Best Life Insurance for People With Atrial Fibrillation (AFib) in 2024

You still have plenty of options available when shopping for life insurance with atrial fibrillation (AFib). Although rates may be slightly higher depending on the type of AFib, life insurance is possible and affordable starting at $18.23/month.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Sep 19, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Sep 19, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

About 2.7 million Americans are living with atrial fibrillation, or AFib — a condition in which your heart beats irregularly, causing you to feel lightheaded, nauseated, and weak. If you’re interested in getting life insurance with atrial fibrillation, you’re in the right place.

Although the type of AFib you’re living with and any other underlying health concerns could impact your life insurance rates, don’t give up. It can be more difficult to get life insurance with a pre-existing condition, but it isn’t impossible.

Read on to learn about how the underwriting process works and how to get affordable life insurance with AFib.

Ready to buy life insurance with atrial fibrillation? Get started with some FREE quotes using our tool.

Best Life Insurance Companies for AFib

If you’re shopping for life insurance quotes after being diagnosed with atrial fibrillation, one of the first questions on your mind is where to start. While it’s no guarantee that they’ll offer the cheapest rate available, the top 10 life insurance companies by market share are a solid first choice to start comparison shopping right here with our quote tool. They include:

- Northwestern Mutual Life

- Metropolitan Group

- New York Life

- Prudential

- Lincoln National

- MassMutual

- Aegon

- John Hancock

- State Farm

- Minnesota Mutual Group

Another question might be how much it’s going to cost.

State laws provide general guidelines for setting life insurance prices, so your rates might differ a bit depending on what state you reside in. Rates also tend to differ from company to company.

Many life insurance companies use a formula to determine how likely it is you will die soon, how much interest the company can expect to earn by investing your premium payments, and what expenses the company must pay if it insures you.

The only way to find out for sure how much you’ll pay to get life insurance after being diagnosed with AFib is to get a quote from the companies that interest you. But if you’d like to get a general idea, check out some sample rates below.

Sample Life Insurance Rates

Sample life insurance rates presume you are an average person of a certain age with a certain amount of coverage. We offer sample rates for several risk classes to help you get an idea of how much you’ll pay.

Average Monthly Term Life Insurance Rates for AFib Patients by Rate Class, Age, Gender, and Policy Amount

| Rate Classification | Age | Male $100,000/ 20-Year | Female $100,000/ 20-Year | Male $250,000/ 20-Year | Female $250,00/ 20-Year | Male $500,00/ 20-Year | Female $500,000/ 20-Year |

|---|---|---|---|---|---|---|---|

| Standard | 40 | $18.23 | $16.10 | $32.59 | $28.87 | $59.94 | $51.93 |

| Substandard – 50% over Standard | 40 | $23.49 | $20.34 | $41.67 | $34.41 | $75.60 | $62.63 |

| Substandard – 100% over Standard | 40 | $29.57 | $25.37 | $53.81 | $44.03 | $98.96 | $81.66 |

| Substandard – 150% over Standard | 40 | $35.58 | $27.08 | $64.38 | $53.86 | $120.49 | $94.02 |

| Standard | 50 | $37.36 | $29.05 | $77.31 | $58.36 | $143.59 | $110.95 |

| Substandard – 50% over Standard | 50 | $49.22 | $38.98 | $98.11 | $73.17 | $187.19 | $137.23 |

| Substandard – 100% over Standard | 50 | $63.87 | $50.22 | $129.06 | $94.63 | $247.74 | $181.13 |

| Substandard – 150% over Standard | 50 | $78.93 | $60.45 | $152.46 | $115.80 | $293.77 | $221.02 |

| Standard | 60 | $91.85 | $65.62 | $204.70 | $143.50 | $392.71 | $273.89 |

| Substandard – 50% over Standard | 60 | $126.00 | $86.10 | $251.41 | $175.83 | $492.75 | $337.70 |

| Substandard – 100% over Standard | 60 | $166.25 | $113.05 | $333.37 | $232.60 | $655.15 | $448.42 |

| Substandard – 175% over Standard | 60 | $196.66 | $136.73 | $403.21 | $285.59 | $795.27 | $550.68 |

If you are living with AFib, your life insurance rate will be based on how serious a risk AFib and related conditions present to your health.

Many people with AFib are required to pay substandard rates because they are considered higher risk. This means that you’ll pay more for life insurance than a person who does not have AFib or other serious risk factors.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Life Insurance After Ablation

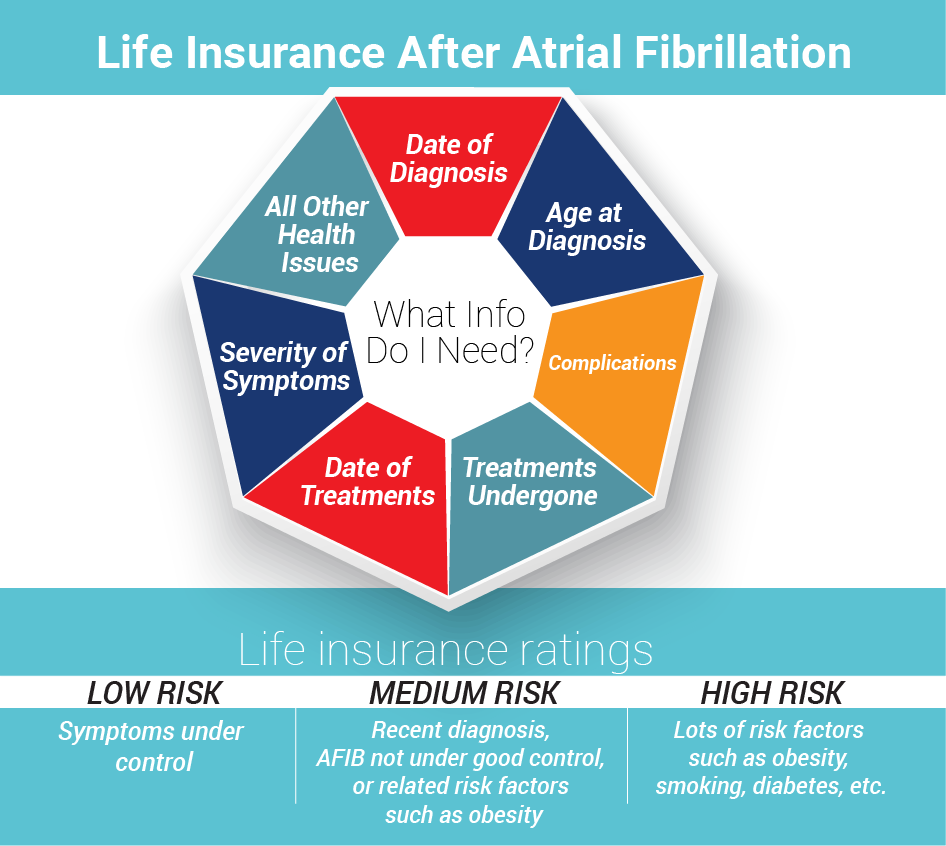

Every health ailment calls for different questions by the insurance’s underwriter. The reason is simple: getting to know more about your condition and the type of medications you take gives the underwriter a complete picture of your life insurance risk class.

In general, you can expect a better rate if you manage your AFib by following your doctor’s orders, taking the medications, and having no significant complications.

Does AFib affect life insurance?

Yes. So, what are life insurance companies looking for when insuring individuals with AFib? Let’s discuss the questions you need to be ready to answer.

Date of First Diagnosis

The longer it’s been since you first got your diagnosis, the better.

Having lived with this condition for a longer period of time demonstrates that it’s not as life-threatening as it may appear if you were newly diagnosed.

You may find it more difficult to get standard life insurance rates if you were diagnosed with atrial fibrillation within the past six months. This is because six months isn’t a long enough time to determine the severity and persistence of your condition.

You may have to purchase guaranteed issue whole life insurance or another whole life insurance policy rather than term life insurance if you’re in this situation.

If you are seeking life insurance over 60 years old and have had atrial fibrillation for a long time, you may qualify for standard rates despite your age and condition, because it proves you have been able to live a normal, healthy life for a long time despite your condition.

Which type of atrial fibrillation do you have?

Since AFib can cause significant health issues even without underlying heart conditions, the underwriter needs to know the type to assess the risk.

Occasional AFib, also called paroxysmal or intermittent AFib may last minutes, hours, or even days, but for most, it requires no medications to manage the condition. If you have no underlying health condition with 10 or fewer episodes per year, the underwriter will classify it as intermittent AFib.

In this case, underwriters may classify you as Preferred Plus, which means you are an extremely low risk and qualify for the lowest available rates.

Persistent AFib is also called chronic because the condition can’t stop by itself and requires medications or electrical shock to help the heart reverse its course and return to a regular beat.

If your persistent AFib has lasted more than 12 months, it’s classified as long-term persistent AFib.

Permanent AFib is a condition that doesn’t go away after treatment and must be controlled by medication for the rest of your life.

Although any of these four types of AFib can lead to serious health consequences, insurance underwriters tend to presume that the more long-term the condition is, the more serious it is.

You will likely pay higher rates for a long-term persistent condition or permanent condition than for an occasional or short-term persistent condition.

In some cases, you could pay up to 200 percent higher than the standard rate, and in extreme cases, you may be denied term life insurance altogether and need to look into other options.

What symptoms do you have with an irregular heartbeat?

If you have atrial fibrillation, you may have any of the following symptoms.

- Chest pain

- Dizziness or lightheadedness

- Shortness of breath

- Weakness

- Fatigue

These symptoms could also be indications that you are having a heart attack or other serious health problems. If you have trouble breathing or severe chest pain, it’s best to go to the ER.

Because these symptoms suggest potentially fatal health problems, your insurance company will probably charge higher rates if you experience them regularly.

What tests have you completed?

Doctors use several tests to help diagnose your atrial fibrillation and decide on the best treatment plan.

Diagnostic Tests for Atrial Fibrillation

| Tests | Description |

|---|---|

| Electrocardiogram (ECG) | The doctor attaches electrodes to your chest to measure the electrical activity in your heart. |

| Holter monitor | A type of portable ECG monitor that you wear on a belt or carry in your pocket. |

| Event recorder | A type of portable ECG monitor that requires you to press a button when you feel your heart beating fast to get a ECG reading. |

| Echocardiogram | An sonogram of your heart, usually taken by holding a transducer over your chest. It is used to diagnose structural heart disease and check for blood clots in your heart. |

| Blood tests | Blood tests are used to check thyroid levels and rule out thyroid disease as a cause of your condition. |

| Stress test | A cardiological exam in which the doctor runs tests on your heart while you are running on a treadmill. |

| Chest x-ray | Chest x-rays are used to check the condition of your lungs and heart and rule out other conditions that might explain your symptoms. |

These tests give your doctor a more complete picture of what is going on with your symptoms.

Insurance underwriters won’t be given copies of your tests, which are confidential medical information. However, they’ll get information about what tests you have taken and what the results suggest about your general health and risk of death. If tests suggest an underlying condition or a poor prognosis, your insurance rate will be higher.

Are you on any medications?

As you know, there are three types of medication your doctor may prescribe for atrial fibrillation.

- Blood thinners – Blood thinners are used to prevent blood clots. This is important if you have AFib because the condition increases the risk of a blood clot traveling to the brain, causing a stroke. However, a side effect of blood-thinning medications is that you will bleed for longer if you cut yourself.

- Beta-blockers – Beta-blockers help slow your heart rate. These medications, which are also used to lower blood pressure, change the electrical signals in your heart to help regulate your heart rhythm. However, side effects may be similar to some of the effects of AFib, especially dizziness and fatigue.

- Calcium channel blockers – In some cases, your doctor will prescribe calcium channel blockers, which slow your heart rate by relaxing your blood vessels. You cannot eat grapefruit or drink grapefruit juice if you’re on this medication and it can cause heartburn or swelling of your feet and ankles.

Now, you might be wondering how being on them affects your life insurance rates.

Your insurance company will have access to your prescription history.

This allows underwriters to assess your risk level more accurately by examining what medications you are on and what they are for.

In general, those who aren’t on any medications to manage their condition are considered lower risk. This is logical because medication suggests a more serious heart condition.

This isn’t a hard-and-fast-rule, so don’t despair if you are on medication. Your medication history is only one factor insurance companies take into account, and if your AFib is under good control, that will make a difference for your rate as well.

What caused the atrial fibrillation?

The most common cause of atrial fibrillation is damage to the heart structure or abnormalities in the heart itself, such as problems with heart valves. These causes can lead to serious health issues, such as heart attacks and strokes.

If this is the cause of your AFib, your insurance company will likely charge higher rates or even decline your life insurance application.

Atrial fibrillation can also be caused by other health issues such as:

- High blood pressure

- Heart attack

- Coronary artery disease

- Overactive thyroid gland

- Exposure to stimulants such as caffeine or alcohol

Some of these conditions are more serious than others, but the underlying cause will always be taken into account when setting life insurance rates for an applicant with atrial fibrillation.

In rare cases, you may have atrial fibrillation without any underlying health issue. This syndrome, which is called lone atrial fibrillation, occurs in approximately 9 percent of AFib patients over 65 and only 2 percent of younger AFib patients.

Serious complications are rare if you have lone atrial fibrillation, so this condition may not seriously affect your rates

Not all AFib patients have underlying heart causes, but most do. The conditions include hypertension, heart attack, abnormal heart valves, and viral infection among many others. If your situation is due to a heart condition, expect a higher rate. Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Life Insurance Underwriting for Atrial Fibrillation

Your AFib isn’t the only condition the underwriter will ask about. Underwriters will be concerned with demographic information such as your age, gender, and marital status.

In general, the older you are, the higher the rates you’ll pay for life insurance. This is because the older you are, the closer you are presumed to be to death.

Women live an average of five years longer than men. For this reason, women tend to pay less for life insurance than men do, even when taking health conditions such as atrial fibrillation into account.

There is some evidence that people who are married live longer than those who are divorced, widowed, or single. So if you’re not married, you’ll pay more for life insurance.

In addition to demographics, insurers are concerned about your general health and family health history.

Obviously, having atrial fibrillation will affect your insurance rates. But it’s not the only condition insurers are concerned about.

In most cases, your potential insurer will ask you to undergo a medical exam. During the exam, the doctor will check your cholesterol level, blood pressure, and other important indicators of your general health.

As mentioned above, your insurer will also look at your prescription history to help determine your general health and how high an insurance risk you may be. Underwriters may also look at your Medical Insurance Bureau, or MIB records to help them assess your health history and general health.

Your full medical records are confidential, but when you apply for insurance, you are required to consent to Medical Insurance Bureau (MIB) being given encrypted medical information.

The more significant health problems you have, the higher your rate is going to be. This is of particular concern if you have AFib because there is often another serious health problem causing your irregular heartbeat.

Smoking is also considered a risk factor, especially if you have AFib or another serious heart issue, as smoking is known to contribute to heart disease.

Your underwriter will also consider your occupation when making insurance rate decisions.

High-risk occupations such as being a fighter pilot, working as a stunt double, or being a police officer present frequent risks to your life. Thus, you’ll pay more for life insurance if you are in one of these occupations than if you sit behind a desk in an office.

If you engage in high-risk habits or hobbies, that will also affect your life insurance rates.

Smoking is an example of a high-risk habit because it makes it more likely you will get cancer or heart disease, possibly shortening your life. In addition, you may be asked to pay higher insurance rates if you have a history of drug abuse, even if you’ve been clean for a long time.

You may also need to pay more for life insurance if you have a poor driving record, especially if you have been arrested for driving under the influence or reckless driving, have been at fault for serious accidents, or have gotten lots of speeding tickets.

Finally, if you have ever served in the military, you’ll pay higher rates for life insurance.

Active duty military personnel often serve in combat zones, even if they aren’t on combat duty, which puts their lives at risk. Unfortunately, veterans often return home from service with physical or mental health issues, and sometimes they get sick years after the fact from exposure to chemicals while they were serving.

Compare Quotes From Top Companies and Save Secured with SHA-256 Encryption

Getting Life Insurance With AFib

When deciding what type of life insurance to get, your primary consideration should be making sure your family is taken care of financially if you were to die suddenly.

Unfortunately, about one-third of consumers would suffer financial problems within a few months if their loved one was to die, which is why you want to put a lot of thought into the type of life insurance policy you purchase.

An accident or illness could happen at any age, and your risk is higher if you have a chronic health condition like AFib. So don’t let the fear of the cost get in your way of getting the coverage you need.

Wondering what your options are? Read on to learn more about different types of life insurance.

Term Life Insurance

Term life insurance is exactly what it sounds like: you get coverage for a certain period of time, usually between 10 and 30 years.

The major advantage of this type of life insurance is that it’s cheaper. In many cases, you can lock in a rate that is good for the life of the policy. So if you get it at a comparatively early age, you will save money.

Keep in mind that an expired term life insurance is possible. Thus, if you die after the coverage period ends, your family will receive no benefits.

In some cases, you may be able to renew term life insurance or convert it into a whole life insurance policy at the end of the term. Talk to your insurance agent about these possibilities before deciding to buy.

Whole Life Insurance

Unlike term life insurance, whole life insurance is permanent. This means that your family will be covered whether you die next year or live to be over 100 years old.

Whole life insurance also grows in cash value over time. You can withdraw some of the cash value as needed or designate funds to go to your beneficiaries after your death.

If you are over the age of 50, you may qualify for guaranteed issue whole life insurance. As the name implies, you are guaranteed approval for this type of insurance, and usually you don’t have to have a medical exam.

Other types of whole life insurance may be available to younger people and require a medical exam.

Whole life insurance is usually more expensive than term life insurance. You can keep costs down by electing a lower coverage amount, but keep in mind that lower coverage means fewer benefits for your family after your death.

Universal Life Insurance

Universal life insurance is a type of permanent life insurance that offers flexible payments. You can adjust your payments to fit your budget and financial needs as long as you pay a minimum amount each month.

Like whole life insurance, universal life insurance grows in cash value over time. You can often grow your investment faster using universal life insurance because of the type of investment options this policy offers.

Critical Illness Insurance

Some life insurance companies offer critical illness inusrance as a separate type of insurance, while others offer it as a rider to an existing life insurance policy. Either way, critical illness insurance allows you to get cash benefits to help defray the costs of health care, including home health aides or hospitalization, during a serious illness such as a stroke.

Since AFib puts you at greater risk of stroke, this type of insurance may be a good idea for you. Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What rate class can I qualify for if I have AFib?

In general, life insurance companies assign people to one of several different rate classes.

Life Insurance Rate Classes

| Rate Class | Description |

|---|---|

| Preferred Plus | Applicant is in exceptional health and otherwise presents little risk. |

| Preferred | Applicant is mostly low risk, but may have a minor health issue such as slightly elevated cholesterol. |

| Standard Plus | Applicant is in generally good health and presents lower than average risks, but has several health issues such as being overweight, high blood pressure, and high cholesterol which are cause for concern |

| Standard | Applicant is in average health. They may have negative health history such as a family member dying of a stroke. |

| Preferred Smoker | Applicant is in good health despite being a smoker and thus qualifies for lower rates than average for smokers |

| Standard Smoker | Applicant is a smoker and has some minor health issues |

| Substandard | Applicant has serious health issues or is otherwise a higher insurance risk |

Preferred Plus is the best rate class you can get. People who are assigned to this class get the lowest rates because they are considered low risk. It’s unlikely that you will be assigned to this class if you have AFib, although if you have lone atrial fibrillation and no other health problems, it’s possible.

Preferred means that you are generally considered a low insurance risk but may have some minor health issues or other risk factors. For example, if you are generally healthy but have high cholesterol, you might be assigned to this rate class.

AFib is considered more than a minor health risk, so this classification is likely not for you if you have this condition.

Standard Plus is reserved for people who are generally low risk but have several indicators of potentially poor health such as high cholesterol, obesity, and diabetes. If your AFib is under control and you don’t have any other health issues, you might qualify for this classification, but it isn’t likely.

Standard means that you are in average health and present an average risk to the insurer. Some people with AFib may qualify for this rate if they don’t have other serious health problems. However, if your family has a history of stroke or heart disease, that puts you at more risk of dying of these diseases, especially if you also have AFib.

Substandard rates are reserved for people who are considered a higher-than-average risk. Most people with AFib will fall into this category.

If XYZ Life Insurance charges $100/month as a standard rate, someone with AFib will pay anywhere between $125 to $275 each month.

If you were recently diagnosed and/or are on a lot of medication for your AFib, your rates will probably tend toward the higher end of the substandard scale than someone who has been living with AFib for a long time and takes little medication for it.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Get the Best Life Insurance Rates

Don’t despair if you have AFib. There are things you can do to help yourself get better life insurance rates than you might think.

The most important thing you can do is take care of your health.

If you avoid smoking, lose excess weight, and follow your doctor’s other recommendations, you improve your chances of getting a lower rate on your life insurance.

It’s also helpful to think through how much life insurance you will need before you begin shopping. It’s usually cheaper to purchase the right type and amount of life insurance upfront than to change your coverage or type of insurance later on.

Finally, spend some time comparison shopping. Different companies may offer different rates. Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What to do if you can’t get life insurance?

In rare cases, your health and other risk factors may be so severe that you don’t qualify for life insurance on the first try. If this happens to you, don’t panic. You still have a couple of options.

If you are over 50, you can get guaranteed issue whole life insurance. Again, this type of life insurance doesn’t require a medical exam, and you are guaranteed coverage if you apply.

If you are under 50, consider asking your employer about group insurance options. Often you can get this type of insurance if you have a pre-existing condition that precludes you from getting individual life insurance.

Case Studies: Life Insurance With Atrial Fibrillation (AFib) (Companies + Rates)

Case Study 1: John’s Journey to Affordable Coverage

John, a 54-year-old individual, was diagnosed with atrial fibrillation (AFib) six months ago. Concerned about his family’s financial security, he decided to explore life insurance options. Knowing that his AFib could impact the rates, John was determined to find affordable coverage.

After comparing quotes from multiple top-rated life insurance companies, John found a policy that suited his needs. Despite his recent AFib diagnosis, he was able to secure coverage starting at $18.23/month. Although slightly higher than standard rates, John was relieved to have found a policy that offered him financial protection.

Case Study 2: Sarah’s Struggle for Coverage

Sarah, a 63-year-old woman, has been living with atrial fibrillation for several years. She had managed her condition well and followed her doctor’s advice. However, when she applied for life insurance, she faced challenges due to her age and AFib.

After exploring various options, Sarah found that her persistent AFib and age were considered high-risk factors by most insurance companies. As a result, she was quoted rates significantly higher than the standard premiums. Sarah decided to continue her search and consult with an insurance agent to explore other possibilities.

Case Study 3: Mark’s Unexpected Denial

Mark, a 40-year-old with a history of AFib and hypertension, applied for life insurance with hope to protect his family’s future. However, despite managing his condition and having a relatively healthy lifestyle, he was unexpectedly denied coverage by several insurance providers.

Upon seeking professional advice, Mark discovered that some insurers considered his combination of AFib and hypertension too risky to offer standard coverage. Nevertheless, he learned about guaranteed issue whole life insurance, a type of policy that doesn’t require a medical exam.

Mark was relieved to find this option as it provided him with the coverage he needed despite previous denials.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Life Insurance With Atrial Fibrillation: The Bottom Line

Buying life insurance with AFib or any pre-existing condition can be challenging.

Every life insurance company has its underwriting process which they use to classify a potential client for coverage, and some companies may charge you high rates or deny you coverage.

It’s not impossible to get life insurance if you have atrial fibrillation.

If you follow doctors’ orders, improve your general health, and shop around for the best rates, you have a good chance of finding the coverage that you need.

Ready to get started? Use our FREE tool to get life insurance with atrial fibrillation quotes right now.

References:

- https://www.thecardiologyadvisor.com/home/topics/arrhythmia/atrial-fibrillation/lone-atrial-fibrillation-finding-optimal-treatment-strategies/

- https://www.mib.com/facts_about_mib.html

Frequently Asked Questions

Can I get life insurance if I have atrial fibrillation (AFib)?

Yes, it is possible to get life insurance with atrial fibrillation (AFib). Although rates may be slightly higher depending on the type of AFib, life insurance is available and affordable starting at $18.23/month.

How are life insurance rates determined for individuals with AFib?

Life insurance rates for individuals with AFib are based on several factors, including the type of AFib, the severity of the condition, the presence of underlying health concerns, and the individual’s overall health. Rates can vary from company to company, so it’s important to get quotes from multiple providers.

What information do I need to provide when applying for life insurance with AFib?

When applying for life insurance with AFib, you may be asked to provide information such as the date of your first diagnosis, the type of AFib you have, the symptoms you experience, the tests you have completed, the medications you are taking, and the underlying cause of your AFib.

How can I improve my chances of getting affordable life insurance with AFib?

Managing your AFib according to your doctor’s orders, having a longer period of time since your diagnosis, and maintaining good overall health can improve your chances of getting more affordable life insurance rates. It’s also beneficial to compare quotes from multiple insurance companies to find the best rates available.

Can I get life insurance with atrial fibrillation if I have other pre-existing conditions?

Yes, it is possible to get life insurance with atrial fibrillation even if you have other pre-existing conditions. However, the presence of additional health conditions may impact your rates and the availability of certain policy options. Insurance companies consider various factors when assessing your risk, including the severity and management of your conditions. It’s important to provide accurate and detailed information about all your pre-existing conditions during the underwriting process to ensure you receive the most accurate quotes and suitable coverage options. Working with an experienced insurance agent or broker can help you navigate the process and find the best life insurance policy for your specific needs.

My AFib is completely controlled by medication. Do I need to mention it when applying for life insurance?

Your insurer will look at your prescription history as well as your medical history to help assess your risk level, so they’ll definitely find out about any medications you are on for your AFib or any other condition. It’s always best, to be honest about your medications or your health history.

I have AFib at a relatively young age, but my doctor says I should live a normal lifespan. Do I really need life insurance?

Anyone could get a fatal illness or be involved in a fatal accident regardless of how old or healthy they are. So it’s best to purchase life insurance now so that your family will be protected if something unexpected happens to you.

I have a lot of health problems, not just AFib. Should I even bother applying for life insurance?

Applying for life insurance is worth a try regardless of your health. Many insurance companies accept applicants who have health issues, even if they require you to pay a higher rate than average, and if you don’t apply, you definitely won’t have coverage.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.