AIG Life Insurance Review (Companies + Rates)

AIG life insurance rates are usually considered affordable, with term quotes starting at just $10 per month. Also known under its affiliate American General, AIG is considered a solid choice for customer service. However, American General reviews mention feeling unsatisfied with the lack of life insurance riders.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

The Brief - AIG

| Key Info | Company Specifics |

|---|---|

| Year Founded | 1919 |

| Current Executive | CEO - Brian Duperreault CFO- Mark Lyons |

| Number of Employees | 64,000 |

| Total Sales / Total Assets | $49,792,000,000 / $525,060,000,000 |

| HQ Address | 175 Water Street New York, NY 10038 |

| Phone Number | 1-888-760-9195 |

| Company Website | www.aig.com |

| Premiums Written - Individual Life | $42,604,328 |

| Financial Standing | $3,348,000,000 |

| Best For | Individual Life Insurance |

- AIG offers a variety of term and permanent life insurance

- Most AIG reviews praise the company’s affordability

- AIG does not offer many life insurance rider options

AIG, which also operates under the American General name, sells a variety of life insurance options. These options include a variety of term and permanent policies.

While the policies are usually affordable, AIG and American General ratings mention that the company lacks add-on options. That’s not a problem for people looking for basic life insurance, but might not be the best fit if you want to customize your policy.

Wondering where to buy life insurance? Explore American General life insurance ratings below to see if this company is right for you. Then, enter your ZIP code into our free tool above to find the best life insurance rates possible.

AIG Life Insurance Ratings

Although AIG has had financial problems in the past, most credit rating agencies give it a high credit rating, demonstrating that AIG’s financial ratings are improving and that the company’s outlook is financially stable. Rather than rely solely on AIG life insurance reviews on Yelp, get reviews from all the industry’s best.

AIG A.M. Best Rating

A.M. Best offers AIG a credit rating of A and a long-term credit rating of A+. These high credit marks confirm that AIG is financially stable and will honor its financial obligations to its policyholders throughout the world. The American General A.M. Best rating is comparable to companies like MetLife, Allstate, and Prudential.

AIG Better Business Bureau (BBB) Rating

The Better Business Bureau rates AIG at A-. AIG life insurance reviews from BBB explain that AIG lost points because it didn’t respond to one complaint filed against it. AIG complaints are clearly rare.

However, with 52 years of history, it’s impressive that the company only has one negative mark against it, and the BBB does not provide details of the complaint. Furthermore, the high rating demonstrates that the majority of customers are satisfied with the service they’ve received from this insurance provider.

AIG Moody’s Rating

Moody’s credit ratings are based on the borrower’s ability to make interest payments on loans. For life insurance policyholders, this is a measure of how likely an insurance company is to pay out the promised amount if the policyholder cashes out early.

In AIG’s case, Moody rates it at Baa1, which means that there is a moderate risk of default. However, Moody’s long-term forecast is that AIG will continue to be financially stable, which means that this rating will likely go up over time as AIG continues to pay its debts.

AIG Standard and Poor’s (S&P) Rating

Standard and Poor’s is one of the best-known credit rating entities. Like Moody’s, it rates companies according to their ability to pay back debts. The AIG S&P rating is a solid BBB+, placing it in the medium-to-high creditworthiness range. This suggests that AIG has a stable financial outlook.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

AIG Insurance Reviews by Customers

The National Association of Insurance Commissioners, or NAIC, regulates the insurance industry throughout the United States. If a consumer has a problem with an insurance company, such as failure to pay out claims as agreed, that consumer can file a complaint with NAIC. Data is based on the NAIC Complaint Index.

According to the NAIC, consumers filed 34 complaints against AIG in 2018; 50 percent of these complaints had to do with claims. However, only two of the complaints were filed against the life insurance division of AIG rather than against other types of insurance AIG offer.

AIG J.D. Power Rating

J.D. Power provides annual customer satisfaction surveys for insurance companies. In 2018, AIG scored an average of two out of a possible five points on J.D. Power’s customer satisfaction surveys, though it scored a three in terms of how easy its statements were for policyholders to understand.

How to Get AIG Quotes

AIG offers a wide variety of life insurance policies to help consumers get coverage that meets their needs. Its focus is on individual and family life insurance policies and concentrates its marketing efforts on being helpful to potential consumers. Luckily, getting American General life insurance quotes is simple.

More than a third of consumers would feel the financial impact within a few months if a loved one were to die, which is one of the primary reasons to purchase the right life insurance policy for your family. This is one of the primary reasons to begin shopping for life insurance.

Younger people often don’t buy life insurance because they have other financial priorities or fear the cost will be prohibitive. But no matter what your age, it’s important to shop for life insurance because you never know when a catastrophic illness or accident will occur. There’s even life insurance for low-income families.

AIG Life Insurance Quotes by Gender

While there are many factors that determine sample life insurance rates, AIG tends to charge women slightly less than men for life insurance. This is probably because, on average, women tend to live longer than men, and it’s considered a lower risk to insure a woman.

Interestingly, women continue to pay lower rates even if they smoke, although insurance rates go up for smokers compared to non-smokers.

AIG Term Life Insurance Monthly Rates by Term Length and Gender

| Age | $100,000/10-Year: Male | $100,000/10-Year: Female | $100,000/20-Year: Male | $100,000/20-Year: Female |

|---|---|---|---|---|

| 25-Year-Old | $10 | $9 | $11 | $11 |

| 30-Year-Old | $10 | $9 | $11 | $11 |

| 35-Year-Old | $11 | $10 | $11 | $11 |

| 40-Year-Old | $12 | $11 | $14 | $12 |

| 45-Year-Old | $15 | $13 | $18 | $14 |

| 50-Year-Old | $17 | $15 | $26 | $20 |

| 55-Year-Old | $27 | $21 | $37 | $27 |

| 60-Year-Old | $38 | $26 | $56 | $48 |

| 65-Year-Old | $55 | $45 | $99 | $82 |

Age is also a primary factor. In every case, rates go up as a person ages, so a young person pays only a few dollars for life insurance while someone who is 65 or older pays at least a hundred dollars per month, if not more.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

AIG Life Insurance Options

AIG offers a number of life insurance products for consumers in various situations, all centered around ensuring a comfortable future for its clients and their families.

AIG Life Insurance Policies

| Product | Who It's Best For |

|---|---|

| Term Life Insurance | Individuals/families looking for basic life insurance |

| Guaranteed Issue Whole Life Insurance | People over the age of 50 who want a guarantee of permanent protection. |

| Quality of Life Insurance | Individuals who want to provide financial assistance to their loved ones after they are gone. |

| Universal Life Insurance | People who want flexible coverage and the ability to get benefits while still alive |

| Variable Universal Life Insurance | People who have knowledge about investments and want to invest their life insurance funds. |

If you’re older than 50 and have medical issues, it might be hard for you to get life insurance at a reasonable rate from many companies. You’d be considered high-risk and would have to pay higher premiums or even be denied coverage.

In this case, AIG’s Guaranteed Issue Whole Life Insurance might be an option for you, as it provides insurance regardless of your medical history and doesn’t require a medical exam.

On the other hand, if you’re young, in good health, and just want to make sure your family is covered in the event of a tragedy, term life insurance might be for you. This type of insurance covers you for between 10 and 35 years, depending on the policy you choose, and premiums are low.

You need to keep in mind that your policy will not cover you after the specified time period ends. For example, if you buy a 10-year policy and die after 12 years, your family won’t receive any benefits.

AIG offers a wide range of life insurance products. The company’s mission is to provide life insurance to meet every customer’s unique needs, and many of its products can be customized to fit your circumstances.

AIG Term Life Insurance

American General term life insurance provides death benefits over a specific period of time. This type of insurance is usually cheaper than other types of life insurance. AIG term life insurance will cover you for 10, 20, 30, or 35 years.

AIG also offers a flexible type of term life insurance for those who are looking to protect themselves both before and after retirement. AIG Return of Premium term life insurance is a good addition if you think you might outlive your term life insurance policy with AIG.

AIG Select-a-Term

AIG’s conventional term life insurance is called Select-a-Term because you can select the term you want coverage for. AIG term life insurance reviews mention that Select-a-Term can be used in conjunction with other financial or personal goals, such as a specific year you plan to retire.

“With Select-a-Term, Kevin has the flexibility to purchase a term policy that meets his 30-year retirement horizon perfectly.” (AIG Brochure for Select-a-Term)

In its brochure, AIG gives the example of a 40-year-old who wants to retire at age 70. He chooses a 30-year Select-a-Term policy so his family’s financial needs will be covered should he die prior to reaching retirement age.

This type of insurance can also be used to make sure your kids are able to go to college should you die prematurely, or cover other financial needs based on your family’s individual situation. Employers can also purchase this type of insurance on behalf of their employees.

Compare Quotes From Top Companies and Save Secured with SHA-256 Encryption

While Select-a-Term is only valid for the selected period of time, policyholders have the option of converting it to whole life insurance at the end of the term or when they turn 70, whichever comes first.

AIG Flexible Quality-of-Life Insurance

Flexible Quality-of-Life insurance is a customized type of term life insurance meant to help people protect their quality of life after major events. For example, people who received life insurance through their employers might need to replace that policy with a term life insurance policy after retirement.

One of the unique features of this product is that it offers accelerated death benefits should the policyholder suffer a serious health issue that stops them from being able to take care of themselves. Many American General life insurance reviews state that the accelerated death benefit gives them a sense of peace.

For example, if you have a chronic health condition such as multiple sclerosis that advances to the point that you can no longer dress or bathe yourself without assistance, you can receive benefits from your insurance prior to your death.

This helps mitigate the high cost of health care or hiring people to help you with your daily living tasks. You can use your life insurance benefits to help pay for these needed services.

You can also receive benefits if you suffer a critical illness such as a major heart attack or stroke or if you’re diagnosed with a terminal illness and expected to die within 24 months.

Your minimum benefit with this policy is $100,000. Anyone under the age of 95 is eligible, making this one of the few companies that offer life insurance for an 85-year-old.

As with Select-a-Term, this type of insurance is fully convertible to whole life insurance once you reach the age of 70.

AIG Permanent Life Insurance

AIG offers an assortment of permanent life insurance options. AIG permanent options include guaranteed issue whole life insurance, universal life, variable universal life, and more.

Before you sign up for a permanent plan, make sure to read through AIG whole life insurance reviews. Permanent life insurance costs more than term life.

AIG Guaranteed Issue Whole Life Insurance

Sometimes called final expense insurance, guaranteed issue whole life insurance isn’t limited to a specific period of time. Instead, the policyholder is guaranteed benefits upon death so that their family can pay for funeral costs and other final expenses. If you want AIG life insurance for seniors with serious medical concerns, a guaranteed issue whole life plan is probably your best choice.

AIG offers this type of insurance to anyone between the ages of 50 and 85. Policyholders don’t have to have a medical exam to get coverage, but you do have to be over the age of 50 to qualify. Many people prefer no-exam life insurance simply since they don’t need to visit the doctor.

You can purchase between $5,000 and $25,000 worth of coverage based on your family’s financial needs and how much you can afford to pay.

You can also convert a term life insurance policy into whole life insurance at the end of the term or when you turn 70, whichever comes first. If you’re interested in this type of coverage, you can find the AIG guaranteed issue whole life insurance brochure online.

AIG Universal Life

Like whole life insurance, universal life insurance offers coverage throughout the course of your life and provides benefits to your loved ones upon your death. However, you may be able to adjust your premium amounts and death benefits over time. In addition, universal life insurance contains a cash value element.

Premiums are calculated based on the costs associated with your death, such as funeral costs and the cash value element. When you pay your premiums, cash paid in excess of your death costs earns interest. You can withdraw some of the cash value of your policy at any time, although you’ll have to pay taxes on the withdrawals.

AIG Index Universal Life

Index universal life insurance works by investing the cash value portion of your life insurance policy into a well-known index account such as the S&P 500. AIG offers two options for this type of life insurance policy.

Value+ Protector focuses on protecting your investment. According to AIG:

Value+ Protector is a protection-focused index universal life product that combines many of the advantages of guaranteed universal life insurance, but with special features and interest crediting strategies that are designed to reduce costs and help deliver maximum value.

Max Accumulator+ is designed to maximize your earnings through investments. This product functions similarly to a retirement account in that your money is invested to grow the worth of the account.

AIG Variable Universal Life

Variable universal life insurance allows you to invest the funds paid into insurance into the insurance company’s investment fund. The value of the insurance policy fluctuates with the market.

AIG recommends variable universal life insurance for experienced investors.

The benefit of this type of insurance is that if you know the market well enough, you can invest funds wisely and provide far greater benefits to your loved ones after your death than you would with other types of life insurance policies.

AIG has one such plan available. The company offers information for investors on its website about its investment fund’s performance.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

AIG Life Insurance Riders

AIG offers an accelerated benefit rider for policyholders who purchase Quality of Life insurance. This rider allows policyholders to receive benefits while they’re still alive, under certain conditions:

- The policyholder has a chronic illness that significantly impacts their ability to function in their day-to-day life.

- The policyholder is diagnosed with a terminal illness and is expected to live no more than 24 months.

This rider allows the policyholder to claim benefits ahead of their death by filling out a form documenting the illness and their intention to use the benefits as stated in the rider.

For other possible riders like the AIG terminal illness rider or AIG long-term care insurance, make sure to ask a representative. Some riders are available in some states but can be hard to find elsewhere.

How AIG Calculates Life Insurance Rates

If you’re wondering what factors affect your rate, the answer is: it depends. AIG reviews say that, like other insurance companies, American General takes a wide range of factors into account when determining rates.

However, there are several common factors that are likely to affect your rate.

Demographics

One of the primary factors that affect life insurance rates is age. The older you are, the more likely you are to die, since everyone succumbs to an illness or accident eventually. Thus, older people must pay higher premiums than younger people because it’s more likely that their beneficiaries will need to file a claim.

Gender is also a factor because women live an average of five years longer than men. Thus, AIG life insurance policies for women usually have lower rates.

Finally, AIG considers marital status when determining life insurance rates. Married people often live longer than single people, so those who are married tend to have lower rates than those who are divorced, widowed, or single. Life insurance divorce rates tend to be just a bit higher.

Current Health and Family Medical History

Your current health is a primary consideration because serious health problems could lead to an early death.

With the exception of the Guaranteed Whole Life Insurance product, AIG requires potential policyholders to undergo a medical examination as part of the life insurance process. During this examination, you’ll have your cholesterol level, blood pressure, and other vital indicators of health tested. Getting life insurance with high cholesterol is still possible with AIG.

AIG underwriters will also have access to your prescription records regardless of whether you’re required to take a medical exam. Underwriters can also look at Medical Information Bureau records.

MIB records are not your past medical records, which are confidential. However, when you apply for insurance or other applicable services, you’re required to consent to MIB being given encrypted medical information. Underwriters then can access this information to help them determine the level of risk related to insuring you.

Having serious health problems obviously will raise your rates. AIG also considers smoking to be a risk factor. Life insurance for smokers or those who use e-cigarettes will have higher rates than those who don’t.

High-Risk Occupations

If your occupation presents regular risks to your health or well-being, your policy rates will be higher. For example, pilots, people who do stunts for a living, or police officers are at higher risk of death than people who work behind a desk in an office.

High-Risk Habits

If you engage in high-risk recreational activities or have certain unhealthy habits, your premiums will be higher because of the increased risk to your life.

Hobbies such as skydiving are considered high-risk, as are activities such as smoking or using recreational drugs. If you have a history of drug abuse, you may also have to pay higher premiums. Drug abuse is a big red flag for life insurance companies.

In addition, your driving record can, surprisingly, affect your rate. If you have a poor driving record, particularly if you have DUIs, license suspensions, or lots of accidents, you’re considered a high risk of dying in a car accident.

Veteran or Active Military Status

Being in the military can put you at a higher risk of death, especially if you are on combat duty or are stationed in a war zone.

Similarly, your veteran status can affect your rates. Many veterans have service-related disabilities that affect their mental and physical health.

How to Get the Best AIG Rates

When shopping for the best rate, remember that rates tend to change from state to state. NAIC suggests model laws for each state to follow. However, insurance rates are always regulated at the state level. This allows state commissioners to create regulations that best serve those living in their state.

For example, in New York, rates are determined by three factors: mortality, interest earnings, and expenses related to running an insurance company. Other states may or may not determine rates using these same factors.

In general, determining your life expectancy will be the biggest factor in calculating your rate. As discussed above, your general health, your habits, and your occupation all play a role in life expectancy.

Term life insurance is usually cheaper than whole life insurance. However, you need to think about how a death benefit works when you finally need it. Regardless of how cheap your monthly premiums are, it won’t help your family if you die after the policy expires.

In addition, buying life insurance when you’re younger is usually cheaper. Because age is such an important aspect of life expectancy, your rate will always be higher if you buy as an older person even if you purchase a shorter-term policy.

The best ways to save with AIG include:

- Taking care of your health: The healthier you are, the lower your rate is going to be. So make sure you see your doctor for regular checkups, eat healthily, and maintain a healthy body weight.

- Avoiding smoking: Smoking is a health risk, and thus, smokers must pay higher rates. If you’re a smoker, quitting can help protect your health as well as save you money.

- Being responsible with your payments: Late or missed payments can generate late fees and cause lapses in coverage, so be sure to pay on time every month. You can make a payment by phone, online, or in person. Whenever you make phone payments, make sure to call in time for the payment to process so you will not be late.

- Buying the correct amount of life insurance: Consider your options and purchase the best plan for you and your family. If you decide later that you need more coverage, changing your plan can be costly, and you may end up needing supplemental insurance coverage.

- Buying sooner rather than later: Again, the older you are, the more you will pay for your premiums. American General life insurance company reviews repeatedly state that the earlier you start shopping, the better.

AIG prides itself on offering customized, flexible plans to meet the needs of diverse families. Thus, in theory, it provides the best rate for everybody.

In practice, however, AIG offers better rates to younger policyholders, stressing in an informational blog post that the younger you are, the less you are likely to pay.

Although AIG takes health risks into account when underwriting policies, it’s considered one of the best life insurance companies for people with chronic illnesses, such as diabetes or other health conditions.

Its Quality of Life flexible insurance plan provides an affordable option for people in this situation. The accelerated benefits rider helps mitigate health care costs. In addition, older people with health issues can get coverage via the Guaranteed Whole Life Insurance plan.

AIG Sample Life Insurance Monthly Rates for Male Non-Smoker

| Age | $100,000/10-Year | $100,000/20-Year | $250,000/10-Year | $250,000/20-Year |

|---|---|---|---|---|

| 25-Year-Old Male | $10.03 | $10.94 | $10.34 | $12.90 |

| 30-Year-Old Male | $10.03 | $10.94 | $10.34 | $12.97 |

| 35-Year-Old Male | $10..64 | $11.17 | $11.67 | $13.53 |

| 40-Year-Old Male | $12.48 | $14.14 | $13.81 | $18.12 |

| 45-Year-Old Male | $14.86 | $17.59 | $17.95 | $28.28 |

| 50-Year-Old Male | $17.01 | $26.16 | $25.86 | $41.68 |

| 55-Year-Old Male | $26.62 | $37.26 | $41.68 | $69.89 |

| 60-Year-Old Male | $38.22 | $55.75 | $63.70 | $124.42 |

| 65-Year-Old Male | $55.07 | $99.29 | $113.71 | $207.35 |

While the table above offers sample rates for non-smoker males, AIG offers a range of rates based on your age, gender, and type and amount of coverage you are purchasing. Keep in mind that the rates in the above table are sample rates only; your quote may differ based on these and other factors.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

AIG Financial Tools

AIG offers some resources for policyholders via its website, including:

- A blog containing articles about what life insurance is, why it’s important, and how to determine how much you need

- A calculator that allows you to input basic information and get an idea of what you’ll pay for various life insurance products

The homepage of AIG’s website also includes links to its annual financial reports, which help both investors and potential policyholders understand how stable the company’s finances are, and news and interviews of interest to investors.

Canceling an AIG Life Insurance Policy

Hopefully, you’ll purchase a policy that works for you so you won’t have to cancel. Unfortunately, though, sometimes people do end up having to cancel. If your policy isn’t meeting your needs or your financial circumstances make it unaffordable, you need to know how to cancel your policy.

Term life insurance policies are generally easier to cancel, but you should be able to cancel any policy by contacting AIG. If your coverage no longer meets your needs, you might also consider converting a term life insurance policy to a whole life insurance policy or changing the amount of coverage you’re paying for.

Compare Quotes From Top Companies and Save Secured with SHA-256 Encryption

AIG may also cancel a Select-a-Term policy if you don’t convert it by the end of the term of coverage or if you fail to pay your monthly premium. If you’re concerned about your policy, you can always call the American General life insurance phone number for more information.

How to Cancel AIG Life Insurance

In general, if you have a term life insurance policy, you can cancel it by not paying your premium. However, this isn’t recommended because it can hurt your credit.

Instead, the best way to cancel your American International Group Life Insurance policy is to contact AIG and request that it be canceled. You may or may not get a refund. Some AIG policies offer a cash surrender, which is the money the policy pays you if you cancel the policy.

To cancel your life insurance policy with AIG, take the following steps.

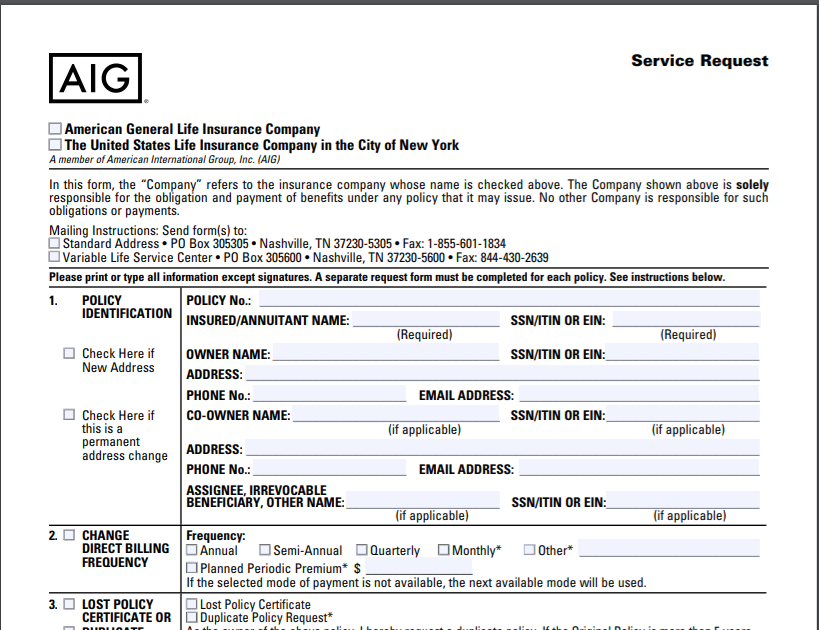

#1 – Download the Form

Download the cancellation form from AIG’s website.

#2 – Fill Out Sections 1 and 7

The form you need to fill out looks like this, and having your American General life insurance policy information on hand will make things easier.

You only need to fill out the first and last sections

#3 – Mail the Form to the Correct Address

The form has two addresses listed on top. If you’re trying to cancel universal life insurance, send it to the bottom address. Otherwise, send it to the top address.

#4 – Contact AIG Customer Service

Contact AIG’s customer service at (888) 475-2452 (or 800-340-2765 if you have universal life insurance) to find out what additional forms are required. Request any additional forms. You can also talk to your representative about other options, such as lowering your monthly premium amounts, if you don’t want to cancel outright.

#5 – Fill Out Additional Forms (When Necessary)

Fill out all additional forms. Make a copy for yourself before sending them back to AIG in the mail.

Double-check your bank statements to make sure that premiums don’t continue to be processed from your bank account. If a premium has been processed in error, contact AIG.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

AIG Life Insurance Claims Process

When a loved one dies, you might not feel like dealing with the financial aspects of death while in the throes of grief. But you need to file your claim with AIG right away so that you can get the benefits you’re entitled to and reduce the financial pressure during this difficult time.

Luckily, AIG direct life insurance reviews state the company is generally quick to resolve claims and send death benefits to a beneficiary. Follow the steps below to file an AIG life insurance claim.

#1 – Obtain a Certified Copy of the Death Certificate

The procedure for obtaining a death certificate differs by state. Contact your state’s Department of Vital Records to find out what you need to do and how to get copies of the certificate.

Request at least two copies of the death certificate so that you can retain a copy for your records.

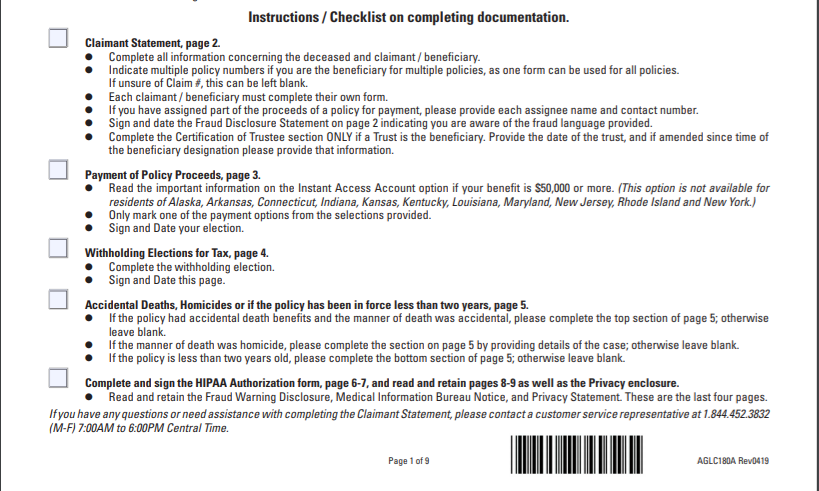

#2 – Download and Fill Out the Claimant Statement Form

You’ll file your claim using the Claimant Statement form, which you can get online.

When you fill out this form, if there are multiple beneficiaries, each beneficiary must file their own claim. Also, if a trust is a beneficiary, you must fill out the Certification of Trustee section.

#3 – Sign the Fraud Disclosure Statement

Make sure you sign the Fraud Disclosure Statement included with this form to indicate that you are aware of the penalties for fraud.

You may need to fill out additional forms included with the Claimant Statement, including forms related to withholding taxes and

#4 – Return the Signed Forms Along with All Necessary Documents

Attach a copy of the death certificate, a copy of the policy, and copies of any obituaries or death notices in your local newspaper to the Claimant Form and Fraud Disclosure Statement.

If you have Quality of Life Insurance and are filing a critical illness claim rather than a death benefit claim, fill out this form and return it to AIG.

On average, it takes about a week to receive your payout once you’ve filed your claim, according to AIG Direct. However, it may take longer if your claims representative has any questions while processing the claim.

Getting an AIG Insurance Quote

When you’re ready to buy life insurance, your next step is to find out how much it costs. AIG makes it easy to get a life insurance quote. You can use the same site to get the cheapest life insurance quotes from AIG Direct.

#1 – Go to AIG.com

You can find information about all of AIG’s products on its life insurance webpage. Read through the descriptions of each type of coverage and find the one that most interests you.

#2 – Click the Quote Button to Go to the Quote Request Form

Each life insurance product has a blue button marked “Quote” next to it. Click that button to request a quote. This will bring you to a page that has a quote request form.

#3 – Fill Out the Request Form

The request form will require you to provide your personal contact information as well as indicate how much coverage you want to purchase (e.g., $250,000).

The info you’ll need includes:

- Identifying information, such as your full legal name, date of birth, and legal gender

- Contact information, such as phone numbers you can be reached at and your email address

- Health information, such as your height, your weight, and whether you use nicotine products

- Your desired coverage amount. AIG offers between $100,000 and $2 million worth of coverage

These are just some basic details to help AIG get you an estimate.

#4 – Receive a Call or Email from AIG

An AIG representative will call or email you to discuss your needs and give you a quote.

AIG Mobile Service

AIG does not have a mobile application, so both mobile and desktop users must access information via their web browser.

Information about life insurance is easy to find on AIG’s home page.

The easiest way to get to what you’re looking for is to click on the link for life insurance halfway down the page. Don’t scroll further down, as you may be overwhelmed with the sheer amount of information for investors, customers, and potential customers that is mixed together at the bottom of the page.

Once you access this page, everything is straightforward. You can request a quote, learn about different products, or access needed forms.

You can also access a calculator to help you determine how much coverage you need by clicking on the link on the right-hand side of the top of the page.

If you don’t want to have to click through to the correct page from the AIG homepage, bookmark this site: https://www.aig.com/individual/insurance/life.

Finding the page is even easier from mobile, as you’ll see a button that says LIFE INSURANCE as soon as you browse to the homepage. Once you browse to the life insurance page, just scroll to find what you are looking for.

While most information is easy to find either on desktop or mobile, AIG’s web design can be infuriating if you’re looking for information such as how to cancel or modify your policy.

There is a button for contacting AIG that will take you to a list of needed phone numbers, and there is an e-services area that members can log into. This area offers needed forms and allows you to make payments or claims online. However, there are no publicly available links to information about modifying or canceling your policy.

In addition, AIG doesn’t offer live chat with representatives on its website, so you have to call AIG if you have a question or problem that you can’t find the answer to while browsing the site.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Pros and Cons of AIG Life Insurance

To summarize, here is a list of AIG’s pros and cons.

Pros of AIG Life Insurance

- AIG offers a large number of policies, which means you can find the appropriate coverage for nearly any situation.

- The accelerated benefit rider allows policyholders with chronic or terminal illnesses to get the coverage they need for themselves and their families.

- AIG has subsidiaries all over the world, so you can get coverage no matter where you’re based.

Large companies offer added convenience for policyholders since they can continue to provide coverage if you move.

Cons of AIG Life Insurance

- AIG’s website is not particularly user-friendly, and it can be difficult to figure out how to do what you need to do.

- AIG is not a top-10 company, financially speaking, so there is a risk that the company won’t be able to pay out claims as required.

- Some reviewers have reported long wait times or difficulty resolving problems via the customer service department.

AIG Life isn’t perfect – no company is. It’s up to you to decide if the good outweighs the bad.

AIG Life Insurance Company History

In 1919, American Cornelius Vander Starr established Asiatic Insurance Underwriters in Shanghai, China. The company’s first U.S. office opened in New York in 1926, and by 1939, New York City was its center of operations.

Compare Quotes From Top Companies and Save Secured with SHA-256 Encryption

The company became known for its support of soldiers and veterans during and after World War II, as well as opening offices all over the world during this time. It officially changed its name in 1967 when it was incorporated in Delaware. AIG has been providing life insurance since the early 2000s when it acquired American General Corporation.

Some highlights of AIG’s long history:

- During World War II, C.V. Starr corresponded personally with the families of employees being held in internment camps so they would know their loved ones were safe. Starr was also an early committed supporter of the Marshall Plan, which provided financial assistance to areas devastated by the war after it was over.

- AIG acquired Globe and Rutgers Insurance Group in 1952, allowing it to greatly expand its presence in the U.S. market.

- During the 1962 World Series, AIG provided travel insurance for the New York Yankees to protect players in the event of a travel accident.

- In the 1970s, AIG was a leader both at home and abroad. It provided insurance for construction workers who were building the Metro system in Washington, D.C. as well as being the first American insurance company to do business with the People’s Republic of China.

- AIG has been working with its partners in Asia to develop road safety programs since 2013.

With all of these highlights, there have also been some not-so-great incidents. What went wrong at AIG? AIG got carried away lending at one point. However, they seem to be rebounding well after going through some financial turmoil.

AIG continues to make changes. The Wall Street Journal recently highlighted AIG with their article, “American International Group to Divest Life-Insurance Business”. The article opens up on AIG’s efforts to use subsidiaries for life insurance products.

AIG’s Market Share

AIG’s market share has remained relatively steady between 2016 and 2018. In all three years, it has held about 2 percent of the market share and earned more than $3 million each year. Its NAIC ranking slipped slightly in 2018, however, and it was ranked 14th in the nation rather than 12th.

AIG Market Share (2016-2018)

| Year | Rank | Market Share |

|---|---|---|

| 2016 | 12 | 2.19% |

| 2017 | 12 | 2.12% |

| 2018 | 14 | 2.04% |

American International Group is an international company based in Delaware with offices and subsidiaries throughout the world. Its subsidiaries include:

- AIG Aviation Inc. – Georgia

- AIG Bulgaria Insurance and Reinsurance Company EAD – Bulgaria

- AIG Claim Services, Inc – Delaware

- AIG Credit Corp – Delaware

- AIG Equity Sales Corp – New York

- AIG Federal Savings Bank – Delaware

- AIG Finance Holdings Inc – New York

- AIG Financial Advisor Services, Inc – Delaware

- AIG Financial Products Corp – Delaware

- AIG Funding, Inc – Delaware

- AIG Global Real Estate Investment Corp – Delaware

- AIG Global Trade and Political Risk Insurance Company – New Jersey

- AIG Golden Insurance Ltd – Israel

- AIG Life Insurance Company – Delaware

- AIG Life Insurance Company of Canada – Canada

- AIG Life Insurance Company of Puerto Rico – Puerto Rico

- AIG Marketing, Inc – Delaware

- AIG Memsa, Inc – Delaware

- AIG Private Bank Ltd – Switzerland

- AIG Retirement Services Inc – Delaware

- AIG Technologies, Inc – New Hampshire

- AIGTI Inc – Delaware

- AIG Trading Group Inc – Delaware

- AIU Insurance Company – New York

- AIU North America, Inc – New York

- American General Corporation – Texas

- American Home Assurance Company – New York

- American International Insurance Company of Delaware – Delaware

- American International Life Assurance Company of New York – New York

- American International Reinsurance Company, Ltd. – Bermuda

- American International Underwriters Corporation – New York

- American International Underwriters Overseas, Ltd. – Bermuda

- American Life Insurance Company – Delaware

- AIG Life (Bulgaria) Z.D. A.D – Bulgaria

- ALICO, S.A – France

- American Life Insurance Company (Kenya) Limited – Kenya

- Pharaonic American Life Insurance Company – Egypt

- AIG Life Insurance Company (Switzerland) Ltd. – Switzerland

- American Security Life Insurance Company, Ltd. – Lichenstein

- Birmingham Fire Insurance Company of Pennsylvania – Pennsylvania

- China America Insurance Company, Ltd. – Delaware

- Commerce and Industry Insurance Company – New York

- Commerce and Industry Insurance Company of Canada – Ontario

- Delaware American Life Insurance Company – Delaware

- Hawaii Insurance Consultants, Ltd. – Hawaii

- HSB Group, Inc. – Delaware

- National Union Fire Insurance Company of Pittsburgh, Pa – Pennsylvania

- NHIG Holding Corp. – Delaware

- Pharaonic Insurance Company, S.A.E – Egypt

- The Philippine American Life and General Insurance Company – Philippines

- Risk Specialist Companies, Inc. – Delaware

- United Guaranty Corporation – North Carolina

AIG has held onto a small but stable corner of the market over the past three years, having been ranked between 12th and 14th in the country for market share. American General’s average market share, as noted above, is about 2 percent.

Although its market share slipped slightly in 2018, Moody’s and Standard and Poor’s both rate AIG as a fairly financially stable company.

Fortune suggests that AIG’s financial issues are related to the amount of debt it carries and backs up Moody’s and Standard and Poor’s assertions that this company is only a moderate risk for investors and consumers.

For policyholders, this means that there is only a slight risk that AIG will not have the assets needed to pay out claims in a timely manner, but that this eventuality is not likely.

AIG Premiums Written

| Year | Premiums Written |

|---|---|

| 2016 | $3,404,569,801 |

| 2017 | $3,479,171,719 |

| 2018 | $3,336,397,453 |

AIG sold slightly more premiums in 2017 than in 2016, but the number of premiums written fell slightly again in 2018, which is what accounts for the company’s rank falling from 12 to 14 in 2018. This is important because the number of premiums written translates to the number of policies sold.

The more premiums AIG writes in a year, the more money it takes in meaning that it’s more likely to pay out dividends to policyholders as needed.

AIG’s premiums written are in the $3.3 billion range, slightly below MetLife, which holds the number 10 spot in market share. In comparison, Northwestern Mutual, which has the biggest portion of the market share, writes over $10 billion worth of premiums each year.

AIG Market Share Comparison

| Rank | Company | Market Share |

|---|---|---|

| 1 | Northwestern Mutual | 6.42% |

| 2 | Metropolitan | 6.00% |

| 3 | New York Life | 5.68% |

| 4 | Prudential | 5.57% |

| 5 | Lincoln | 5.36% |

| 6 | Massachusetts Mutual | 4.19% |

| 7 | Aegon US | 2.94% |

| 8 | John Hancock | 2.83% |

| 9 | State Farm | 2.83% |

| 10 | Minnesota Mutual | 2.70% |

| 14 | AIG | 2.04% |

Three companies at the bottom of the top 10 hold a similar percentage of the market share to AIG. This is unsurprising, considering that AIG is ranked 14th in the nation in terms of market shares. However, AIG is far less competitive with companies such as Northwestern Mutual, which has over 8 percent of the market.

AIG had a net loss of $6 million in 2018. This represents a 99.9 percent decline in income over 2017. While this doesn’t sound like great news, AIG is in a far better position than it was in 2017, when its net loss was over $6 billion.

The company is on the upswing and is more likely to be able to pay out claims than it has been in the past. These losses also occurred during the same period of time in which the insurance industry as a whole earned about $9 billion less than it had during the prior year. Despite its losses, AIG paid out a substantial number of benefits and dividends to policyholders and stockholders.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

AIG’s Position for the Future

AIG’s share of the market has been steady since 2016, suggesting that the company is financially stable and will continue to be so in the future.

The company went through a restructuring in 2018, replacing its CEO and bringing on new members of its board of directors. This restructuring was aimed at helping AIG increase its sustainability, which is a measure of its expected continued financial success.

According to its annual letter to shareholders, AIG’s profitability increased in the fourth quarter, and its stock is rising in value as of December 2019. This is an improvement over December 2018, where American International Group’s stocks reported net losses of $1.41 per share.

However, AIG’s stock gain of 0.42 percent is modest compared to the gain of 1.36 percent by MetLife, which currently holds the No. 10 spot in terms of market share.

AIG’s Online Presence

AIG’s website provides information about its insurance products, including life insurance, as well as providing a members-only area where policyholders can make payments or file claims. AIG’s life insurance page also provides useful information for potential policyholders, such as articles about how to determine how much life insurance you need to buy.

The website is dedicated to helping you find appropriate products, as well as helping current policyholders manage their policies and/or file claims. The homepage, however, can be confusing or overwhelming for new customers, as it also contains news about the company and information for investors.

The easiest way to learn about AIG’s life insurance policies is to visit the life insurance page directly, which is focused solely on providing information about life insurance options.

AIG does not provide live chat with agents on its website, although customers can download enrollment and other forms online. AIG’s phone number, fax number, and mailing address are listed on the site for potential and current policyholders who need to contact the company.

AIG Commercials

AIG’s commercials offer consumers advice and help in protecting their assets and their finances.

This info-driven marketing approach demonstrates AIG’s commitment to helping policyholders safeguard their financial future. However, none of its current commercials are dedicated specifically to life insurance. Instead, AIG offers advice about topics such as paying down your student loan debt and protecting your property from natural disasters.

AIG also has a line of commercials featuring the U.K. All Blacks rugby team. This line of commercials uses voiceover narration from a member of the team to encourage people to do things for their loved ones. The All Blacks AIG logo is front and center on their jersey, becoming a staple in recent years.

These commercials are life insurance specific and take a more inspirational tone, which may help people see buying life insurance as something positive to do for their loved ones. This can be helpful for those who find the subject of end-of-life planning to be depressing.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

AIG and the Community

AIG is active in the international communities it serves, particularly communities affected by natural disasters such as wildfires, droughts, or floods. It has partnered with Rise Against Hunger since 2014 to help reduce world hunger in areas afflicted by these problems.

Employees can volunteer at any time of the year to help with Rise Against Hunger. AIG often sponsors events in its various offices in which teams of employees compete to see who can package the most meals for those in need within a given period of time.

In April 2018, AIG held 12 such events as part of Global Volunteer Month and packaged over 225,000 meals. In its London office alone, AIG was able to package 50,000 meals in one day.

AIG is also committed to protecting and sustaining the environment. It advises companies around the world about how to conduct business in an environmentally conscious manner and has achieved astounding results such as:

- A reduction of 34 percent in utility usage and carbon emissions across its UK and NYC offices

- Recycling of over 40,000 devices through its asset return program

- A reduction of 47 percent in document life cycle costs from 2015 to 2018

AIG has also invested over $2.8 billion in renewable energy products.

AIG’s Employees

Niche’s surveys show that 60 percent of employees stay with AIG for two to five years. Employees enjoy a number of perks, including flexible work hours and an on-site gym.

Employees also receive excellent health care coverage and retirement benefits, and the majority of employees are satisfied with their vacation time, sick time, and family leave time. Best of all, 80 percent of employees feel their work makes a positive impact on the world.

Compare Quotes From Top Companies and Save Secured with SHA-256 Encryption

Based on reviews at Glassdoor.com, AIG has an average rating of 3.1 out of five stars, and 48 percent of employees would recommend the company to a friend. The majority of employees feel that AIG offers them a good work-life balance and worthwhile benefits, although some employees feel it is difficult to get approval from senior management for projects.

AIG is also committed to creating and maintaining a diverse workforce.

“At AIG, we believe that diversity and inclusion are critical to our future and our mission – creating a foundation for a creative workplace that leads to innovation, growth, and profitability.” (AIG About Us page)

The company is featured on DiversityInc’s 2019 Top 50 Companies for Diversity and Top Companies for Women Executives lists and has received a score of 100 percent on the Human Rights Commission’s Corporate Equality Index, a measure of LGBTQ inclusivity, for eight years in a row.

Awards AIG has received include:

- Water Street’s Corporate Diversity Champion Award – 2018

- Gold Award, LGBT Index in Japan – 2016, 2017, 2018

- Human Rights’ Commission Best Places to Work Award – 2019

- DiversityInc Top 50 – 2019

- Business Insurance Innovation Awards – 2018

- National Intern Day Top 100 Programs for Interns – 2018

- Canada’s Top Employers for Young Professionals – 2019

The AIG awards will most likely keep coming as they solidify their financial standing.

Get AIG Life Insurance Today

AIG is a fairly solid company that offers a range of options for coverage. This company’s biggest strength is its dedication to offering products to meet customers’ needs regardless of their unique circumstances.

The Quality of Life insurance product is especially geared toward protecting people who are facing major life changes, and you have lots of options for coverage length and amounts if you go with a more traditional term life insurance, as well.

You may want to talk to an AIG agent to get even more information. However, you can always take advantage of our resources to start comparing rates. Start today by using our free quote tool below to compare AIG life insurance quotes.

Frequently Asked Questions

Am I too young to purchase life insurance at AIG?

By law, anyone over the age of 18 can purchase life insurance for themselves. However, parents can purchase policies that cover their needs should a minor succumb to a tragic illness or accident. In general, financial experts suggest purchasing life insurance before your 35th birthday to get optimal rates. However, AIG offers a range of products for adults of all ages, and anyone over the age of 18 and younger than the age of 95 may qualify.

I’m single and have no plans to get married or start a family. Does AIG have a life insurance option that makes sense for me?

AIG offers several life insurance options that might fit the needs of a single person who has no dependents.

- Term life insurance can cover you for up to the next 30 years so that if something were to happen to you, your family wouldn’t have to worry about paying for your burial/funeral expenses.

- Whole life insurance might still be an option for you. If you’re over 50, you qualify for this type of policy and can designate anyone you want as your beneficiary.

- If you want to invest funds so you can leave money to friends or family after you die, you may consider universal life insurance.

The bottom line is that everyone’s situation is different, and even if you have no dependents and don’t plan to ever have any, you might need to provide funeral costs or want to provide benefits to friends or family even though you are not responsible for financially providing for them.

What options does AIG have for someone who prefers to do things using mobile technology?

Although AIG doesn’t have an app, most areas of its website work well with mobile browsers. You can also service your policy online via AIG’s website. E-services allow you to view and change policy details, make payments, and update your contact info.

How do I figure out how much coverage I need?

Everyone’s situation is different, so you’ll want to discuss your options with your financial advisor and your family before you make a decision. However, AIG has a calculator on its site that you can use to help you decide how much coverage to purchase.

What is AIG Select-a-Term?

AIG Select-a-Term is a term life insurance policy offered by AIG. It allows policyholders to choose the length of their coverage, typically ranging from 10 to 35 years, based on their specific needs.

Can you cancel an AIG Life Insurance policy?

Yes, you can cancel an AIG Life Insurance policy. However, the process may vary depending on the specific policy and state regulations. It is recommended to contact AIG’s customer service or your insurance agent for guidance on the cancellation process.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.