $229 | $153 |

Average Globe Life insurance rates by age show that if you purchase $30,000 worth of coverage, you can expect to pay between $10/month and over $200/month.

Life Insurance Monthly Rates for Non-Smokers

| Age & Gender |  |  |  | Average | ||||

|---|---|---|---|---|---|---|---|---|

| 25-Year-Old Female | $158 | $195 | $187 | $132 | $164 | $173 | $143 | $165 |

| 25-Year-Old Male | $152 | $237 | $231 | $147 | $176 | $178 | $164 | $184 |

| 35-Year-Old Female | $164 | $196 | $191 | $137 | $161 | $178 | $166 | $170 |

| 35-Year-Old Male | $160 | $248 | $238 | $151 | $171 | $190 | $175 | $190 |

| 45-Year-Old Female | $262 | $314 | $239 | $209 | $229 | $242 | $238 | $248 |

| 45-Year-Old Male | $245 | $378 | $283 | $230 | $255 | $292 | $239 | $275 |

| 55-Year-Old Female | $414 | $496 | $435 | $373 | $453 | $407 | $341 | $417 |

| 55-Year-Old Male | $696 | $584 | $615 | $451 | $527 | $534 | $396 | $543 |

| 65-Year-Old Female | $924 | $941 | $903 | $763 | $1,139 | $937 | $684 | $899 |

| 65-Year-Old Male | $1,416 | $1,412 | $1,577 | $1,049 | $1,367 | $1,380 | $955 | $1,308 |

In comparison, check out these average rates for the top ten life insurance companies by market share. Some of them don’t offer term life insurance, while others’ rates begin in the hundreds of dollars for younger people and ask older people to spend over $1,000 per month.

What life insurance products does Globe Life have available?

Globe Life offers both term life and whole life insurance policies.

Globe term life insurance policies are generally cheaper than whole life insurance policies but are time-limited, which means you only get coverage for a certain amount of time. For example, if you purchase a 10-year policy, your family will get death benefits if you die during that 10-year period.

Many term life policies offer you the ability to either renew or switch convertible term life insurance to whole life as the term nears expiration, however, so you can always check with your insurer about this possibility.

Conversely, whole life policies offer permanent life insurance coverage, so your family will get benefits regardless of how long it’s been since you purchased the policy. In addition, whole life insurance policies build in cash value, while term life insurance policies don’t.

Does Globe Life offer term life insurance?

Globe Life advertises that its term life insurance rates start at $3.49/month for adults. However, it’s important to remember that not everybody will get the same rate. Your rate depends on several factors, such as your age, health, occupation, habits, and military status.

In addition, if your term life insurance expires, you have the option of renewing it. However, your rates will generally be higher when you renew because you’re 10 or more years older than you were when you purchased it.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Can you get whole life insurance from Globe Life?

Globe Life only offers whole life insurance for kids. If a life insurance company offers insurance for children, as Globe Life does, you may want to take advantage of it because it offers financial benefits that can help your child get off to a good start when they reach adulthood.

Since the policy grows in cash value over time, your child could start their adult life with a sizable nest egg if you purchase whole life insurance for them when they are an infant. Can you cash out a Globe Life insurance policy for children? You can while they are still minors, and they can cash out their Globe Life insurance policy themselves once they reach the age of majority.

Does the company offer burial & final expense insurance?

Although Globe Life doesn’t offer Globe Life burial insurance specifically to cover burial costs, your family can use benefits from any life insurance coverage to pay for your burial.

Does Globe Life life insurance offer riders?

Most life insurance companies offer options to customers that they can add to a policy. These options are called riders and allow customers to customize their coverage. The riders offered by Globe Life include:

- Children’s term to 25

- Terminal illness accelerated benefit

- Waiver of premium

Globe Life offers fewer riders than most competitors. As a result, many customers will only have the coverage provided by the standard policy.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How do you get a quote online with Globe Life?

Many people don’t know how to get life insurance quotes online. Fortunately, Globe Life makes it easy to get quotes from them. Simply visit Globe Life’s website and fill out the form at the top of the page. This form allows you to click on one or more of three options: term life for adults, whole life for children, or adults and children.

Simply click on the types of insurance you’re interested in. The white circles will turn to green checkmarks once you click them. Once you’ve done that, fill out the rest of the form. You’ll need your full name, your current address, and your e-mail address. You’ll also need to choose the age ranges you’re interested in. Click on the small checkboxes next to each age range.

Hit the submit button at the bottom of the form when you’ve filled it out. Globe Life will analyze your information and send you a quote and application forms via mail. If you prefer, you can also call Globe Life at 1-844-593-8369 and get a quote over the phone.

How can you buy Globe Life life insurance?

Customers can shop for and buy coverage online, over the phone, or by mail. To purchase a policy by phone, you can speak with a representative by calling the Global Life Insurance phone number at 1-877-577-3860. Representatives are available Monday to Friday from 7:30 p.m. to 6:00 p.m. (CT).

In some cases, customers can buy Globe Life Insurance policies online. However, customers can only purchase some plans by calling the company. Speaking with a representative will help you determine if you can buy your desired policy online.

How do you cancel your Globe Life policy?

Some people cancel their life insurance policies by failing to pay premiums, but this isn’t the best way to go about it. If you simply stop paying premiums, Globe Life could report your failure to pay to credit reporting agencies. It’s better to ask your insurance agent, “How can I cancel my Globe Life insurance policy?” than to simply stop paying.

Unfortunately, Globe Life does not offer a way to cancel life insurance policies online. You’ll need to call the company at 1-844-593-8369 to request cancellation. Once you get through to a representative on the phone, explain the situation and request cancellation. The representative will send you cancellation forms in the mail; just fill them out and send them back to complete your cancellation.

Your cancellation should go into effect starting with the month after you submit the forms. Double-check your bank statements for the next few months to make sure you are not still being charged premium payments. If Globe Life continues to charge you after cancellation, call them to resolve the situation.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How do you make a claim with Globe Life?

You probably won’t feel like it right after losing your loved one, but the best way to make a life insurance claim is to file it right away.

How long does it take Globe Life to pay a claim? It depends, but in most cases you will get your benefits within 30 days of filing.

Start by getting copies of the death certificate from your state’s Department of Vital Records. The Centers for Disease Prevention and Control has the contact info for each state’s department on its website, so you can check this site if you need to find out who to get in touch with. Once you have the death certificate, get the claimant statement online on Globe Life’s website or call Globe Life and request it be mailed to you.

If the life insurance policy is less than two years old, which is the Globe Life life insurance contestability period, you’ll need to fill out the claim form in its entirety, including information about which doctors your loved one saw over the last five years and a statement from their most recent physician. Otherwise, you only need to fill out sections A and D. You’ll also need to attach a copy of the death certificate and any obituaries that appeared in local papers. If the death was an accident or murder, you’ll also need copies of police reports, autopsy reports, and toxicology reports.

All documentation needs to be mailed to Globe Life at:

Globe Life & Accident

Insurance Services Division

PO Box 8076

McKinney, TX 75070

If your claim is more than two years old and your benefits are less than $10,000, you can also email the paperwork to [email protected] or fax it to 1-405-270-1496, Call Globe Life two or three days after mailing your forms to ensure they were received.

If you’re wondering how long it takes Globe Life to pay a claim, there’s good news: In most cases, you’ll get benefits within a few weeks of filing your claim. Be sure to answer the phone if they call so that you can answer any questions they have about your claim.

How are Globe Life’s ratings?

Globe Life & Accident Insurance Company has an A+ (Superior) A.M. Best Financial Strength Rating from A.M. Best, which is the highest credit rating possible. Globe Life has also received an A+ rating from the Better Business Bureau (BBB), which means there are few to no unresolved consumer complaints. However, its BBB listing currently includes three one-star customer reviews. In the company’s defense, Globe Life has responded on the BBB site to all three of these complaints to try to get them resolved.

Standard & Poor’s is a business credit rating company that rates businesses on their financial stability and ability to pay back loans. This company has given Globe Life financial strength rating of AA- This means that Globe Life has some minor credit issues but is considered extremely likely to pay back its debts. This is good news for policyholders. Companies that can pay their debts are unlikely to go bankrupt, which means that they will likely still be in business when your family needs to make a claim even if it is years from now.

What do reviews say about Globe Life’s customer experience?

No matter how good a company’s life insurance policies sound on paper, you’ll want to read the best customer experience reviews and worst customer experience reviews to get a sense of what the best and worst life insurance companies are. Globe Life has received a score of 2.75 on the NAIC Complaint Index, which means that it has far more complaints than the average life insurance company. In 2019, it received 70 complaints about its products and services, though NAIC does not provide specifics.

In 2019, there was a Globe Life insurance lawsuit settlement in which the company was ordered to pay $7.3 million in restitution for improperly denying claims.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What is Globe Life’s market share?

Globe Life holds a very small part of the life insurance market share. It isn’t listed in the National Association of Insurance Commissioners’ Top 125 Life Insurance Companies for 2018.

Liberty Mutual, which ranks 125th, holds just .03% of the market, so Globe Life must hold less than that.

Top 10 Life Insurance Companies and Globe Life by Market Share

| Rank | Companies | Market Share |

|---|---|---|

| 1 | Northwestern Mutual | 6.42% |

| 2 | Metropolitan | 6.00% |

| 3 | New York Life | 5.68% |

| 4 | Prudential | 5.57% |

| 5 | Lincoln | 5.36% |

| 6 | Massachusetts Mutual | 4.19% |

| 7 | Aegon US | 2.94% |

| 8 | John Hancock | 2.83% |

| 9 | State Farm | 2.83% |

| 10 | Minnesota Mutual | 2.70% |

| N/A | Globe Life | <.03% |

In contrast, Northwestern Mutual, which is the number-one ranked life insurance company by market share, dominates the market with a whopping 6.42% share.

Are you wondering what is the most reliable life insurance company? The NAIC rankings help consumers figure this out by listing the 125 most financially stable companies each year. However, Globe Life’s failure to rank doesn’t mean it’s a poor risk. After all, it underwrote more than $2 million worth of premiums in 2019 and is considered financially stable. Learn more about the life insurance underwriting process here.

Here is a list of Globe Life’s subsidiaries.

- American Life Insurance Company

- National Life Insurance Company

- Liberty National Life Insurance Company

- United American Life Insurance Company

- Globe Life insurance Company of New York

- Family Heritage Life Insurance Company

Where does Globe Life operate?

Globe Life operates in every state except for New York. Its subsidiary, National Life Insurance Company, operates in that state. In 2019, Torchmark Company announced it would begin doing business under the Globe Life insurance Inc name, effectively merging with Globe Life Insurance Omaha.

Globe Life Insurance Premiums Written

| Year | Premiums Written |

|---|---|

| 2017 | $2,373,099 |

| 2018 | $2,464,728 |

| 2019 | $2,581,628 |

Globe Life reported a financial gain of $701.5 million in 2019. This large financial gain suggests the company is on the upswing and will continue to remain in business for years to come.

Globe Life Insurance vs Life Insurance Industry Net Income Growth and Loss

| Year | Globe Life | Industry |

|---|---|---|

| 2017 | 0% | 7.0% |

| 2018 | 23.2% | -18.6% |

Globe Life made significant gains not only in 2019 but also in 2018 when the life industry as a whole was losing money. As of May 2020, Globe Life’s stock performance has been mostly steady over the past 12 months but is dipping slightly. Globe Life’s position for the future may be slightly worse than it is now. Its stock is currently falling, though it has remained fairly steady, over the past 52 weeks and its current price is still a bit higher than it was on its worst day.

In addition, Globe Life’s premiums have increased from year to year, which means the company is taking in more money each year. This is a strong indicator of long-term financial stability which should help policyholders trust that Globe Life will still be around when they need to file claims.

What is Globe Life’s history?

Globe Life Insurance Company has been providing inexpensive life insurance policies to rural Oklahoma communities since 1951 and in 1964, expanded its services to 36 other states. Its longevity is a strong sign of reputation.

Globe Life’s company headquarters is in McKinney, Texas. The company is a large contributor to Texas culture, having purchased the naming rights to the Texas Rangers Ballpark in 2014.

How is Globe Life’s online presence?

For most insurance companies, using social media is of primary importance. Globe Life does have a Facebook page, where it posts videos, graphics, and information to help consumers understand their life insurance options and offer help meeting their needs during difficult times such as the COVID-19 pandemic.

Globe Life also posts promotional videos on its Twitter account and has an Instagram account where it posts informational photos as well as testimonials. None of these social media accounts are listed on Globe LIfe’s website.

This suggests that Globe Life hasn’t fully grasped the importance of having a life insurance company social media campaign to attract new customers, particularly younger ones.

The Globe Life website allows policyholders to log in in order to make payments and review policy documents. This service can be accessed with your Globe Life login directly from the main website.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Does Globe Life run commercials?

Globe Life does advertise on television and has offered a range of commercials over the years.

Recently, Globe Life has produced life insurance TV commercials explaining why people choose this company to meet their life insurance needs. Current commercials emphasize consumers’ hopes for the future and how Globe Life insurance helps protect those hopes.

How is Globe Life active in the community?

People often prefer to work with companies that do good for the community, especially in difficult times. Through its Family Heritage subsidiary, Globe Life supports several charities, such as

- Harvest For Hunger

- Toys for Tots

- Girl Scouts

- Boy Scouts of America

Employees are encouraged to donate time and money to these and other charitable organizations of their choosing. Another way that Globe Life has become one of many businesses that give back to the community is via its involvement with Special Olympics in Dallas, near the company’s headquarters.

The company has sponsored the FC Dallas Special Olympics team every year since 2014. The company’s support allows people with physical and mental disabilities to participate in a special sporting event that can help boost their self-esteem.

Who are Globe Life’s employees?

Globe Life is a mid-size company that employs about 3,100 people, and almost half of them would recommend the company to a friend, according to Glassdoor. Its average rating on that site is three stars out of five, and the majority of employees state that Globe Life offers a good work-life balance, opportunities for advancement, and some benefits.

Globe Life offers a 401(k) plan, a health care plan, and reimbursement of gym membership fees. They also are eligible for a pension plan after five years of employment.

Globe Life has also won several awards throughout its lifetime:

- Stevie Award: Best Customer Service Department Gold Winner (2014, 2016)

- NEO Success Award Winner (2012–2015)

- 100 Centurion Winner Weatherhead (2002–2006; 2009–2011; 2014)

Globe Life is committed to diversity and hires people from all walks of life to assist in its goal of providing cheap and effective life insurance to customers.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Does Globe Life have any additional programs?

Globe Life offers a few articles about different types of life insurance on its site. For example, you can read about Globe life insurance rates for seniors.

Globe Life doesn’t offer insurance calculators or other online tools for consumers. However, you can sign up for the Globe Life insurance Eservice Center online, which allows you to ask questions about your policy and make payments.

Is the website easy to use?

Globe Life offers a basic website that has a quote form, information about its policy options, and some information about the company. There are few extras on the site it’s designed only for sales.

There is a Globe Life insurance app. However, your Globe Life insurance policy login on this app only allows you to make payments, not to file claims

You’ll want information about the pros and cons of any life insurance company you’re considering. Here are some of the pros and cons of purchasing life insurance policies with Globe Life.

What are the pros of Globe Life Insurance?

You’ll want information about the pros and cons of any life insurance company you’re considering. Here are some of the pros and cons of purchasing life insurance policies with Globe Life.

There are a few advantages to using Globe Life.

- It’s cheaper than most life insurance companies.

- You can purchase life insurance for children.

- You don’t have to have a medical exam.

Make sure to consider these advantages when making your decision.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the cons of Globe Life Insurance?

Consider the following drawbacks to using Globe Life.

- Globe Life whole life insurance isn’t available for adults. You’ll have to purchase term life insurance, which is time-limited.

- Rates go up as you age. Whenever you renew a term life insurance policy, you’ll pay more because you’re older.

- You can’t do much online. The website is basic, there’s no mobile app, and you have to call the company to make a claim or make changes to your policy.

These drawbacks might make it more difficult for you to get the coverage you need using Globe Life.

Globe Life: What is the bottom line?

Globe Life lives up to its promise of offering cheap life insurance, with some caveats. It offers term life insurance for adults and whole life insurance for children at rock-bottom prices, though your rates will go up every 10 years or so.

If you don’t mind dealing with your insurance company over the phone rather than online or the hassle of renewing every few years, this company may meet your needs.

Is there anything you’d like to know about Globe Life that we haven’t covered? Check out the FAQ below or leave us a comment. Hopefully, this Globe Life insurance review provided everything you need to know. Ready to compare life insurance rates?

Frequently Asked Questions

Does Globe Life offer term life insurance?

Yes, Globe Life offers term life insurance. Their term life insurance rates start at $3.49 per month for adults. However, actual rates may vary based on factors such as age, health, occupation, habits, and military status.

Can you get whole life insurance from Globe Life?

Globe Life offers whole life insurance specifically for children. Whole life insurance provides permanent coverage and builds cash value over time. It can be a beneficial investment for a child’s future.

How do you make a claim with Globe Life?

To make a claim with Globe Life, you need to contact their claims department directly. You can find the contact information on their website or in your policy documents. They will guide you through the claims process and provide the necessary forms and documentation.

What life insurance riders can you get?

Globe Life Insurance does not offer any riders, including accidental death insurance. However, they do offer cancer insurance in addition to life insurance, providing cash benefits if you are diagnosed with cancer.

Can I purchase Globe Life insurance if I am a smoker?

Yes, Globe Life offers coverage to both smokers and non-smokers. However, keep in mind that smokers may generally have higher premiums due to the increased health risks associated with smoking.

Can I customize my Globe Life insurance policy to fit my specific needs?

Globe Life insurance policies are typically standard and may not offer extensive customization options. However, you can choose the coverage amount based on your needs and select between term life and whole life insurance options.

My children are healthy. Why should I purchase insurance for them through Globe Life?

The major reason to purchase life insurance for children is that it helps secure their financial future. Children’s life insurance policies grow in value over time so that they have substantial assets by the time they reach adulthood. Also, their adult rates may be cheaper if they’ve had a policy since childhood.

Does Globe Life really offer insurance for just $1/month?

One of Globe Life’s promotional offerings involves allowing you to pay just $1 for your first month of insurance. Afterwards, your rate may go up. However, Globe Life offers some of the cheapest insurance around and you may pay only a few dollars each month, depending on other factors.

Can I get Globe Life insurance even if I have serious health problems?

Only your Globe Life representative can answer for sure. Globe Life doesn’t require a medical exam, but underwriters will look at your health history when determining your rate and whether you qualify.

Is Globe life insurance legit?

Globe Life Insurance is a legitimate life insurance company with an A+ (Superior) rating from A.M. Best. However, it has a disproportionate number of consumer complaints. Its 2016 NAIC Complaint Index, which measures the number of complaints a company receives against its size, was 5.10.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michael Leotta

Insurance Operations Specialist

Michael earned a degree in Business Management with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Automatio...

Insurance Operations Specialist

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.