Cigna Life Insurance Review (Companies + Rates)

Our Cigna Life Insurance review finds that Cigna is primarily a health insurance company, but also offers individual term life insurance and several group life insurance options through employers. Cigna whole life insurance quotes start at $28 per month. Cigna life insurance rating from the BBB is an A+.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Feb 7, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Feb 7, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Key Info | Company Specifics |

|---|---|

| Year Founded | 1792 |

| Current Executive | CEO - David M. Cordani |

| Number of Employees | 73,800 |

| Total Sales / Total Assets | $48,650,000,000 / $153,226,000,000 |

| HQ Address | 900 Cottage Grove Rd. Bloomfield, CT 06002 |

| Phone Number | 1-860-226-6000 |

| Company Website | www.cigna.com |

| Premiums Written - Individual Life | $1,844,300,957 |

| Financial Standing | $2,637,000 |

| Best For | Group Life Insurance, Individual Whole Life Insurance |

Have you heard of Cigna? If you’ve been researching cheap life insurance options, the chances are you have.

Cigna is primarily a health insurance company, but it does offer individual whole life insurance policies and several group life insurance options through employers. These policies provide families with financial peace of mind in the event of the policyholder’s premature death.

This company has offered life insurance almost from America’s inception. Today, it holds a small but steady corner of the life insurance market and is rated number 26 on the NAIC top 125.

Read on to learn more about what Cigna can offer you.

Ready to buy cheap life insurance? Get a FREE quote now using our online tool.

Cigna’s Ratings

Cigna is considered a fairly financially strong insurance company, as its revenues and net income continue to grow. It holds the number 26 spot in the NAIC top 125 life insurance companies by market share.

However, its main business is health insurance, and life insurance is supplemental. Thus, investors of this Fortune company are concerned that potential new legislation regarding drug prices and health coverage could hurt its financial standing.

It remains to be seen how, if these predictions come to pass, they could hurt Cigna’s life insurance offerings or ability to pay life insurance claims as needed.

A.M. Best

A.M. Best does not provide a specific rating for Cigna Life Insurance. However, it does give The Cigna Group, which is Cigna’s parent company, a rating of BBB. This rating means that A.M. Best considers Cigna a good credit risk and to be financially stable.

For policyholders, insurance companies need to be rated financially stable because the more stable the company is, the more likely it is to be able to pay out claims as needed.

Financial stability also means that it’s unlikely the company will close shop anytime soon, which might require policyholders to find a different insurance company.

Better Business Bureau (BBB)

In 2018, consumers filed 193 complaints against Cigna with the Better Business Bureau. The majority of these complaints had to do with their health insurance department.

Many consumers give Cigna a one-star review on the site because of problems related to not getting needed services covered or not being able to find a doctor or dentist in their area that Cigna would cover.

However, despite these complaints, the Better Business Bureau gives Cigna a rating of A+.

In addition, since most of the complaints relate to Cigna’s health insurance offerings, they may not be relevant to life insurance policyholders, who by and large appear to have no complaints.

Moody’s

Moody’s gives Cigna Corporation a rating of BAA2.

This means that it considers Cigna to be a moderate credit risk. In other words, Moody’s feels that Cigna is basically financially stable, but certain aspects of how it runs its business suggest the possibility that it could lose money.

This is of concern to policyholders because if Cigna can’t meet other financial obligations, it will delay paying out claims as needed.

Standard & Poor’s (S&P)

Standard & Poor’s gives Cigna an A- rating. However, it also gives the company a negative financial outlook.

S&P’s concerns are mostly about the possibility that Cigna could lose money or suffer a business setback.

However, S&P also reports that Cigna’s diversification of product offerings, including the fact that it offers life insurance, is a sign of potential financial strength.

This negative outlook is partially based on fears that Cigna’s health insurance division will be impacted by federal health care policy after the 2020 presidential election and may not apply to the life insurance division.

NAIC Complaint Index

NAIC reports that Cigna received only four complaints against its life insurance department. In contrast, the health insurance department received 130 complaints.

This backs up the Better Business Bureau’s findings that consumers’ unhappiness is mostly with Cigna’s health insurance, not its life insurance.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Company History

Cigna is one of the oldest insurance companies in the United States. It was originally formed as the Insurance Company of North America in 1792, less than 20 years after the American Revolution.

Shortly after its formation, INA became the first company in America to offer life insurance. At the time, it was a marine insurance company and insured a sea captain against death — and against being captured by pirates — during a sea voyage.

INA became well known in the late 1800s when it helped Americans after two disasters. It was one of the only insurance companies to pay out claims after the Chicago Fire of 1871, and it also paid out massive claims after a big earthquake in San Francisco in 1906.

In the early 20th century, Cigna switched its focus to health and accident insurance, both because Teddy Roosevelt was interested in providing Americans with public assistance to defray health care costs and because the invention of the airline, two World Wars, and other historical events increased the demand for these products.

Cigna changed its name in the early 1980s when INA merged with the company’s other division, Connecticut General Insurance. This merger allowed it to grow its health insurance offerings. It also acquired EQUICOR, a large employee-benefit provider company.

Over time, Cigna has become even more focused on health insurance than life insurance, selling its individual life insurance division to Lincoln National in 1998.

However, in 2002, it took its interest in life insurance international, entering the Chinese market for this product, and it currently offers group life insurance to employers and whole life insurance to individuals

Cigna’s Market Share

Cigna has held onto a small but consistent share of the market since 2016. It consistently ranks between 23 and 26 on the NAIC top 125 list.

However, its numbers show a slight downward trend from 2016 to 2018. In 2016, Cigna held about 1.3 percent of the market and wrote over $1.9 billion of premiums, while in 2018 Cigna held only 1.1 percent of the market and wrote a little over $1.8 billion worth of premiums.

| Year | Rank | Market Share |

|---|---|---|

| 2016 | 23 | 1.28% |

| 2017 | 26 | 1.18% |

| 2018 | 26 | 1.13% |

Cigna has a number of subsidiaries all over the United States. Some of the major subsidiaries include:

- Allegiance Life and Health Insurance

- American Retirement Life Insurance Company

- Benefits Management Corp

- Cigna and CMC Life Insurance Company Limited

- Cigna Behavioral Health, Inc

- Cigna Dental Health, Inc

- Cigna Health and Life Insurance

- Cigna Life Insurance Company of Canada

- Connecticut General Life Insurance

- Provident Health and Life Insurance Company

As mentioned above, Cigna has a small but steady corner of the market. This is good news for policyholders, as it demonstrates the financial stability needed to ensure that Cigna can pay claims as needed.

| Year | Premiums Written |

|---|---|

| 2016 | $1,988,418,908 |

| 2017 | $1,935,034,657 |

| 2018 | $1,844,300,957 |

The number of premiums Cigna has written has fallen slightly from year to year. This is a problem because the more premiums Cigna writes, the more money it takes in — and it needs that money to be able to pay out life insurance claims.

Despite the reduction in the number of premiums written, however, Cigna continues to make a profit and to obtain medium-to-high credit ratings.

Thus, it’s unlikely that the company will close or lose so much money that it’s unable to pay out claims as needed.

Cigna’s premiums written are in the $1.8 billion range. In contrast, Northwestern Mutual, which holds the number one spot in the NAIC rankings, writes over $8 billion worth of premiums each year.

| Rank | Company | Market Share |

|---|---|---|

| 1 | Northwestern Mutual | 6.42% |

| 2 | Metropolitan | 6.00% |

| 3 | New York Life | 5.68% |

| 4 | Prudential | 5.57% |

| 5 | Lincoln | 5.36% |

| 6 | Massachusetts Mutual | 4.19% |

| 7 | Aegon US | 2.94% |

| 8 | John Hancock | 2.83% |

| 9 | State Farm | 2.83% |

| 10 | Minnesota Mutual | 2.70% |

| 26 | Cigna | 1.13% |

Cigna’s market share is far below the lowest company in the NAIC top 10 and it doesn’t look like that’s going to change any time soon since its market share and premiums written are going down from year-to-year.

However, these losses are offset by the fact that Cigna’s net income has grown from 2017 to 2018, while the industry as a whole lost income during this time period.

| Year | Cigna | Industry |

|---|---|---|

| 2017 | 21.1% | 7.0% |

| 2018 | 18.5% | -18.6% |

As this table suggests, Cigna’s net income is far more than the industry as a whole, suggesting that it has more financial strength than expected.

Cigna’s Position for the Future

Cigna’s share of the market is relatively stable, which bodes well for its future. This is probably why it gets moderate to high credit ratings from sites such as Moody’s.

As mentioned above, Cigna’s focus is primarily on its health insurance offerings. According to its annual letter to stockholders, Cigna merged with Express Scripts in 2018, which it expects will help it deliver personalized health care services to consumers.

This is mixed news for life insurance policyholders, as Cigna’s profits in the health insurance industry could trickle down to life insurance as well, but the lack of focus could indicate that Cigna plans to discontinue or reduce its life insurance offerings.

Disability and life insurance account for only 10.77 percent of Cigna’s total revenue — again, life insurance isn’t a primary interest for this company.

Considering that Cigna has already sold a large portion of its life insurance business to Lincoln Insurance, a top 10 performing company, and that most of its offerings are now in group life insurance plans, you can expect that its individual life insurance offerings will go by the wayside sooner or later.

However, Cigna offers employers group rates on insurance plans that often include both health and life insurance, so this segment is more likely to stick around.

Cigna’s Online Presence

Cigna’s home page offers information about all of the types of individual insurance plans it offers, such as health insurance and dental insurance.

The site offers links to various types of health insurance, but to get to information about individual life insurance, you must click on the link for “Other Supplemental Insurance.”

The homepage also offers information about group plans and informative blog posts about issues related to health, such as the effect of stress on health.

Cigna offers information about individual whole life insurance policies on its life insurance page.

The home page is geared toward potential policyholders. Information includes an explanation of what whole life insurance is, why you should buy it, and information about different available plans.

Cigna also has a page for employers to get information about group life insurance. This page offers employers information about group plans and ways to contact Cigna to get started.

Cigna does not offer live chat with agents on its website. However, you can fill out an online form if you have questions and an agent will get back to you.

Cigna’s Commercials

Cigna’s commercials are information-driven, which means that they focus on offering viewers the facts they need to make good decisions about life insurance.

For example, check out their commercial for term life insurance.

This commercial uses drawings to supplement the narrator’s explanations of what term life insurance is, how it works, and why you should purchase it.

This type of commercial fits Cigna’s branding as a company that wants to help consumers enjoy good health — including good financial health. While it’s not particularly inspirational in its tone, it does convey empathy by acknowledging that financial planning for your death isn’t a pleasant topic.

This commercial focuses on helping people live healthier and more financially secure lives by offering them the option of getting coverage for critical illnesses before they hit.

Cigna in the Community

Cigna considers corporate responsibility to be an important aspect of its business model.

It focuses its advocacy efforts on health, wellness, and the environment.

Cigna is currently involved in a five-year global initiative to promote good health among youth worldwide. Currently, this program is attempting to reduce childhood hunger.

To this end, Cigna has partnered with Blessings in a Backpack. This organization depends on volunteers to pack donated goods in backpacks for hungry children. All 70,000+ of Cigna’s employees have participated in packing backpacks for kids. This provides meals for more than 87,000 kids across the United States.

According to this video, Cigna has fed over one million children worldwide through its advocacy efforts.

Cigna is also involved in supporting many other initiatives to help kids maintain physical and mental health.

For example, it supports Girls On The Run, an after-school program that focuses on improving young girls’ lives through physical activity. This program also gives young girls something productive to do after school.

Finally, Cigna has been a leader in the movement for environmental sustainability. According to its corporate responsibility page:

As a global health service company, we recognize the connection between personal health and the health of our environment.

To this end, Cigna devotes time and resources to creating and implementing plans to run its business in an environmentally sustainable manner. Some of its programs include:

- Providing chargers for electric vehicles to promote the use of this type of vehicle by employees

- Purchasing renewable energy at energy auctions so that Cigna offices can be powered by wind, solar, or other renewable sources of energy rather than by coal, oil, or natural gas

- Shredding all unneeded documents and then recycling the shreds

Cigna’s Employees

According to Niche, 70 percent of Cigna’s 70,000+ employees are happy working for the company and a whopping 91 percent like the people they work with.

Cigna employees enjoy benefits such as the ability to work from home, flexible work hours, and tuition assistance if they want to go back to school to improve their job skills.

Employees also enjoy traditional benefits such as health care coverage, paid family leave time, and paid time off. About 65 percent of employees are happy with their benefits, and 70 percent say they are encouraged to take vacations each year.

According to Glassdoor.com, Cigna receives an average of 3.8 out of 5 stars in employee reviews, and 65 percent of employees would recommend Cigna to a friend. The majority of employees feel that flexible hours and the ability to work from home as needed help them achieve a suitable work-life balance.

Cigna is committed to diversity and has a Diversity and Inclusion Team that reports directly to the Executive Vice President. It’s especially concerned about ensuring that people with disabilities are included in its workforce.

Here is a brief interview with Cigna’s Chief Diversity Officer in 2014.

One of the primary ways that Cigna promotes diversity is by offering health care provider training for working with diverse populations. Current training modules include information about working with Asian, Hispanic, LGBTQ+, and African-American populations.

Awards Cigna has received include:

- Dow Jones Sustainability Index – 2018-2019

- Hunger Hero Award (Feeding Children Everywhere) – 2018

- Above and Beyond Award (Diversity Best Practices) – 2018

- Top 100 Best Corporate Citizens – 2014 – 2018

- 100 percent score on the Human Rights Campaign’s Corporate Equality Index – 2018

- 90 percent score on Hispanic Association on Corporate Responsibility’s Corporate Inclusion Index – 2018

- Best Places to Work for People With Disabilities – 2018

- Black Enterprise Top 50 Companies for Diversity – 2018

Shopping for Life Insurance

Cigna’s focus is on group life insurance policies that you can sign up for through your employer, although the company does also offer individual whole life insurance policies.

Whether you participate in a group life insurance policy or buy your own policy, buying life insurance is one of the most important purchases you’ll ever make. More than a third of people would feel the financial impact within a few months if a loved one were to pass away. Your life insurance policy will help protect your family from this possibility.

If you’re under the age of 35, you might think that you don’t need life insurance or that the cost is going to be prohibitive. But the truth is that everybody needs life insurance because you never know when a catastrophic accident or illness will occur.

Wondering whether Cigna’s life insurance offerings are right for you? Read on.

Coverage Offered

Cigna offers only one type of individual life insurance: term life insurance. However, you can get other types of life insurance via your employer.

| Product | Who Its Best For |

|---|---|

| Individual whole life insurance | People who want coverage for their families that is not tied to their employer |

| Group term life insurance - employer paid | Employers who want to offer basic term life insurance policies; employees who want to get life insurance coverage at work at minimum cost to themselves |

| Group term life insurance - employee contribution | Employers who want to offer the option of allowing employees to purchase term life insurance; employees who want customized term life insurance plans |

| Group universal life insurance | Employers who want to offer the ability to use life insurance as an investment plan/retirement plan; employees who want to take advantage of such a plan |

There are a variety of options for employers to choose from.

Employers can purchase basic term life insurance and provide it to employees, require employees to purchase their own life insurance on a group plan or provide a combination of the two types.

If you’re mostly concerned about saving money, basic term life insurance via your employer might be your best option. This option offers you life insurance for a specified period of time, and you don’t have to pay anything, as it’s fully covered by your employer.

Keep in mind, though, that term life insurance is time-limited. It only covers you for a specified period, so if you die after the policy expires, your family’s financial needs won’t be covered by this type of insurance.

If your family mainly depends on your income, you might be better off with a policy you pay for yourself so you can get a larger amount of coverage.

It’s often cheaper to pay for term life insurance via your employer. If you’re self-employed, don’t work outside the home, or otherwise don’t qualify for group insurance, you can also purchase whole life insurance via Cigna, which is a more permanent type of life insurance that covers your family no matter when a fatal accident or illness occurs.

Types of Coverage Offered

Life insurance isn’t Cigna’s main business and thus it offers a limited number of plans. In addition, you may be limited to the options your employer offers to employees.

Term

Term life insurance is a type of life insurance where you’re covered for a specific period of time, usually between 10 and 30 years, depending on the policy.

If you die during the coverage period, your family is entitled to benefits. These benefits can help cover burial and other final expenses and/or provide money for your family to live on for a certain period of time following your death.

Term life insurance policies only cover your family for a certain amount of time, but in some cases, you can convert them to whole life insurance policies after the coverage period ends.

Cigna doesn’t offer individual term life insurance policies. However, it offers two types of group term life insurance.

- Employer-paid term life insurance is completely paid for by your employer. You fill out enrollment paperwork, your employer submits it, and Cigna approves it. This is the cheapest option for you, as you won’t have to pay anything for coverage, but you may be limited as to how much coverage you can sign up for.

- Employee-contributed term life insurance requires you to pay some or all of the premiums yourself. Your employer takes your contribution directly out of your paychecks and forwards it to Cigna, so you never have to worry about missing a payment. This option is more expensive but may allow you to choose higher coverage amounts.

You don’t need a medical exam to qualify for group life insurance coverage through Cigna. This means that you can get coverage even if you have a pre-existing medical condition such as diabetes.

Whole

Unlike term life insurance, whole life insurance offers permanent coverage for policyholders — your family will be covered no matter when your death occurs.

Whole life insurance is the only type of insurance that Cigna offers for individuals; in fact, there is no group insurance option for this type of insurance.

You can purchase coverage ranging from $2,000 to $25,000, depending on your family’s financial needs. Your premium is guaranteed to remain the same every month regardless of fluctuations in the market.

To qualify, you must be between the ages of 50 and 85. You may be able to get a 5 percent discount if you and your spouse both purchase coverage.

After the third year of coverage, your policy begins to accumulate cash value. This cash value grows over time, allowing you to leave a greater amount of money to your beneficiaries after you die or withdraw some of the cash as needed while you’re still alive.

Cigna offers two different whole life insurance plans.

The Level Benefit Plan includes the Accelerated Death Benefit rider so that you can get benefits while you’re still alive if you suffer from a terminal illness.

Cigna does not say on its website what the criteria are for qualification for the Level Benefit Plan; however, it states that the Modified Benefit Plan is available for those who don’t qualify for the Level Benefit Plan.

| Type of Claim | Level Benefit Plan | Modified Benefit Plan |

|---|---|---|

| Non-accidental death (less than 2 years of coverage) | 100% of benefit amount | 110% percent of premiums paid |

| Non-accidental death (more than two years) | 100% of benefit amount | 100% of benefit amount |

| Accidental death (less than two years) | 100% of benefit amount | 100% of benefit amount |

| Accidental death (more than two years) | 100% of benefit amount | 100% of benefit amount |

The main difference between the two plans is that if you suffer a non-accidental death within the first two years of coverage, your family is fully covered under the Level Benefit Plan, while the Modified Benefit Plan provides your family with 110 percent of the premiums paid into it.

For example, suppose you purchased $25,000 worth of coverage and passed away from an illness eight months later. With the Level Benefit Plan, your family would be entitled to the entire benefit amount of $25,000, while the benefits would be substantially lower with the Modified Benefit Plan.

After two years, the coverage is the same under both plans, so this is only a consideration when thinking about the money your family will need if you pass away within the first 24 months of coverage. Find out how much whole life insurance costs.

Universal

Universal life insurance also guarantees you coverage throughout the remainder of your life. The main difference between universal and whole life insurance is that universal life insurance offers you flexibility. You can change your payment amount as needed as long as you cover your premiums, and any excess payment adds to the cash value of the policy.

Cigna offers universal life insurance at group rates through your employer. The policy is portable, which means that if you change employers you can continue to keep your coverage.

In addition, you earn interest on the cash value of your policy. Currently, Cigna’s universal life policies offer an interest of 4 percent on your cash value. You pay for it with pre-tax dollars, which means that you save money on your taxes if you purchase this type of policy.

Riders

Cigna offers several riders for policyholders who purchase an individual whole life insurance policy.

The Accidental Death to Age 100 rider covers policyholders should they suffer an accidental death before the age of 100. It ensures that your family will have the coverage they need if you die in an accident regardless of how much coverage you have.

The Terminal Illness Accelerated Benefits rider allows you to get life insurance death benefits while you’re still living if you find out you have a terminal illness. That allows you to get access to the cash you need to pay for medical treatment, hospice care, or other expenses related to your needs during this difficult time.

If you purchase the Level Benefit Plan, this rider is included at no additional cost.

Critical Illness riders allow policyholders to receive cash benefits to help them if they suffer a serious, life-threatening medical event such as a heart attack or stroke.

Cigna does not provide a critical illness rider for individual life insurance policyholders. However, it does offer additional types of supplemental insurance that act the same way as a critical illness rider:

- Lump Sum Heart Attack and Stroke Insurance offers you cash benefits to cover the cost of treatment if you have a heart attack, stroke, or other cardiological events

- Lump Sum Cancer Insurance provides cash benefits for people who are diagnosed with cancer, regardless of what stage cancer they’re suffering from

- Paid in cash directly to you. In contrast, health insurance makes payments directly to your treatment providers.

There are no critical illness riders attached to group life insurance policies.

Factors That Affect Your Rate

Like most insurance companies, Cigna takes a wide variety of factors into account when determining individual life insurance rates.

Group rates are calculated by considering how many employees are in the group. Premiums are also calculated by age — for example, anyone who is between 35 and 45 pays a certain amount for group life insurance.

Several factors are likely to affect your rates. Read on to find out more.

Demographics

Age is one of the primary factors influencing your life insurance rates.

While it may not be pleasant to think about, the fact is that the older you are, the more likely you are to die. For that reason, older people pay higher premiums than younger people.

Ideally, you want to purchase life insurance before the age of 35 to lock in low rates. But if you’re older than that, don’t despair. There are still plenty of cheap life insurance policies available even if you may need to pay more than you would have if you were younger.

Since women tend to live an average of five years longer than men, your gender is also often a factor in your life insurance rates. Women tend to be insured at lower rates than men.

Finally, many insurance companies consider your marital status when setting life insurance rates. Married people tend to live longer than single people, so if you’re divorced, widowed, or single, you’ll pay higher rates.

Current Health & Family Medical History

Both your own health and your family’s medical history are important factors to life insurance companies.

Medical history is a strong indicator of how likely it is that you’re going to develop a serious or fatal disease. Even if you’re healthy right now, if your parents or siblings have suffered from a serious illness such as cancer or heart disease, it’s more likely that you’ll eventually get this disease, too.

Personal and family medical history is so important that Cigna may require you to undergo a medical exam as part of the application process. During this exam, you’ll have your blood pressure, your cholesterol level, and other vital indicators of your health checked.

Cigna does not require that people applying for individual whole life insurance policies get a medical exam.

Regardless of whether you need a medical exam, Cigna’s underwriters will have access to your prescription records and your Medical Information Bureau records.

Your past medical records are confidential, so Cigna won’t have access to them.

However, whenever you apply for life insurance, you’re required to consent to giving MIB encrypted medical information about yourself.

Cigna’s underwriters can then access this information to help them determine your risk level before insuring you.

You’ll pay higher rates if you or a member of your immediate family has a serious health issue. In addition, smokers usually pay higher rates because of the health risks associated with this habit. Smoking e-cigarettes may also be considered a risk factor.

High-Risk Occupations

If your job presents regular risks to your life, you’ll pay higher rates for life insurance. For example, if you’re a stunt double, a pilot, or a police officer, you’ll most likely pay higher rates for life insurance than if you have an office job.

High-Risk Habits

Smoking is an example of a high-risk habit that could impact your life insurance rates, but it’s far from the only habit that could have this effect. In general, if a habit puts you at greater than average risk of death, your life insurance rates will go up.

Some examples of high-risk habits include:

- Skydiving

- Bungee jumping

- Racecar driving

In addition to these hobbies, you’ll face higher life insurance rates if you’ve ever had a substance abuse problem, even if you’ve been clean for years.

Your driving record can also impact your life insurance rate. If you’ve ever been arrested for driving under the influence or reckless driving, have had frequent accidents, or have more than your share of speeding tickets, your life insurance rate may be higher than if you have a clean driving record.

Veteran or Active Military Status

If you’ve ever served in the military, you’re probably going to have a higher life insurance rate than civilians do.

Military service can be hazardous, especially if you’re stationed in a combat zone, so active military members usually pay more for life insurance.

Veterans also pay higher rates because, unfortunately, some of them develop physical or mental health issues after returning from service that can affect their life expectancy.

Veterans who served in combat zones may have serious injuries, suffer from post-traumatic stress disorder or other mental health issues, or develop a serious illness as a result of exposure to chemicals while on active duty. Thus, they present a greater risk for insurance companies and will likely pay more for life insurance.

Getting the Best Rate with Cigna

Searching for the best insurance rate can be challenging because rates tend to change from state to state. Although NAIC offers model laws that each state can follow, ultimately, it’s up to that state to decide how insurance rates should be set.

For example, New York uses three criteria to establish insurance rates: mortality, interest earnings, and expenses related to running an insurance company. Other states may have similar or different criteria.

Usually, your life expectancy will be the determining factor in setting life insurance rates. States have different ways of calculating rates, but they often boil down to calculating the risk that you’ll die while insured.

Term life insurance is generally cheaper than whole life insurance. While Cigna doesn’t offer individual term life insurance policies, it might be worth checking into any Cigna group term life insurance coverage your employer offers.

Group insurance is often cheaper than individual insurance, and in some cases, your employer may pay the entire cost.

If you decide to get group term life insurance, however, remember that you only get coverage for a specific period of time. Consider carefully when you need the insurance, as it won’t do your family any good if you die after the policy expires.

You also want to buy your policy as soon as possible. The older you are, the more expensive life insurance tends to be, so to lock in lower rates you’ll want to get it now.

Since your insurance is most likely to be employer-based, you should consider what might happen if you leave your job. Group universal life insurance through Cigna is portable, which means that if you change jobs your insurance plan moves with you.

Group term life insurance through Cigna isn’t portable, which means that if you change jobs, you may lose your insurance policy. If you think you may be changing jobs, it’s best to purchase a shorter-term life policy.

However, remember that term life insurance only covers you for a specific period of time.

The best ways to save money on life insurance with Cigna include:

- Taking care of your health – The healthier you are, the longer you’re likely to live — and the lower your insurance premiums will be. Following a healthy diet, exercising, seeing your doctor regularly, and addressing any mental health concerns can help you save money on life insurance.

- Not smoking – Smoking is a high-risk activity that can cause serious health problems as well as raise your life insurance rates, and insurance companies like Cigna may consider e-cigarettes to be risky too. If you don’t smoke, don’t start, and if you do smoke, consider quitting.

- Being financially responsible – Make sure you pay any portion of your Cigna premium that you’re responsible for on time every month. Failure to pay can relate in late fees, and in some cases your policy may lapse and you may need to pay a reinstatement fee.

- Figuring out how much insurance you need before you buy – Do your research and figure out how much coverage you need, what plan is best for you, and how much it will cost you (as opposed to your employer) before you sign up. It’s easier and more cost-effective to get the right amount of life insurance in the first place than to have to change your plan after the fact.

- Buying as soon as possible – The older you are, the higher your rate is likely to be, so you’ll want to purchase life insurance sooner rather than later.

The majority of Cigna life insurance policies are group policies, making this company ideal for people who have stable employment and want to get life insurance through their jobs.

Individual whole life policies require you to be over the age of 50. If you’re considering retiring from your job, you might want to transition from a Cigna group policy to an individual whole life insurance policy.

Cigna’s Programs

Cigna’s homepage contains links to information about all of Cigna’s insurance programs. Because Cigna is mostly focused on health insurance options, potential policyholders must click on “Supplemental Insurance” to find information about life insurance.

You can find information about Cigna’s individual whole life insurance on the individual life insurance homepage and information about group life insurance on the group life insurance homepage.

Since Cigna is dedicated more to health insurance than life insurance, there aren’t a lot of tools available for life insurance customers on its website.

However, you can log into your MyCigna account to pay premiums or make a claim, and you can request a quote from the life insurance homepage.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Canceling Your Policy

Your life insurance policy should meet all your needs. It’s less expensive to purchase the right life insurance policy upfront than it is to change or cancel it after the fact.

In general, term life insurance is easier to cancel, and you may be able to convert your term life insurance to a policy that meets your needs better by talking to your Cigna agent.

You can also cancel term life insurance by failing to pay the premium so that the policy lapses. However, this solution isn’t good for your credit. It’s much better to unenroll through proper channels so that you don’t hurt your credit or your ability to purchase a different life insurance policy.

If you’re considering canceling your life insurance policy because you’re changing jobs, keep in mind that Cigna group universal life insurance policies are portable, which means that the policy comes with you to your new job.

How to Cancel

The best way to cancel your life insurance policy is to contact Cigna directly.

Your life insurance may or may not be refundable if you cancel it. In most cases, term life insurance policies are non-refundable. However, whole life and universal life insurance policies grow in cash value as you pay into them, and this may be refundable.

#1 – Contact Cigna By Phone or Internet Chat

If you want to cancel your policy, your first step is to get in touch with Cigna.

You can contact Cigna by phone or online to cancel your insurance.

Cigna offers round-the-clock customer service at 1-800-997-1654. Simply call this number and tell the agent you want to cancel your life insurance policy.

Alternatively, if you prefer to use Cigna’s online services, you can log in to MyCigna and chat between the hours of 9 a.m. and 8 p.m. EST on weekdays. You’ll need to set up a MyCigna account if you don’t have one before you can use this option.

#2 – Request the Forms You Need

Ask Cigna to send you the forms that you need to fill out. If you’re using MyCigna, you may be able to download these forms directly to your computer.

#3 – Fill Out Forms and Send Them Back

Fill out all forms as soon as you receive them. You’ll need to provide your policy number as well as some personal information.

Once your forms are filled out, mail or fax them back to Cigna.

#4 – Contact Cigna for Next Steps

Call or live chat with Cigna to let your representative know that you’ve submitted your cancellation paperwork and ask whether you need to do anything else.

#5 – Double-Check That You’re Not Continuing to Pay Premiums

Check your next paystub or bank statement to make sure you’re not continuing to pay premiums after you’ve canceled your life insurance. If you find you’ve been charged for a premium after the cancellation date, contact Cigna to resolve the issue.

How to Make a Claim

When you lose a loved one, the last thing you want to think about is how to pay for their funeral and other final expenses. That’s why it’s so important to make a life insurance claim right away.

Making your claim will allow you to get the benefits you’re entitled to, which will help your financial situation while you’re dealing with your loved one’s death.

#1 – Obtain Copies of the Death Certificate

You’ll need at least two copies of the death certificate to file a life insurance claim. Keep a copy of the certificate for your records as well as submit one with the life insurance claim form.

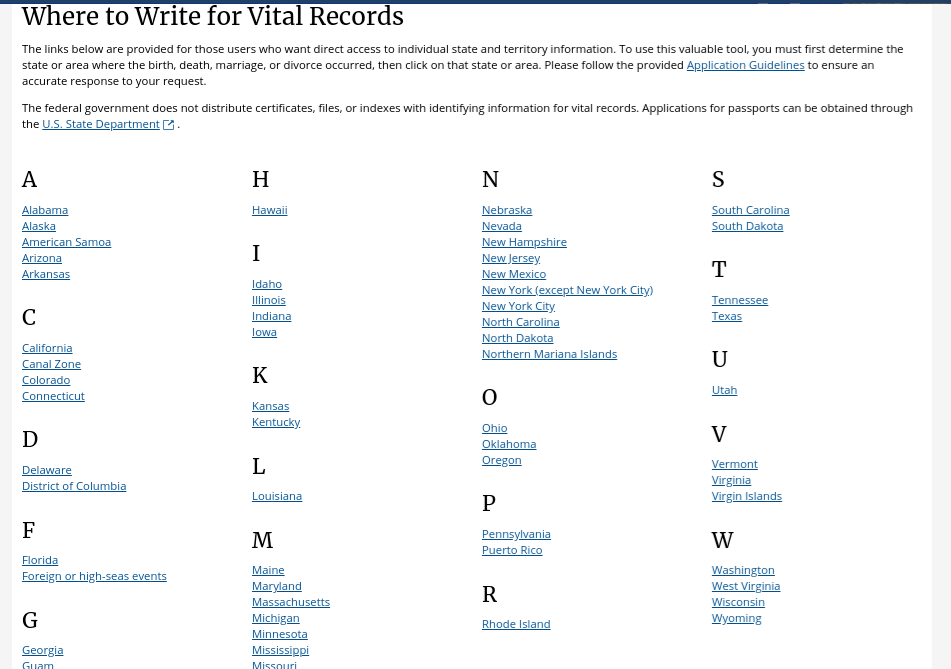

State laws vary, but in general, you can get copies of the death certificate from your state’s Department of Vital Records. This department may go by various names, such as the Department of Birth, Marriage, and Death Records.

You can find your state’s Department of Vital Records via the Centers for Disease Control and Prevention’s website

If you’re not sure whom to contact, start by visiting the website for the Centers for Disease Control and Prevention. The CDC lists each state’s Department of Vital Records. Click on the link for your state to get the contact info.

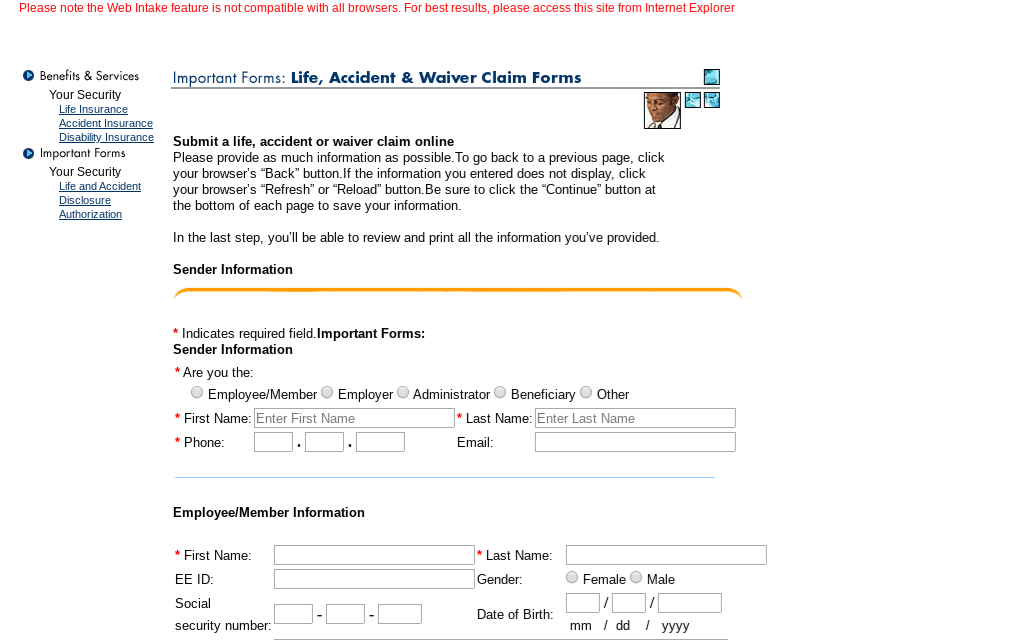

#2 – Fill Out the Claim Form

In most cases, you can fill out your Cigna life insurance claim online.

You’ll need information such as:

- Your loved one’s policy number

- Whether this is group or individual insurance

- A copy of the death certificate

- How and when the person died

- The person’s last state of residence

- The state where the death certificate was issued

If you prefer not to share this information online, you can download a hard copy of the needed form, print it, and fill it out by hand.

#3 – Mail or Fax the Form and Supporting Documentation

If you fill out the form online, you can submit it via the internet. However, you’ll still need to mail or fax supporting documentation such as the death certificate.

If you download or print the form, you’ll need to mail or fax the completed copy along with your supporting documentation.

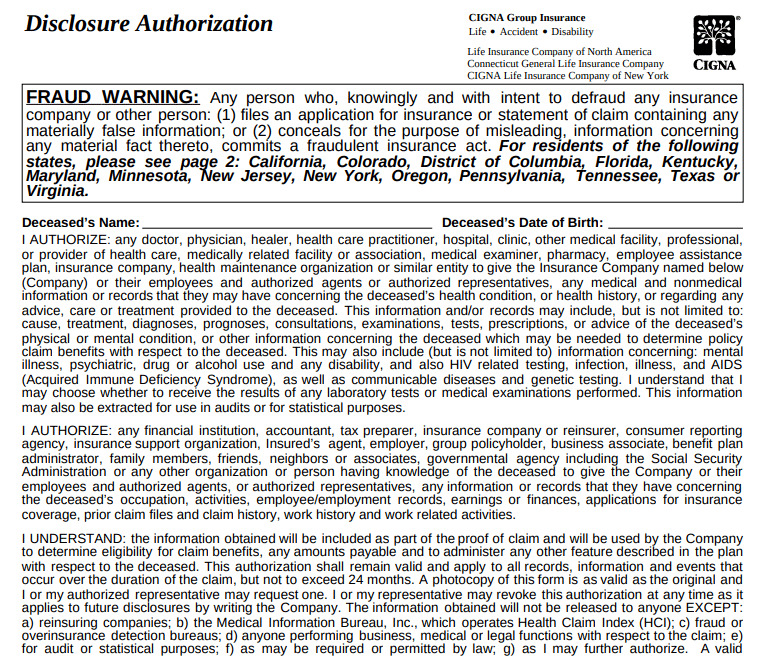

#4 – Submit A Disclosure Authorization Form (If Needed)

In some cases, such as if you’re applying for accelerated benefits following being diagnosed with a terminal illness, you’ll need to submit a disclosure authorization form.

You may need to authorize health care providers to disclose information to Cigna when you make your claim.

This form permits health care providers to discuss the policyholder’s private health information with Cigna. It provides details about what information will be disclosed.

#5 – Receive Life Insurance Benefits

Cigna doesn’t provide information about how long it takes to receive your benefits after you file your claim. However, in general, life insurance claims take seven to 14 days to process. It can take longer if Cigna needs to get additional information after you submit the claim.

How to Get a Quote Online

Ready to buy life insurance? Your next step is to get a quote.

Cigna does not offer quotes online for individual whole life insurance, nor for any of its group insurance plans. However, you can get a quote by calling 1-855-358-8533.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Design of Website/App

Cigna’s website is designed mainly for health insurance policyholders. There is information about life insurance policies on the website, but it’s difficult to get to.

If you’re interested in individual life insurance, you must first click on “Supplemental Insurance,” then on “Whole Life Insurance.”

You also can find information about group life insurance on the life insurance homepage. However, you have to go to the Group Benefits page, not the Information for Employers section.

Cigna offers three mobile apps, but these apps are all geared toward health insurance consumers. There are no apps specifically for life insurance consumers.

Pros & Cons

It’s important to understand both the positives and negatives when deciding on a life insurance policy.

Pros

- Cigna is a financially stable company, so it isn’t likely to disappear any time soon.

- Cigna offers a wide range of riders.

- Group universal life insurance is portable, so you can take it with you if you change jobs.

- You can make claims online.

- You can reach customer service by phone 24 hours a day.

Cons

- Cigna’s focus is on health insurance, not life insurance, so there aren’t as many life insurance options or as much info on its website for life insurance customers as you’d get with a company dedicated to life insurance.

- There is only one type of individual life insurance, and it’s only available to people over the age of 50.

- You can only get term life insurance via your employer, and it’s not portable.

The Bottom Line

Cigna is a health insurance company that also offers a limited number of life insurance options. Most of Cigna’s life insurance is offered through employers. If this is an option at your job, it may be worth looking into.

Group life insurance rates are fairly cheap, but term life insurance isn’t portable.

So if you’re considering changing jobs or worried about getting laid off, you might want to go with group universal life insurance instead.

If you’re looking for individual life insurance, this may not be the company for you, as Cigna only offers one plan, and it’s for people over the age of 50.

However, if you’ve used Cigna’s group term life insurance before and are nearing retirement age, you might want to consider transitioning to an individual whole life insurance policy so that you can continue to get coverage once you retire.

Ready to get started with your personalized plan options? Get started now with a FREE quote below.

Frequently Asked Questions

What is Cigna Life Insurance?

Cigna Life Insurance is a type of insurance policy offered by Cigna, a global health services company. It provides financial protection to your loved ones in the event of your death, helping to ensure their financial security.

What types of life insurance does Cigna offer?

Cigna offers various types of life insurance policies to meet different needs:

- Term Life Insurance: Provides coverage for a specific term, typically 10, 20, or 30 years.

- Whole Life Insurance: Offers lifelong coverage with a cash value component that grows over time.

- Universal Life Insurance: Combines life insurance coverage with the potential for cash value accumulation and flexible premium payments.

What are the benefits of Cigna Life Insurance?

Cigna Life Insurance offers several benefits, including:

- Financial Protection: It provides a death benefit to your beneficiaries, ensuring their financial stability in the event of your passing.

- Flexibility: Cigna offers a range of policy options to suit your unique needs and budget.

- Cash Value Accumulation: Certain policies, such as whole life and universal life, build cash value over time that you can borrow against or use for other financial needs.

- Optional Riders: Cigna allows you to customize your policy with additional riders, such as accelerated death benefit, accidental death benefit, and more.

How do I apply for Cigna Life Insurance?

To apply for Cigna Life Insurance, you can visit their website or contact their customer service. You will need to provide personal information, answer health-related questions, and undergo a medical underwriting process. The application process may vary depending on the type and amount of coverage you require.

Can I convert my Cigna term life insurance policy to a permanent policy?

Yes, Cigna typically allows conversion options for their term life insurance policies. This means you can convert your term policy to a permanent policy, such as whole life or universal life, without having to undergo additional medical underwriting. It’s important to review the terms and conditions of your specific policy for conversion details.

How can I pay my Cigna Life Insurance premiums?

Cigna offers multiple premium payment options, including electronic funds transfer (EFT), credit/debit card payments, and paper check payments. You can choose the payment method that is most convenient for you.

Can I change my beneficiaries on my Cigna Life Insurance policy?

Yes, you can typically change your beneficiaries on your Cigna Life Insurance policy. You will need to contact Cigna’s customer service or access your online account to request a beneficiary change form. Be sure to keep your beneficiary designations up to date to ensure your policy benefits are distributed according to your wishes.

What happens if I miss a premium payment?

If you miss a premium payment for your Cigna Life Insurance policy, there may be a grace period during which you can make the payment without any adverse effects on your coverage. The specific grace period and its terms will be outlined in your policy. If you fail to make the payment within the grace period, your policy may lapse or be terminated.

Can I cancel my Cigna Life Insurance policy?

Yes, you can typically cancel your Cigna Life Insurance policy if you no longer need the coverage. It’s important to review the cancellation terms and any potential fees or consequences outlined in your policy. Contact Cigna’s customer service to initiate the cancellation process.

I’m a young person just starting at my first job. What options does Cigna insurance have for me?

Young people should absolutely consider life insurance so that they can lock in low rates and gain coverage for their families should a tragedy happen.

Cigna doesn’t offer individual life insurance options for younger people, but they do offer both term and universal life insurance through your employer. If you’re not sure you’re going to stay with this job long-term, you might want to go with universal life insurance.

Are there any advantages to purchasing individual whole life insurance rather than a group policy?

Term life insurance policies only cover you for a limited period of time, plus they aren’t portable, so if you retire or change jobs, you’ll lose coverage. If you’re over the age of 50 and are considering retirement, an individual whole life insurance policy might make the most sense for you. That way, you’ll have coverage for the rest of your life — including after you retire.

Will Cigna be adding more life insurance options later?

It’s impossible to predict. Cigna, like many large businesses, often buys other companies or sells some of its subsidiaries. Currently, the trend is toward selling its life insurance businesses to other companies, but that trend could change.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.