10 Best Life Insurance Companies in 2025 (Expert Favorites)

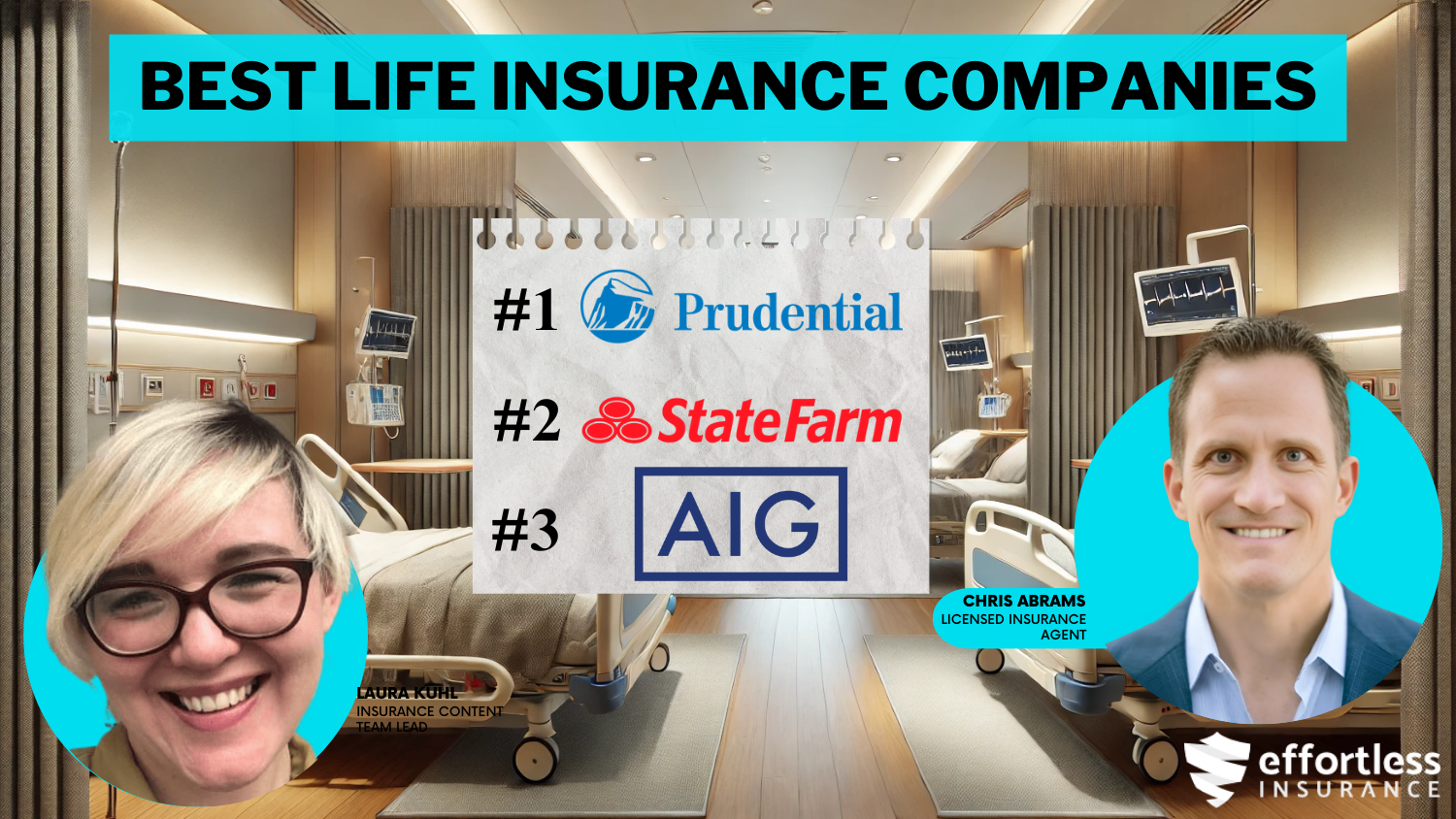

The best life insurance companies are Prudential, State Farm, and AIG, with rates at $28 per month. They’re known for affordable plans, plenty of options, and financial stability. Choosing one of these companies will give you reliable, budget-friendly coverage and peace of mind.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Life Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Licensed Life Insurance Agent

UPDATED: May 5, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: May 5, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Life Insurance

A.M. Best Rating

Complaint Level

18,155 reviews

18,155 reviews 163 reviews

163 reviewsCompany Facts

Full Coverage for Life Insurance

A.M. Best Rating

Complaint Level

163 reviews

163 reviewsPrudential, State Farm, and AIG offer the best life insurance companies for affordable and comprehensive coverage, with rates starting at $28 per month.

Our Top 10 Picks: Best Life Insurance Companies

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 13% | A+ | Financial Stability | Prudential | |

| #2 | 17% | B | Customer Service | State Farm | |

| #3 | 12% | A | Extensive Coverage | AIG |

| #4 | 10% | A+ | Health-Based Incentives | John Hancock | |

| #5 | 6% | A++ | Mutual Ownership | MassMutual | |

| #6 | 11% | A++ | Financial Health | New York Life |

| #7 | 12% | A++ | Consistent Performance | Northwestern Mutual | |

| #8 | 11% | A++ | Policyholder Benefits | Guardian Life | |

| #9 | 7% | A+ | Competitive Rates | Banner Life |

| #10 | 4% | A+ | Customer Satisfaction | Mutual of Omaha |

Known for financial stability, flexible policy options, and responsive customer service, these industry leaders make securing dependable life insurance straightforward. Different types of life insurance policies come in various forms, including term life insurance, whole life insurance, and universal life insurance.

By comparing these top companies, you can find the ideal plan to protect your loved ones and secure a solid financial future. Free instant life insurance quotes are just a click away. Enter your ZIP code to get started.

- Best life insurance companies offer term and whole life for all budgets

- Top insurers provide strong financial backing and custom policy options

- Prudential is the top pick with plans starting at just $28 per month

#1 – Prudential: Top Overall Pick

Pros

- Strong Financial Rating: Prudential has an A+ rating, which shows it’s reliable and financially stable—important for anyone wanting dependable life insurance.

- Affordable Plans: With coverage starting at just $32 a month, Prudential offers budget-friendly options for those who still want quality insurance.

- Variety of Policies: Prudential life insurance has lots of choices, from term to permanent life insurance, so customers can find a plan that fits their needs.

Cons

- Few Discounts: Prudential’s bundling discount is only 13%, which is lower than what some other companies offer.

- Detailed Approval Process: The approval process can be slow because Prudential looks closely at each applicant’s information.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Customer Service

Pros

- Friendly Customer Service: State Farm is known for putting customers first and helping out at every step.

- Low Starting Rates: You can get coverage for as low as $37 a month, which makes it budget-friendly.

- Bundling Savings: State Farm life insurance gives a 17% discount if you combine different insurance policies, which can save you money.

Cons

- Higher Cost for Bigger Plans: Some of the larger coverage plans can get expensive.

- Not the Best Online Tools: Managing your life insurance online with State Farm isn’t as easy as with some other companies.

#3 – AIG: Best for Extensive Coverage

Pros

- Wide Coverage Options: AIG life insurance has lots of options to meet different financial needs. Discover our guide here. “Country Financial Life Insurance Review.”

- Affordable Starting Rates: Plans start at $34 a month, making it flexible for different budgets.

- Strong Financial Standing: With an A rating from A.M. Best, AIG is known for being financially reliable.

Cons

- Limited Discounts: AIG’s bundling discount is lower, at just 12%, compared to some other companies.

- Complicated Policy Terms: Some of AIG’s policies have complex features that might be hard to understand for some customers.

#4 – John Hancock: Best for Health-Based Incentives

Pros

- Health Rewards: John Hancock life insurance vitality program gives rewards to policyholders who maintain a healthy lifestyle.

- Affordable Rates: Starting coverage is just $31 per month, which is budget-friendly for health-conscious people.

- Strong Financial Stability: John Hancock Life Insurance reviews show an A+ rating from A.M. Best, indicating strong financial security.

Cons

- Complicated Health Program: The Vitality program can be confusing for those who don’t want to track their health activities.

- Limited Options for Seniors: Some seniors might find fewer coverage choices compared to other companies.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – MassMutual: Best for Mutual Ownership

Pros

- Mutual Ownership Structure: MassMutual’s mutual ownership structure benefits policyholders with potential dividends and policyholder involvement.

- Competitive Data Rates: Minimum coverage begins at $35/month, offering budget-friendly options for a broad audience.

- High Financial Rating: MassMutual holds the highest A++ rating from A.M. Best, reflecting its strong financial health.

Cons

- Limited Digital Tools: MassMutual’s online tools and services may not be as advanced as other best rated life insurance providers.

- Complex Products: Its product offerings, including whole life and universal life insurance, may be overwhelming for first-time buyers.

#6 – New York Life: Best for Financial Health

Pros

- Strong Financial Health: New York life insurance has an A++ rating, showing it’s financially solid and reliable.

- Affordable Starting Rates: Coverage starts at $36 a month, making it a budget-friendly option.

- Wide Range of Options: They offer many types of policies, from term to whole life insurance.

Cons

- Few Discounts: The bundling discount is only 11%, which is lower than some other companies.

- Higher Premiums for Big Plans: Premiums can be pricey if you’re looking for large coverage amounts.

#7 – Northwestern Mutual: Best for Consistent Performance

Pros

- Trusted and Reliable: Northwestern Mutual life insurance has a long history of offering dependable life insurance and solid financial stability.

- Expensive for Big Plans: Premiums can get high if you’re looking for a lot orange starts at just $33 a month, making it easy on the budget.

- Variety of Coverage: They offer different plans to fit a range of needs.

Cons

- Basic Online Tools: Managing your policy online isn’t as smooth as with some other companies.

- Few Discounts Available: Not as many options for savings on premiums.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Guardian Life: Best for Policyholder Benefits

Pros

- Extra Benefits: Guardian Life gives dividends to some policyholders, adding value to your coverage.

- Affordable: Plans start at $30 a month, which is great for people on a budget.

- Financially Strong: Guardian Life has an A++ rating, so it’s a reliable choice. Browse our relevant guide “Best Life Insurance Companies That Cover Impaired Risk.”

Cons

- Fewer Options: They don’t offer as many coverage choices as other companies.

- Smaller Discounts: The 11% bundling discount is lower than what other insurers offer.

#9 – Banner Life: Best for Competitive Rates

Pros

- Cheap Plans: Banner Life insurance offers coverage starting at $28 a month.

- Stable: With an A+ rating, they’re financially solid.

- Flexible Options: They have different plans for different needs.

Cons

- Small Discounts: The 7% bundling discount is lower than others.

- Limited Support: It’s harder to reach customer service compared to larger companies.

#10 – Mutual of Omaha: Best for Customer Satisfaction

Pros

- Great Customer Service: Mutual of Omaha life insurance is known for happy customers.

- Low Rates: Plans start at $29 a month, making it affordable.

- Reliable: With an A+ rating, Mutual of Omaha is financially strong.

Cons

- Small Discount: The bundling discount is just 4%, lower than other companies.

- Fewer Options: They offer fewer products than some other insurers.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing The Best Life Insurance Companies For You

When it comes to protecting your loved ones and securing their financial future, life insurance is a smart and necessary investment. The best companies for life insurance offer flexible policies you can tailor to specific goals—whether that’s covering a child’s education, paying off a mortgage, or replacing lost income.

Life Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $34 | $96 |

| $28 | $89 |

| $30 | $91 | |

| $31 | $90 | |

| $35 | $97 | |

| $29 | $92 | |

| $36 | $98 |

| $33 | $95 | |

| $32 | $94 | |

| $37 | $99 |

They can also serve as a means of leaving a financial legacy to loved ones or charitable organizations. However, with so many options available, it can be overwhelming to choose the right policy:

- Term Life Insurance: Term life insurance provides coverage for a specific period, such as 10, 20, or 30 years. It offers a death benefit to the beneficiaries if the insured passes away during the term of the policy. This type of insurance is often more affordable and is ideal for individuals who want temporary coverage.

- Whole Life Insurance: Whole life insurance provides coverage for the insured’s entire lifetime. It offers a death benefit as well as a cash value component that grows over time. This cash value can be accessed by the policyholder during their lifetime for various financial needs.

- Universal Life Insurance: Universal life insurance combines the benefits of both term and whole life insurance. It provides a death benefit and a cash value component, while also offering flexibility in premium payments and death benefit amounts.

Two popular types of life insurance policies are term life insurance vs. whole life insurance. Let’s take a closer look at the differences between these two options.

Term Life Insurance vs. Whole Life Insurance

Term life insurance offers coverage for a set period, usually between 10 and 30 years. It’s a practical option for people who want financial protection during key stages of life, like raising children or paying off debt. Among the life insurance companies best known for term policies, look for those with strong renewal options and clear terms.

On the other hand, whole life insurance offers lifelong protection. It guarantees a death benefit payout regardless of when the policyholder passes away. This type of policy is often chosen by those who want to leave a financial legacy for their loved ones or cover final expenses.

When deciding between term life insurance and whole life insurance, it is crucial to consider your financial goals and budget. Term life insurance is generally more affordable, making it an attractive option for individuals who need coverage for a specific period without breaking the bank.

On the other hand, whole life insurance provides lifelong coverage with a cash value component. This means that as you pay your premiums, a portion of the money goes into a savings or investment account, which can accumulate cash value over time.

Cost Comparison

When reviewing your options, it’s important to compare life insurance companies based on more than just price. While cost matters, gathering quotes from several providers helps you see how coverage amounts, policy terms, and included benefits stack up side by side.

Keep in mind that the cost of life insurance can vary based on factors such as age, health condition, occupation, and lifestyle choices. Additionally, evaluate any potential discounts or incentives offered by the companies to find the most cost-effective option.

Life Insurance Discounts From the Top Providers

| Insurance Company | Available Discounts |

|---|---|

| Lifestyle Change, Health Improvement Program, Multi-Policy |

| Non-Smoker, Multi-Policy, Health Screening |

| Healthy Living, No-Smoker, Multi-Policy | |

| Vitality Program, Healthy Living Rewards, Non-Tobacco | |

| Health Assessment, Long-Term Customer, Family Protection | |

| Health Monitoring, Long-Term Customer, No Tobacco | |

| No-Smoker, Good Health, Family Legacy |

| Multi-Policy, Health Awareness Program, Long-Term Customer | |

| Healthy Lifestyle, Family History, Multi-Policy | |

| No Tobacco, Drive Safe & Save (for those with auto insurance), Multi-Policy |

It’s important to note that while term life insurance generally has lower premiums, whole life insurance may require higher monthly payments due to its lifelong coverage and cash value component.

Prudential stands out for offering reliable, affordable coverage with top-tier financial stability.Jeff Root Licensed Insurance Agent

However, the cash value component of whole life insurance can be accessed during the policyholder’s lifetime, providing a source of funds that can be used for various purposes, such as paying off debts, funding education, or supplementing retirement income.

Read More:

Policy Features Comparison

In addition to cost, it is important to consider the features and benefits that different life insurance policies offer. Understanding the different types of life insurance for example, term, whole or universal will help you pick an appropriate policy to suit your needs. Some policies may provide additional benefits, such as accelerated death benefits or living benefits that can prove helpful under specific conditions.

- Accelerated Death Benefits: Permit policyholders to collect a portion of their death benefit if they are diagnosed with a terminal illness. This can also help with medical expenses or be additional income during a hard time.

- Living Benefits: Allow policyholders to access a portion of their death benefit if they experience a qualifying critical illness or disability.

When reviewing policies, think about how added features—like living benefits or riders—match your personal needs. These extras can add value, but they might also increase your premium. That’s why it’s smart to look closely at companies that offer life insurance with flexible options, so you can balance useful features with a cost that fits your budget.

Financial Stability

One of the most critical factors to consider when selecting a life insurance company is its financial stability. After all, you want to choose a company that will be there for you when it matters most. It’s essential to research the company’s financial ratings and evaluate its ability to pay claims in a timely manner.

A financially stable company has a solid track record of paying claims and staying reliable over time. That’s key when narrowing down the best life insurance companies for you. You can check their financial strength through trusted sources like A.M. Best, Standard & Poor’s, and Moody’s.

Customer Service and Claims Processing

While financial strength and solid policy choices matter, a company’s customer service and how it handles claims can shape your entire experience. Excellent life insurance companies stand out by offering helpful support and making the claims process smooth and straightforward for policyholders and their families.

Reading reviews and seeking recommendations from friends or family members can help gauge the company’s reputation in these areas. Look for a company that is known for its prompt and efficient claims processing, as this will ensure that your loved ones receive the benefits they are entitled to without unnecessary delays or complications.

Additionally, consider the level of customer service provided by the company. A responsive and knowledgeable customer service team can address any questions or concerns you may have throughout the life of your policy—including basics like how does life insurance work. This level of support can make a significant difference in your overall satisfaction and peace of mind.

Tips for Getting Affordable Life Insurance

Knowing your budget, goals, and life stage is the first step towards getting affordable life insurance. With so many companies saying they are the best, it can be hard to choose. However, when you concentrate on certain crucial aspects, such as coverage options, providers’ reputations, and policy flexibility, the process is much more understandable.

- Matching Needs to Coverage: Select a life insurance company based on your individual coverage needs, budget, and long-term financial goals.

- Consult with a Licensed Agent: Team up with a life insurance agency or broker who can help you compare policies that best suit your lifestyle while offering the right mix of coverage and affordability.

- Compare Leading Providers: Investigate and compare leading life insurers, such as State Farm or Northwestern Mutual, in order to find policies that establish solid reputations and pay out reliably.

- Read Company Reviews: Review ratings and customer feedback to assess insurers’ claim histories, customer service, and coverage flexibility.

- Assess Age and Life Stage: Pick a policy that suits your age and current life stage, and request agents to provide tailored recommendations suited to you.

Choosing the right life insurance doesn’t have to be complicated. Focus on what fits your needs, not just what looks popular. Compare policies from trusted providers and don’t hesitate to ask questions. Look into company ratings, claim histories, and customer feedback to avoid surprises later.

A good policy should protect your loved ones without putting a strain on your budget. The key is to look at good life insurance companies that offer dependable coverage, clear terms, and support when it matters most, so you can make a confident, informed choice.

How to Choose the Right Life Insurance Policy

Before buying life insurance, take time to figure out how much coverage you really need. Look at your financial responsibilities—like debts, future expenses, and the income your family would need if something happened to you. Once you’ve got a clear idea, start comparing quotes. Don’t rush the decision or settle for the first offer; a good life insurance company will give you the right mix of coverage, cost, and long-term support.

Check the price, obviously, but also the policy details and the company’s reputation. When you’re prepared to make the next step, review the policy in detail. Be sure you understand what’s covered, what’s not, and how the whole thing works. If anything isn’t clear, ask the provider before you sign.

From experience, comparing quotes from multiple top-rated providers is the easiest way to find quality life insurance coverage that fits your needs and saves money.Chris Abrams Licensed Life Insurance Agent

You’ll also want to know where to buy life insurance—whether through an agent, directly online, or with the help of a broker—so you can choose what feels most comfortable and reliable for you. Taking these steps helps you find a policy that actually fits and protects the people who count on you.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Why You Need Life Insurance

Life insurance plays a crucial role in safeguarding your family’s financial well-being in the event of your untimely demise. It provides a financial safety net that can replace lost income, settle outstanding debts, and secure your loved ones’ future. Refer to our guide for further guidance. “What is face value in life insurance?”

Life insurance can also help replace the income you would have provided for your family. This can be especially important if you are the primary breadwinner or if your income is essential for covering daily living expenses, such as mortgage payments, utility bills, and groceries.

Additionally, life insurance can help settle any outstanding debts you may have, such as credit card debt, car loans, or a mortgage. With sufficient life insurance coverage, your loved ones won’t have to worry about financial obligations after your passing. Car insurance vs. life insurance: making the right choice for financial security.

Case Studies: Finding the Right Life Insurance Companies for Different Needs

Each person’s life insurance needs are unique, and finding the right provider can make a significant difference. The following case studies highlight how three individuals with different priorities chose the best life insurance company, considering factors like affordability, coverage options, and long-term value.

- Case Study #1 — Affordable Coverage for a Young Family: When Mark, a 35-year-old father of two, sought life insurance, he prioritized affordable coverage that could secure his family’s financial future without straining their budget. With a term policy from State Farm at just $28 a month, Mark secured a comprehensive plan that would cover major expenses.

- Case Study #2 — Long-Term Investment: Sandra wanted a whole life insurance policy that offered both protection and investment value. Prudential’s whole life insurance policy provided her with lifelong coverage and a cash value component that she could access if needed.

- Case Study #3 — Flexible Term Policy for a Growing Career: As a 30-year-old professional with a dynamic career, Greg needed a flexible insurance policy that could adapt as his income grew. AIG’s term life policy met his needs by offering conversion options and adjustable coverage levels, allowing him to scale his policy with his future earnings.

Each of these examples shows how top insurers that consistently pay out can offer tailored solutions. If you’re trying to find the best life insurance for your situation—whether it’s affordability, long-term value, or flexible terms—it starts with matching your needs to what each provider offers.

Trusted Life Insurance Companies With Flexible Plans

Choosing a life insurance company isn’t just about picking a name you’ve heard before—it’s about finding a provider that aligns with your needs, goals, and the kind of support you want for your family. The companies listed here stand out because they offer reliable service, strong financial backing, and a range of policy options that can be tailored to fit different situations.

Whether your needs are immediate or for years to come, the best choice is the one that gives you comfort and control. Take your time, compare what matters most to you, and don’t be afraid to ask questions along the way.

Safeguard your family’s future while saving on coverage — enter your ZIP code below to compare life insurance quotes with our free tool today.

Frequently Asked Questions

What are the top 10 life insurance companies based on financial strength and customer satisfaction?

The top 10 life insurance companies often include Prudential, State Farm, AIG, MassMutual, New York Life, Northwestern Mutual, Guardian Life, Banner Life, Mutual of Omaha, and John Hancock—ranked for their financial ratings, policy options, and claim reliability.

Who is the best life insurance company for customer service and claims handling?

According to consumer feedback and J.D. Power scores, State Farm consistently ranks among the best for customer service, with responsive support and an easy-to-navigate claims process.

What is the best life insurance company for long-term coverage and flexibility?

Many experts recommend Prudential as the best life insurance company because it offers a wide range of term and permanent policies, strong financial ratings, and flexible riders. If you’re asking, does life insurance cover things like final expenses, income replacement, or debt, Prudential’s policy options are designed to handle all of that—and more—based on what you choose.

What are the best life insurance companies for high coverage amounts and fast approvals?

If you need a high face-value policy quickly, top life insurance companies like AIG and Banner Life offer accelerated underwriting and high limits with minimal delays for qualified applicants.

Who has the best life insurance policy for families with young children?

State Farm and Guardian Life offer policies with conversion options and child rider add-ons, making them ideal for young families seeking flexibility and coverage that grows with their needs.

How do State Farm term life insurance reviews compare to other top providers?

State Farm term life insurance reviews point to a smooth application process, reliable customer support, and steady rates, though some say it’s priced higher than online-only providers. If you’re weighing your options, understanding the pros and cons of term life insurance, like lower upfront costs but no cash value, can help you decide if State Farm’s approach fits your needs.

Is State Farm’s best whole life insurance policy worth it for long-term savings?

State Farm’s whole life insurance policy includes guaranteed cash value growth, fixed premiums, and dividend eligibility, making it a strong option for those seeking stable long-term savings and lifelong coverage.

What makes top-rated life insurance companies stand out in today’s market?

Top rated life insurance companies earn their status through a mix of strong financial ratings (A or higher from A.M. Best), a wide range of policy types, transparent pricing, and positive customer reviews.

What should I look for when comparing life policy insurance options across top providers?

To understand how life insurance works, it helps to look at key factors like the company’s financial strength, available term lengths, renewal rules, living benefits, and whether the policy lets you add riders for things like chronic illness or income replacement.

How does Banner Life vs. Protective Life compare on rates and flexibility?

Banner Life often provides lower premiums and more term options, while Protective Life stands out for its policy conversion features and guaranteed universal life products—ideal for those needing long-term planning tools.

Shop around for personalized life insurance quotes that fit your needs and budget by entering your ZIP code.

What are the top life insurance companies for young adults just starting out?

Young adults often benefit most from companies like Banner Life, State Farm, and Prudential, which offer affordable term life options, policy conversion flexibility, and digital application processes with fewer health requirements.

Who are the best life insurance companies for seniors or those over 60?

Companies like Mutual of Omaha, AIG, and New York Life often stand out when you’re looking for the best life insurance for seniors over 60, thanks to their guaranteed issue policies, no-exam options, and permanent coverage that can be adjusted to meet long-term needs.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Life Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Licensed Life Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.