Gerber Life Insurance Review (Companies + Rates)

A 20-year-old female, non-smoker can get a 20-year Gerber Life term policy with $100,000 of coverage for just $15 per month. Our Gerber Life insurance review suggests that the company offers term life and permanent life insurance. Gerber Life insurance rating from A.M. Best is an A.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Aaron Englard

Insurance Premium Auditor

With over a decade of experience in insurance premium auditing, audit department management, and business audit representation, Aaron has developed a deep understanding of audit regulations, compliance requirements, and industry best practices. As the Founder & CEO of AdvoQates, he specializes in representing businesses during their audits to ensure accurate, transparent, and fair assessments ...

Insurance Premium Auditor

UPDATED: Jun 9, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Jun 9, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Key Info | Company Specifics |

|---|---|

| Year Founded | 1967 |

| Current Executive | CEO - Keith O'Reilly |

| Number of Employees | 537 |

| Total Sales / Total Assets | $4,700,000,000 / $51,800,000,000 |

| HQ Address | 1311 Mamaroneck Ave., Suite 350, White Plains, NY 10605 |

| Phone Number | 1-800-704-2180 |

| Company Website | www.gerberlife.com |

| Premiums Written - Individual Life | $471,600,000 |

| Financial Standing | $721,247,000 or +16.19% from Previous Year |

| Best For | Guaranteed Issue Life Insurance |

Searching for life insurance for yourself can be daunting and overwhelming. While feeling confused and scrolling through life insurance websites, you come across child life insurance.

Do you need to buy life insurance for your child?

Gerber Life is one of the few companies that mainly advertise child life insurance. This Gerber Life insurance review provides a deeper look into the company and its types of life insurance policies.

By the end, you’ll be able to decide whether you should buy child life insurance or even your own policy.

Before jumping into the arms of Gerber Life, you should always shop around for the best deal. Start by using our FREE tool to compare quotes now!

Gerber Life’s Ratings

The most common and fastest way to compare companies and gauge how well they do is by using rating systems. Below is a table of Gerber Life’s ratings from some of the most recognized rating agencies.

| Ratings Agency | Gerber Life's Ratings |

|---|---|

| A.M. Best | A (Excellent) |

| Better Business Bureau (BBB) | A+ (Highest) |

| NAIC Complaint Index | 1.19 |

| Consumer Affairs | 3 out of 5 stars / 41 reviews |

Now, what do these ratings even mean? Let’s take a look at each rating agency individually.

A.M. Best

A.M. Best’s credit ratings are forward-looking, independent, and objective opinions regarding an insurer’s, issuer’s, or financial obligation’s relative creditworthiness. In short, it gives you a professional risk assessment of any rated company.

A.M. Best’s financial strength ratings focus on how well the company can hold up its end of the bargain. Gerber received an A rating, meaning that the company has an excellent disposition to handle its financial obligations.

Better Business Bureau (BBB)

Better Business Bureau ratings don’t focus on money but on the interactions between businesses and consumers. Customer reviews do not apply. BBB gathers data from public sources and the enterprises themselves.

There are seven rating elements the BBB evaluated before giving Gerber an A+. The A+ means that it has been operating a long time with minimal complaints and few unresolved complaints.

NAIC Complaint Index

The purpose of the National Association of Insurance Commissioners (NAIC) Complaint Index is to compare the performances of different companies. To determine a company’s index, you must divide the number of complaints by the number of premiums written.

Gerber has an index of 1.19, which is slightly higher than the national average of 1.00. Anything above means more complaints than average, and anything below means fewer.

Consumer Affairs

Of all the rating agencies, Consumer Affairs bases its grade strictly on the ratings and opinions of actual consumers. Out of 41 reviews, Gerber averages three out of five stars.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Company History

Gerber is an interesting company with roots in food production and distribution. The company’s mission has always revolved around newborns and infants but has grown to include all children and now offers products for adults, as well.

In 2007, Nestle acquired the Gerber Products Company. Then in 2018, Gerber Life Insurance Company was sold to Western and Southern Financial Group. The Gerber trademark will stay for the foreseeable future.

Gerber Life’s Market Share

Since the Gerber Life Insurance Company is a small subsidiary of a large financial group and was previously a part of a giant food conglomerate, individual financial information about the company is scarce. Instead, we’ll look at the financial standings of the parent companies.

| Top Life Insurance Companies | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| Northwestern Mutual Life Insurance Co. | 8.10% | 8.30% | 8.10% | 8.20% | 8.20% |

| Lincoln National Corporation | 4.80% | 4.90% | 5.00% | 5.30% | 5.80% |

| New York Life Insurance Group | 5.50% | 5.80% | 5.60% | 5.80% | 5.70% |

| Massachusetts Mutual Life Insurance Company | 3.70% | 3.90% | 4.20% | 4.50% | 4.80% |

| Prudential Financial, Inc. | 3.70% | 4.20% | 4.30% | 4.50% | 4.50% |

| John Hancock Life Insurance Company | 3.20% | 3.08% | 3.70% | 3.60% | 3.60% |

| State Farm Mutual Automobile Insurance | 3.40% | 3.50% | 3.50% | 3.50% | 3.60% |

| Transamerica (Aegon) | 3.50% | 3.40% | 3.50% | 3.50% | 3.60% |

| Pacific Life | 2.03% | 1.95% | 1.94% | 2.29% | 2.90% |

| Western & Southern Financial Group (2018); Nestle (2014-2017) | 0.23% | 0.24% | 0.27% | 0.27% | 0.95% |

Within the first quarter of 2019, Western and Southern Financial increased to 1.22 percent of the market share. One can reasonably assume that such an increase would be accredited to Western and Southern buying Gerber Life late in 2018.

There are some Gerber Life specific statistics out there; according to S&P Global, over the past 20 years, the company’s total individual direct premiums have risen an average of 7.6 percent annually, and never has it risen less than 1.1 percent.

Gerber Life’s Position for the Future

Year-over-year, Gerber sees overall growth, with much of it being attributed to an influx of guaranteed life policies. With all the baby boomers reaching retirement, guaranteed life is sure to grow even more over the next couple of years.

Obviously, the baby boomer generation is not the only area subject to growth in the future. Gerber Life has already established a presence on social media, which is where many people get their news and see the most ads.

Due to the Gerber Life company being acquired by Western and Southern, a makeover of the company’s marketing strategy may be addressed to help it keep up with other big-name life insurance companies.

The internet provides a vast array of options where it is easy for a company to get lost.

On the flip side, social media can be used against you when applying for life insurance; Gerber may use this to its advantage in the future. With most of Gerber’s policies not requiring a medical exam and with social media sometimes depicting a different person from reality, more people may turn to Gerber Life in the future.

Gerber Life’s Online Presence

The 21st century so far has been dominated by the rise of social media and advancements of fingertip technology. Gerber has a profile on each of the major social media platforms, just like most companies.

Social media tends to be just a big popularity contest. We use followers, subscribers, and how active a company is online to judge its possible success in the era of technology.

Gerber’s Facebook profile has earned a rating of 4.6 out of five, based on the opinions of 29,569 people. That, however, seems irrelevant when we look at the 1,154,124 likes the company also received. Almost the same amount of people follow the company.

The profile posts a couple of times a week, reflecting a well-maintained social media persona. This checks out when we take a look at Gerber’s Twitter account, which posts about twice a week as well for its 26,300 followers.

Over on Instagram, Gerber has 12,100 followers, and about 9,600 people view the Gerber Pinterest profile monthly. Another 1,317 people follow the company on LinkedIn, which also has 311 registered employees.

Also, on YouTube, there are 1,940 subscribers to the Gerber channel, where about 80 videos have been posted over the last decade or so. Even though some of the followers may be the same people on different platforms, that still is a pretty massive following.

Of course, there is also the company website, which will be discussed in more detail later on, but the website is fairly easy to use and full of understandable information.

Gerber Life’s Commercials

Gerber has been around for a long time, which means they’ve released many commercials. Below is one from 1988. Some of the information isn’t up to date, so keep that in mind. Let’s just watch how the commercial is set up and see who it targets.

As expected, Gerber Life is aimed at parents and grandparents with young children. The commercial is jam-packed full of information; it’s not flashy or paired with a jingle like most other insurance companies’ commercials.

This next commercial shows a very similar informational pitch that also starts out with the tagline “Is your child protected for the future? Gerber, the baby people you have known since you were a baby.”

The above commercial is from 2005, and as we can see in the second commercial, the live baby and the living room create a warmer and more inviting commercial with the same type of information that’s in the commercial almost 20 years earlier.

Gerber Life in the Community

The Gerber Foundation was founded in 1952, 15 years before Gerber Life was established. The foundation aims to enhance the life of infants and young children via grants and scholarships for pediatric research.

A company so dedicated to children has partnered with Reading is Fundamental (RIF), which is a nonprofit striving for a literate America.

Gerber Life’s Employees

Gerber Life is a much smaller company than the big corporation whose logo it utilizes. That being said, there are 54 reviews from current or former employees across three job information sites – Glassdoor, Payscale, and Indeed.

The average overall rating for Gerber is three out of five stars. These ratings are based on current or former employees opinions regarding the following categories:

- Work/life balance

- Management

- Compensation and benefits

- Culture and value

- Career opportunities

The compensation and work/life balance categories were, on average, rated higher than the rest, especially management. Within the written reviews, management and being stressful are the two most common negatives.

According to Payscale, the company is composed of 75 percent female employees and 25 percent male. The average salary is $52,000 a year, with an average bonus of $3,000. Positive reviews often mention good benefits like paid time off, 401(k), employee discounts, and health and life insurance.

Shopping for Life Insurance

No one is ever prepared for a loved one to leave them. The time after a loved one’s death can be overwhelming and confusing. You must make sure your death doesn’t bring a financial burden to add on.

According to the 2018 Insurance Barometer Study by LIMRA and LifeHappens, 35 percent of households would feel the financial impact of the loss of the primary wage earner within one month. Within the same study, 61 percent said they don’t buy life insurance or more of it because they have other financial obligations.

Life insurance is actually more affordable than most people think; 44 percent of millennials overestimated the cost of life insurance by five times. Let’s check out Gerber’s average rates for term life insurance.

Average Gerber Life Male vs Female Life Insurance Rates

Gerber advertises that you can have a policy for your child for only pennies a day. Also, with the ability to lock in rates when you open the policy, it helps to see how much more you may be paying if you decide to buy later on.

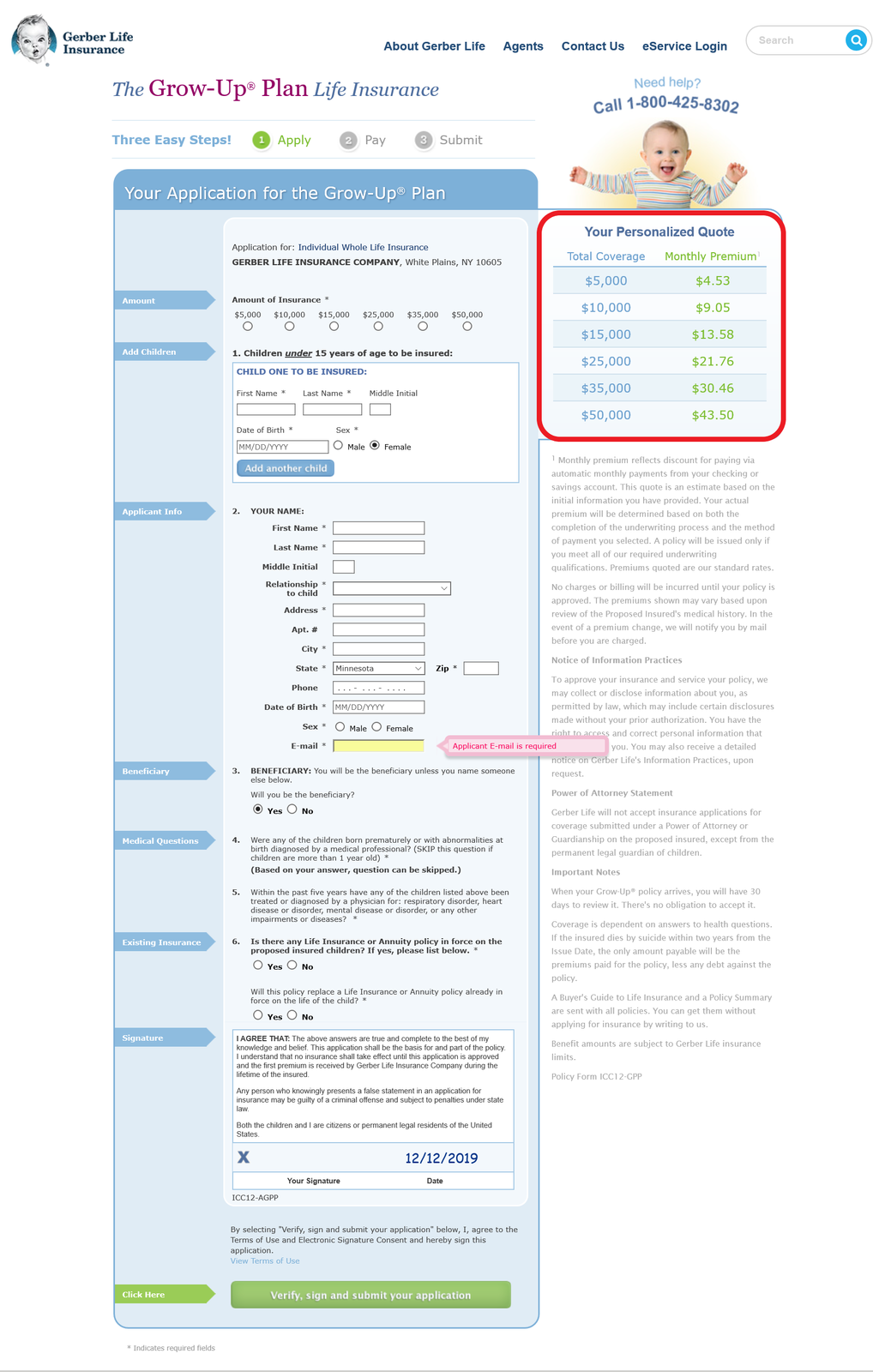

Since Gerber offers policies from 14 days all the way through the final years, let’s take a look at some sample rates for the policies that are determined by age group. The Grow-Up® plan seems like a logical place to start.

The below table reflects sample rates for children under 1 up to the age of 14 in the state of Minnesota. Gerber’s Grow-Up® plan provides less coverage than adult life insurance – ranging from $5,000 to $50,000. All rates are on a per-month basis.

| Age | $5,000 | $10,000 | $15,000 | $25,000 | $35,000 | $50,000 |

|---|---|---|---|---|---|---|

| Under 1 | $3.27 | $6.53 | $9.80 | $15.70 | $21.98 | $31.40 |

| 1 | $3.40 | $6.79 | $10.19 | $16.30 | $22.82 | $32.60 |

| 2 | $3.50 | $7.00 | $10.50 | $16.83 | $23.56 | $33.65 |

| 3 | $3.61 | $7.22 | $10.84 | $17.34 | $24.27 | $34.67 |

| 4 | $3.73 | $7.45 | $11.19 | $17.91 | $25.07 | $35.82 |

| 5 | $3.85 | $7.68 | $11.53 | $18.51 | $25.91 | $37.01 |

| 6 | $3.96 | $7.93 | $11.89 | $19.05 | $26.67 | $38.09 |

| 7 | $4.09 | $8.19 | $12.28 | $19.71 | $27.60 | $39.43 |

| 8 | $4.24 | $8.47 | $12.71 | $20.35 | $28.48 | $40.69 |

| 9 | $4.38 | $8.76 | $13.13 | $21.07 | $29.49 | $42.13 |

| 10 | $4.53 | $9.05 | $13.58 | $21.76 | $30.46 | $43.50 |

| 11 | $4.69 | $9.38 | $14.07 | $22.56 | $31.59 | $45.13 |

| 12 | $4.85 | $9.70 | $14.55 | $23.33 | $32.66 | $46.65 |

| 13 | $5.03 | $10.05 | $15.08 | $24.19 | $33.87 | $48.38 |

| 14 | $5.20 | $10.38 | $15.58 | $24.98 | $34.98 | $49.97 |

From these tables, it seems like insuring a child is pretty cheap – a $5,000 policy at least – but a $50,000 policy is most likely unnecessary. The mortality rate for children in America is lower than that of adults. Children are also dependents, so a loss of income is not the issue when a child passes away.

If you buy a $5,000 policy for your 5-year-old, by the time they hit 18, you will have spent a little over $600 in premiums. An average funeral is about $8,500, so if tragedy strikes, a $5,000 death benefit could come in handy, but the chances of the policy being needed are slim.

Take a look at a $50,000 policy that is bought for a 5-year-old. Almost $6,000 would be spent on premiums by the time they reach age 18. Many experts suggest that child life insurance is excessive.

The Grow-Up® plan is available to children up to 14 years of age. For 15- to 17-year-olds, the young adult plan is available. Here is a table showing sample rates for that age group.

| Age | $5,000 | $10,000 | $15,000 | $25,000 | $35,000 | $50,000 |

|---|---|---|---|---|---|---|

| 15 | $5.39 | $10.79 | $16.18 | $25.95 | $36.32 | $51.88 |

| 16 | $5.59 | $11.17 | $16.77 | $26.91 | $37.67 | $53.82 |

| 17 | $5.79 | $11.58 | $17.37 | $27.88 | $39.02 | $55.74 |

When the child turns 18, the amount of coverage automatically doubles, which means at the most $100,000. As the next table shows for the Young Adult Plan, over $50 a month for $50,000 worth of coverage is ridiculous.

The term rates for adults are separated by male and female. Later on, gender and smoking will be mentioned as a factor that can affect life insurance rates; Gerber does not charge different prices for boys and girls under 18.

First, let’s take a look at rates for non-smoking females age 20 to 50 years old. These rates are based on a 20-year term in Minnesota with coverage ranging from $100,000 to $300,000.

| Age | $100,000/20-Year | $150,000/20-Year | $200,000/20-Year | $250,000/20-Year | $300,000/20-Year |

|---|---|---|---|---|---|

| 20 | $15.58 | $20.88 | $26.17 | $31.46 | $36.75 |

| 25 | $16.00 | $21.50 | $27.00 | $32.50 | $38.00 |

| 30 | $18.75 | $25.63 | $32.50 | $39.38 | $46.25 |

| 35 | $21.50 | $29.75 | $38.00 | $46.25 | $54.50 |

| 40 | $27.58 | $38.88 | $50.17 | $61.46 | $72.75 |

| 45 | $33.58 | $47.88 | $62.17 | $76.46 | $90.75 |

| 50 | $45.67 | $66.00 | $86.33 | $106.67 | $127.00 |

A 20-year-old female who doesn’t smoke can get a 20-year term policy with $100,000 of coverage for just over $15 a month. Compare that to about $55 a month for a 17-year-old to have $50,000 of coverage. There is a difference between the two that explains the disparity.

The young adult plan is a whole life insurance policy that will be revisited at length in the next section, but the main importance is that a whole life policy has a cash value portion, which is essentially a savings component.

But more on that later. Let’s take a look at how gender and age affect rates through Gerber. The next table is based on the same situation as the previous table, with the switch of gender being the only change.

| Age | $100,000/20-Year | $150,000/20-Year | $200,000/20-Year | $250,000/20-Year | $300,000/20-Year |

|---|---|---|---|---|---|

| 20 | $19.75 | $27.13 | $34.50 | $41.88 | $49.25 |

| 25 | $20.58 | $28.38 | $36.17 | $43.96 | $51.75 |

| 30 | $23.17 | $32.25 | $41.33 | $50.42 | $59.50 |

| 35 | $25.67 | $36.00 | $46.33 | $56.67 | $67.00 |

| 40 | $34.92 | $49.88 | $64.83 | $79.79 | $94.75 |

| 45 | $44.08 | $63.63 | $83.17 | $102.71 | $122.25 |

| 50 | $62.50 | $91.25 | $120.00 | $148.75 | $177.50 |

For both males and females, a 60-year-old would pay about three times the monthly rate of a 20-year-old – a prime example of how buying early can be beneficial financially. Let’s examine the price difference for genders.

It’s common knowledge that, on average, women live longer than men. To insurance companies, this means the odds are higher for them to have to pay out death benefits sooner and at a faster rate for men rather than women.

For a young couple of 30, the male would pay $32.25 a month for $150,000 worth of coverage, while the female would only pay $25.63 a month. That’s over $80 more a year.

Now, one’s lifestyle choices can affect life insurance rates even more than age or gender. Below is a table reflecting the rate for female smokers under the same pretenses as above.

| Age | $100,000/20-Year | $150,000/20-Year | $200,000/20-Year | $250,000/20-Year | $300,000/20-Year |

|---|---|---|---|---|---|

| 20 | $25.00 | $35.00 | $45.00 | $55.00 | $65.00 |

| 25 | $25.83 | $36.25 | $46.67 | $57.08 | $67.50 |

| 30 | $32.83 | $46.75 | $60.67 | $74.58 | $88.50 |

| 35 | $39.83 | $57.25 | $74.67 | $92.08 | $109.50 |

| 40 | $54.33 | $79.00 | $103.67 | $128.33 | $153.00 |

| 45 | $68.83 | $100.75 | $132.67 | $164.58 | $196.50 |

| 50 | $97.83 | $144.25 | $190.67 | $237.09 | $283.50 |

Imagine that the couple from before decided to pick up smoking. The female smoker would pay about twice the amount that her non-smoking counterpart would pay.

Shall we see if this also rings true for males who smoke?

| Age | $100,000/20-Year | $150,000/20-Year | $200,000/20-Year | $250,000/20-Year | $300,000/20-Year |

|---|---|---|---|---|---|

| 20 | $35.75 | $51.13 | $66.50 | $81.88 | $97.25 |

| 25 | $37.42 | $53.63 | $69.83 | $86.04 | $102.25 |

| 30 | $45.00 | $65.00 | $85.00 | $105.00 | $125.00 |

| 35 | $52.58 | $76.38 | $100.17 | $123.96 | $147.75 |

| 40 | $76.00 | $11.50 | $147.00 | $182.50 | $218.00 |

| 45 | $99.33 | $146.50 | $193.67 | $240.84 | $288.00 |

| 50 | $146.08 | $216.63 | $287.17 | $357.71 | $428.25 |

As you most likely guessed, smoking for males hikes up life insurance rates just the same as females who decide to smoke.

Now that we have an idea of how much life insurance costs, let’s look at what Gerber Life has to offer.

Coverage Offered

Even though Gerber has always been dedicated to young people, adults are now able to seek a life insurance policy for themselves, as well.

The coverage is also referred to as the death benefit, which is the amount of money that the insurance pays upon the death of the insured.

Few people in the world would leave behind debt for their loved ones. Life insurance can be a peace of mind for married couples, new parents, retirees, those with mortgages, and those with children.

With so many different situations in the world, there are also a variety of life insurance policies to choose from. Let’s explore the different types of coverage Gerber offers.

Types of Coverage Offered

In general, life insurance comes in two forms: term life and permanent life insurance. With most term policies, coverage is available until the end of the term, then the policy ends, and nothing is paid out. Permanent policies are slightly different,

Permanent policies usually have two parts: the death benefit and a savings component. The savings aspect of a whole or universal life policy is referred to as cash value, which is accessible while you’re still alive.

Term

When you buy term life, you’re covered for the duration, as stated in the policy. Gerber offers terms of 10, 20, or 30 years like most other insurance companies. The initial monthly rate is the only monthly rate – it’ll never increase.

At Gerber, getting term life is fast, easy, and available within minutes online. This is possible because, unlike many companies that require a medical exam, Gerber doesn’t.

The amount of coverage that Gerber offers for term life varies between $100,000 and $300,000. There are plans with rates as low as $16 a month.

Whole

Permanent life insurance such as whole life makes sure you are covered for life as long as the premiums are paid. Just as with term life, Gerber locks in your rates for coverage ranging from $50,000 to $300,000.

The best part is you get to choose the starting amount of coverage.

What sets whole life apart from term life is that permanent policies often have cash value portions in addition to the death benefit. A small part of each premium is added to the cash value, which is there for you if you need to cover emergency needs or borrow against it.

These types of policies are only eligible for people 18 to 70 years old. Medical exams aren’t always required.

If you’re older than 51 years of age or are applying for coverage greater than $100,000, there will most likely be a medical exam required. Otherwise, only a few health questions are asked.

Guaranteed

Guaranteed life is a specific form of whole life insurance that is used to cover final expenses. As the title suggests, acceptance is guaranteed.

From Gerber, this type of insurance is only available to those ages 50 to 80. There are no medical exams, but there is a long health questionnaire that you must fill out, which you can do online.

The premiums never increase, and there is a cash value portion; the big difference is the available death benefit. With guaranteed life, the coverage ranges from $5,000 to $25,000.

Accident Protection

This type of plan provides $20,000 to $100,000 to dependents in case of accidental death or disability. The cash payout can help pay out-of-pocket medical expenses and cover lost wages.

There are no medical exams, no health questions, and no waiting period. Your policy will be effective immediately for as little as seven cents a day. Benefits can never be reduced, and the premiums will never increase.

A married couple could be pre-approved for a combined $200,000 worth of coverage if they are between the ages of 19 and 69.

Gerber Life Grow-Up® Plan

The Grow-Up® plan is whole life insurance for children from 14 days to 14 years old; parents, grandparents, and legal guardians are the only ones that can complete a child’s application. Premiums never increase, and coverage ranging from $5,000 to $50,000 is guaranteed.

Lifelong insurance is guaranteed regardless of future health or occupation. There is also a cash value portion that helps give the child another leg up when reaching adulthood.

Before you leap at the chance to purchase a life insurance policy for your child, you should do a little research. Many articles, like this one from the HuffPost, explain why child life insurance is often a bad investment.

Young Adult Plan

Once a child turns 15, they’re no longer eligible for the Grow-Up® plan. Children from 15 to 17 are eligible for coverage under Gerber’s Young Adult plan. The monthly rates for this type of whole life policy will be locked in as well.

When the child turns 18, the coverage automatically doubles, and the cost stays the same. Upon becoming the policyholder at age 21, the insured will have the option to keep the policy as well as add additional coverage.

The big difference between the two plans for minors is that the Young Adult plan has a guaranteed cash value option to give an advantage upon entering adulthood.

Gerber Life College Plan

Everyone wants a bright future for their children. What better way to light the path than to have a college savings plan for the future? Unlike 529 plans or other college savings, Gerber allows the money to be used for college expenses or whatever the policyholder would like.

This type of policy grows over time and is not affected by the stock market. When the plan reaches maturity, a guaranteed payment of $10,000 to $150,000 is made to the policyholder.

If the unthinkable were to happen prior to the maturity date, the full benefit would be paid to the beneficiary.

Factors That Affect Your Rate

Insurance companies and their policies are far from one-size-fits-all. Many different characteristics can affect your rates. The insurance companies’ goals are to maximize profits and the number of premiums while minimizing and assessing the risks.

Some of these are out of anyone’s control, such as some demographics or medical history. Others are based on important life choices.

Demographics

Age is often the number one factor when it comes to setting a price for life insurance premiums. The younger you are, the less likely the insurance companies will have to pay out soon.

Gender is another factor that lies outside of our control when it comes to affecting life insurance rates. Women generally live longer than men. Insurance companies are trying to play the game with the best odds in mind.

On average, men pay 38 percent higher premiums than women. Elderly men seem to have the short end of the stick. A more individualized factor is one’s medical history.

Current Health & Family Medical History

Before most life insurance companies agree to insure you, a medical exam must be performed. During this exam, your blood pressure, cholesterol, and heart are looked at and assessed. The risk of having a heart attack is evaluated thoroughly.

Insurers may also request your full health records before insuring you. This is to check for serious conditions such as having high cholesterol or high blood pressure, which would surely increase your rates.

There is also the case of diabetes. Type 1 diabetes is usually diagnosed young, causing life insurance rates to always be higher. Type 2 diabetes is often diagnosed in later years and can depend on one’s lifestyle.

Some of these medical conditions can be managed or minimized. However, there is a medical history that can’t be overshadowed or diminished. Complicated family medical history such as stroke or cancer and pre-existing medical conditions of your own often harm life insurance rates.

While these are important to pay attention to when shopping for life insurance, Gerber doesn’t require a medical exam for most of the policies that they offer.

High-Risk Occupations

Your personal life isn’t the only thing on display when the life insurance underwriting is in progress. Your work life can have just as much as an effect. Insurance companies will charge you more if your life is in danger while on the clock.

Our minds tend to go to law enforcement or firefighting when we think of dangerous occupations, although construction and transportation are two industries with extremely high numbers of fatal work injuries.

This means that your dream of becoming a pilot can be just as costly as being an ice road trucker or even a big city construction worker.

High-Risk Habits

Why does the insurance company need to know so much about your personal life? The short, and possibly dark, answer is that the higher the risk of you dying, the more you’ll pay to cover your life.

If you make unhealthy choices, the insurance companies will increase the premiums of your life insurance. Habits such as smoking or excessive drinking can cause insurers to increase their rates.

Smoking is a major behavior that almost every life insurance company evaluates, but it’s not the only one. Do you have one or many instances on your driving record relating to speeding, reckless driving, or driving while under the influence of drugs or alcohol?

That’s right. Past mistakes related to reckless behavior can come back to haunt your life insurance rates. The way you go about having fun is also examined. To all the adrenaline junkies out there, know that a higher premium is a possibility.

Engaging in high-risk activities such as skydiving or racing cars makes you a financial risk to the insurance company because of how your life could potentially be cut short. Some policies become void if death occurs via skydiving or any other listed exclusions.

Whatever insurance company you go with, they will take a look into your life and charge you accordingly. How much weight each factor holds varies from company to company. This is why getting life insurance quotes is so important when it comes to maximizing your policy and your dollar.

Veteran or Active Military Status

There are many benefits for the men and women who are willing to lay down their lives for their country. The U.S. Department of Veterans Affairs (VA) assists veterans and their families with health and life insurance as well as final expense life insurance.

For people in active military service, there is a low-cost option called the Servicemembers’ Group Life Insurance, where you are automatically enrolled under the maximum coverage if you qualify. You may deny or change the coverage, but it’s available to all military members.

What happens when you’re no longer on active duty? Veterans who had an SGLI policy are eligible to switch to Veterans’ Group Life Insurance. A plus side to this that no proof of good health is necessary. There is, however, a maximum of $400,000 worth of coverage.

If you’ve served in the military, there is less to worry about in terms of final expenses. It’ll be free for you and your family to be buried in a national cemetery.

The VA’s office will pay a burial allowance to the deceased’s survivors to cover funeral expenses. Also, if burial takes place beside a national cemetery, the VA will still cover the burial.

Getting the Best Rate with Gerber Life

The thing with life insurance rates is that they vary not only by the company, medical conditions, and personal lifestyle but by each state, as well. The good part about it is that the National Association of Insurance Commissioners (NAIC) has a model of how states should structure their insurance laws and regulations.

These regulations are recommended to protect consumers from being exploited by insurers. Insurers base the premium rates on mortality and interest along with additional expenses, such as operating costs.

Companies use a mortality table in most cases to plan average life expectancy and estimate how much in death claims will be paid out each year. This is taken into consideration when the company invests the premiums in making money off the interest.

For the insurance company, it’s one big balancing act that is strictly by the numbers – even though the numbers can be highly volatile. That’s why it’s wise to know how to play the game to your advantage.

The best thing you can do is buy now. The longer you wait to purchase life insurance, the more it’s going to cost. The average increase in rates between the age of 30 and 50 is over 225 percent.

Of course, there are other simple ways to help get the lowest rates; most of it is common sense. Stay healthy, don’t smoke, and don’t take unnecessary physical risks

Gerber Life’s Programs

Regardless of whether you get a Gerber Life college savings plan, Gerber’s website offers college planning resources. It offers information on how to plan and pay for college, as well as why it’s important to have a Gerber college plan in place for your child.

There are also life insurance resources to help people understand how life insurance works and what type of policy suits you best. Videos, articles, and a thorough terminology tool assist in helping inform people about life insurance.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Canceling Your Policy

Canceling a life insurance policy can be tedious but also a relatively simple process. When canceling term life insurance, you don’t receive a refund or payment of any kind; whole life policies are different because of cash value.

The cash value is often also referred to as the surrender value, meaning the value received when you cancel the policy. Of course, the insurance company will keep any money for outstanding loans or fees.

How to Cancel

There are a few steps that you can be taken to ensure that your policy is properly canceled. Contacting an agent is an obvious first step, but you should also send in a written request via mail or fax.

Let’s see how to find Gerber’s full contact information.

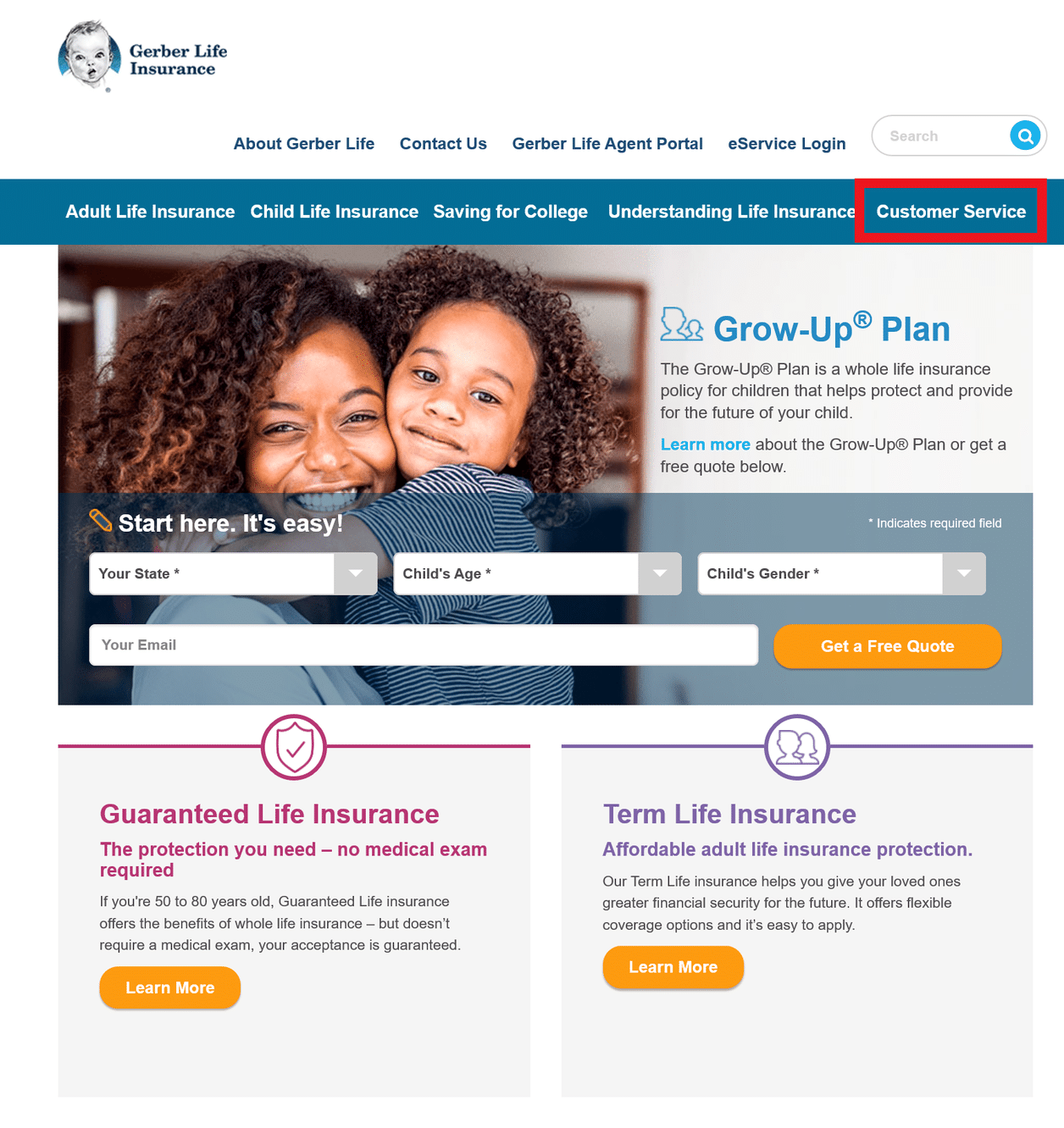

#1 – Visit Gerber Life’s Home Page and Click “Customer Service” at the Top Right-Hand Side of the Screen Inside the Blue Bar

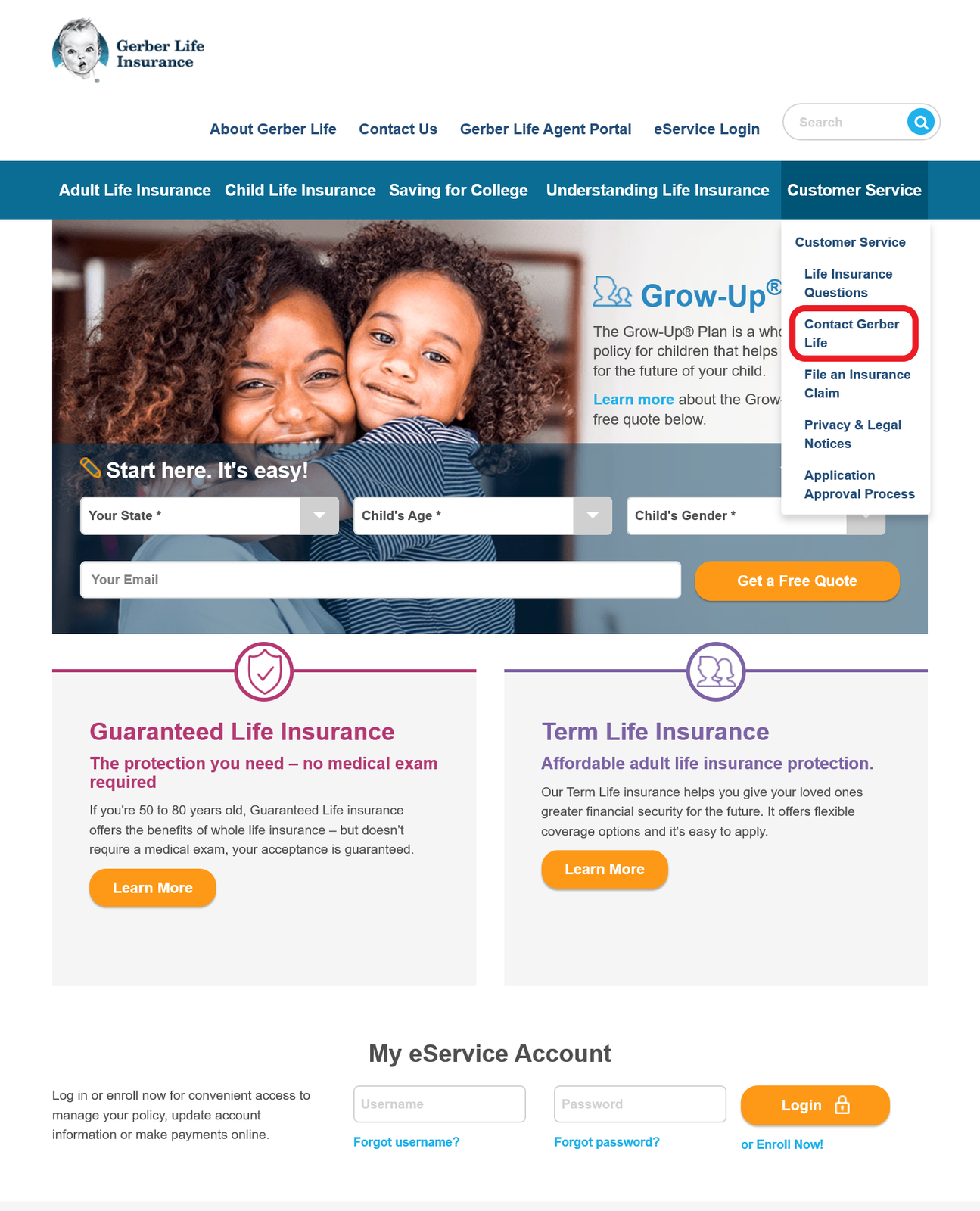

#2 – From the Dropdown Menu, Click “Contact Gerber Life”

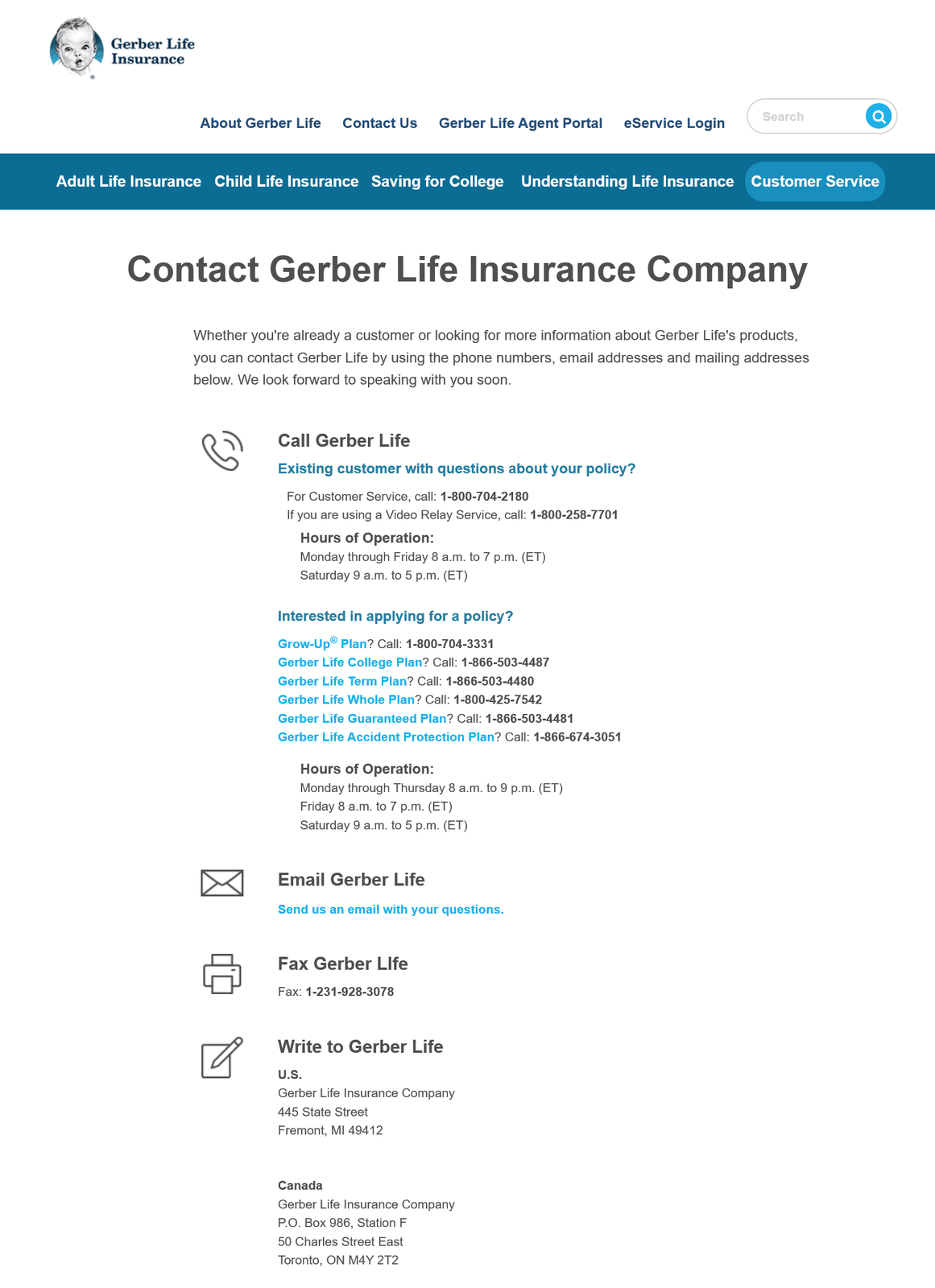

#3 – Review Phone Numbers, Fax Numbers, Addresses, Emails, and Hours of Operations

After talking to a Gerber agent and sending a written cancellation request, you need to make sure you turn off automatic payments. Make sure to monitor your accounts to make sure the payments stop.

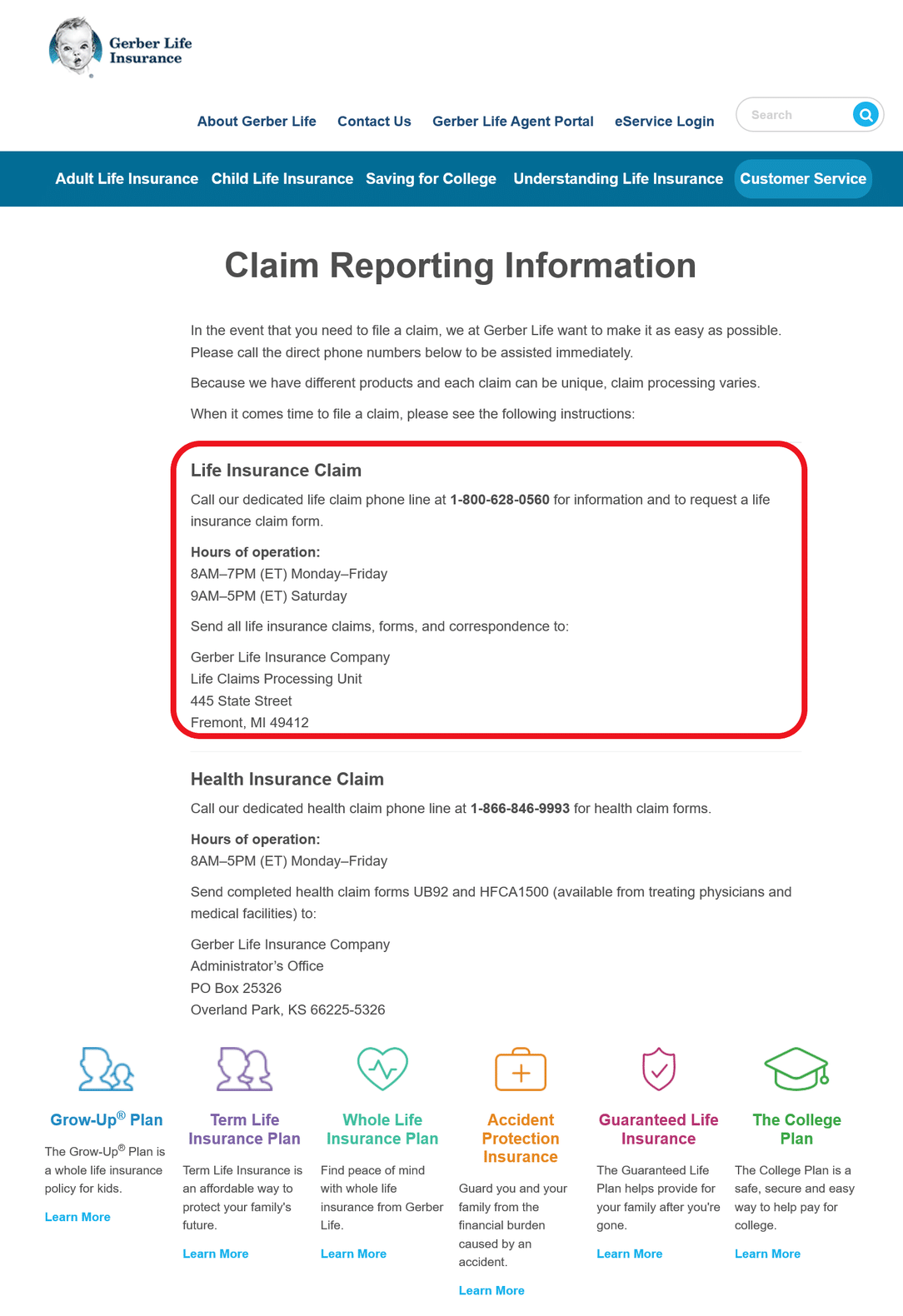

How to Make a Claim

The reality of it all is that you may be put in the position where you must file a life insurance claim. Most companies require you to contact the company or agent directly due to verification needs.

Before filing a claim, there are a few things you should have on hand to make the process go smoothly.

- Social Security number of the deceased

- Policy number (if accessible)

- Beneficiary names and information

- Death certificate (multiple copies)

A representative will make sure to inform you of any other information the insurance company may need. To find the best way to contact Gerber in order to make a life insurance claim, first visit Gerber Life’s website.

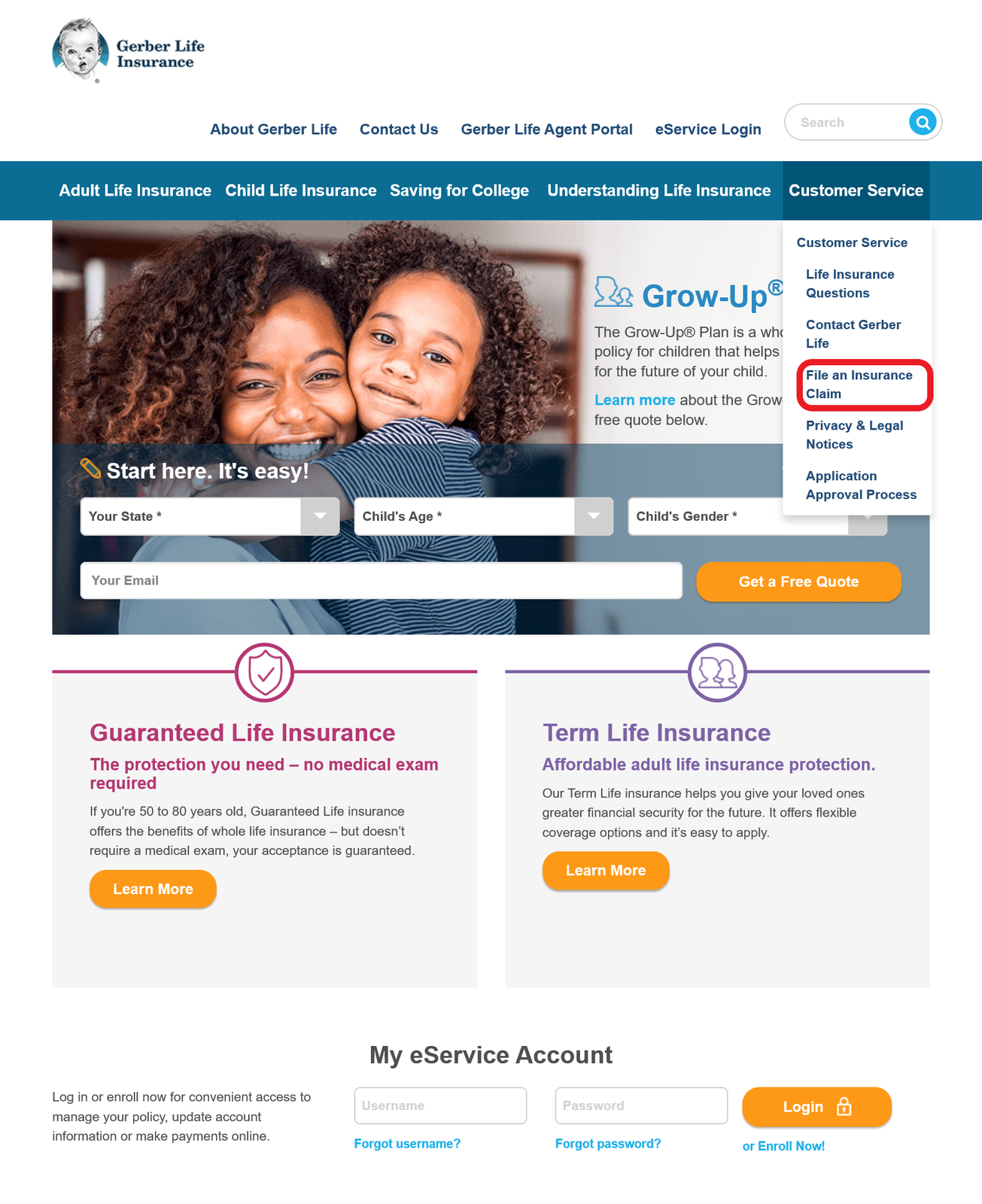

On the main page, click “Customer Service” on the right-hand side of the page. A drop-down menu will appear; click “File an Insurance Claim.”

The next page includes information about making a life insurance claim with Gerber. The most important information would be the telephone number (1-800-628-0560), hours of operation (8 a.m. to 7 p.m. Monday-Friday and 9 a.m. to 5 p.m. Saturday), and the address to the Life Claims Processing Unit (445 State St., Fremont, MI 49412).

After filling out the claim form and mailing it in, all there is to do is wait. Sometimes it can take 30 to 60 days to receive the death benefit. Staying in regular contact with an agent can guarantee the completion of the process.

How to Get a Quote Online

To shop around properly for life insurance, you need to get several different quotes. Many insurance companies don’t offer juvenile life insurance, but since that’s Gerber’s main gig, there is a quote tool specifically for the Grow-Up® plan.

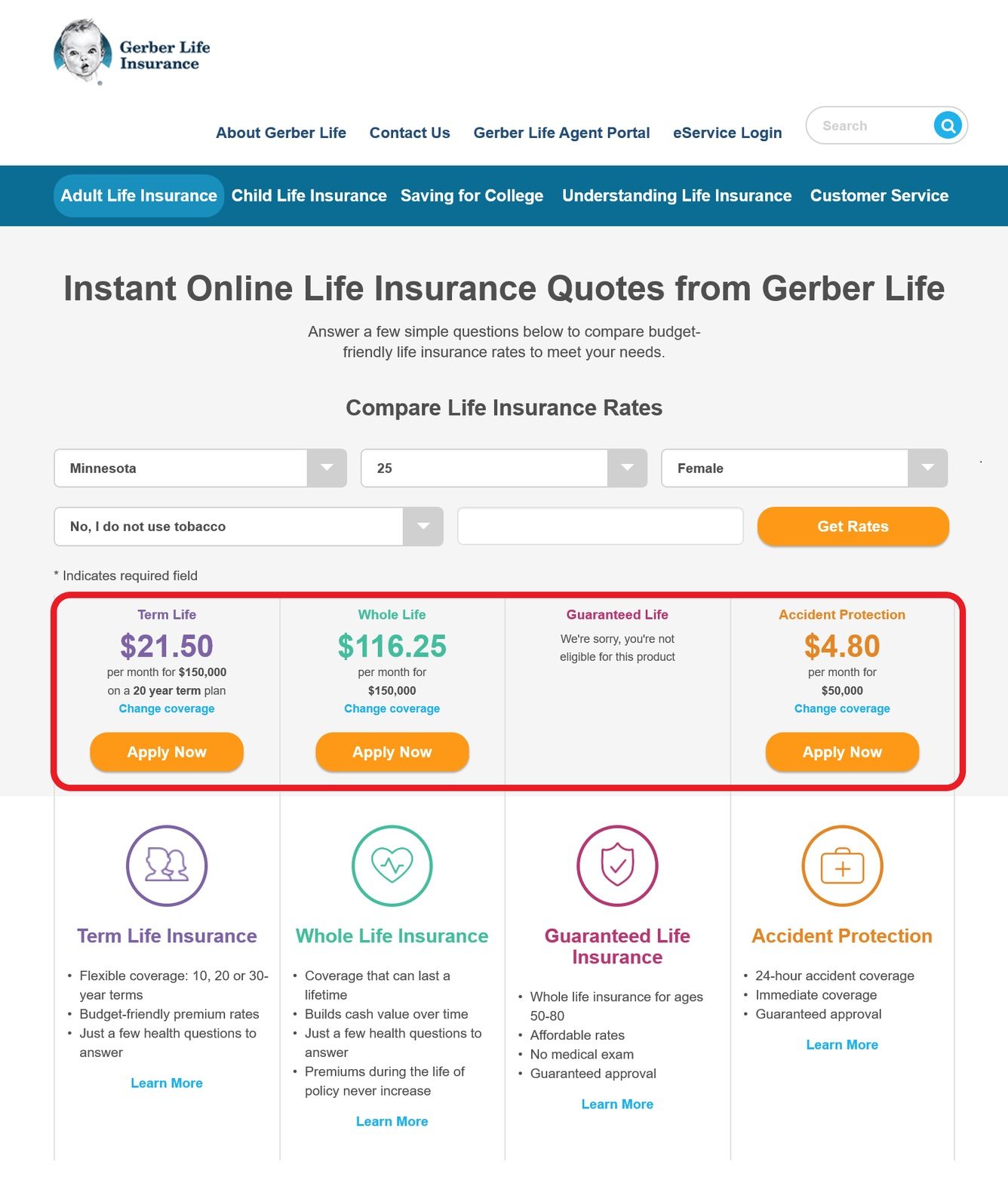

There is also a quote tool used for adults that provides estimates for a term, whole, guaranteed, and accident protection policies. The best part is that it takes only seconds to fill out the form and get quotes.

So let’s cut to the chase with a step-by-step on how to get children and adult quotes from Gerber.

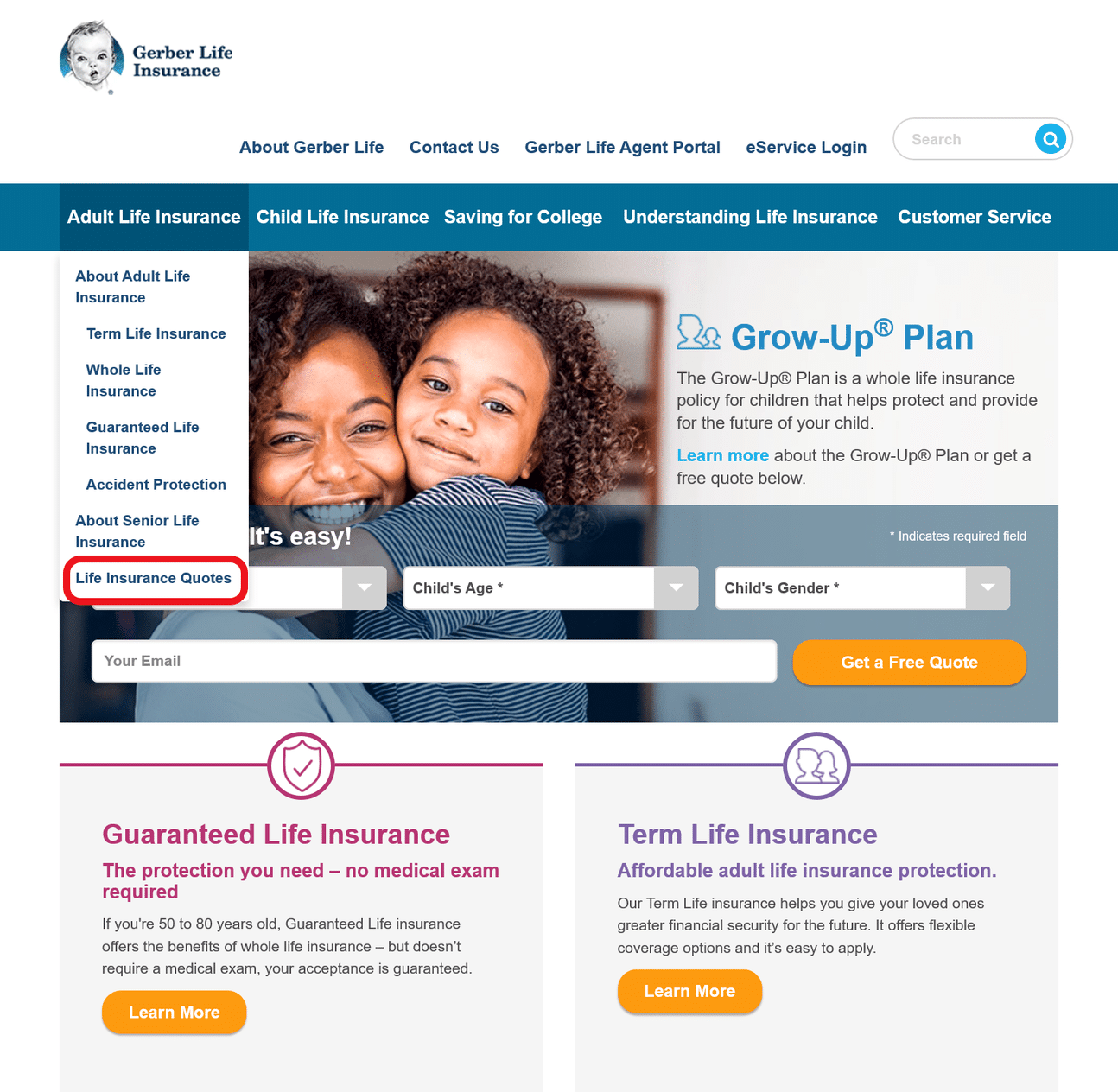

#1 – Visit Gerber Life’s Home Page

#2 – Fill Out the Grow-Up® Plan Form at the Top of the Home Page, Then Click “Get a Free Quote”

#3 – Review Quotes on the Right Side of the Page, Then You Can Go Ahead and Fill Out the Application Immediately

Now let’s take a look at how to get a quote for an adult. Start by going back to Gerber’s homepage.

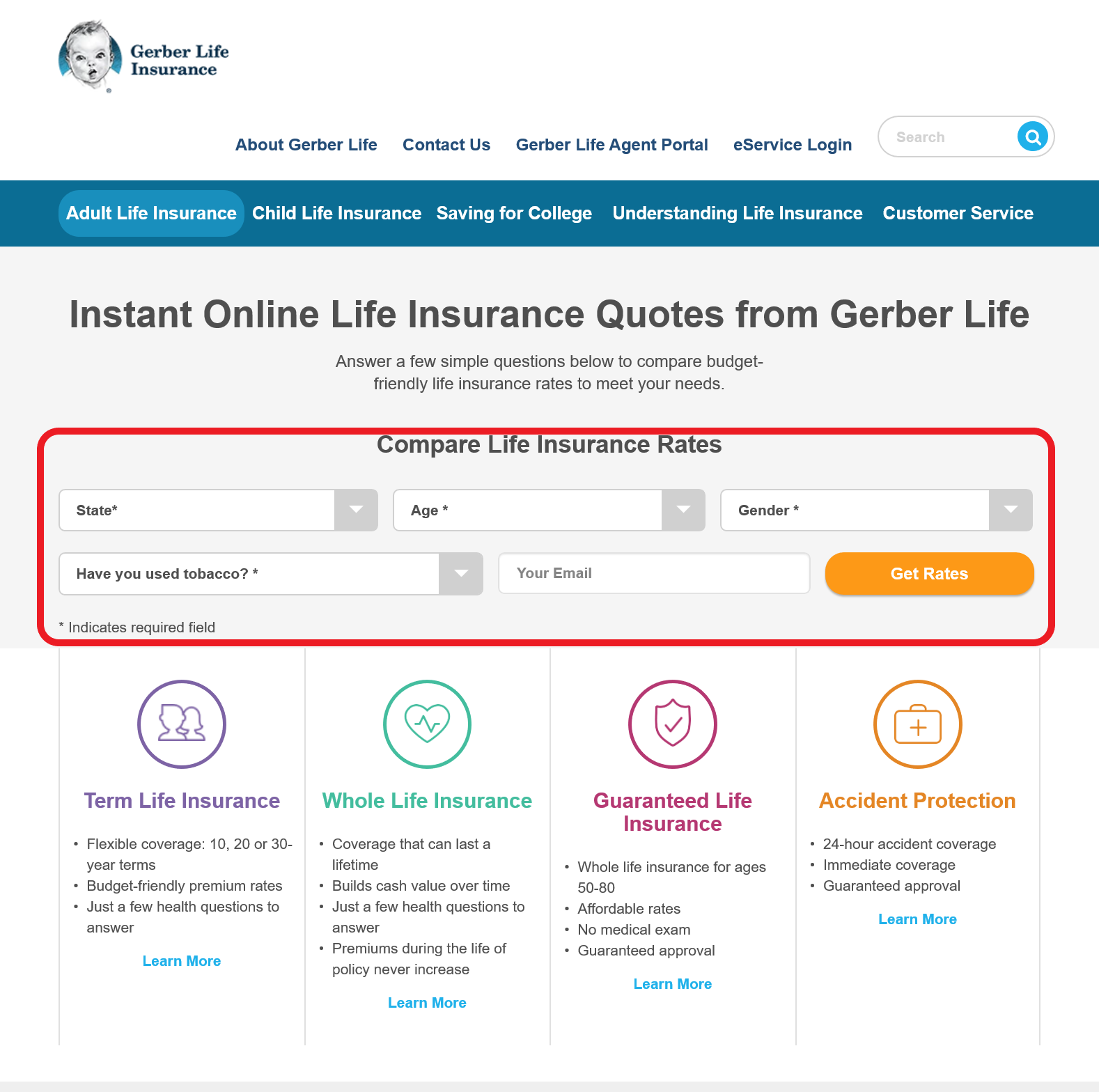

#4 – Click on “Adult Life Insurance,” and Then Click “Life Insurance Quotes” at the Bottom of the Dropdown Menu

#5 – Fill Out the Form, Then Click “Get Rates”

#6 – Review Quotes for a Term, Whole, Guaranteed, and Accident Protection Policy, and Then Click “Apply Now” if You Wish to Buy Immediately

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Design of Website/App

Obviously, much thought was given into the design of Gerber’s website. The Grow-Up® plan, the most popular product, is showcased on the homepage front and center along with a form to obtain a quote.

The nine categories along the top of the screen cover all the basics, and most of them have detailed drop-down menus to help users navigate easily throughout the website.

Unfortunately, there is no app for policyholders. However, there is an app for Gerber Life insurance agents. It has a four-star rating, but reviews suggest it hasn’t been updated in a long time.

Pros & Cons

Just like people, insurance companies have both strengths and weaknesses. Below is a table to summarize a few of each.

| Pros | Cons |

|---|---|

| Lock in low rates and guaranteed coverage early on | Child life insurance is seen as wasteful when child mortality rates are low |

| Save throughout the child's years as a minor | High policy loan interest rate (8 percent) |

| Gerber offers policies for all stages of life | Small death benefits for Grow-Up and Young Adult plans |

| Rarely are any medical exams required | Bad way to invest money for future expenses |

The Bottom Line

Gerber is a brand known in every household in America, and people trust what they think they know. Even though the Gerber Life Insurance Company has been sold off, it still bears that brand.

The company was built by focusing on children. When child life insurance wasn’t lucrative enough, the company expanded to include adult life insurance. Child life insurance is often seen as unnecessary.

If you’re looking for an adult life insurance policy, Gerber is worth looking at along with other companies. However, child life insurance should rarely, if ever, be sought out. Instead, consider other savings options.

Frequently Asked Questions

What is Gerber Life Insurance?

Gerber Life Insurance is a subsidiary of the Gerber Products Company, well-known for their baby food products. Gerber baby food life insurance products are designed to provide financial protection to individuals and their families.

What are the benefits of choosing Gerber Life Insurance?

Some benefits of choosing Gerber Life Insurance include:

- Brand reputation and trust: Gerber has been a trusted name in baby products for decades.

- Simple application process: Gerber Life Insurance offers a straightforward and hassle-free application process.

- Coverage options for different life stages: Gerber Life Insurance provides policies for individuals of all ages, including children and seniors.

- Cash value accumulation: Whole life policies from Gerber build cash value over time, which can be accessed if needed.

How can I apply for Gerber Life Insurance?

To apply for Gerber Life Insurance, you can visit their website or contact their customer service. They will guide you through the application process, which typically involves providing personal information, medical history, and selecting the desired coverage amount and policy type.

Is Gerber Life Insurance only for children?

No, Gerber Life Insurance is not only for children. While Gerber is well-known for its products for infants and young children, Gerber Life Insurance provides coverage for people of all ages. They offer policies for children, adults, and seniors, catering to different life stages and needs.

Can I customize my Gerber Life Insurance policy?

Gerber Life Insurance policies typically offer customization options to meet individual needs. You can often choose the coverage amount, policy duration (for term policies), premium payment frequency, and add optional riders to enhance your coverage. These options allow you to tailor the policy to your specific circumstances and goals.

How is the customer service and claims process with Gerber Life Insurance?

Gerber Life Insurance strives to provide excellent customer service to its policyholders. They have customer support channels to address inquiries, offer online account management, and provide a streamlined claims process. The specific experience may vary based on individual circumstances and the nature of the claim.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Aaron Englard

Insurance Premium Auditor

With over a decade of experience in insurance premium auditing, audit department management, and business audit representation, Aaron has developed a deep understanding of audit regulations, compliance requirements, and industry best practices. As the Founder & CEO of AdvoQates, he specializes in representing businesses during their audits to ensure accurate, transparent, and fair assessments ...

Insurance Premium Auditor

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.