Best Life Insurance for Overweight Individuals in 2025 (Top 10 Companies)

Banner Life, Prudential, and AIG offer the best life insurance for overweight individuals, with rates starting at just $20 per month. These companies are known for their personalized underwriting, affordable prices, easy access, and complete coverage options for overweight individuals.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

UPDATED: Mar 18, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Mar 18, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

0 reviews

0 reviewsCompany Facts

Whole Policy for Overweight Individuals

A.M. Best Rating

Complaint Level

0 reviews

0 reviews 163 reviews

163 reviewsCompany Facts

Whole Policy for Overweight Individuals

A.M. Best Rating

Complaint Level

163 reviews

163 reviewsThe best life insurance for overweight individuals comes from Banner Life, Prudential, and AIG, with Banner Life being the top choice for low rates and good coverage.

These companies have plans starting at $20 per month, making insurance affordable for people who might pay more elsewhere. They offer options that work well for overweight people, with fair prices and flexible plans.

Our Top 10 Company Picks: Best Life Insurance for Overweight Individuals

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | A+ | Flexible Policies | Banner Life |

| #2 | 10% | A+ | Comprehensive Care | Prudential | |

| #3 | 11% | A | Flexible Coverage | AIG |

| #4 | 12% | A+ | Simple Approval | Mutual of Omahal | |

| #5 | 13% | A+ | Health Support | John Hancock | |

| #6 | 13% | A+ | Quick Coverage | Transamerica | |

| #7 | 11% | A+ | Health Guidance | Pacific Life | |

| #8 | 14% | A | Customizable Plans | Lincoln Financial | |

| #9 | 11% | A++ | Dependable Support | New York Life |

| #10 | 14% | A+ | Affordable Premium | Protective Life |

Each company has substantial benefits, making them excellent choices for life insurance. Gain further insight with this guide, “Types of Life Insurance: Find the Right Policy for Your Needs.”

Simplify your life insurance shopping by entering your ZIP code into our free quote comparison tool and find coverage that fits your budget and needs.

- Banner Life is the top choice for the best life insurance for overweight individuals

- Prudential and AIG also offer affordable coverage options

- Rates start at $20/month, with flexible plans and great value

#1 – Banner Life: Top Overall Pick

Pros

- Top Coverage: Banner Life has a special approach that works well for overweight individuals looking for whole-life insurance.

- Low Monthly Prices: Starting at just $20/month for basic coverage, Banner Life offers affordable options for overweight individuals.

- Customizable Policies: Banner Life lets you change your plan to fit your needs, which is great for overweight individuals.

Cons

- Limited Whole Coverage: It might cost more for overweight individuals than with other companies offer. View this guide, “Banner Life Insurance Company Review,” to learn more.

- Premiums Could Go Up: Prices could increase based on health check-ups and policy changes for overweight individuals.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Prudential: Best for Comprehensive Care

Pros

- Ideal Life Insurance for Overweight People: Prudential offers complete care options that suit the needs of overweight individuals.

- Flexible Plans: Prudential has many add-ons and options that work for overweight individuals. Dive into this “Prudential Life Insurance Review” guide for additional details.

- Good Financial Ratings: Prudential has an A+ rating, making it a trusted choice for overweight individuals.

Cons

- Starting Rates Are Higher: Basic coverage starts at $25/month, which may not be as low for overweight individuals as with some other companies.

- Many Options Can Be Confusing: The different types of coverage for overweight individuals may be hard to choose.

#3 – AIG: Best for Flexible Coverage

Pros

- Good Life Insurance for Overweight People: AIG has flexible plans that work well for overweight individuals.

- Low Prices: Basic plans start at $28 per month, making them a good choice for overweight individuals. For further insights, refer to this guide, “AIG Life Insurance Review. “

- Strong Financial Rating: AIG has an A rating. Overweight individuals can feel safe knowing they are financially strong.

Cons

- Whole Coverage Costs More: AIG’s $45 per month whole policy may be more expensive than other insurers offer for overweight individuals.

- Fewer Extra Options: AIG has fewer add-on choices for overweight individuals.

#4 – Mutual of Omaha: Best for Simple Approval

Pros

- Simple Approval: Mutual of Omaha makes it easy to get approved, even for people who are overweight.

- Affordable Rates: Coverage starts as low as $22/month, making it a great choice for those overweight individuals.

- Friendly Support: The company offers helpful and friendly customer service, which is especially useful for overweight customers.

Cons

- Limited High-Coverage Options: Whole coverage costs $37 per month, which might be lower than other companies offer.

- More Health Checks: Overweight individuals may need to do extra health tests to get higher coverage. Read this “Mutual of Omaha Life Insurance Review” guide for more details.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – John Hancock: Best for Health Support

Pros

- Best Life Insurance for Overweight Individuals: John Hancock has plans that include health support for overweight individuals.

- Focus on Wellness: Offers rewards for staying healthy, which can motivate overweight individuals. Discover more in this guide, “John Hancock Life Insurance Review.”

- Strong Financial Rating: An A+ rating means John Hancock is a reliable choice for overweight individuals.

Cons

- Higher Starting Prices: Minimum coverage is $30/month, which might be more expensive for overweight individuals.

- Complex Health Program: The health rewards program may have rules that are hard for overweight individuals to meet.

#6 – Transamerica: Best for Quick Coverage

Pros

- Quick Coverage: Transamerica can quickly approve and provide coverage for people who are overweight.

- Competitive Rates: Their term policy costs $24/month. It is a great deal for those who are overweight.

- Health Guidance: Transamerica provides simple health tips for overweight individuals. For more information, view this “Transamerica Life Insurance Company Review” guide.

Cons

- Limited Discount Options: With a 13% bundling discount, the savings may be less than other insurers offer for overweight individuals.

- Data Rates: Premiums may be higher for overweight individuals than some providers offering similar health support.

#7 – Pacific Life: Best for Health Guidance

Pros

- Best Coverage: Pacific Life stands out because it offers good health support for overweight individuals.

- Affordable Basic Coverage: This basic coverage starts at $27/month, which is a fair price for overweight individuals.

- Strong Financial Ratings: An A+ rating means Pacific Life is safe and reliable for overweight individuals.

Cons

- Higher Cost for Whole Coverage: It costs $44/month, which may be more expensive for overweight individuals.

- Fewer Extra Options: A few additional options are available for overweight individuals. For more information, see this “Indexed Universal Life Insurance: Pros & Cons” guide.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Lincoln Financial: Best for Customizable Plans

Pros

- Reasonable Plans: Lincoln Financial offers customizable plans to fit the different needs of overweight individuals.

- Financially Strong: An A rating shows Lincoln Financial is economically strong and reliable for individuals who are overweight.

- Flexible Policies: They offer many terms and coverage amounts that are helpful for overweight individuals.

Cons

- Higher Starting Prices: The term coverage starts at $26/month, which may cost overweight individuals more than other companies offer.

- Limited Discounts: Fewer chances to save money for overweight individuals. Uncover the details in this guide, “Best Life Insurance Companies That Accept ITIN.”

#9 – New York Life: Best for Dependable Support

Pros

- Excellent Life Insurance for Overweight Individuals: New York Life offers reliable support for overweight individuals.

Top Financial Rating: An A++ rating shows the company is strong financially, which benefits overweight individuals.

Lots of Coverage Options: Offers many choices for overweight individuals. This “New York Life Insurance Review” guide has all your answers.

Cons

- Higher Starting Costs: Their lowest coverage starts at $29/month, which could be more difficult for overweight people to afford.

Limited Discounts: There are fewer ways to get a discount for overweight individuals.

#10 – Protective Life: Best for Affordable Premium

Pros

- Reasonable Coverage: Protective Life gives affordable plans that are good choices for overweight individuals.

- Low Prices: A $23/month starting rate is cost-effective for overweight individuals. For a deeper understanding, see this guide, “Protective Life Insurance Review.”

- Good Customer Service: They are known for giving reliable support, which overweight individuals may value.

Cons

- Whole Coverage Costs More: It costs $38/month, which may be higher than other insurers offer for overweight individuals.

- Fewer Custom Options: There are fewer add-ons or extra features for overweight individuals.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Can You Be Denied Life Insurance Due to Weight

In most cases, insurance companies won’t deny coverage outright unless a person is overweight and has other health issues or family history concerns. If blood and urine tests show irregularities or elevated liver function, the insurance company will more than likely assume heavy drinking.

Life Insurance for Overweight Individuals Monthly Rates by Provider & Coverage Level

| Insurance Company | Term Policy | Whole Policy |

|---|---|---|

| $28 | $45 |

| $20 | $35 |

| $30 | $48 | |

| $26 | $42 | |

| $22 | $37 | |

| $29 | $47 |

| $27 | $44 | |

| $23 | $38 | |

| $25 | $40 | |

| $24 | $39 |

They will start asking more questions, requesting more information, and will eventually get to the bottom line about your current alcohol habits and use. According to the CDC, obesity-related conditions, such as heart disease, stroke, type 2 diabetes, and certain types of cancer, are some of the leading causes of preventable death.

Overweight individuals can secure affordable life insurance coverage by focusing on tailored plans that fit their unique health needs and lifestyle.Michelle Robbins Licensed Insurance Agent

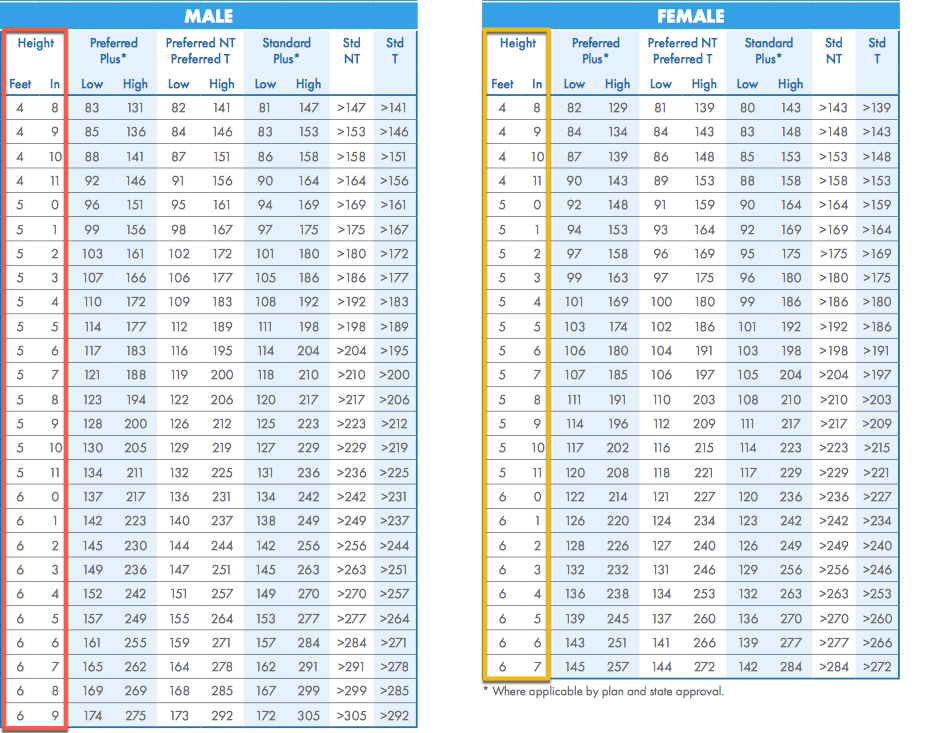

How does BMI affect life insurance? The chart below provides life insurance weight limits by height for each risk class. These charts, including the height and weight chart for life insurance and the life insurance weight chart, help underwriters evaluate risk.

The life insurance height weight chart provide gender-specific guidance, while the insurance height and weight chart and the insurance BMI chart apply to broader demographics. These charts are often different from one company to another.

For instance, State Farm Life Insurance Life calculates its life insurance underwriting risks differently than other insurers. If you are overweight, knowing which company will give you the best rate based on your height-to-weight ratio is crucial.

Banner life insurance offers preferred rates to individuals who are 6’0″ up to 207 lbs. AIG life insurance provides great rates up to 217 lbs, while Prudential life insurance offers the best rates up to 228 lbs.

Losing Weight Before Applying for Life Insurance

Any rapid weight loss can be a sign of another ailment, such as bulimia or depression. Even if you lose weight in a healthy way, such as by changing your nutrition and exercise habits, a rapid weight loss within a year will result in adding at least 50% of the weight back to the application.

Don’t look at life insurance as just a safety net. It can be a tool for protecting what matters and preserving your legacy. pic.twitter.com/ye7pLntVNb

— Protective Life (@ProtectiveLife) June 10, 2024

Does weight affect health insurance, too? The answer is yes. According to the NCBI, obese individuals can pay as much as $732 more in annual health insurance costs.

Life Insurance Discounts From the Top Providers for Overweight Individuals

| Insurance Company | Available Discounts |

|---|---|

| No-Exam Option, Wellness Rewards |

| Healthy Lifestyle, Bundling, No-Exam Option |

| Wellness Rewards, Bundling, Family Discount | |

| Family Discount, Healthy Lifestyle | |

| No-Exam Option, Healthy Lifestyle | |

| Wellness Rewards, Family Discount |

| Wellness Rewards, Bundling | |

| No-Exam Option, Health Management | |

| Family Discount, Healthy Lifestyle | |

| No-Exam Option, Health Management |

Today, health insurance for overweight applicants often offers weight loss programs or weight management incentives.

The Underwriter’s Questions

To make a good impression on an insurance underwriter, share details about your current life that show stability and commitment to staying sober.

Talk about things like whether you’re going to school, have a steady job, or are involved in family life, such as having children. These examples show that you’re likely to continue living a sober life. Be prepared to answer questions like your age, smoking habits, and body measurements (weight and height) to help the underwriter understand your overall health and risk level.

Life insurance for overweight individuals should prioritize personalized coverage options that account for health considerations and financial goals.Daniel Walker Licensed Insurance Agent

Even for no exam life insurance, you will need to provide written answers to these questions. For those pursuing whole life insurance, these tools, including the insurance weight chart and the insurance height weight chart, play a critical role in underwriting decisions.

Case Studies: Real-Life Experiences of Overweight Individuals

Real stories can show how top life insurance companies help overweight people. Here are three cases showing how these companies provide affordable and reliable coverage. Expand your understanding with this guide, “How does life insurance work?”

- Case Study #1 – Sarah Finds an Affordable Policy with Banner Life: At 42, Sarah was concerned that her weight might make it hard to find affordable life insurance. However, Banner Life came through with a policy that fit her budget—starting at just $20 a month. Knowing her family would be financially secure gave her peace of mind.

- Case Study #2 – Michael’s Personalized Plan with Prudential: Michael, 38, was looking for a life insurance plan that fit his needs. Prudential offered affordable coverage with great protection, making him feel confident in his decision—especially since it works well for people who are overweight.

- Case Study #3 – Lisa’s Affordable Coverage from AIG: Lisa, 45, thought life insurance would be too expensive. When she saw AIG’s plan starting at just $28 a month, she felt at ease knowing her family would be cared for.

These stories show that Banner Life, Prudential, and AIG provide trustworthy life insurance. To instantly compare life insurance quotes from the top providers, simply enter your ZIP code into our free quote comparison tool.

Frequently Asked Questions

Why is life insurance important for overweight individuals?

Life insurance offers financial security for loved ones. Overweight individuals may find higher rates with some insurers, but companies like Banner Life, Prudential, and AIG offer affordable options.

What makes Banner Life a top choice?

Banner Life is a top choice due to low rates starting at $20 per month and strong coverage options for overweight individuals. Despite challenges, many providers cater to overweight or obese individuals with flexible terms, ensuring accessible life insurance for overweight solutions. If you need life insurance coverage, enter your ZIP code into our free tool to save time and money.

What do insurers consider for overweight individuals?

Insurers look at age, medical history, weight, and overall health. Companies like Banner Life and AIG use these factors to offer competitive rates. Gain further insight with this guide, “How a Pre-Existing Conditions Affects Life Insurance.”

Are there affordable life insurance plans for overweight people?

Yes, AIG and Prudential offer plans starting at $20 per month, making them good options for affordable coverage. Resources like the height and weight chart for life insurance, the height and weight chart for insurance, and the AMA weight chart provide benchmarks for applicants.

Why choose Prudential?

Prudential offers flexible plans at reasonable prices, making it a good option for overweight individuals. Some companies, like Americo, provide customized plans with tools such as the Americo height and weight chart.

How does AIG compare for rates?

AIG offers affordable rates starting at $20 per month, making it a reliable option for cost-effective coverage. Expand your understanding with this guide, “Best Guaranteed Issue Life Insurance Companies.”

What benefits does Banner Life offer?

Banner Life provides low rates and customizable policies, making it a top pick for affordable coverage.

What should overweight people look for in life insurance?

When considering life insurance for overweight applicants, insurers often refer to tools like the life insurance height and weight chart or the life insurance BMI chart to determine eligibility and premium rates. It would help to look for reasonable rates, flexible options, and strong customer support. Banner Life, Prudential, and AIG are great choices.

Why are rates higher for overweight individuals?

Life insurance for obese policyholders often costs more due to the health risks associated with obesity, but Banner Life, AIG, and Prudential offer lower rates than many competitors. See this “10 Best Life Insurance Companies for High-Risk Individuals” guide for a deeper understanding.

Why is AIG recommended?

AIG is recommended for its low rates starting at $28 per month and reliable coverage for overweight individuals. Compare term life insurance rates by entering your ZIP code into our free tool today.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.