Best Life Insurance for Kidney Transplant Patients in 2025 (Your Guide to the Top 10 Companies)

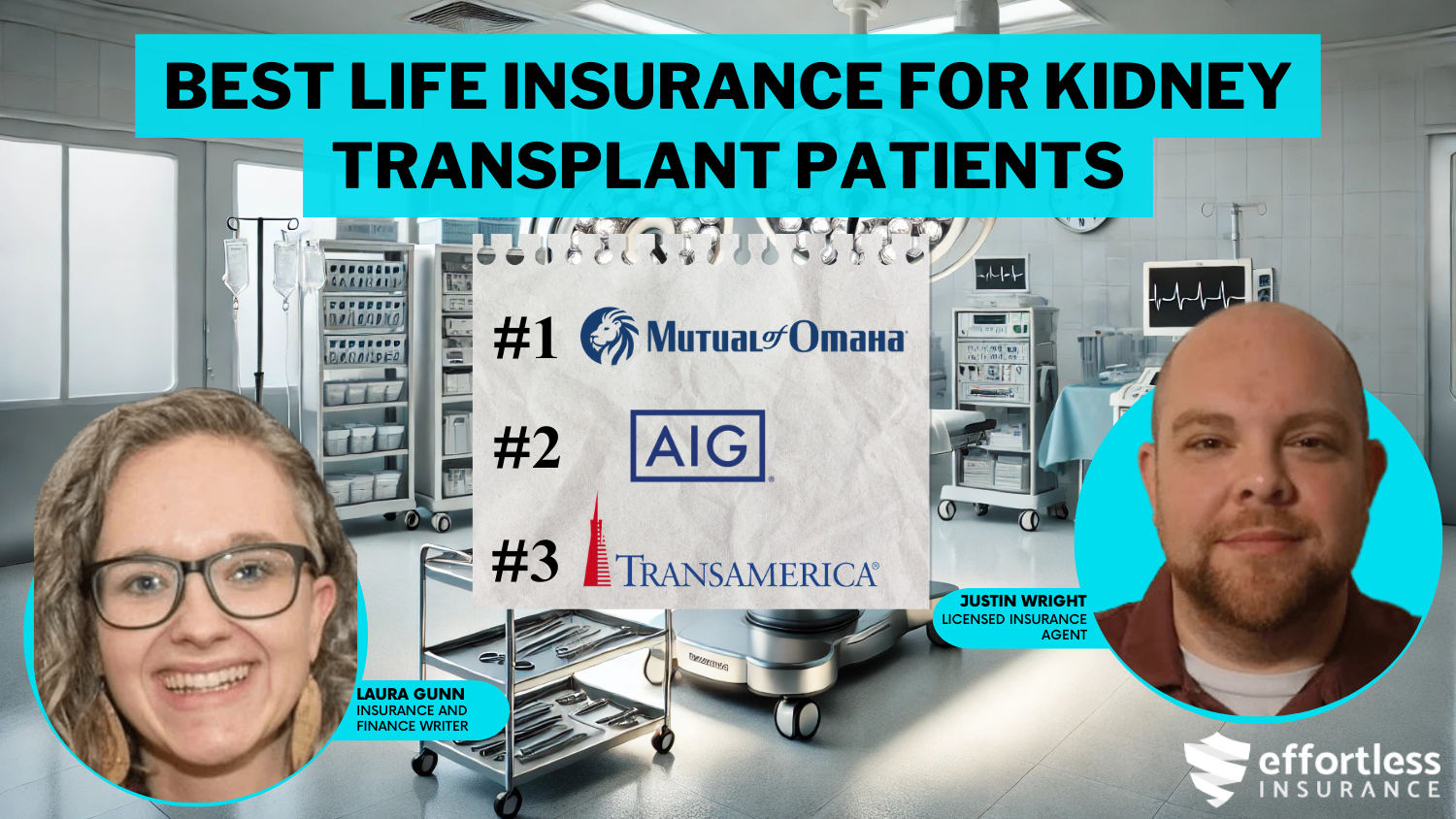

The best life insurance for kidney transplant patients starts at $25/month, with top companies like Mutual of Omaha, AIG, and Transamerica. Mutual of Omaha stands out with flexible plans, AIG offers solid coverage, and Transamerica provides high benefits for different needs.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: Jan 17, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Jan 17, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

0 reviews

0 reviewsCompany Facts

Whole Policy for Kidney Transplant Patients

A.M. Best

Complaint Level

0 reviews

0 reviews 163 reviews

163 reviewsCompany Facts

Whole Policy for Kidney Transplant Patients

A.M. Best

Complaint Level

163 reviews

163 reviews 0 reviews

0 reviewsCompany Facts

Whole Policy for Kidney Transplant Patients

A.M. Best

Complaint Level

0 reviews

0 reviewsThe best life insurance for kidney transplant patients comes from Mutual of Omaha, AIG, and Transamerica. They’re great options because they’re affordable, flexible, and offer solid coverage. Mutual of Omaha is the best pick, with rates starting at just $25 per month, making it a super budget-friendly choice.

This article examines each provider’s strengths and limitations, helping kidney transplant patients navigate their unique insurance needs confidently.

Our Top 10 Company Picks: Best Life Insurance for Kidney Transplant Patients

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 6% | A+ | Flexible Plans | Mutual of Omaha | |

| #2 | 10% | A | Comprehensive Care | AIG |

| #3 | 8% | A+ | High Benefits | Transamerica | |

| #4 | 9% | A++ | Whole Life | MassMutual | |

| #5 | 22% | A++ | Flexible Terms | Guardian Life | |

| #6 | 11% | A++ | Wellness Rewards | New York Life |

| #7 | 12% | A++ | Affordable Rates | Northwestern Mutual | |

| #8 | 15% | A+ | Customer Service | Banner Life |

| #9 | 14% | A+ | No-Exam | Prudential | |

| #10 | 20% | A+ | Term Flexibility | John Hancock |

Compare sample life insurance rates to determine the best way to secure affordable life insurance for kidney transplant patients. It’s best to wait to apply for life insurance until at least three years after your transplant surgery.

When you’re ready, you can buy life insurance for kidney transplant patients by entering your ZIP code into our free rate tool above.

- Life insurance for kidney transplant patients covers pre-existing conditions

- Specialized policies for kidney transplant recipients may have higher premiums

- Mutual of Omaha, AIG, and Transamerica are top picks, starting at $25/mo

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – Mutual of Omaha: Best Overall Pick

Pros

- Affordable Rates: Their lowest monthly rate is just $25, making it affordable for kidney transplant patients. To learn more, check this Mutual of Omaha Life Insurance review.

- Flexible Plans: Mutual of Omaha has policies designed to meet the unique needs of kidney transplant patients.

- Quick Approval: Mutual of Omaha is known for a smooth and fast policy approval process for kidney transplant patients.

Cons

- Limited Benefits: Their plans might not offer the biggest benefit amounts compared to other companies for kidney transplant patients.

- Fewer Wellness Rewards: Unlike some other companies, Mutual of Omaha doesn’t really focus on offering wellness perks for kidney transplant patients.

#2 – AIG: Best for Comprehensive Care

Pros

- Comprehensive Support: AIG is great at helping kidney transplant patients get the necessary coverage, even with complicated medical histories.

- Affordable Premiums: Offers competitive term life insurance rates at $27 per month for kidney transplant patients. Discover more in our AIG Life Insurance review.

- Customizable Coverage: AIG allows kidney transplant patients to adjust their policies based on changing health needs.

Cons

- Higher Costs: If you need higher coverage, premiums can go up quite a bit for kidney transplant patients.

- More Paperwork: When you apply, AIG may ask for extra health records from kidney transplant patients.

#3 – Transamerica: Best for High Benefits

Pros

- High Benefit Options: Transamerica gives kidney transplant patients some of the highest benefit amounts available.

- Guaranteed Issue Coverage: Great for kidney transplant patients who might not qualify for regular plans.

- Affordable Starting Rate: Term life insurance premiums start at just $28 per month for kidney transplant patients.

Cons

- Waiting Periods: Policies for kidney transplant patients may have a waiting period before full benefits. Find more in our Transamerica Life Insurance Company review.

- Limited Flexibility: The plans for kidney transplant patients may not be as customizable as other options out there.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#4 – MassMutual: Best for Whole Life Coverage

Pros

- Lifetime Coverage: MassMutual specializes in whole-life policies that provide lifetime protection for kidney transplant patients. For more details, check out the different types of life insurance.

- Cash Value Growth: Policies for kidney transplant patients build cash value over time, adding financial security.

- Reasonable Rates: Term life coverage costs $30 per month for kidney transplant patients.

Cons

- Higher Initial Costs: Premiums for kidney transplant patients can feel higher upfront than term plans.

- Complex Application: Kidney transplant patients may need to provide more documentation than simpler plans require.

#5 – Guardian Life: Best for Flexible Terms

Pros

- Customizable Terms: Guardian Life allows kidney transplant patients to adjust their coverage periods easily.

- Affordable Rates: Monthly premiums for kidney transplant patients start at $30 for term life coverage. Discover where to buy life insurance.

- Solid Reputation: Guardian Life has a long history of reliability and customer satisfaction for kidney transplant patients.

Cons

- Fewer Perks: Policies for kidney transplant patients may not include wellness rewards or extra benefits.

- Limited Discounts: Bundling discounts for kidney transplant patients are not as generous as those other companies offer.

#6 – New York Life: Best for Wellness Rewards

Pros

- Health Incentives: According to our New York life insurance review, the company offers wellness rewards for kidney transplant patients who maintain good health.

- Trusted Provider: They’ve been around for a long time, so you can really trust them to have your back as a kidney transplant patient.

- Competitive Rates: Starting at just $31 per month for kidney transplant patients with term life coverage.

Cons

- Unexpected Higher Costs: Whole life insurance coverage plans can get expensive for kidney transplant patients.

- Longer Application Process: The approval process can take a bit longer than expected for kidney transplant patients.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#7 – Northwestern Mutual: Best for Affordable Rates

Pros

- Affordable Plans: Northwestern Mutual has coverage starting at just $32 a month for kidney transplant patients.

- Reliable Support: Their agents are great at walking kidney transplant patients through the process. See our “Northwestern Mutual Life Insurance Guide.” for more.

- Custom Policies: They allow kidney transplant patients to create plans that fit their unique health and financial needs.

Cons

- Limited Online Options: Managing your policy online can be a bit tricky for kidney transplant patients with Northwestern Mutual.

- Fewer Add-Ons: They don’t offer as many extra perks like wellness rewards for kidney transplant patients.

#8 – Banner Life: Best for Customer Service

Pros

- Great Support: Banner Life offers excellent customer service, especially for kidney transplant patients.

- Customizable Plans: Banner Life policies can be adjusted to match your unique needs as a kidney transplant patient.

- Affordable Rates: Term life coverage for kidney transplant patients costs $33 per month. Check out our Banner Life Insurance Company review for more details.

Cons

- Higher Starting Premiums: Rates for kidney transplant patients are slightly higher than other companies.

- Limited Perks: Policies for kidney transplant patients don’t offer as many extra benefits or rewards.

#9 – Prudential: Best for No-Exam Policies

Pros

- No Medical Exam Required: This is ideal for kidney transplant patients who want a simple approval process.

- Flexible Terms: Prudential offers customizable term life plans for kidney transplant patients, according to the Prudential life insurance review.

- Reasonable Rates: Costs just $34 per month for term life insurance coverage for kidney transplant patients.

Cons

- Higher Costs: Premiums for kidney transplant patients are often higher for no-exam policies.

- Limited Options: Prudential focuses more on term policies than whole life for kidney transplant patients.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#10 – John Hancock: Best for Flexible Term Options

Pros

- Flexible Terms: Prudential offers many term length options, even for kidney transplant patients.

- Wellness Rewards: Prudential provides discounts for staying healthy with good habits like exercising and eating well.

- Affordable Starting Rates: Term life coverage premiums start at $35 per month Our John Hancock Life Insurance review provides all the details.

Cons

- Higher Costs: Premiums can be pricey for kidney transplant patients with basic coverage options.

- Complicated Process: Applications may take longer than expected with other insurance providers.

Average Life Insurance Rates for Kidney Transplant Patients

Expect life insurance quotes for kidney transplant patients to be higher than average. Commonly, recovered transplant patients earn substandard premiums that cost 25% more than the standard or base rates. Life insurance rates for kidney transplant patients cost around $36 per month.

Kidney Transplant Patients Life Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Term Policy | Whole Policy |

|---|---|---|

| $27 | $185 |

| $33 | $215 |

| $30 | $200 | |

| $35 | $230 | |

| $30 | $210 | |

| $28 | $190 | |

| $31 | $220 |

| $32 | $225 | |

| $34 | $218 | |

| $28 | $195 |

As you can see, kidney transplant life insurance costs fall within an affordable range. But you must wait for at least three years after surgery, or you risk denial of coverage. For more info, explore our guide, “How Pre-Existing Conditions Affect Life Insurance.”

Average Monthly Term Life Insurance Rates for Kidney Transplant Patients

| Insurance Company | Available Discount |

|---|---|

| Bundling, Long-Term, Health Stability |

| Bundling, Regular Health Monitoring |

| Healthy Lifestyle, Post-Transplant Care | |

| Wellness Program, Nonsmoker | |

| Financial Planning, Transplant Recovery Support | |

| Bundle (Life and Health), Long-Term Client Stability | |

| Bundling, Health Recovery |

| Preferred Health, Organ Transplant Support | |

| Healthy Lifestyle, Nonsmoker Stability | |

| Loyalty, Health Improvement Program |

The table below compares the average monthly rates for a 20-year term policy with a $100,000 death benefit at both the standard and substandard tiers relevant to kidney transplant patients:

Average Monthly Term Life Insurance Rates for Kidney Transplant Patients: Standard versus Substandard Rates

| Age | Average Standard Monthly Rates | Average Substandard Monthly Rates (25% Increase) |

|---|---|---|

| 25-years-old | $11 | $13 |

| 30-years-old | $11 | $14 |

| 35-years-old | $11 | $14 |

| 40-years-old | $13 | $16 |

| 45-years-old | $16 | $20 |

| 50-years-old | $23 | $29 |

| 55-years-old | $32 | $40 |

| 60-years-old | $52 | $65 |

| 65-years-old | $91 | $113 |

If your kidney is from overseas, most companies will deny your application because there’s no way to regulate overseas medical operations. Similarly, some companies increase your premiums if your kidney comes from a cadaver versus a living donor.

If you already had term life insurance before your transplant, your costs will likely increase at the time of your policy renewal. Unfortunately, if your body rejects the transplant for any reason, you will not be able to purchase traditional life insurance.

Dialysis patients may qualify for wellness rewards, which can help lower premiums and provide essential financial support for ongoing medical needs.Eric Stauffer Licensed Insurance Agent

When your body rejects the transplanted kidney, it can cause serious health problems that make it much harder to get approved for regular life insurance. Insurance companies see this as a higher risk because ongoing kidney rejection can lead to more medical issues, frequent hospital visits, and even the need for another transplant.

As a result, most traditional life insurance companies may deny coverage or offer much higher premiums. In these cases, exploring other options, like guaranteed issue life insurance, which doesn’t require a medical exam or approval based on health conditions, is essential.

Impact of Kidney Transplants on Life Insurance

Life insurance for high-risk individuals is always more complicated than for people in average health. Unfortunately, organ transplants indicate to life insurance companies that you’ve experienced both poor health and pre-existing high-risk conditions. For example, kidney failure is often a symptom of diabetes, hepatitis C, and high blood pressure.

It’s called a ‘plan’ for a reason. As Financial Advisor, Tina T. Hoang, explains: a financial plan combines all of your goals and creates a living, breathing, long-term approach to achieving them. When your life changes, your plan changes with you. That’s the plan. pic.twitter.com/MHDX42bUvM

— Northwestern Mutual (@NM_Financial) May 3, 2023

Even after a kidney transplant, health complications may still occur. According to the American Kidney Fund, fewer than 1 in 20 patients experience acute organ rejection within the first six months post-surgery. However, chronic failure occurs more frequently after several years. Want to know how to stay healthy? Learn the benefits of eating healthy.

Therefore, most companies do not sell life insurance policies to transplant patients until after three years of controlled health. Unfortunately, other insurance providers are unwilling to take on such a risk altogether.

If you are a kidney donor, your insurance rates also might go up. To prevent the increase in costs, have the transplant center write a letter to your provider explaining that your life expectancy is not affected.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Getting Life Insurance After a Kidney Transplant

Getting life insurance after a kidney transplant can be challenging. Insurance companies consider your health to decide if you can get coverage. Your health now and in the future plays a significant role in this decision.

If you’re healthy for about three years after your transplant, you’ll likely get regular life insurance like term or whole life insurance. This shows the insurance company that you’re doing well after the transplant.

However, if your health is poor, you have problems with your transplant, or your body rejects the kidney, the insurance company might deny you coverage. In these cases, they see you as a higher risk. Want to explore further? Check out our guide, “Life Insurance Attending Physician Statement.”

Consider a guaranteed issue whole life insurance policy instead. If you can’t get regular life insurance, you can look into a guaranteed issue life insurance policy. This type doesn’t require a medical exam, so it’s easier to get. The coverage might be smaller, but it’s a good option if you can’t qualify for regular insurance.

Case Studies: Life Insurance for Kidney Transplant Patients

Getting life insurance after a kidney transplant can feel tricky, but finding coverage that works for you is possible. With the right insurance company and some planning, transplant patients can get the protection they need. Here are three simple examples of how people found the right insurance for them.

Case Study #1: Emily’s Success with Life Insurance Plans:

After her kidney transplant, Emily waited three years before applying for life insurance to give her health time to improve. She found a plan that fit her with Mutual of Omaha’s flexible options. Through careful planning, Emily could get the coverage she needed at an affordable price.

Case Study #2 – Benjamin’s Transplant Coverage:

Before his transplant, Benjamin had life insurance, but it was too expensive, so he looked for other options. After the surgery, he worked with AIG because they offer great care. Thanks to AIG, he was able to lower his premiums, making his insurance easier to manage.

Case Study #3 – Olivia’s Protection Coverage:

After some complications with her kidney transplant, Olivia couldn’t couldn’t life insurance. But she was able to get covered through Transamerica’s issue whole-life policy. This gave her the protection she needed, even though her health was challenging. Find additional info about the best life insurance companies that cover impaired risk.

Understanding Life Insurance for Kidney Transplant Patients

Getting life insurance after a kidney transplant can be tricky, but with the right approach, coverage can be found. The case studies show that working with flexible companies, waiting for health improvements, or exploring whole-life policies can help patients secure affordable coverage. Planning ahead and considering all options will help you find the right plan for your needs.

Every transplant patient’s situation is different, and the right policy depends on factors like health, age, and goals. Working with an experienced agent can help you find the best option and ensure financial security for you and your family. Learn the details about life insurance costs.

These stories show kidney transplant patients can find the right coverage with the proper planning and support. Find the best life insurance companies for kidney transplant patients near you by entering your ZIP code into our free rate tool below.

Frequently Asked Questions

Can transplant patients get life insurance?

Yes, there are options for life insurance for transplant patients. While many insurance companies offer coverage, the terms and premiums may vary based on your health, the type of transplant you’ve had, and there are many benefits for transplant patients depending on how well they’ve recovered.

What is the best health insurance for kidney transplant patients?

The best health insurance for kidney transplant patients covers surgery, medications, and follow-up care. Some plans are specifically designed for transplant needs. Enter your ZIP code to start comparing premiums from highly-rated insurers in your area.

Can I get life insurance after a kidney transplant?

Yes, life insurance after kidney transplant is available, although it may depend on your recovery and medical history. Insurance companies will evaluate your overall health, including how well your kidney transplant has worked and whether you have any related complications. Get more insights in our guide, “Dos and Don’ts of Life Insurance.”

Does insurance cover kidney transplants and other organ transplants?

Yes, Most policies do. Similarly, does insurance cover kidney transplant surgeries? In most cases, yes. It’s important to check the policy for any exclusions or additional requirements, like pre-approval or waiting periods.

How much does a kidney transplant cost with insurance?

The kidney transplant cost with insurance can vary widely. The cost of a kidney transplant with insurance often includes deductibles, co-pays, and follow-up expenses. The total amount you may pay will depend on your specific health insurance plan and coverage limits, so it’s important to review your policy for detailed information.

Is dialysis covered under life insurance?

Typically, dialysis covered under life insurance is not standard. However, specialized policies like life insurance for kidney dialysis patients may offer tailored coverage. For more info, check our guide, “Best Life Insurance for Dialysis Patients.”

What does kidney transplant insurance coverage include?

Kidney transplant covered by insurance usually includes pre-operative evaluations, the surgery itself, and post-surgical care. Depending on the plan, it may also cover the costs of any complications or additional treatments required during recovery.

Can I get life insurance with a kidney transplant history?

Yes, life insurance with kidney transplants is available. However, premiums may be higher depending on your health and medical history.

How much is a kidney transplant with insurance?

For health insurance after a kidney transplant with insurance, some plans provide affordable coverage for follow-up care and medications. Find out all you need in our guide, “Life Insurance Coverage Questions.”

Are kidney transplants covered by insurance in the U.S.?

Yes, most comprehensive health plans, including kidney transplant insurance, cover transplant procedures. Does another provider have lower rates? Find out by entering your ZIP code into our free quote comparison tool.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.