Best Life Insurance for Felons in 2025 (Your Guide to the Top 10 Companies)

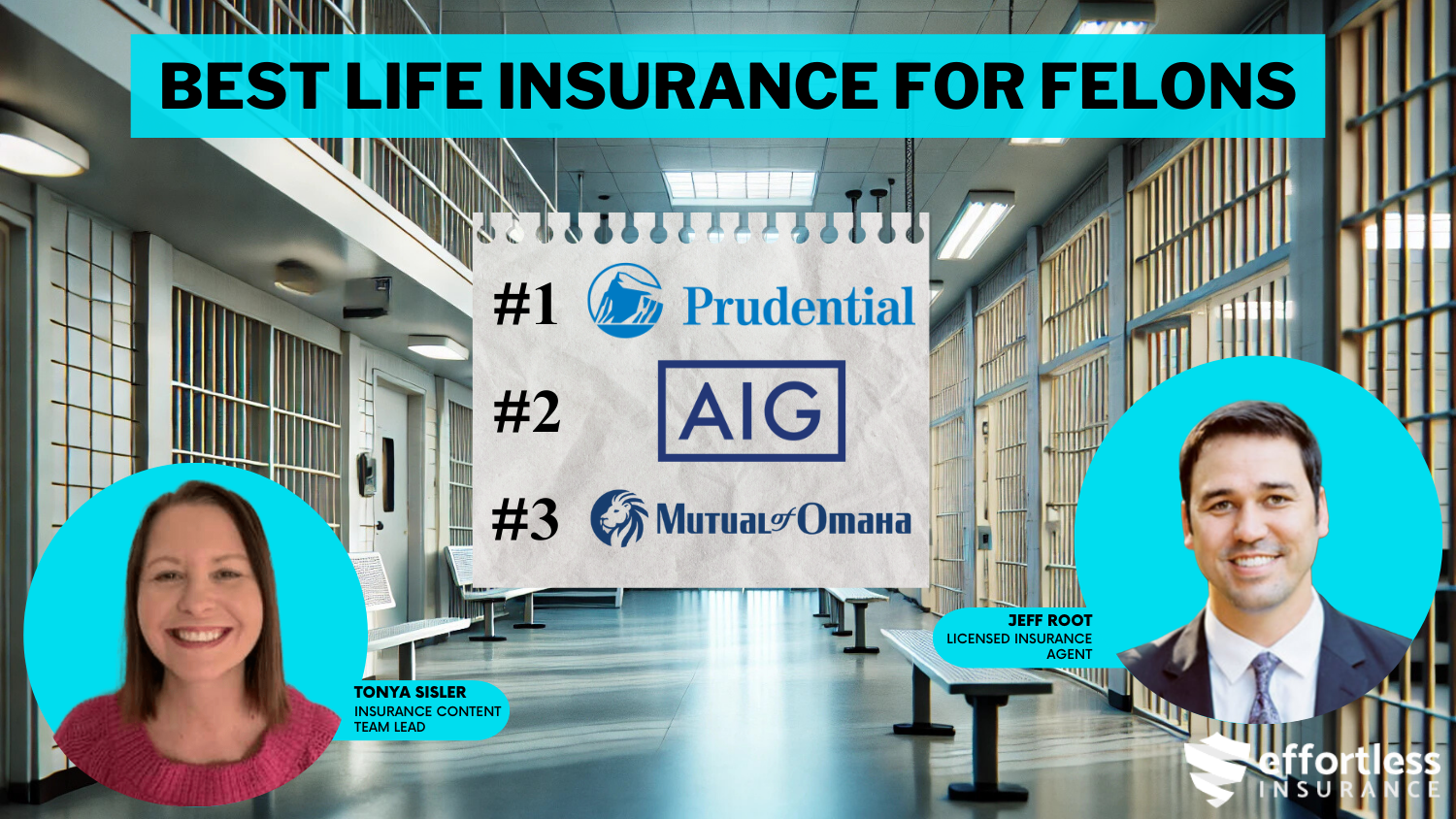

Prudential, AIG, and Mutual of Omaha are the best choices for life insurance for felons, with rates starting at just $25 a month. Prudential is the best overall option, AIG works well for higher-risk cases, and Mutual of Omaha stands out for its flexible policy and coverage options.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Life Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Licensed Life Insurance Agent

UPDATED: Jan 30, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Jan 30, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

0 reviews

0 reviewsCompany Facts

Whole Policy for Felons

A.M. Best Rating

Complaint Level

0 reviews

0 reviews 163 reviews

163 reviewsCompany Facts

Whole Policy for Felons

A.M. Best Rating

Complaint Level

163 reviews

163 reviews 0 reviews

0 reviewsCompany Facts

Whole Policy for Felons

A.M. Best Rating

Complaint Level

0 reviews

0 reviewsThe best life insurance for felons comes from Prudential, AIG, and Mutual of Omaha, with rates starting at just $38. These companies offer the most affordable premiums and coverage options for people with a criminal record.

Prudential is the best pick overall, offering great value and strong coverage. AIG is a solid choice for high-risk cases, and Mutual of Omaha stands out for its flexible policies. All three are worth considering for affordable and reliable life insurance.

Our Top 10 Company Picks: Best Life Insurance for Felons

| Company | Rank | Bundling Discount | A.M. Best Rating | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | A+ | Flexible Terms | Prudential | |

| #2 | 5% | A | High Risk | AIG |

| #3 | 12% | A+ | Policy Flexibility | Mutual of Omaha | |

| #4 | 17% | B | Local Support | State Farm | |

| #5 | 8% | A+ | Term Options | Transamerica | |

| #6 | 5% | A+ | Guaranteed Issue | Gerber Life |

| #7 | 7% | A+ | Low Premiums | Banner Life |

| #8 | 10% | A- | Community Perks | Foresters Financial |

| #9 | 10% | A++ | Health Rewards | Guardian Life | |

| #10 | 10% | A | Simple Policies | Colonial Penn |

There are many things a traditional life insurance company might consider when determining rates for felons as you can see from our best life insurance companies that cover impaired risk page.

Comparing quotes is integral to finding the best rates possible. Enter your ZIP code into our free tool today to see what quotes might look like for you.

- Find the best life insurance options for felons with rates at $38/month

- Felons can still qualify for life insurance with specialized providers

- Prudential offer the best life insurance for felons for its flexible terms

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – Prudential: Top Overall Pick

Pros

- Low Cost: Prudential offers life insurance for individuals with criminal record, starting at $45 a month. It’s an easy way to help your family without spending too much.

- Flexible Plans: Prudential understands everyone is different. They let felons choose plans that fit their needs.

- A Trusted Name: You can count on Prudential. Their good reputation means felons can trust that they’ll have reliable coverage and be well taken care of.

Cons

- Limited Tech: The website and app for prudential life insurance guide aren’t user-friendly for felons managing their life insurance.

- Complex Policies: Some plans may be complicated for felons to fully understand without guidance, which could make finding the Best Life Insurance for Felons more challenging.

#2 – AIG: Best for High Risk

Pros

- Great Rates: AIG offers life insurance for felons starting at $50 a month, making it an affordable option.

- Plenty of Choices: Felons can choose from different plans to find what fits them best. Read more with our guide, “AIG Life Insurance Review.”

- No Health Check: AIG keeps it simple with life insurance for felons that doesn’t need a medical exam—it’s fast and easy.

Cons

- Higher Rates: AIG’s life insurance for felons starts at $50 a month, which is a bit more than some other options and might be tough for those on a tight budget.

- Less Flexible: Their policies aren’t very customizable, which might not be ideal for felons with specific needs.

#3 – Mutual of Omaha: Best for Policy Flexibility

Pros

- Low Rates: Mutual of Omaha offers life insurance for felons starting at just $42 a month, making it one of the most affordable choices.

- Great Support: They provide friendly customer service, so felons can get help whenever they have questions.

- Quick and Easy: The application process is simple and fast, so getting life insurance doesn’t take long.

Cons

- Outdated Online Tools: Their website and app can be tricky for felons to use when managing insurance.

- Policy Restrictions: Some plans might have extra requirements for felons to qualify for coverage, according to the Mutual of Omaha life insurance guide.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#4 – State Farm: Best for Local Support

Pros

- Affordable Rates: Life insurance for felons starts at $48 a month, offering a good mix of cost and quality.

- Lots of Choices: Felons can choose from a variety of plans, making it one of the best life insurance for felons options.

- Bundle Discounts: Felons can save by combining different life insurance for felons with other policies.

Cons

- Basic Online Tools: The digital features for managing life insurance for felons are not very advanced.

- Higher Rates: Premiums for life insurance for felons can go up for felons depending on risk factors, as noted in the State Farm life insurance review.

#5 – Transamerica: Best for Term Options

Pros

- Affordable: Transamerica offers the best life insurance for felons, starting at just $46 a month, making it easy to fit into your budget.

- Extra Benefits: Their life insurance for felons also covers serious illnesses, giving you more protection and options.

- Trusted: Transamerica is a well-known company, so that you can trust them for life insurance for felons.

Cons

- Complicated Plans: Some policies might be tricky for felons to understand without extra help. To Learn more, find answers in our guide, “Transamerica Life Insurance Company Review.”

- Slow Support: Getting help from customer service might take longer than expected for felons.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#6 – Gerber Life: Best for Guaranteed Issue

Pros

- Lowest Rates: At just $38 a month, the Gerber life insurance guide highlights one of the cheapest life insurance options for felons.

- Simple Plans: The policies are easy to understand, perfect for felons looking for life insurance for felons that’s simple.

- Guaranteed Approval: Felons can quickly get life insurance for felons without needing a medical exam or meeting tough qualifications.

Cons

- Limited Coverage: The payouts might not be enough if you have bigger financial needs or responsibilities.

- Fewer Options: There aren’t as many policy choices for felons to choose from or compare.

#7 – Banner Life: Best for Low Premiums

Pros

- Reasonable Rates: Felons can get life insurance with Banner Life for as low as $47 a month, making it budget-friendly.

- Flexible Terms: These plans can be adjusted to match what felons need, as highlighted in the Banner Life insurance company review.

- Large Payouts: This is great for felons seeking substantial life insurance coverage supporting their long-term financial responsibilities.

Cons

- Rates Are Higher: Depending on personal risk factors, life insurance costs for felons may be slightly higher than for other providers.

- Essential Tools: Their online platform for felons managing life insurance could be more advanced and could use additional features.

#8 – Foresters Financial: Best for Community Perks

Pros

- Affordable Rates: Felons can get life insurance for as little as $43 a month, which is very cheap.

- Health Perks: Plans include benefits to help felons stay healthy and feel better.

Community Help: Foresters offers felons life insurance while helping families and local communities.

Cons

- Fewer Choices: There aren’t many plans for felons to pick from. For more info, check out our guide, “Foresters Life Insurance Company Review.”

- Slower Approval Process: Getting life insurance for felons can take longer than expected due to additional background checks and underwriting requirements.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#9 – Guardian Life: Best for Health Rewards

Pros

- Fair Rates: Life insurance for felons starts at $44 a month, a reasonable price for coverage. For more info, check out our relevant guide, “Best Life Insurance.”

- Financially Strong: Guardian Life offers reliable life insurance for felons, so you can feel sure your family will be taken care of.

- Flexible Payments: You can pay for life insurance monthly or yearly, which makes it easier to work with your budget, even if you have a record.

Cons

- Higher Renewals: Rates for life insurance for felons might go up over time, making it harder to afford later.

- Limited Availability: Life insurance for felons isn’t offered everywhere, so it might not be available in some places.

#10 – Colonial Penn: Best for Simple Policies

Pros

- Budget-Friendly Rates: Colonial Penn offers life insurance for felons for just $40 a month. It’s cheap. Find out more in our guide, “Colonial Penn $9.95 Plan Reviews.”

- Easy Process: The application is fast and straightforward so that felons can get life insurance without problems.

- No Medical Exam: Felons can get life insurance without needing a medical exam or anything tricky.

Cons

- Lower Coverage: The payouts might need more if you need more money to cover more considerable expenses as a felon.

- Limited Policy Options: There aren’t many options to change your plan, which might not be great for some felons.

How much does life insurance cost?

How long your coverage lasts. Rule of thumb: Your term should last at least until you retire, and should also cover your longest financial obligation (like a child’s college costs).

Felons Life Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Term Policy | Whole Policy |

|---|---|---|

| $50 | $130 |

| $47 | $128 |

| $40 | $115 |

| $43 | $118 |

| $38 | $110 |

| $44 | $121 | |

| $42 | $115 | |

| $45 | $120 | |

| $48 | $125 | |

| $46 | $122 |

The amount your loved ones would receive if anything should happen to you before your policy expires. Rule of thumb: Most financial planners recommend an amount 10-15x your current income.

Life Insurance Discounts From the Top Providers for Felons

| Insurance Company | Available Discounts |

|---|---|

| Healthy Lifestyle, Family Bundle, Accelerated Death, Wellness Program |

| Multi-Policy, Annual Payment, Accelerated Underwriting, Electronic Application |

| Loyalty Program (for renewing policies), Senior, Pre-Existing Condition Waiver |

| Community Member, Family Health Perks, Non-Tobacco, Member Rewards |

| Automatic Bank Payment, Multi-Child (for family plans), Family Protection Plan |

| Healthy Living, Early Enrollment, No-Smoking, Health Engagement Program | |

| Wellness Program, Multi-Policy, Automatic Payment, Online Enrollment | |

| Legacy Loyalty, Non-Smoker, Family, Military Affinity | |

| Good Health, Financial Bundle, Automatic Payment, Vehicle Protection Plan | |

| Senior, Family, Non-Smoker, Healthy Lifestyle |

Monthly estimates for life insurance rates are influenced by a number of factors, but your health has the biggest impact on the final cost. For additional information, check out our guide, “Types of Life Insurance.”

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Do life insurance companies check criminal records?

When applying for life insurance with a criminal background (i.e., a felony conviction or misdemeanour) remember that insurance companies will deem you a high-risk client with a felony record. When applying for life insurance, an individual is assessed based on a set of potential risks to the carrier. The agency then decides to either approve the policy without restrictions, approve it with higher rates, or deny it.

Felons often face higher premiums, but choosing a provider with flexible underwriting and a history of working with high-risk applicants can help secure affordable coverage.Tracey L. Wells Licensed Insurance Agent & Agency Owner

In assessing an individual with a criminal history, an insurance company has to consider the impact incarceration might have had on the person’s well-being. Incarceration is undoubtedly a traumatic experience, one that can take a toll on mental and physical health.”

But there’s also a higher chance of contracting certain diseases while in prison, which could ultimately result in death years later. Drug use is sometimes closely related to incarceration, and will also be considered by the life insurance company. These factors may result in premature death.

What life insurance options do felons have?

Can felons get life insurance? If you’re trying to get life insurance as a felon, but have been turned down, you have three choices for a more accessible policy:

- Group life insurance through your employer – If you work for a company and they provide life insurance, you could get a life policy through that program. Keep in mind that the coverage is effective as long as you work for them. Generally, this type of insurance does not require a background check from the insurance company. Typical coverage amounts range from $25,000 to $50,000.

- Accidental death and dismemberment insurance – This policy pays benefits for death caused by an accident. A death resulting from a heart attack or stroke won’t be covered. This isn’t ideal, but it’s better than nothing.

- Guaranteed issue – This policy has a two to three years graded benefits clause, which means that, if you die within two to three years, no death benefit will be paid; instead the beneficiaries will collect the total premium paid plus 10% interest. The max amount on guaranteed issue life insurance for convicted felons (or anyone) is $40,000 and you must be over the age of 40.

Can a felon get a life insurance license? Can a felon sell life insurance? There are some felonies that bar you from getting your insurance license, but can a felon work in insurance? It is up to the individual insurance company to decide if they wish to hire a formerly incarcerated person.

What life insurance companies offer policies to felons?

Each carrier views your situation differently, but Prudential tends to be the most lenient. They use “underwriting credits,” meaning if you’re overweight, between 18 and 59, and have no other medical issues, you may qualify for a preferred rate instead of a standard one. To find out more, visit our guide, “Life Insurance: Most Frequently Asked Questions.”

The same goes for a felony. If you can show an outstanding recovery and rehabilitation, you may get a better rate. It’s doubtful this would be preferred, but a standard to table 4 would be the norm. Keep in mind that underwriting guidelines are changed frequently, and what is true today may not be accurate in a few months.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Can I get life insurance while on probation?

Unfortunately, that’s not usually an option. Life insurance companies require a one-to-five-year waiting period after probation has ended to obtain coverage with a standard rating class. The further back your criminal activity happened, the better. For a deeper look, see our guide, “Life Insurance Coverage Question.”

Many life insurance companies don’t want to insure a person on probation because there is a higher likelihood of returning to jail and life insurance for inmates is nearly impossible to obtain. The criminal justice system is still monitoring someone on probation, and any small violation can place him or her in prison once again.

Former felons looking to buy life insurance should always be honest. The first thing the carrier does when they get an application is a background check. If you lied on the application, they will deny your application without giving you a chance. And keep in mind that being denied life insurance with one carrier will open the doors for others to follow suit.

Can a felon get a life insurance license?

If you’re interested in selling life insurance, you may be wondering, “can I get my insurance license with a felony?” You may be able to become a licensed insurance agent if you have a felony on your record, but you’ll have to do some research to find the companies or agencies that will employ you once you’re a licensed agent.

How does life insurance work? Well, if your felony conviction does not fall into any of the categories listed above, you may find that you can sell life insurance with a felony. As you search for the right life insurance coverage, be sure to use our free quote tool below to compare quotes from multiple companies and find coverage options and monthly rates that work for you.

What are some important tips on life insurance for felons?

When applying for life insurance, be sure that you write an exceptional cover letter describing your situation. Tell the company what happened, and take full responsibility for your conviction. If you can show a stable workplace, some education, and a connection to service in your community, you will have a far better chance of getting your life insurance policy issued. Also, be sure to research policies specific to your area. Find out more in our guide, “10 Best Life Insurance Companies.”

Insurance companies want your business, but not for any price. The underwriting method provides them with time to perform their groundwork and get to know you before deciding whether or not you’re a good match for them. Despite the hurdles, obtaining a life insurance policy with a criminal background is possible. Life insurance for felons can be easily found.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: How Felons Can Secure Affordable Life Insurance

Getting life insurance as a felon can be hard, but there are affordable options if you know what to do. In these case studies, we’ll show how three people found life insurance, each taking a different path to get the best coverage.

- Case Study #1 – Mark’s Success with Flexible Terms: Mark, 38, had a felony conviction from 8 years ago and wasn’t sure if he could afford life insurance. After looking at different options, he went with Prudential, which gave him a plan for $45 a month. His premiums were a little higher because of his past, but the policy gave him the needed coverage.

- Case Study #2 – Emily’s Secure Coverage: Emily, a 42-year-old with a felony conviction in the last 5 years, knew she would be considered high-risk by most insurers. AIG offered her a plan with slightly higher rates at $50/month, but their experience with high-risk cases helped her secure the coverage she wanted. Emily learned that being upfront with insurers about her history allowed her to get a fair deal.

- Case Study #3 – Brian’s Search for Policy Flexibility: Brian, who is 55 years old, had a felony from 12 years ago and needed life insurance that worked with his budget and goals. Mutual of Omaha offered flexible plans, letting him choose the coverage he wanted starting at $42 a month. It gave him peace of mind without breaking the bank.

These case studies show that, while it may take a little time, there are options available when it comes to finding the right policy after a felony. You can find affordable life insurance that works for you with the right provider.

Frequently Asked Questions

Can a felon get life insurance?

Yes, can a felon get life insurance is a frequent question, and the answer is yes—though it can be challenging to secure life insurance for ex-felons or find life insurance companies that insure felons. If you’re wondering, can you get life insurance if you’re a felon, it often depends on the crime and how much time has passed.

Does having a criminal record affect life insurance eligibility?

When applying for life insurance with criminal record concerns, a life insurance background check plays a significant role. Can you get life insurance if you’re a felony? Yes, but insurers assess risks carefully, which is why life insurance policies for felons may have higher costs or stricter terms. Enter your ZIP code to compare rates from the top providers near you.

Are there life insurance companies that insure felons?

Yes, life insurance companies that insure felons do exist and may offer life insurance for ex-felons or life insurance no background check options. If you’ve asked, can you get life insurance if you’re a felon, these companies might provide tailored solutions. Need more info? Check the guide, “Where To Buy Life Insurance.”

Can you get life insurance if you have a felony?

Can you get life insurance if you have a felony? Yes, but life insurance with criminal record issues often comes with limitations. Some life insurance companies that accept felons offer options for life insurance for ex felons or even life insurance no background check policies.

Can you get life insurance on someone in jail?

Can you get life insurance on someone in prison or jail? While most insurers deny coverage for incarcerated individuals, burial insurance for inmates may be an alternative. This is a more specific question compared to can you get life insurance if you’re a felon, but both highlight the challenges felons face.

Why can’t felons get life insurance easily?

Why can’t felons get life insurance easily? Insurers see felons as high risk. Questions like can you get life insurance if you’re a felon or can convicted felons get life insurance arise because insurance companies may restrict coverage for applicants with severe criminal records. Expand your knowledge with our guide, “Life Insurance with Pre-Existing Conditions.”

Can felons sell life insurance or become licensed agents?

Can felons sell life insurance? It depends on state regulations. To answer can you get a life insurance license with a felony, some states allow it if rehabilitation can be proven, while others deny licenses altogether. This creates unique challenges for those with a life insurance with criminal record history.

Does a felony affect car insurance rates too?

Does a felony affect car insurance? Yes, just as it affects life insurance with criminal record applications, it can lead to higher premiums. Like can you get life insurance if you’re a felon, the answer depends on the felony and insurer. You can also enter your ZIP code into our free comparison tool to start comparing rates now.

Do life insurance companies do background checks?

Yes, life insurance companies that insure felons often conduct a life insurance background check. This ensures that applicants, whether they are asking can you get life insurance if you’re a felon or can you get a life insurance license with a felony, meet specific eligibility standards. For more details, read our guide, “Life Insurance Basics.”

What are the best options for felons needing life insurance?

Felons can explore life insurance no background check policies, burial insurance for inmates, or life insurance policies for felons. If you’re wondering can you get life insurance if you’re a felon, guaranteed issue or specialized life insurance for ex-felons may work best.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Life Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Licensed Life Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.