10-Million-Dollar Term Life Insurance Policy

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Life Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about life insurance when he got his first policy for his own family. He has been featured as a life insurance expert speaker at agent conventions and in top publications. As an independent licensed life insurance agent, he has helped clients nationwide to secure affordable coverage while making the...

Licensed Life Insurance Agent

UPDATED: Jan 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Jan 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

If you intend to buy a 10-million-dollar life insurance policy, in addition to being healthy, you’ll need to demonstrate your financial need for such amount. After all, the purpose of life insurance is to safeguard a client’s wealth, not build it.

Our needs and wants are constantly clashing with each other. Do I need this new phone or fast car? Well, if you have the funds, you don’t have to have the need. Your desire is sufficient.

Not valid when you buy 10-million-dollar life insurance. Affordability or being healthy aren’t the only questions. You’ll also need to show a compelling requirement and purpose for such protection.

In this post, I will go over who can qualify for such a comprehensive policy and the rates.

Get Ready to Answer In-Depth Questions

- Is there an insurable interest?

- Is there a purpose for such an amount?

- What is the economic loss? How was it determined?

- Are there any applications pending with other companies? What amount?

- Who is the payor?

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Needs Can a 10-Million-Dollar Policy Meet?

All life insurance cases, but notably $10 million and over, are reviewed from a needs-based approach, and premiums must be within the insurer’s affordability underwriting guidelines and bear a reasonable relationship to a loss.

Here are the needs a $10 million life policy can meet:

1. Income Replacement

Replacing a lost income due to untimely death is a legitimate reason for life insurance. Its purpose is to provide a stream of income to beneficiaries to maintain the current lifestyle, not to create a lavish lifestyle.

Hence, insurance companies determine the face amount you are eligible for using a combination of two methods:

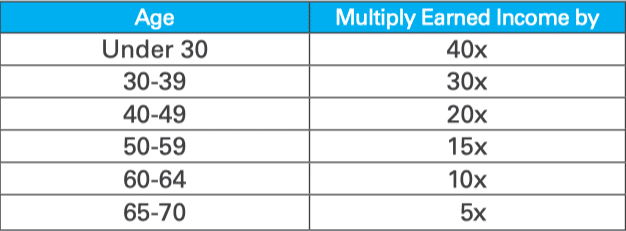

- Income factor table: They calculate your face value based on earned and unearned income (passive) using a multiple of earned income method. Earned income is defined as income that will terminate upon the insured’s death, such as salaries, social security, or cash distribution from a business. Unearned income doesn’t cease upon the death of the insured, such as investment, 401(k) distribution, or rent collection from investment. From the insurance company’s standpoint, a portion of unearned income can be added to the multiplier formula, but not all, since it isn’t passive income and doesn’t depend upon the insured’s life. The table below shows the younger you are, the higher the multiplier you can use, and as you get older, the need for life insurance diminishes and so does the multiplier. For instance, those under 30 years old need to make at least $250,000 (income ×40) per year to qualify for a 10-million-dollar policy, and those in their 60s (income × 10) will need to make a million per year to be eligible for the same coverage.

- Premium-to-income relationship: A good rule of thumb to follow is that your total premium should not exceed 10% of the payer’s pre-tax income. Some companies have this factor at 5%. For instance, if your income is $100,000 per year, your premium must be under $10,000 per year.

Income Factor Table

2. Estate Conservation

High net-worth individuals who seek asset protection and estate tax planning purchase life insurance to help mitigate the significant tax cost a beneficiary will incur due to the estate transfer.

Doing so also helps conserve the assets in the family instead of selling them to meet the tax obligation when that time arrives. At the time of publication, the estate tax can be upward of 40 percent and are subject to estate tax if the property is valued more than $5.49 million.

The insurance carrier will use interest rates ranging from 5% to 10% to estimate future value, depending on the applicant’s age and growth spans, which are typically 7 to 20 years. By estimating a property’s future value, they can permit a larger policy if needed.

3. Charitable Giving

For many wealthy individuals, the need to give back or pay forward is a reason to live. A life insurance policy can be used to satisfy such a requirement should the donor die.

The underwriter will estimate such value based on the potential financial loss an institute will suffer due to the donor’s death. As part of the underwriting process, the underwriter will request evidence of present and past giving along with a pledge of future donation which is outlined in an agreement of some sort.

Typically, the amount you will be granted is around ten times the annual contribution.

4. Key Person

Key person life insurance is intended to protect a key employee in the company. This is frequently viewed as the amount required to replace such a person. A key person is a valuable employee who is not a business owner.

The underwriter will want to see yearly income for the last few years, and the amount of life insurance is usually 5–10 times his or her annual income. In this instance, to buy a 10-million-dollar policy, your key employee must earn 1–2 million per year.

5. Funding a Buy-Sell Agreement

This agreement involves a business owner who wishes to sell the entire business to someone upon his death. The person who proposes to buy the business holds a life insurance policy equal to the value of the company.

Upon the death of the business owner, the buyer can use the death benefit funds and purchase it from the owner’s estate. This buy-sell agreement allows the continuation of the business by choosing a successor and supplying him with the cash to buy it later on.

You can expect to get a death benefit amount that is equal to the business’s current value.

Prepare to Provide Documentation

Buying a 10-million-dollar life insurance policy will be approached very differently than buying lower face amounts. You will need to provide third-party documentation to support your income, debts, and net worth based on the reason for your insurance. For instance, if you need income replacement, you will need to show your yearly income. If you seek a buy-sell agreement, the value of your business will be required.

Below is a list of some of the documentation you must provide based on the reason you buy insurance:

- Attorney letter

- CPA letter

- Audited CPA statements

- Broker-dealer statements

- Tax returns

- Tax assessment or appraisal

- W-2 forms

- Charitable giving statements

10-Million-Dollar Term Life Insurance Monthly Rates

*All rates quoted on this page are for a super-preferred healthy individual who does not use tobacco. Monthly rates are updated as of May 2019 and are subject to underwriting approval.*

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: 10-Million-Dollar Term Life Insurance Policy

Case Study 1: High-Net-Worth Individual With Complex Estate Planning

John, a successful entrepreneur with substantial assets, sought a 10-million-dollar term life insurance policy to address estate tax planning needs and asset protection for his beneficiaries. He wanted to ensure that his loved ones would not face significant financial burdens due to estate taxes upon his passing.

After providing documentation of his net worth, financial planning strategies, and estate goals, John qualified for the policy with affordable premium rates.

Case Study 2: Key Person Coverage for a Valuable Employee

Alpha Corporation, a thriving company, decided to protect its business interests by securing a 10-million-dollar term life insurance policy on its key employee, Mark. As a valuable employee with a high income, Mark’s contributions were vital to the company’s success.

The policy would provide financial security to the company in the event of Mark’s untimely death, helping with business continuity and finding a suitable replacement.

Case Study 3: Generous Philanthropist With Charitable Giving Goals

Laura, a wealthy philanthropist, wanted to ensure that her charitable work would continue even after her passing. She opted for a 10-million-dollar term life insurance policy as part of her charitable giving strategy. The policy’s death benefit would support her chosen charitable causes, enabling her philanthropic endeavors to have a lasting impact on the community.

Laura provided evidence of her charitable history and a commitment to future donations, which helped secure the policy with favorable terms.

Bottom Line

Purchasing a 10-million-dollar life insurance coverage is reserved for those who have the financial requirements, provided they can prove it through third-party documentation.

You will be looked at through a microscope when applying for a 10-million-dollar policy for the obvious reason: the carrier is on the hook for millions should you die.

In addition to being able to afford it, you may also be required to undergo different testing based on your age or overall health, such as EKG, stress test, or providing an attending physician statement (APS).

Use the form on this page to compare rates from top-rated companies.

Frequently Asked Questions

What is a 10-million-dollar term life insurance policy?

A 10-million-dollar term life insurance policy is a type of life insurance coverage that provides a death benefit of $10 million to the designated beneficiaries if the insured person passes away within the specified term of the policy.

Who might consider a 10-million-dollar term life insurance policy?

A 10-million-dollar term life insurance policy is typically suitable for individuals with high-income levels, substantial financial responsibilities, or complex estate planning needs. It may be considered by those looking to provide financial security for their beneficiaries in the event of their untimely death.

What is the duration of a typical term for a 10-million-dollar term life insurance policy?

The term duration for a 10-million-dollar term life insurance policy can vary depending on the insurer and the specific policy selected. Terms usually range from 10 to 30 years, but longer or shorter terms may also be available.

How much does a 10-million-dollar term life insurance policy cost?

The cost, or premium, of a 10-million-dollar term life insurance policy varies depending on several factors, including the insured person’s age, health, occupation, lifestyle, and the length of the term. Generally, premiums for higher coverage amounts tend to be higher than for lower coverage amounts.

What are the advantages of a 10-million-dollar term life insurance policy?

Some advantages of a 10-million-dollar term life insurance policy include:

- Providing substantial financial protection for beneficiaries in the event of the insured person’s death.

- Offering flexibility to choose the term length that aligns with specific financial needs and goals.

- Potentially covering large financial obligations such as estate taxes, business debts, or mortgages.

Can the death benefit of a 10-million-dollar term life insurance policy be used for any purpose?

Yes, the death benefit of a 10-million-dollar term life insurance policy can typically be used for any purpose chosen by the beneficiaries. It can help cover various financial needs, such as paying off debts, funding education expenses, maintaining a desired standard of living, or providing an inheritance.

Are medical exams required to obtain a 10-million-dollar term life insurance policy?

The requirement for a medical exam to obtain a 10-million-dollar term life insurance policy depends on several factors, including the applicant’s age, health history, and the insurance company’s underwriting guidelines. In some cases, a medical exam may be necessary to assess the applicant’s health and determine the premium rates.

Can a 10-million-dollar term life insurance policy be converted to permanent life insurance?

Some term life insurance policies offer a conversion feature that allows the policyholder to convert the term policy into a permanent life insurance policy, such as whole life or universal life insurance. However, it’s important to review the terms and conditions of the specific policy to determine if this option is available.

How can one apply for a 10-million-dollar term life insurance policy?

To apply for a 10-million-dollar term life insurance policy, individuals typically need to contact an insurance provider or work with an insurance agent. The application process involves providing personal information, completing a health questionnaire, and potentially undergoing a medical exam, depending on the insurer’s requirements.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Life Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about life insurance when he got his first policy for his own family. He has been featured as a life insurance expert speaker at agent conventions and in top publications. As an independent licensed life insurance agent, he has helped clients nationwide to secure affordable coverage while making the...

Licensed Life Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.